Nabors Industries Ltd

NYSE: NBR

$80.13

Closing price April 24, 2024

The top analyst upgrades, downgrades and other research calls from Thursday include Barrick Gold, Buffalo Wild Wings, Caterpillar, Coca-Cola, GrubHub, Nabors Industries and Wynn Resorts.

Published:

Last Updated:

General Electric, AT&T, Nabors Industries, and Chesapeake Energy all posted new 52-week lows Wednesday.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Tuesday include Alphabet, Check Point Software, Chesapeake Energy, Chevron, Intel, MannKind, Schlumberger and Transocean.

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Friday include Alibaba, Blue Apron, Gap, Harmony Gold, Myriad Genetics, Noble and Walmart.

Published:

Last Updated:

J.C. Penney, Nabors Industries, Whiting Petroleum, and Synergy Pharmaceuticals all posted new 52-week lows Monday.

Published:

Last Updated:

These four stocks have massive upside potential. While not suitable for all accounts, for those with higher risk tolerance these stocks could be huge winners for patient investors with a long horizon.

Published:

Last Updated:

Clearly this a value play for investors, especially buying shares in front of what is expected to be declining or stagnant earnings. These companies have fought through oil price swings before, and...

Published:

Last Updated:

The top analyst upgrades, downgrades and other research calls from Friday include Advance Auto Parts, Cliffs Natural, Foot Locker, Nabors, Sensata and Stanley Black & Decker.

Published:

Last Updated:

Avon, Ensco, Southwestern Energy, and Nabors posted new 52-week lows on Tuesday.

Published:

Last Updated:

The question remains whether the recent oil price level will stick or even push higher. In fact, a few analysts think they have the answer, based on a few prevailing tailwinds, to where oil and gas...

Published:

Last Updated:

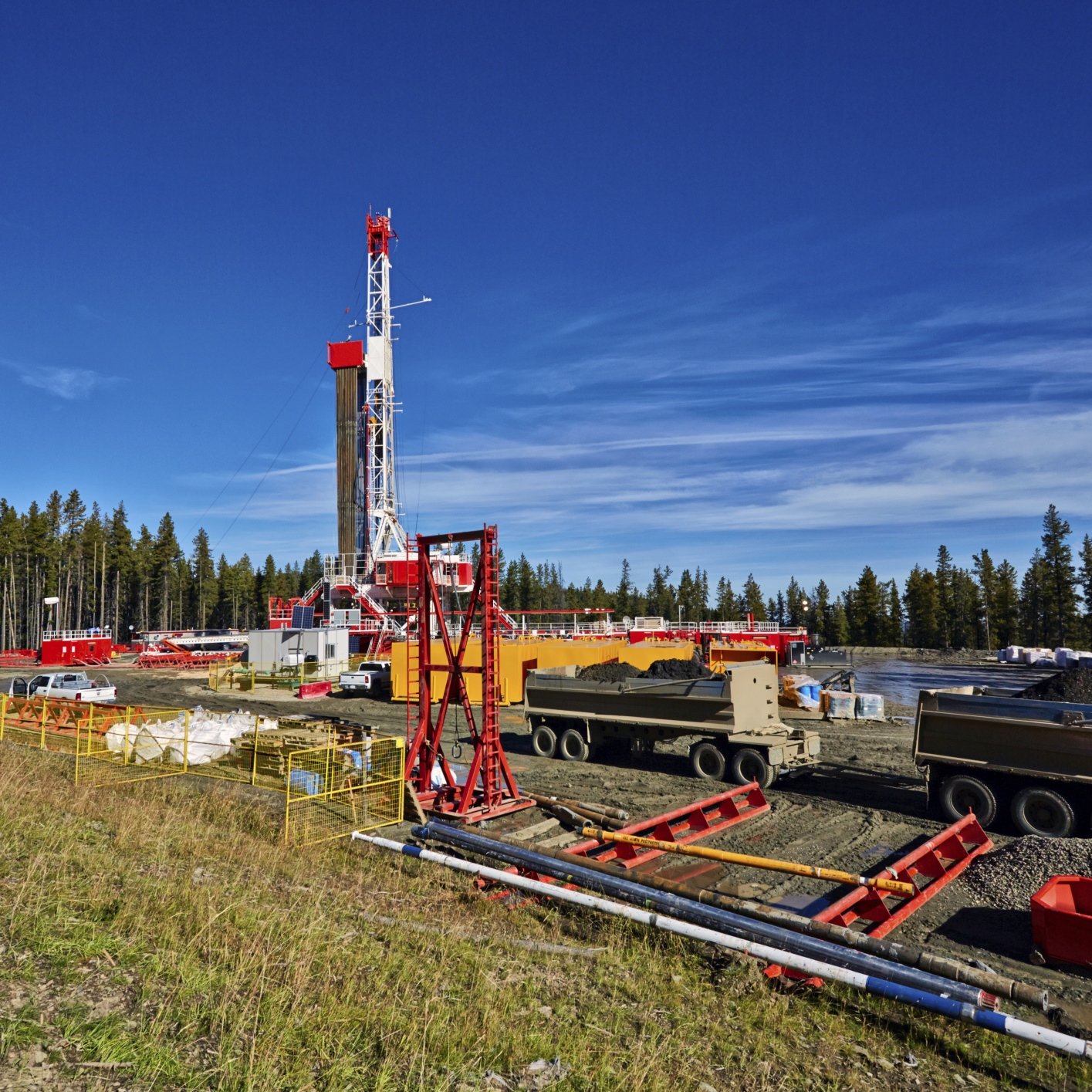

While the spot price of oil may remain volatile, buying the top land drillers with exposure in the best basin plays in the United States makes good sense for aggressive growth investors.

Published:

Last Updated:

SunTrust Robinson Humphrey feels that the demand trends for the top oilfield services companies remain solid and investors should advantage of the current weakness and buy the dip.

Published:

Last Updated:

If you were buying oil services this time last year, you had either years of experience in the sector, were a deep value investor with a very long time line, or you plain and simple had nerves of...

Published:

Last Updated:

The top analyst upgrades, downgrades and initiations seen on Wednesday include Baker Hughes, Halliburton, J.C. Penney, Palo Alto Networks, Schlumberger, Walt Disney and Wells Fargo.

Published:

Last Updated:

The top analyst upgrades and downgrades and other calls seen in the energy sector on Wednesday include Baker Hughes, Chevron, Nabors Industries, Occidental Petroleum and Royal Dutch Shell.

Published:

Last Updated: