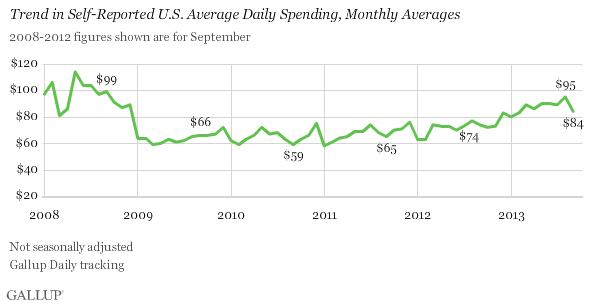

After posting a five-year high in July, consumer spending pulled back in September, according to the latest Gallup self-reporting survey on Americans’ spending habits. The August daily average of $95 fell to $84 in September. The survey asks consumers to say how much they spent, excluding major purchases like houses and cars and routine household bills, and it offers an estimate of discretionary spending. Source: Thinkstock

Source: Thinkstock

Gallup noted that September spending typically drops from the August average, but this year’s decline of $11 is considerably larger than usual. In each of the past three years, spending has dropped $3 to $4 in September compared with August.

A spending drop of 9.3% was noted among households with annual income of $90,000 or more. The drop among households with lower annual income was an even larger at 12.1%. According to Gallup, the drop was greatest among households with incomes between $60,000 and $90,000, where August spending of $122 fell to $87, nearly 29%.

As Gallup notes, the spending pullback is connected to Americans’ worries about the overall economy and the then-pending shutdown of the federal government. The longer the shutdown continues, the greater is the chance that October spending will post another sharp decline. Add in the fast-approaching debt limit debate and the situation could turn materially worse.

Because consumer spending accounts for more than two-thirds of U.S. gross domestic product (GDP), the country’s economic recovery could well stall again as it did in 2011 when Republicans and Democrats did not agree until the eleventh hour on raising the federal debt ceiling.

Source: Gallup

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.