Energy

Are North Dakota Oil Rig Counts Signaling a Trough Is Near ... or Here?

Published:

Last Updated:

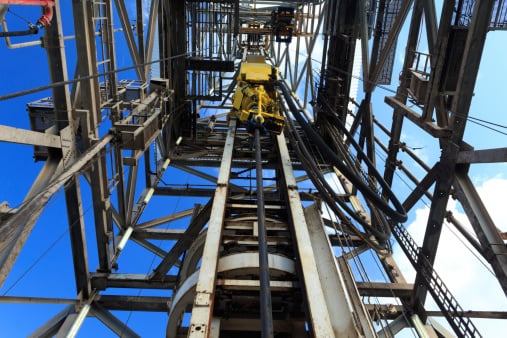

Is it possible that the never-ending rig count decline is ending in North Dakota? There could be good news headed the way of companies like Whiting Petroleum Corp. (NYSE: WLL), Nabors Industries Ltd. (NYSE: NBR) and XTO under Exxon Mobil Corp. (NYSE: XOM). It appears as though the rig count in North Dakota may be confirming what some analysts and investors are looking at as a trough in the rig counts in North Dakota. Source: Thinkstock

Source: Thinkstock

The current active drilling rig list in North Dakota was 84 for the May 25, 2015, date. While this is down from 191 at the same time in 2014 (and versus 186 in 2013 and 214 in 2012), it is little changed from the prior two weeks. North Dakota is effectively the second largest state for oil now, thanks to the Bakken shale region.

For a secondary trend as a confirmation, the latest U.S. data showed an active drilling rig count at 659, down from 660 the prior week and down from 1,528 a year earlier.

The news did not act as a driver for the stocks on Monday, but a strong “market sell” bias may be more of an issue than the North Dakota rig counts. It is one issue to try to call a bottom and another issue entirely for certain investors to try to say that the long decline may finally be reaching close to a trough. Picking exact bottoms can be a sucker’s game. Picking a trend can create large gainers, as long as the move isn’t more than 10% or 20% off the mark. As a reminder, stocks pop and drop on any given day, but the stock market tries to start discounting big trends sometimes two quarters out.

Again, the shares in the oil patch are not reacting positively based just on North Dakota data. Strong dollar fears hurt oil again on Monday, as did a third of four trading days where weakness persisted. Also, each of the 10 sectors of stocks in the S&P 500 was lower on Monday.

The current list of North Dakota’s 84 active rigs shows the current location, a well name, which county the rigs are in and a start date. The list also shows whether each rig has an undetermined next location (taken from rig crews) or a next destination. Those rigs designated with a next location showed that the data is from anticipated rig locations obtained from rig crews, which was shown as perhaps not being reliable and subject to change at any time.

ALSO READ: The 9 Most Misleading Product Claims

Nabors Industries was down almost 7% Tuesday at $14.64. Its 52-week trading range is $9.91 to $30.24, and its consensus analyst price target is $17.29.

Exxon Mobil has been trying to find a bottom for some time now. After a 1.5% drop in shares to $85.10, the 52-week range is $82.68 to $104.76. The consensus analyst price target was last seen at $93.60, and Exxon Mobil was just recently reincluded in our own list of ten stocks to own for a decade.

Whiting Petroleum shares were down 2.5% at $32.95, versus a consensus price target of $43.72. Whiting has a 52-week range of $24.13 to $92.92.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.