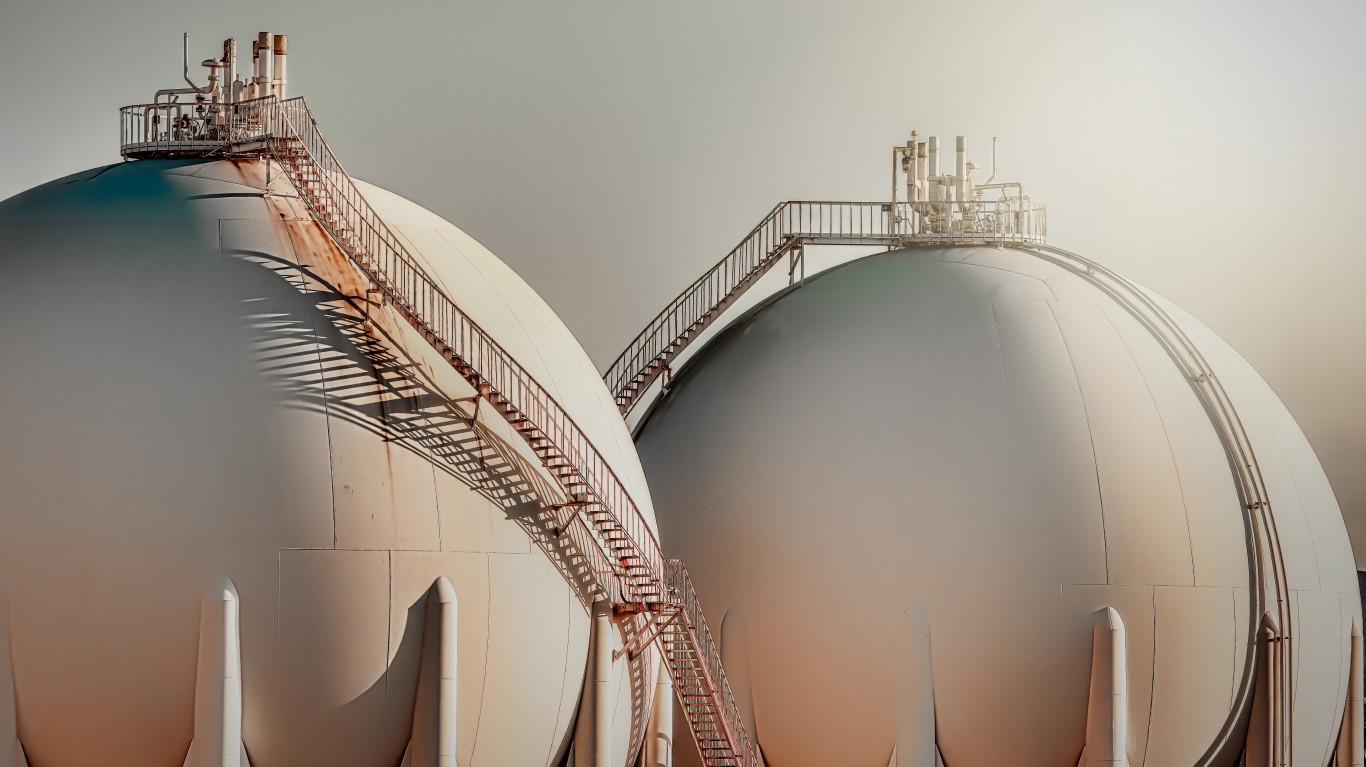

oil and gas

The inflationary environment over the past few years has constricted consumer buying power, resulting in supplementary income requirements by many. For those who cannot augment their paychecks with...

Published:

When it comes to companies and organizations that have shaped the course of history behind the scenes, oil companies sit toward the top of the list. Few companies have as big an impact on our...

Published:

Few things stick in the news headlines quite as well as the fluctuations in gasoline prices. In our car-obsessed culture, gasoline is literally the lifeblood of our civilization. Small changes,...

Published:

Before U.S. markets open on Friday, the country's two largest oil and gas companies will report earnings.

Published:

Oil and gas supermajor Chevron will buy Hess for $53 in an all-stock transaction expected to close in the first half of 2024.

Published:

With oil prices rising and demand expected to grow over the coming years, these five top exploration and production companies could be the next takeover targets.

Published:

The big integrated oil companies in the United States and Europe are likely to benefit if the Hamas-Israel war escalates. These six dividend-paying legacy blue chips remain solid investments for...

Published:

Exxon Mobil has announced the purchase of oil shale giant Pioneer Natural Resources for nearly $60 billion in an all-stock purchase.

Published:

Exxon Mobil reportedly is considering an offer of $60 billion to acquire Permian Basin producer Pioneer Natural Resources. It would be the year's largest acquisition.

Published:

Oil prices dropped after a report that the nation's gasoline inventories rose sharply last week.

Published:

Goldman Sachs feels that these five top oilfield services leaders will benefit from the surge in crude oil prices.

Published:

A new report from the International Energy Agency suggests that there is still time to limit the imapct of carbon emissions.

Published:

These seven top energy stocks come with large and dependable dividends and have solid upside to the posted consensus price targets, so they make sense now for growth and income investors considering...

Published:

A federal district judge in Louisiana has issued an order requiring that the U.S. Interior Department proceed with a planned sale of oil and gas leases in the Gulf of Mexico.

Published:

These seven major energy infrastructure stocks offer safe and reliable distributions and, with oil prices on the rise, look like great buys now for income investors seeking total return potential.

Published: