Investing

Private Equity Better Than Stocks for Your Money (APO, BX, CG, KKR)

Published:

Last Updated:

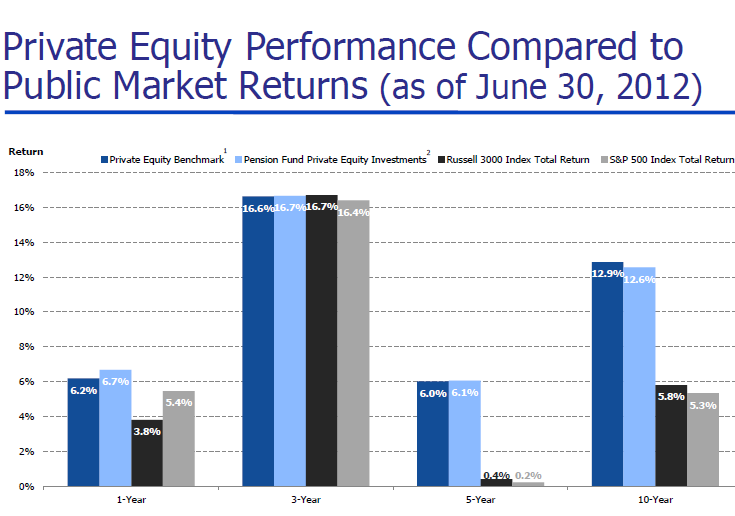

A report on Thursday from the Private Equity Growth Capital Council is showing just how private equity has outperformed the broader S&P 500 Index over the last ten years. We would make a note that based upon the name of the group and its membership that the report is almost certainly going to hold the sector of private equity in the best light that it can.

Members of this group include Apollo Global Management LLC (NYSE: APO), The Blackstone Group (NYSE: BX), The Carlyle Group (NASDAQ: CG), Kohlberg Kravis Roberts & Co. (NYSE: KKR), and many other private equity leaders. The annualized returns of 12.6% over the past 10 years outpaced portfolio target returns of 7% or 8%.

Over the past five years, the S&P 500 lost more than half of its value before doubling to get back to the starting point. This group’s report is showing that private equity investments continued to provide higher returns on an annualized basis for its pension funds, charitable foundations and endowments.

The group’s private equity returns outpaced the S&P 500 even including dividends and net of management fees for each of the featured return horizon. The gains were said to be 7.5 percentage points over a ten year horizon and by 5.8 percentage points over a five year horizon according to the quarterly PEGCC Private Equity Performance Update.

PEGCC’s analysis of recently published data from 15 pension funds that are among the 50 largest funds by assets shows median private equity returns exceeded the S&P 500 for 1-, 3-, 5-, and 10-year time horizons by 1.3, 0.3, 5.9, and 7.3 percentage points.

A chart from the group’s full presentation has been copied below to include in the report. Again, the group putting this together is in private equity showing relative returns. That full presentation is included here.

JON C. OGG

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.