Source: Thinkstock

One company that seems still to like the fiber optic business is Zayo Group Holdings Inc. (NYSE: ZAYO), which priced an initial public offering (IPO) of 21 million shares at $19 a share on Thursday and began trading Friday morning at $21.51. The company had originally planned to sell 28.9 million shares in an IPO price range of $21 to $24.

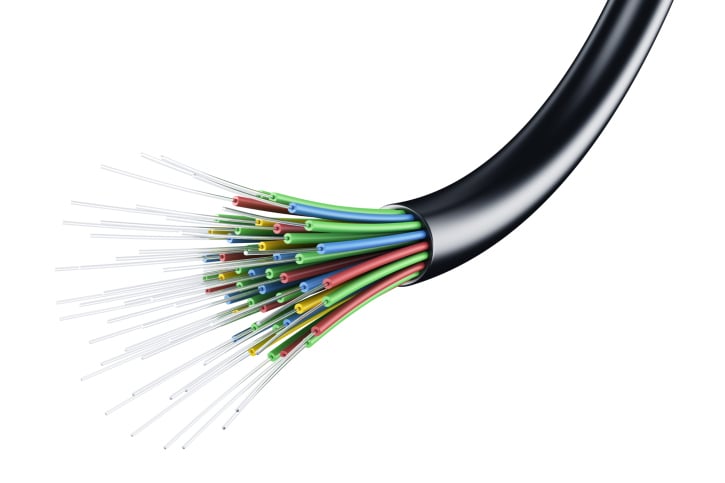

Zayo’s primary businesses are installing leased dark fiber, fiber to cellular towers and small cell sites, dedicated wavelength connections, Ethernet and IP connectivity and other high-bandwidth offerings.

Selling shareholders offered slightly more than 5 million shares in the IPO and the company offered some 16 million. The underwriters had an option to acquire another 3.03 million shares from the selling stockholders. The original plan called for the company to sell 11 million shares and selling stockholders to sell 17.8 million shares.

At the IPO price, the company’s market cap is around $4.54 billion. Zayo raised about $300 million, while selling shareholders pocketed around $100 million.

In the noon hour on Friday, the stock traded at $22.07, up more than 16%, after earlier hitting a high of $22.85.

ALSO READ: The Best and Worst Performing Dow Stocks of 2014

[protected-iframe id=”c14e3de8bfbfebd4dddd16f52c4fbeec-5450697-30366712″ info=”//ipo.findthebest.com/w/6XHUlNPKEf3″ width=”600″ height=”400″ frameborder=”0″ scrolling=”no”]

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.