Investing

Meet the New ETF Using Artificial Intelligence to Pick Stocks to Buy

Published:

Last Updated:

You have probably heard that there is an exchange traded fund (ETF) strategy for just about every kind of investing theme or trend. Some themes are very short-lived and fads, while others seem like they would be no-brainers and obvious for tracking traditional sectors and themes. Now there is an ETF launch for investors who want their stocks picked by artificial intelligence.

Wednesday brought on the launch of the AI Powered Equity ETF (NYSE: AIEQ) by EquBot for investors. This new ETF claims to be the first to apply artificial intelligence and machine learning throughout the investment process.

The launch is in partnership with ETF Managers Group. AIEQ is said to be an active ETF built on EquBot’s proprietary algorithms and is said to be the world’s first artificial intelligence ETF. It is using cognitive and big data processing abilities of IBM’s Watson to analyze and pick U.S.-listed investment opportunities.

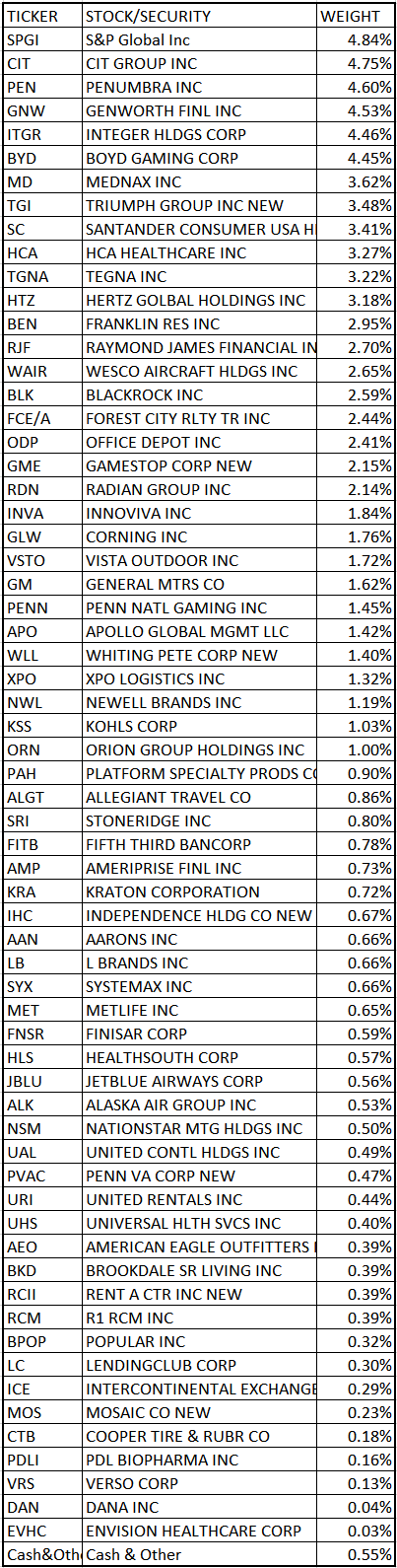

Investors are going to want to know what it is that they are really buying. EquBot and ETFMG represents that the ETF’s portfolio generally will have a concentration of between 30 and 70 U.S. equities that have volatility that is comparable to the broader U.S. equity market.

The criteria here is quite broad, and it appears as though the ETF may be considering micro-cap investments along with large cap ones. The launch release indicated that AIEQ may invest in securities of companies of any market capitalization. The ETF’s expense ratio was set at 0.75%.

While all sizes of investments are considered, the chart on the next page shows the concentration with 65 different picks.

The company’s press release said:

EquBot’s approach ranks investment opportunities based on their probability of benefiting from current economic conditions, trends, and world- and company-specific events, and identifies those equities with the greatest potential for appreciation.

With artificial intelligence, computer systems are able to perform tasks that would normally require human intelligence, such as visual perception, speech recognition, decision-making, and translation between languages. In the case of AIEQ, the fund’s underlying technology is constantly analyzing information for approximately 6,000 U.S.-listed equities, including company management and market sentiment, and processes more than one million regulatory filings, quarterly results releases, news articles, and social media posts every day.

In short, the new AIEQ ETF hopes to mimic an army of equity research analysts that never sleep and to remove human error and bias from investing process. The ETF also hopes to automatically learn from experience and to keep improving without having to be explicitly programmed.

Art Amador, co-founder and chief operating officer of EquBot, said of the ETF:

We believe we’re pioneering a whole new investment category; one that will soon have investors and advisors diversifiying their portfolios among passive, active and AI approaches… Everyday, there is more information, not less. That information explosion has made the jobs of portfolio managers, equity analysts, quantitative investors and even index builders more challenging. New technology in artificial intelligence helps solve those challenges and we’re very pleased to be bringing AIEQ to market to make an AI approach to investing available to all.

Chida Khatua, CEO and co-founder of EquBot, said:

Machine learning is one of the most powerful applications of artificial intelligence. As powerful as many algorithms underlying expensive quantitative hedge funds and other vehicles might be, unless they’re also built with AI and machine learning baked right in, mistakes can be propogated and opportunities for outperformance can be missed.

After looking through the AIEQ’s prospectus, we did take some key notes that investors will want to consider on how the fund will hopefully grow and how it will be treated for dividends, distributions and taxes. The fund’s managers intend to pay out dividends, if any, quarterly and distribute any net realized capital gains to its shareholders at least annually.

The AIEQ ETF is treated as a separate entity for federal tax purposes and intends to qualify for the special tax treatment afforded to regulated investment companies under the code. As long as the fund qualifies as a regulated investment company, it will pay no federal income tax on the earnings it distributes to shareholders. The fund’s tax status of distributions was represented in the prospectus as follows:

- The Fund will, for each year, distribute substantially all of its net investment income and net capital gains.

- The Fund’s distributions from income will generally be taxed to you as ordinary income or qualified dividend income. For non-corporate shareholders, dividends reported by the Fund as qualified dividend income are generally eligible for reduced tax rates.

- Corporate shareholders may be entitled to a dividends-received deduction for the portion of dividends they receive that are attributable to dividends received by the Fund from U.S. corporations, subject to certain limitations. The Fund’s strategies may limit its ability to distribute dividends eligible for the dividends-received deduction for corporate shareholders.

- Any distributions of net capital gain (the excess of the Fund’s net long-term capital gains over its net short-term capital losses) that you receive from the Fund are taxable as long-term capital gains regardless of how long you have owned your shares. Long-term capital gains are currently taxed to non-corporate shareholders at reduced maximum rates.

- Dividends and distributions are generally taxable to you whether you receive them in cash or in additional shares through a broker’s dividend reinvestment service. If you receive dividends or distributions in the form of additional shares through a broker’s dividend reinvestment service, you will be required to pay applicable federal, state or local taxes on the reinvested dividends but you will not receive a corresponding cash distribution with which to pay any applicable tax.

- The Fund may be able to pass through to you foreign tax credits for certain taxes paid by the Fund, provided the Fund meets certain requirements.

- Distributions paid in January but declared by the Fund in October, November or December of the previous year may be taxable to you in the previous year.

- The Fund will inform you of the amount of your ordinary income dividends, qualified dividend income, foreign tax credits and net capital gain distributions received from the Fund shortly after the close of each calendar year.

See the list of holdings below:

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.