Special Report

The Worst CEOs of 2016

Published:

Last Updated:

Many factors influence a company’s performance — some within the control of corporate leadership and some outside of it. If things go south, no matter the cause, corporate leaders are often the ones to take the heat.

In 2016, several CEOs did not perform well for their companies. Top manage ment is expected to have impeccable knowledge of the industry and its customers. To manage the risks of doing business, CEOs must make strategic decisions to steer the company in the right direction. For these reasons, investors watch CEOs very closely. While firing a CEO can itself result in a share price drop, there often is no other choice.

24/7 Wall St. reviewed scandals, firings, corporate restructurings, recent financial history, and other performance metrics associated with CEOs of major U.S. public corporations.

Click here to see the worst CEOs of 2016.

Click here to see the best CEOs of 2016.

Some of the largest CEO missteps occurred in companies that until that point were quite successful. For example, at Wells Fargo, which has been highly profitable for years, federal regulators revealed thousands of employees at the bank had created over several years millions of unauthorized bank and credit card accounts to pad earnings. Former CEO John Stumpf stepped down as a result of the scandal.

Similarly, prior to Valeant’s epic stock price collapse earlier this year, the drugmaker’s revenue tripled in three years. Its share price went from under $60 in 2012 to over $250 in July 2015. Similarly, Chipotle Mexican Grill was one of the most successful fast food chains in recent memory. Its share price surged from around $250 in 2012 to nearly $750 in August 2015. However, in the wake of the restaurant’s food safety crisis and a related federal criminal investigation in early 2016, sales declined and the company’s share price plummeted. Chipotle co-CEO Monty Moran has since stepped down.

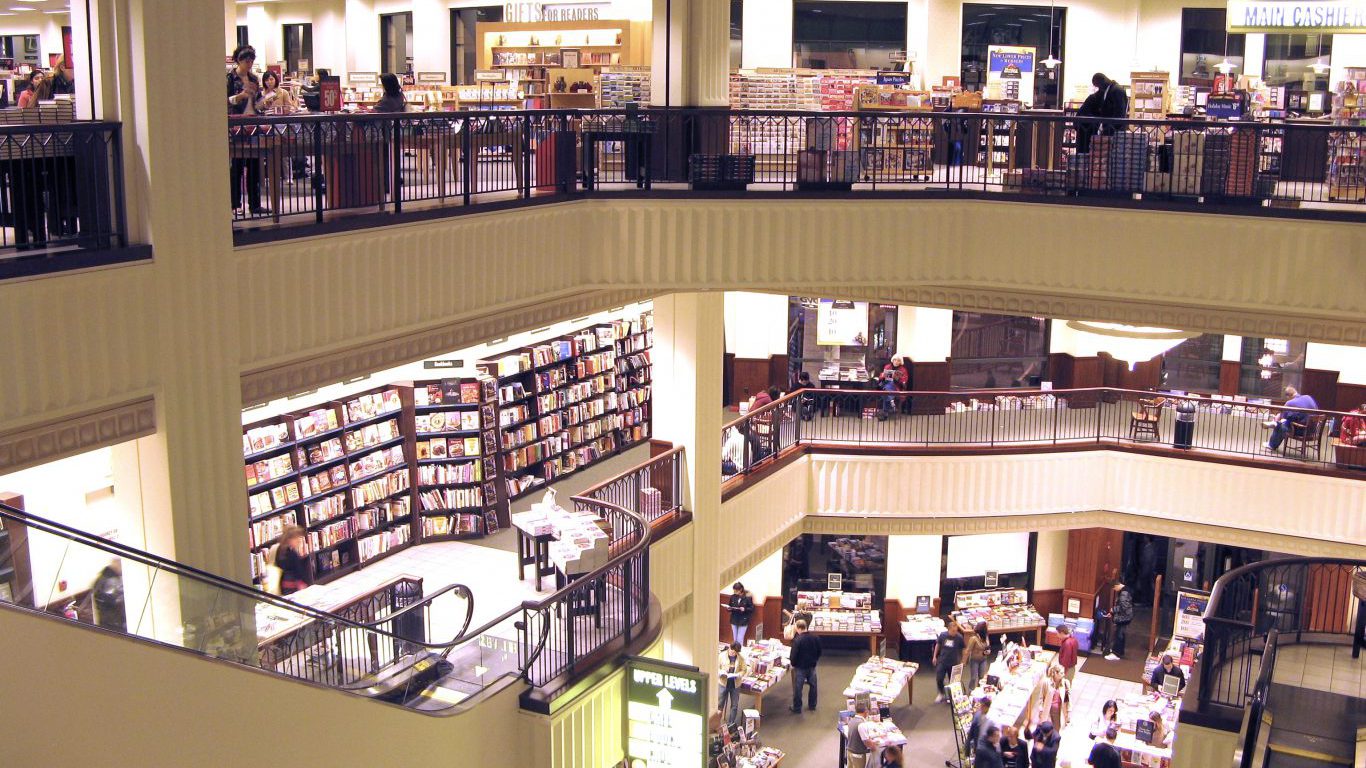

Not all CEOs are handed the reins of a successful company in a flourishing industry. When an executive is brought into an organization that has struggled for years to make a profit, he or she is expected to innovate, expand into growth opportunities, and cut back on operations that are no longer profitable. Several CEOs on this list inherited difficult roles but did nothing with their opportunity. Barnes & Noble CEO Ronald Boire was brought on to stem the bleeding at the struggling bookstore. While Boire tried to expand B&N’s repertoire, he found little success and left within a year.

To determine the worst CEOs of 2016, 24/7 Wall St reviewed CEOs or former CEOs who led major companies at some point during the year. The CEOs that made our list headed their companies while corporate financials or shares declined, or put their companies in serious jeopardy by allowing or engaging in illicit activities. Financial data for each company was obtained from the most recent financial documents filed with the federal government.

These are the worst CEOs of 2016.

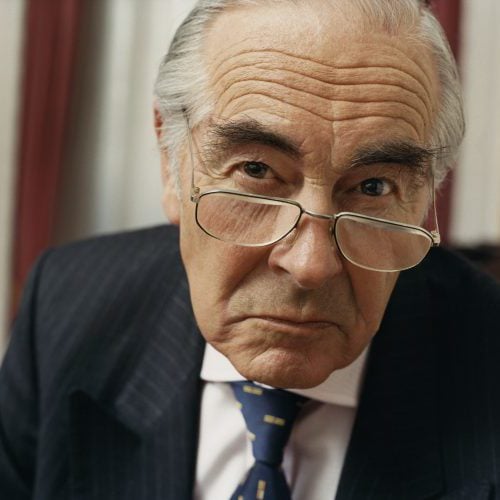

1. Ronald D. Boire

> Company: Barnes & Noble Inc. (NYSE: BKS)

> 3-yr stock price change: 18.30%

> CEO tenure: September 2015 – August 2016

Ronald Boire stepped down as the head of Barnes & Noble in August 2016. He was the third departure in as many years. Boire lasted less than a year, assuming the CEO role in September, 2015, after previous CEO Michael Huseby moved to role of executive chairman. Boire’s tenure at the company was marked by failure. Like other brick-and-mortar retailers, Barnes & Noble struggles to compete with e-commerce sites like Amazon, a problem exacerbated by the rise of e-readers and e-books. Boire attempted to expand the company’s repertoire through games, puzzles, music, and more, but these appear to have made little difference in reversing the company’s fortunes. Barnes & Noble reported a $24.6 million loss in its fiscal 2016 year, which ended a few months before Boire’s departure.

2. Monty Moran

> Company: Chipotle Mexican Grill Inc. (NYSE: CMG)

> 3-yr stock price change: -28.15%

> CEO tenure: January 2009 – January 2017

Chipotle Mexican Grill’s problems began in 2015, when hundreds of customers and employees who had eaten at a location in Simi Valley, California became sick with norovirus. Issues related to contaminated food and health code violations at locations nationwide continued into 2016, sending the company’s share price plummeting.

In the wake of the fallout, the board decided to let go of co-CEO Monty Moran, who will depart in January 2017. Despite the fact that health code violations also occurred under founder and current co-CEO Steve Ells’s, watch, he will act as the company’s sole chief executive going forward.

3. Renaud Laplanche

> Company: LendingClub Corp. (NYSE: LC)

> 3-yr stock price change: -77.88%

> CEO tenure: 2006 – May 2016

LendingClub is the largest online lender by total volume in the United States. Earlier this year, the company’s founder, Renaud Laplanche was ousted amid scandal and a subsequent subpoena from the Justice Department. According to an audit conducted by an outside law firm, Laplanche failed to inform the board about his own investment in a LendingClub customer. After he stepped down, LendingClub’s share value was cut in half, and has yet to fully recover.

Within months of leaving the company, Laplanche started a new marketplace lending site called Credify Finance that will likely directly compete with LendingClub.

4. Terry Lundgren

> Company: Macy’s Inc. (NYSE: M)

> 3-yr stock price change: -32.07%

> CEO tenure: February 2003 – present

Terry Lundgren, CEO of Macy’s for well over a decade, will step down in early 2017, handing the top position to current company president, Jeff Gennette. The century-and-a-half old business has been struggling in recent years with slow mall traffic and growing competition from online retailers. Lundgren tried to improve Macy’s fortunes by closing stores and reducing costs. Still, the company has faced declining profits in the last two years, and investor confidence has slipped dramatically in the last year and a half.

With Lundgren out, shareholders are hoping Gennette will be able to overhaul the company’s business and reverse recent trends.

5. Ben Baldanza

> Company: Spirit Airlines Inc. (NASDAQ: SAVE)

> 3-yr stock price change: 27.30%

> CEO tenure: May 2006 – January 2016

Over the course of his career as CEO of Spirit Airlines, Ben Baldanza took a little known company and — by providing little in the way of comfort or customer service — offered cut rate airfare and poached business from industry giants. Recently however, other major airlines have fought back, offering fares that closely match Spirit’s with better customer service and fewer additional fees. Baldanza’s abrupt January exodus may be tied to his association with the company’s reputation for poor customer service.

Spirit is now headed by former company director, Robert Fornaro. Since Fornaro took the top job, Spirit’s shares have climbed by more than 40%.

6. Ron Sargent

> Company: Staples Inc. (NASDAQ: SPLS)

> 3-yr stock price change: -43.08%

> CEO tenure: February 2002 – June 2016

Office supply company Staples announced earlier this year CEO Ron Sargent would be stepping down after holding the top job for 14 years. Sargent’s departure from the company came on the heels of a failed $6.3 billion merger he helped orchestrate with competitor Office Depot. Regulators killed the merger on the grounds that it would violate antitrust laws.

Currently, Staples president Shira Goodman is acting as CEO while a special committee reviews more permanent candidates for the job.

7. J. Michael Pearson

> Company: Valeant Pharmaceuticals International Inc. (NYSE: VRX)

> 3-yr stock price change: -88.02%

> CEO tenure: February 2008 – May 2016

Michael Pearson is the former CEO of Valeant Pharmaceuticals International Inc., a company now under investigation for fraud. When an alleged major kickback scheme between Valeant and Pennsylvania-based specialty pharmacy company Philidor Rx Services was discovered in late 2015, the company’s stock price, which has been skyrocketing since 2010, quickly did an about face. The stock continued its downward trajectory in 2016, plummeting nearly 90% year-to-date. Pearson left the company in May, but he and the company remain under multiple federal investigations, not just for the Philidor scandal, but also with regards to the company’s charitable giving practices and its billing of national health insurance exchanges.

8. Philippe Dauman

> Company: Viacom Inc. (NYSE: VIAB)

> 3-yr stock price change: -59.16%

> CEO tenure: September 2006 – August 2016

Media giant Viacom has struggled in recent years as Paramount has suffered at the box office and streaming services have increasingly taken a chunk of the market. The company’s net income declined from $2.40 billion in fiscal 2013 to $1.44 billion in fiscal 2016. In May 2016, Long-time executive and CEO Philippe Dauman entered into a power struggle with majority owner, media mogul Sumner Redstone, for control of the company. Not only has Dauman not managed to achieve his goal through an expensive lawsuit, but also he eventually agreed to leave the company. Throughout this, Viacom’s operations continued to suffer as management and resources were tied up in the legal battle. Some ratings agencies have noted they are considering downgrading Viacom’s debt to junk status. Dauman, however, has received a $72 million severance package.

9. John Stumpf

> Company: Wells Fargo & Co. (NYSE: WFC)

> 3-yr stock price change: 21.21%

> CEO tenure: June 2007 – October 2016

John Stumpf recently stepped down from his role as CEO of Wells Fargo as a result of the scandal involving the bank’s ethically questionable sales tactics. The third largest bank in the United States is currently under investigation by the Department of Justice for sales practices during Stumpf’s tenure. The scandal received significant media attention as Stumpf was grilled by a bipartisan team of lawmakers on Capitol Hill. Though Stumpf earned tens of millions of dollars in his nearly 10 years at the head of the bank, he did not receive a severance package upon his voluntary retirement.

Since Stumpf’s departure, Wells’ COO, Tim Sloan, was elected CEO, and the company’s share price has climbed by over 20%.

10. Walter Robb

> Company: Whole Foods Market Inc. (NASDAQ: WFM)

> 3-yr stock price change: -45.58%

> CEO tenure: May 2010 – December 2016

After more than half a decade as co-CEO of high-end grocery store chain Whole Foods Market, Walter Robb will step down at the end of 2016. Going forward, the company will be headed by current co-CEO and co-founder John Mackey.

Under Robb, the grocery chain expanded from 12 stores to more than 460. However, it has also been embroiled in several scandals in recent years. Whole Foods was accused in 2015 of overstating the weight of pre-packaged items in New York City locations and for overcharging customers in Los Angeles in 2014. Additionally, due in large part to increasing competition, which led to declining profits, the company’s share price has been roughly halved in the last three years. Robb will receive a $10 million severance payment and a lifetime discount at the supermarket chain.

11. Ursula Burns

> Company: Xerox

> 3-yr stock price change: -27.8%

> CEO tenure: July 2009 – present

Beginning at Xerox as a summer intern in 1980, Ursula Burns has worked in various positions at the company for well over three decades, eventually taking the reigns from Anne Mulcahy in 2009. The transition occurred as the company reported falling sales in the face of the global recession, and things would get worse under Burns’ leadership.

Under Burns, Xerox acquired Affiliated Computer Services, expanding the company’s reach into the business services sector. Since then, Xerox revenue has fallen from $20 billion in 2013 to $18 billion in 2015. Xerox plans to split its operations in two: a business process outsourcing company and a printer business company. Burns will not head either entity.

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.