Janet Yellen

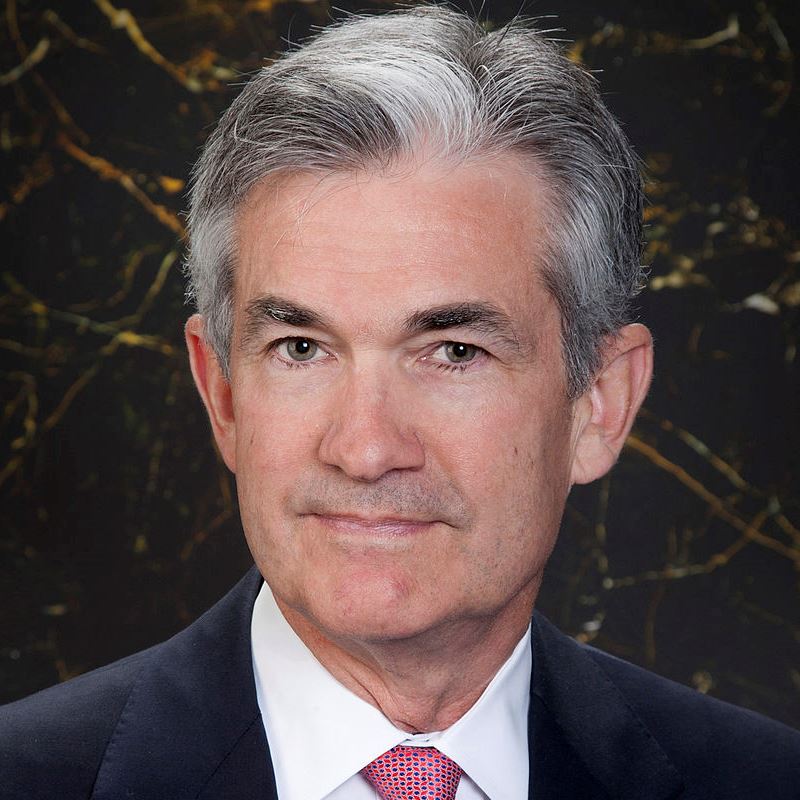

There are 10 takeaways that the investment community should take away from Fed Chair Powell's testimony.

Published:

Last Updated:

If you thought that one Federal Reserve FOMC meeting had a lot of details, there are always the expanded FOMC meeting minutes which give investors another look into how to interpret what the Fed...

Published:

Last Updated:

The U.S. Federal Reserve has released the minutes of the January 2018 Federal Open Markets Committee (FOMC) meeting. While there were no major adjustments to the course the FOMC has set, this is the...

Published:

Last Updated:

Any time there is a Federal Reserve meeting investors pay attention. After all, the Federal Open Market Committee is the body inside the Fed which can determine whether or not to raise interest...

Published:

Last Updated:

Forget about being too nervous about the Federal Reserve hiking interest rates. In the September FOMC meeting, Janet Yellen and the FOMC have indicated that most Fed governors are expecting just one...

Published:

Last Updated:

Wednesday, September 20, 2017, will mark the Federal Reserve’s September Federal Open Market Committee (FOMC) meeting announcement. The announcement also will include forecasts by the Federal...

Published:

Last Updated:

While many investors look over each and every word for clues about monetary policy ahead, Fed Chair Yellen's prepared remarks for the testimony contained no major surprises.

Published:

Last Updated:

Janet Yellen and the Federal Open Market Committee have confirmed what the market was bracing for (or hoping for) — a Fed Funds rate hike. What is also now on the table is that the Federal...

Published:

Last Updated:

On a day when the Federal Reserve is expected to hike interest rates, investors, economists and business owners might wonder what lower inflation readings will do to the decision.

Published:

Last Updated:

Despite the Federal Reserve keeping its target fed funds rate on hold at a target range of 0.75% to 1.00%, all eyes are waiting for Friday’s key employment report from the Labor Department....

Published:

Last Updated:

If the Federal Reserve and the financial markets are correct, 2017 will end up being the year that interest rates start to become more and more normalized on a historical basis.

Published:

Last Updated:

Now that the Federal Reserve has voted to raise interest rates for the first time in 2017, it is important to consider what this might mean for borrowers. Specifically, home buyers.

Published:

Last Updated:

If you were under the belief that the underlying economy was not yet strong enough to support an interest rate hike, note that the Federal Reserve has raised interest rates.

Published:

Last Updated:

According to Fitch Ratings, rising interest rates in 2017 and 2018 are not expected to present a broad concern for U.S. corporate bond issuers in aggregate. Still, pockets of risk could challenge...

Published:

Last Updated:

This Friday's unemployment report is also one of the freshest economic views before Federal Reserve decides whether to raise interest rates at the March FOMC meeting.

Published:

Last Updated: