All the brokerage firms and banks that we follow here at 24/7 Wall St. keep a list for their institutional and retail clients of high-conviction stock picks. Generally, they not only like these stocks on a longer-term basis, but usually they have solid upside to the assigned target price. Since the beginning of the year, many Wall Street firms have tweaked their lists to account for potential changes in 2021, and one firm has added some outstanding stocks we feel could have outsized upside.

[in-text-ad]

In a recent Goldman Sachs research report, the analysts made a big move by adding three top software stocks to the well-respected Americas Conviction List. However, remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Coupa Software

This is a recognized leader in what is called sourcing applications. Coupa Software Inc. (NASDAQ: COUP) provides a unified, cloud-based spend management platform that connects organizations with suppliers globally. The company offers spend management cloud applications that are pre-integrated. The platform offers consumerized financial applications.

The Coupa Software platform offers consumerized financial applications. Its spend management suite includes procurement, invoicing, expenses, sourcing, inventory, contract lifecycle management, budgeting, analytics, open business network, supplier information management and storefront.

The platform offers features such as procure-to-pay solution; online invoice management, and inventory management and tracking software system. Its solutions for business needs include financial compliance and mobile productivity. The company’s solutions for enterprise resource planning include Oracle and NetSuite. Coupa offers solutions for industries, including financial, health care, oil and gas, retail, technology, and food and beverage.

Goldman Sachs is very positive on the stock:

Along with the rest of growth software, Coupa has traded off 23% from its high on 2/18 (versus S&P down 2% in that time frame). But we see an attractive entry point at current levels – 26x calendar year 2022 sales vs. high growth peers at 26x, despite our expectations for above-peer growth as we believe fundamentals for Coupa are improving after a relatively brief period of disruption from the pandemic. Coupa is very much levered to the improving pace of digital transformations, specifically those taking place in the ERP suite, a category that our checks suggest is increasingly being prioritized as companies move through their wish list of system migrations. Coupa has a total addressable market of over $50 billion before taking into account the payments opportunity. This $50 billion runway includes the potential spend for its core offerings of procurement, expense management, invoice management, and community intelligence.

Late last year, Goldman Sachs raised its $328 price target to a stunning $413. The Wall Street consensus target is just $284.04. Coupa Software stock pulled back almost 7% on Monday to close at $267.55 a share.

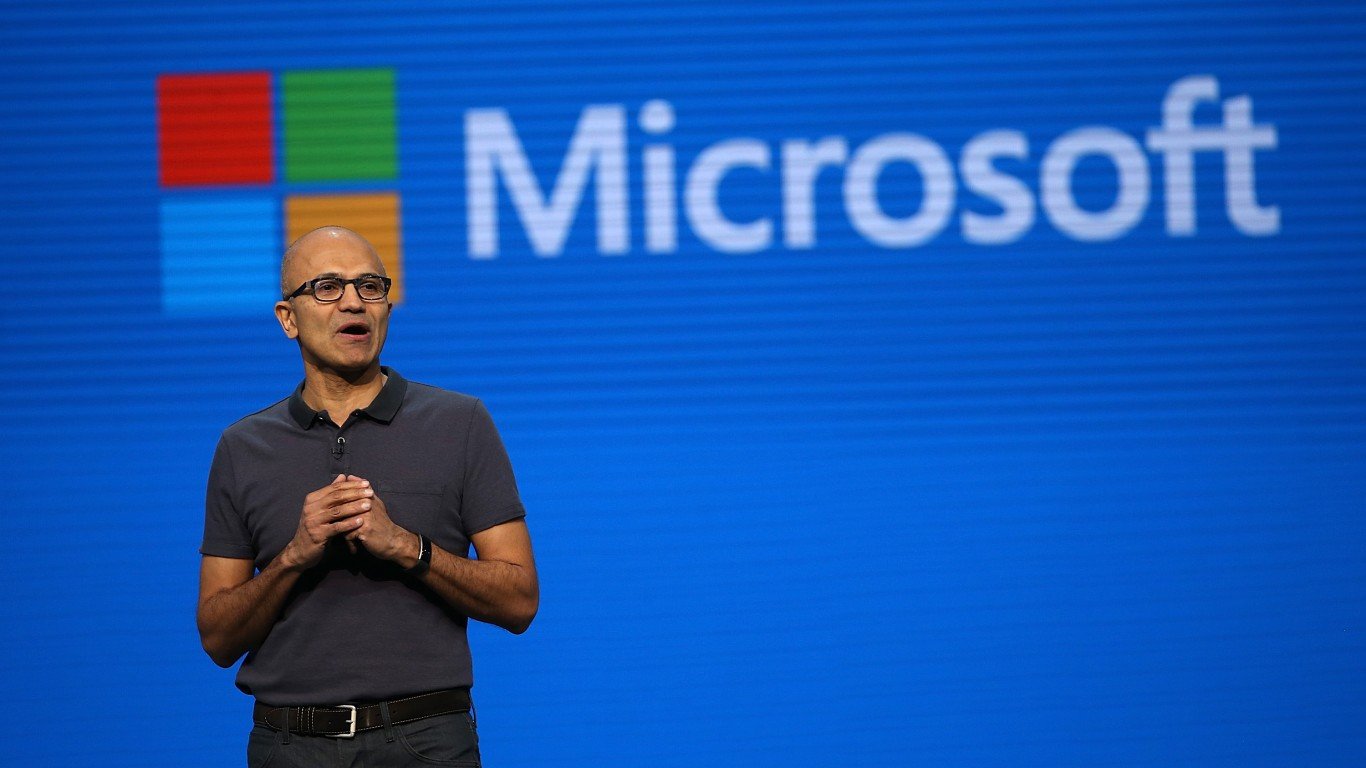

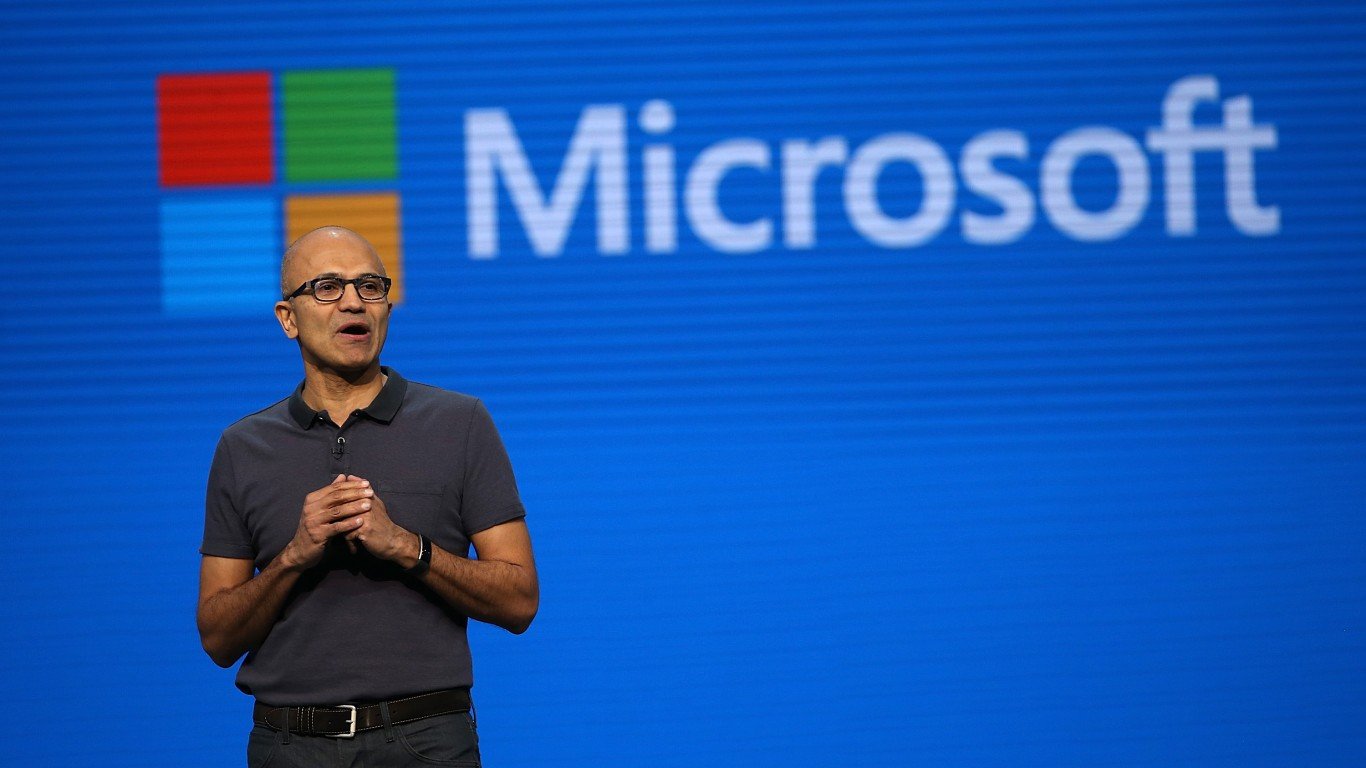

Microsoft

This is a more conservative way for investors to participate in the massive cloud growth and utilization. Microsoft Inc. (NASDAQ: MSFT) manufactures, licenses, and supports a wide range of software products. The company has transformed its business model from a component-driven model (personal computer, server) to one driven by the need for cloud capacity.

Many Wall Street analysts agree that Microsoft has become a clear number two in the public or hyper-scale cloud infrastructure market with Azure, which is the company’s cloud computing platform offerings, and which continues growing at triple-digit levels. Some have flagged Azure as the biggest rival to Amazon’s AWS service.

Some analysts maintain that Microsoft is discounting Azure for large enterprises, such that Azure may be cheaper than AWS for larger users. The cloud was big in 2020 earnings reports, and it will remain a growing part of the software giant’s earnings profile.

It should be noted the company had a massive hack over the weekend that could prove to be a near-term negative for the company.

[in-text-ad]

Goldman Sachs noted this about the software behemoth:

With a strong presence across all layers of the cloud stack, including applications, platforms, and infrastructure, Microsoft is well positioned to capitalize on a number of long-term secular trends, including public cloud and SaaS adoption, digital transformation, Artificial Intelligence/Machine learning, Business intelligence/analytics, and Development Ops (amongst others). We see a pathway for sustained double-digit topline growth alongside continued margin expansion, particularly as the Commercial Cloud business continues to grow as a percentage of the overall mix.

Shareholders receive a 1.0% dividend. The Goldman Sachs price target is $315, and the consensus target is $243.33. Microsoft stock closed at $227.39 on Monday.

Salesforce

This company blew away Wall Street recently with a gigantic $27.7 billion purchase of Slack Technologies. Salesforce.com Inc. (NYSE: CRM) provides enterprise cloud computing solutions, with a focus on customer relationship management to various businesses and industries worldwide.

Salesforce’s enterprise cloud computing applications and platform services include Sales Cloud, which enables companies to store data, monitor leads and progress, forecast opportunities, gain insights through relationship intelligence and collaborate around sales on desktop and mobile devices.

The company also provides Service Cloud, which enables companies to deliver personalized customer service and support, as well as connect their service agents with customers on various devices, and Marketing Cloud, which enables companies to plan, personalize and optimize customer interactions.

Last year Salesforce completed the acquisition of Tableau Software, bringing together the world’s number one customer relationship management company with the world’s number one analytics platform. Salesforce aims to enhance its digital advertising value proposition (and its other existing product offerings) by expanding its data footprint to become the pioneer supplier of a consumer data platform for the corporate market.

The Goldman Sachs report noted this:

Salesforce remains poised to be one of the most strategic application software companies in the $1 trillion total addressable market cloud industry, in our view. With a broad and expanding platform that spans sales, service, ecommerce, marketing, Business intelligence/analytics, artificial intelligence, custom applications, integration, and collaboration, we view Salesforce as well positioned to capitalize on accelerated digital transformation spending, as enterprises across verticals grapple to form a holistic view of their customers across an increasingly complex customer journey involving multiple touchpoints and channels.

The $315 Goldman Sachs price target for Salesforce.com stock compares to the $274.71 consensus target and Monday’s $207.72 final print.

These three top stocks offer investors looking for technology, and specifically software, outstanding long-term growth potential. In addition, these companies are so dominant in their specific software silos that they will be next to impossible to dislodge by the competition.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.