Azure Midstream Partners L.P. has filed an S-1 form with the U.S. Securities and Exchange Commission (SEC) for an initial public offering (IPO). No terms were given for the offering, but the filing is up to $175 million. The company will list on the New York Stock Exchange under the symbol AZUR. Source: Kinder Morgan Inc.

Source: Kinder Morgan Inc.

The offering only has two underwriters: Citigroup and Bank of America Merrill Lynch.

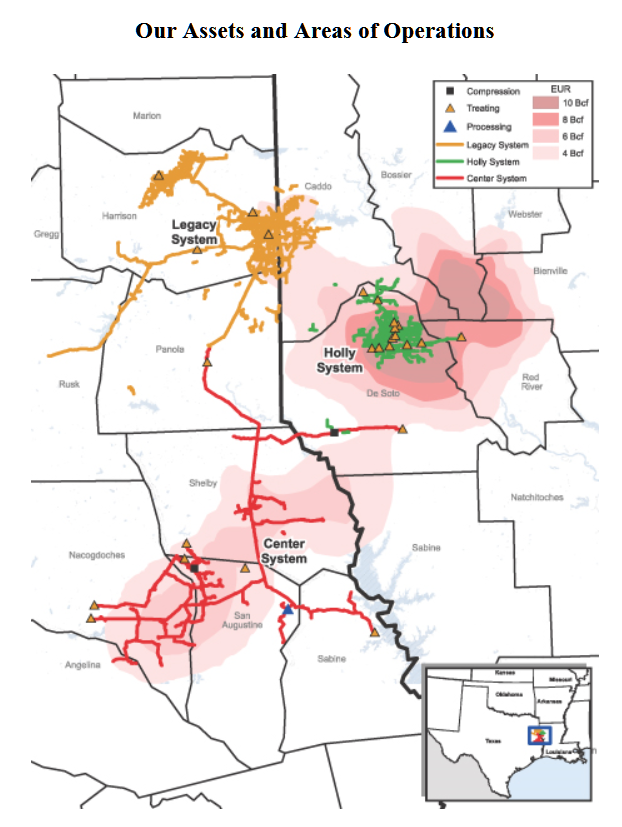

Azure is a Delaware limited partnership focused on owning, operating, developing and acquiring midstream energy infrastructure that is strategically located in core producing areas of unconventional resource basins in North America. The company currently provides natural gas gathering, compression, treating and processing services in North Louisiana and East Texas in the prolific Haynesville and Bossier shale formations, the liquids-rich Cotton Valley formation and the shallower producing sands in the Travis Peak formation. According to the U.S. Energy Information Administration, these formations comprise the third largest natural gas basin in the United States in terms of natural gas production.

At the consummation of this offering, the assets will consist of a 40% limited partner interest, as well as the general partner interest, in Azure Midstream Operating. At the end of September, Azure Midstream Operating’s gathering systems included approximately 1,365 miles of pipeline, which gathered an average of approximately 991 MMcf/d of natural gas during the nine months that ended in September. At the same time, Azure generated over 90% of its revenues under long-term, fixed-fee and fixed-spread natural gas gathering and sales agreements that are intended to mitigate the direct commodity price exposure and enhance the stability of cash flows.

ALSO READ: Dividend Watch: Key Analyst Sees Higher MLP Distributions

Customers include some of the largest natural gas producers in North America, such as Bunge, EXCO, BP, Chesapeake Energy, Devon Energy, Encana, EOG Resources and EP Energy.

Substantially all gas gathering revenue is underpinned by minimum volume commitments, minimum revenue commitments or acreage dedications, including life of lease arrangements. The contracted revenue under minimum volume and revenue commitments on the Azure’s systems represented approximately 56.9% of revenue for the nine months that ended in September.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.