Collapsing demand for energy will reduce carbon emissions by 8% this year and demand will decline by 6%. That’s the equivalent of 6 million barrels of oil a day, or the entire energy demand of India, the world’s third-largest consumer of energy.

Demand declines are expected to be even greater in developed countries. U.S. demand for energy is forecast to drop by 9% in 2020, while demand in the European Union is expected to fall by 11%.

[in-text-ad]

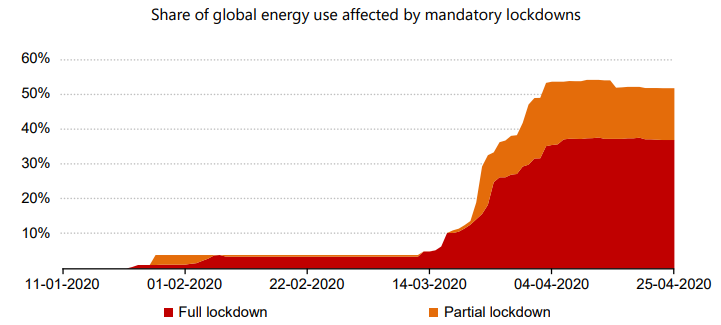

The forecasts were reported Monday by the International Energy Agency (IEA) in the latest version of the Global Energy Review. The IEA estimated that each month of worldwide lockdown at the levels seen in early April reduces annual global energy demand by about 1.5%.

Between March 3 and April 4, lockdowns reduced global energy demand from around 5% to more than 50%.

Coal demand is forecast to decline by nearly 300 million metric tons of oil equivalent, while demand for natural gas is expected to decline by about 175 million metric tons and oil demand is set to fall by more than 400 million metric tons. Only renewables are forecast to see a modest increase.

The IEA projects coal demand to fall by 8%, the largest decline since World War II, and natural gas demand is expected to sink by 5%. Solar PV, wind and hydropower are on track to help raise renewable electricity generation by 5% in 2020.

The expected decline in carbon emissions would be the largest ever recorded, as well as nearly six times larger than the drop of 400 million metric tons following the global financial crisis.

Dr. Fatih Birol, the IEA’s executive director, commented:

This is a historic shock to the entire energy world. Amid today’s unparalleled health and economic crises, the plunge in demand for nearly all major fuels is staggering, especially for coal, oil and gas. … It is still too early to determine the longer-term impacts, but the energy industry that emerges from this crisis will be significantly different from the one that came before. …

And if the aftermath of the 2008 financial crisis is anything to go by, we are likely to soon see a sharp rebound in emissions as economic conditions improve. But governments can learn from that experience by putting clean energy technologies – renewables, efficiency, batteries, hydrogen and carbon capture – at the heart of their plans for economic recovery. Investing in those areas can create jobs, make economies more competitive and steer the world towards a more resilient and cleaner energy future.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.