PMV Pharmaceuticals has filed an amended S-1 form with the U.S. Securities and Exchange Commission (SEC) for its initial public offering. The company intends to price its 7.35 million shares in the range of $16 to $18, with an overallotment option for an additional 1.10 million shares. At the maximum price, the entire offering is valued up to $152.15 million. The company intends to list its shares on the Nasdaq under the symbol PMVP.

The underwriters for the offering are BofA Securities, Cowen, Evercore ISI and Goldman Sachs.

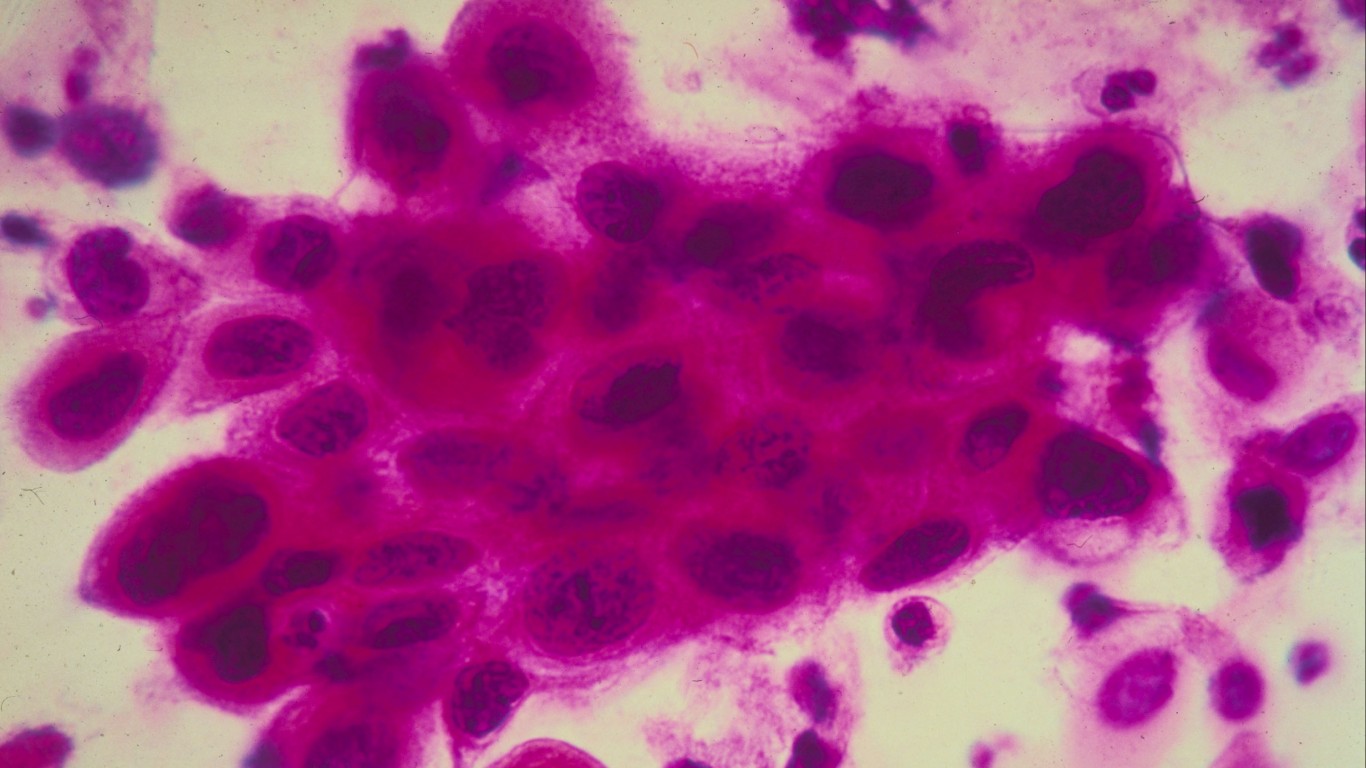

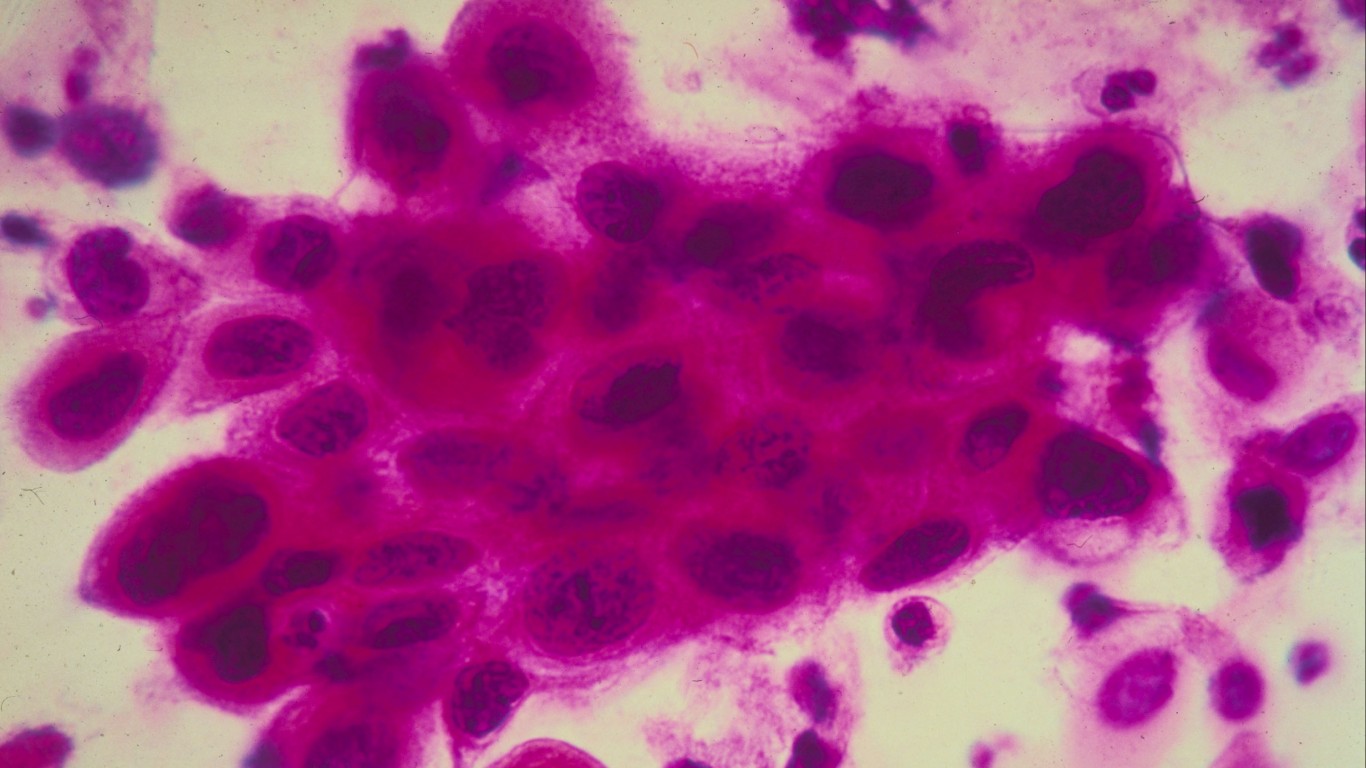

This precision oncology company is pioneering the discovery and development of small molecule, tumor-agnostic therapies targeting p53 mutations. As it stands, p53 is a well-defined tumor suppressor protein known as the “guardian of the genome,” and normal, or wild-type, p53 has the ability to eliminate cancer cells. However, mutant p53 proteins can be misfolded and lose their wild-type tumor-suppressing function. These p53 mutations are found in approximately half of all cancers.

The field of p53 biology was established by the firm’s co-founder Dr. Arnold Levine when he discovered the p53 protein in 1979. PMV has leveraged more than four decades of research experience and developed unique insights into p53 to create a precision oncology platform designed to generate selective, small molecule, tumor-agnostic therapies that structurally correct specific mutant p53 proteins to restore their wild-type function.

Ultimately, the firm is deploying its precision oncology platform to target the top 10 most frequent, or hotspot, p53 mutations that are collectively associated with approximately 10% to 15% of all cancers.

PMV expects to advance its next program, targeting the p53 R273H hotspot mutation, into lead optimization in the first half of 2021. The firm owns worldwide commercial rights to all of its programs. The strategy is to seek FDA approval under an accelerated pathway, and management believes its Phase 1/2 clinical trial has the potential to serve as a pivotal study.

The company intends to use the net proceeds from the offering to fund its Phase 1/2 development of PC14586, the development of the R237H program, further pipeline development and general corporate purposes.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.