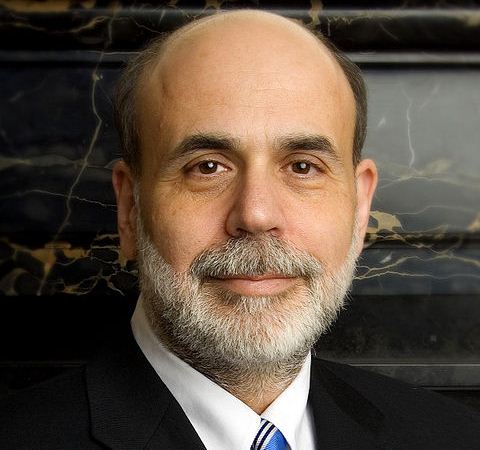

Ben Bernanke has done little to sell a full recovery of the U.S. economy to the public or Congress. He knows better. And, QE3 can hardly be considered a stroke of optimism. Source: courtesy U.S. Federal Reserve

Source: courtesy U.S. Federal Reserve

Recent green shoots have started to turn brown, it seems, and Bernanke made a direct observation about these in a speech:

What are the headwinds that have slowed the return of our economy to full employment? Some have come from the housing sector

He added:

Lenders cite a number of factors affecting their decisions to extend credit, including ongoing uncertainties about the course of the economy, the housing market, and the regulatory environment. Unfortunately, while some tightening of the terms of mortgage credit was certainly an appropriate response to the earlier excesses, the pendulum appears to have swung too far, restraining the pace of recovery in the housing sector.

And:

A second set of headwinds stems from the financial conditions facing potential borrowers in credit and capital markets. After the financial system seized up in late 2008 and early 2009, global economic activity contracted sharply, and credit and capital markets suffered significant damage. Although dramatic actions by governments and central banks around the world helped these markets to stabilize and begin recovering, tight credit and a high degree of risk aversion have restrained economic growth in the United States and in other countries as well.

Finally,

A third headwind to the recovery–and one that may intensify in force in coming quarters–is U.S. fiscal policy. Although fiscal policy at the federal level was quite expansionary during the recession and early in the recovery, as the recovery proceeded, the support provided for the economy by federal fiscal actions was increasingly offset by the adverse effects of tight budget conditions for state and local governments. In response to a large and sustained decline in their tax revenues, state and local governments have cut about 600,000 jobs on net since the third quarter of 2008 while reducing real expenditures for infrastructure projects by 20 percent.

Douglas A. McIntyre

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.