While most of Wall Street focuses on large and mega cap stocks, as they provide a degree of safety and liquidity, many investors are limited in the number of shares they can buy. Often the biggest public companies, especially the technology giants, trade in the low-to-mid hundreds, all the way up to over $1,000 per share. At those steep prices, it’s pretty hard to get any decent share count leverage.

Many investors, especially more aggressive traders, look at lower-priced stocks as a way to not only make some good money but to get a higher share count. That can really help the decision-making process, especially when you are on to a winner, as you can always sell half and keep half.

We screened our 24/7 Wall St. research database and found five additional stocks that are trading under the $10 level and could provide investors with some solid upside potential. These are rated Buy at SunTrust Robinson Humphrey as well. While much better suited for aggressive accounts, they could prove exciting additions to portfolios looking for solid alpha potential.

Endo

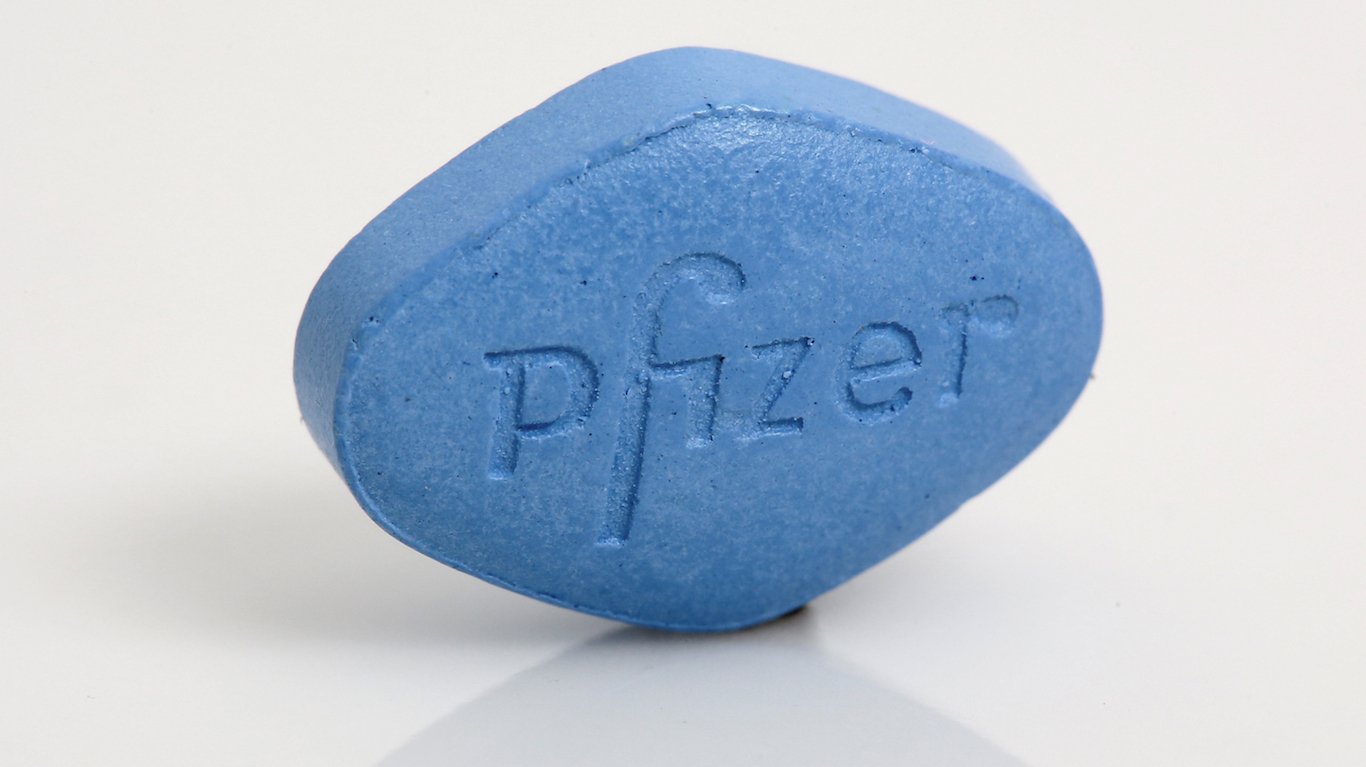

This stock is down a massive 60% since last fall and could hold incredible potential for patient investors. Endo International PLC (NASDAQ: ENDP) is an Irish-domiciled global specialty pharmaceutical company that develops, manufactures and commercializes branded and generic pharmaceutical products. The company has operations in the United States, Canada, Latin America, South Africa and India.

Endo redomiciled in Ireland following its 2014 acquisition of Paladin Labs, which significantly reduced the company’s tax rate. Endo has expanded through several M&A transactions, including Auxilium (brands) and Par (generics).

The company posted solid first-quarter results with earnings, excluding non-recurring items, that were better than the S&P Capital IQ Consensus estimate. Revenues rose 2.9% year over year to $720 million, which also topped analysts’ expectations.

First-quarter 2019 Sterile Injectables revenues increased 25% from the first quarter of 2018. Branded Pharmaceuticals — Specialty Products revenues increased 19% year over year. All in all, it was a very good report.

The SunTrust price objective for the shares is a lofty $13, though the Wall Street consensus target price is slightly higher at $13.75. The stock was last seen on Friday trading at $6.52.

Enerplus

This off-the-radar stock also has big upside to the SunTrust price target. Canada-based Enerplus Corp. (NYSE: ERF) engages in the exploration and development of crude oil and natural gas in the United States and Canada. The company’s oil and natural gas properties are located primarily in North Dakota, Montana, Colorado and Pennsylvania, as well as Alberta, British Columbia and Saskatchewan.

The company posted quarterly earnings that beat the consensus estimate, an earnings surprise of 15%. In the previous quarter, Enerplus delivered an earnings surprise of more than 10%. Over the last four quarters, the company has surpassed consensus earnings estimates twice.

SunTrust has a price target at $13 on the stock, which compares to the consensus target last seen at $13.59. The stock traded on Friday’s close at $8.44 a share.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.