Last year, and so far this year, it seems to be much more like 1999, as technology initial public offerings that made little or no money came out and rocketed higher. However, some of the glow has worn off, and some of the deals retreated to much lower price levels or traded lower right out of the chute. Some top hedge funds reportedly were shorting the IPOs as soon as they could, and now it appears that many of the same hedge funds could be piling into the shares.

[in-text-ad]

We screened our 24/7 Wall St. research database looking for backdraft trade ideas on some of the stocks that have had some wild price swings in 2021. We found four companies that are rated Buy across Wall Street and that also offer stellar technologies and applications. While not suited for conservative investors, they make sense for aggressive investors looking for solid ideas. It is important to remember that Facebook was cut in half after its IPO and traded down to $17. Yet, it closed recently at $351 a share.

It also is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

Convey

This stock sputtered out of the block and could be offering among the best upside potential. Convey Holding Parent Inc. (NASDAQ: CNVY) provides technology-enabled solutions and advisory services to assist its clients with workflows across product developments, sales, member experience, clinical management, core operations and business intelligence and analytics in the United States.

The company operates through two segments. The Technology Enabled Solutions segment offers technology solutions through web-based customizable applications that are used to identify, track and administer contractual services or benefits provided under a client’s plan to its Medicare and Medicaid beneficiaries.

It also provides analytics over health care data to capture and assess gaps in risk documentation, quality, clinical care and compliance. The company’s software solutions for health plans include enrollment and billing technology, supplemental benefits solution, agent and broker management, membership and financial reconciliation, compliance monitoring and data analytic solutions.

The Advisory Services segment offers advisory services, including sales and marketing strategies, provider network strategies, compliance, star ratings, quality, clinical, pharmacy, analytics and risk adjustment. The company serves government-sponsored, Medicare, Medicaid and provided sponsored plans, as well as pharmacy benefits managers.

Canaccord Genuity has a Buy rating and a Wall Street high $18 price target. No consensus target was available. The shares closed trading on Wednesday at $8.79.

DoubleVerify

Digital media is a white-hot new silo for investors, and this is a great way to play it. DoubleVerify Holdings Inc. (NYSE: DV) offers a software platform for digital media measurement, data and analytics. The company offers DV Authentic Ad, a metric of digital media quality that evaluates the existence of fraud, brand safety, viewability and geography for each digital ad. Its DV Authentic Attention solution provides exposure and engagement predictive analytics to drive campaign performance, and its Custom Contextual solution allows advertisers to match their ads to relevant content to maximize user engagement and drive campaign performance.

[in-text-ad]

The company also provides DV Publisher suite, which includes unified analytic, campaign delivery insight, media quality insight and optimization, industry benchmark and video delivery automation solutions. Its Pinnacle provides customers with access to data on all the digital ads and enables them to make changes to ad strategies on a real-time basis, and its Connected TV solution detects fraudulent device signatures.

The company’s software solutions are integrated across the digital advertising ecosystem, including programmatic platforms, social media channels and digital publishers.

The Goldman Sachs Buy rating comes with a Wall Street high $47 price target. The consensus target is $40.63, and the stock closed at $36.11 on Wednesday.

iPower

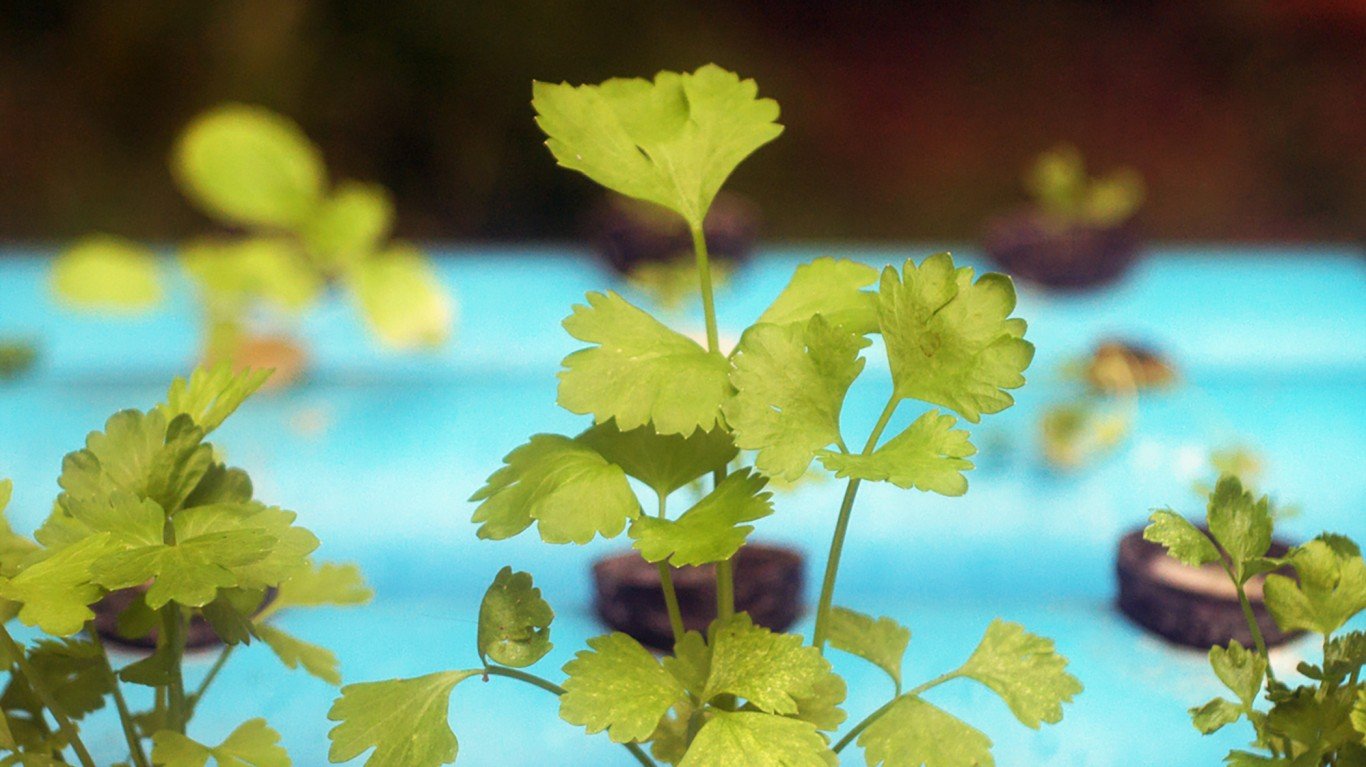

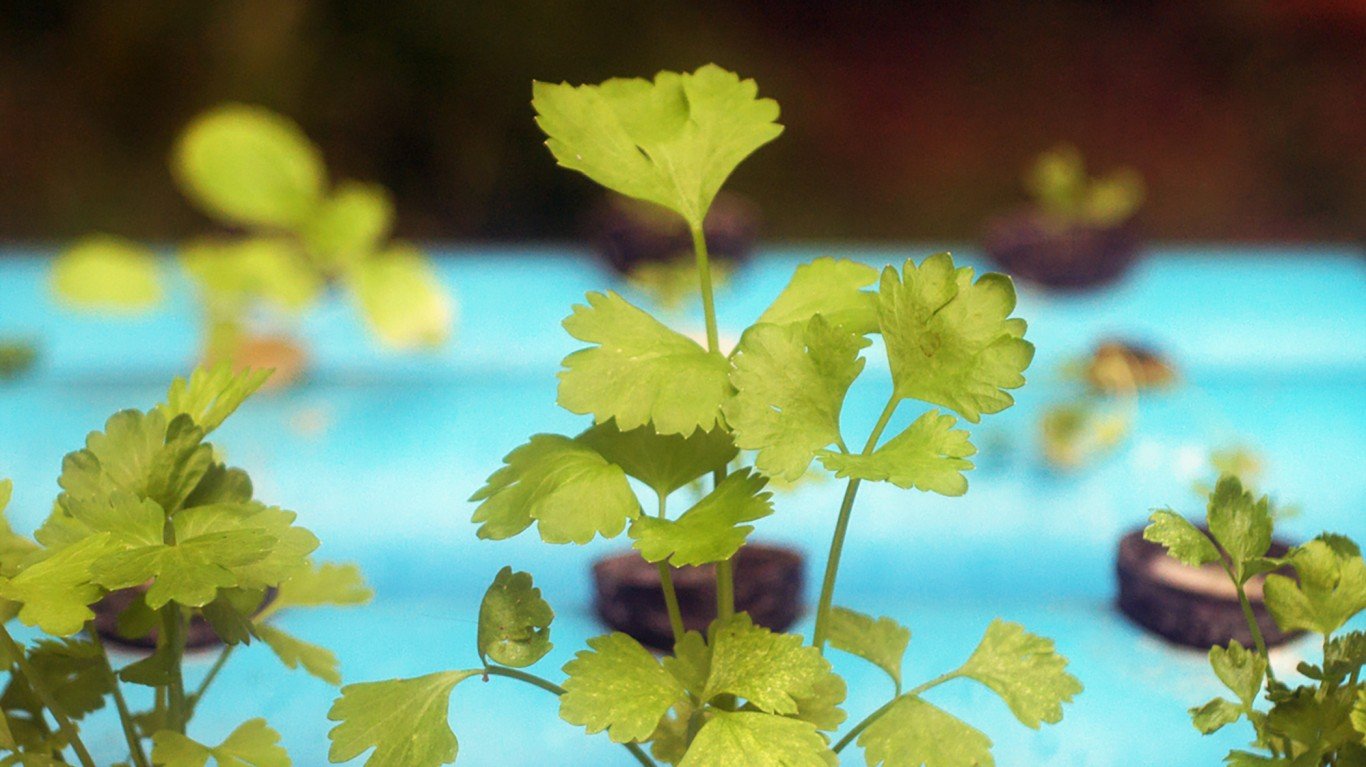

Shares of this unique company offer aggressive investors an outstanding entry point. iPower Inc. (NYSE: IPW) supplies hydroponics equipment online in the United States. Its products include advanced indoor and greenhouse grow-light systems, ventilation systems, activated carbon filters, nutrients, growing media, hydroponic water-resistant grow tents, trimming machines, pumps and accessories for hydroponic gardening, as well as other indoor and outdoor growing products under the iPower and Simple Deluxe brands through its Zenhydro website and various third-party e-commerce channels.

The company is one of the leading online retailers and suppliers of hydroponics equipment and accessories in the United States. iPower offers thousands of stock-keeping units from its in-house brands, as well as hundreds of other brands through its website and its online platform partners, all of which are fulfilled from its two fulfillment centers in southern California. iPower has a diverse customer base that includes both commercial businesses and individuals.

D.A. Davidson has a Buy rating and a strong $10 price target, which tops the $9.50 consensus target. The stock closed most recently at $5.89 a share.

SoFi Technologies

This company took the SPAC route for its IPO and offers investors completely new ways to manage their money and the future. SoFi Technologies Inc. (NASDAQ: SOFI) provides digital financial services.

Its financial services allow its members to borrow, save, spend, invest and protect their money. The company offers student loans, personal loans for debt consolidation and home improvement projects, and home loans.

SoFi Technologies also provides cash management, investment and other related services. In addition, it operates Galileo, a technology platform that offers services to financial and non-financial institutions, and Apex, a technology-enabled platform that provides investment custody and clearing brokerage services.

Rosenblatt started coverage in June with a Buy rating and a $30 price target. The consensus target is $27.50. The shares ended Wednesday at $15.52.

Once again, it is important to remember these stocks are only suitable for aggressive growth investors with a high risk tolerance. With that caveat stated, they all offer excellent entry points and have posted some decent earnings results out for the gate.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.