There was palatable fear earlier this week, ahead of the staggering consumer price index number that came out Wednesday, and with good reason. The 9.1% increase for June was the highest since June of 1981, and some even feel that it could have been closer to 10%. Either way, Americans are paying more for everything. While the peak inflation narrative is working its way across Wall Street, and we may see improved numbers next month as oil has plummeted, only time will tell.

[in-text-ad]

One thing inflation does is ravage stock portfolios. With both the Nasdaq and the S&P 500 in bear market territory, it makes sense to look for stocks that do well in inflationary times and pay dependable dividends. We screened our 24/7 Wall St. research universe looking for stocks in sectors that have historically done well, and energy, gold and real estate showed up in a big way. The timing looks right for both energy and gold, as both sectors have been slammed recently.

We then screened those three sectors looking for stocks rated Buy at major Wall Street firms that come with dependable dividends and offer solid entry points. Seven companies look like great ideas now and for the rest of 2022. It is important to remember that no single analyst report should be used as a sole basis for any buying or selling decision.

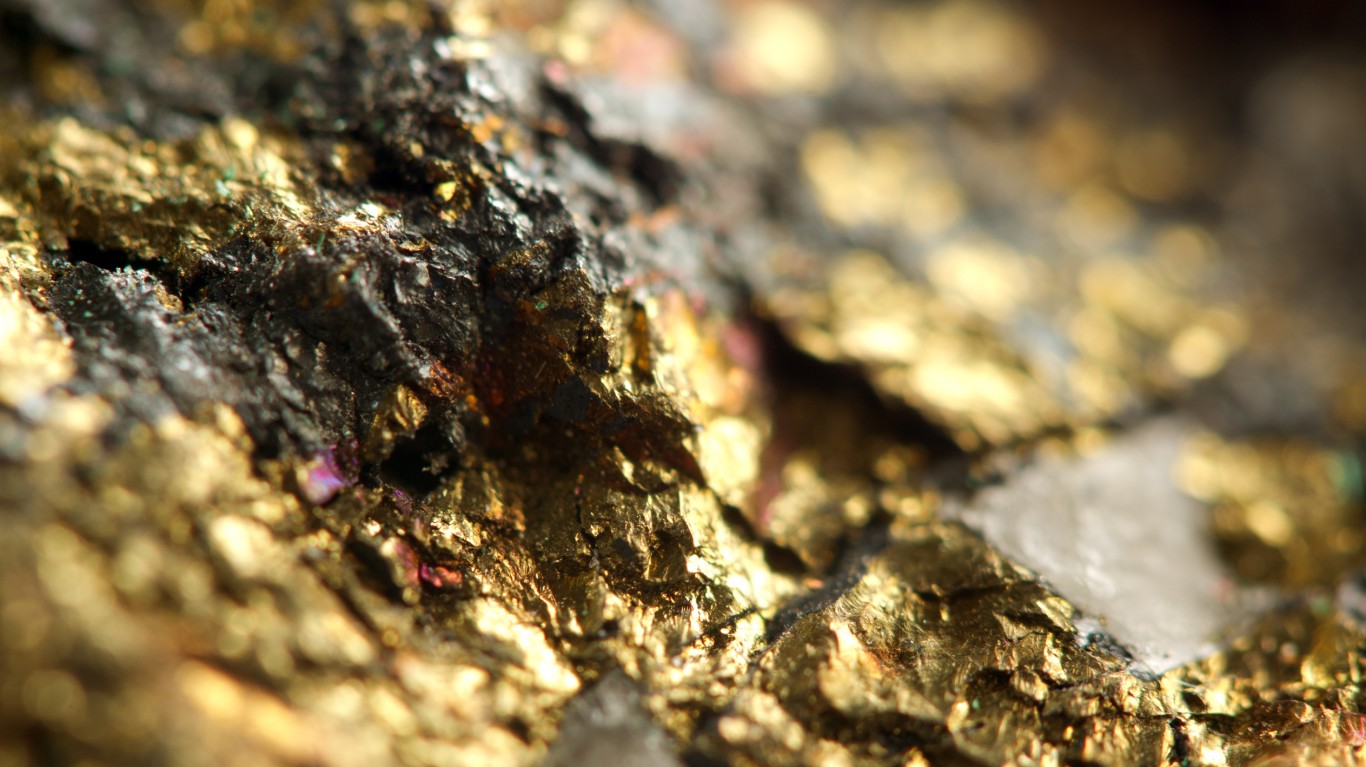

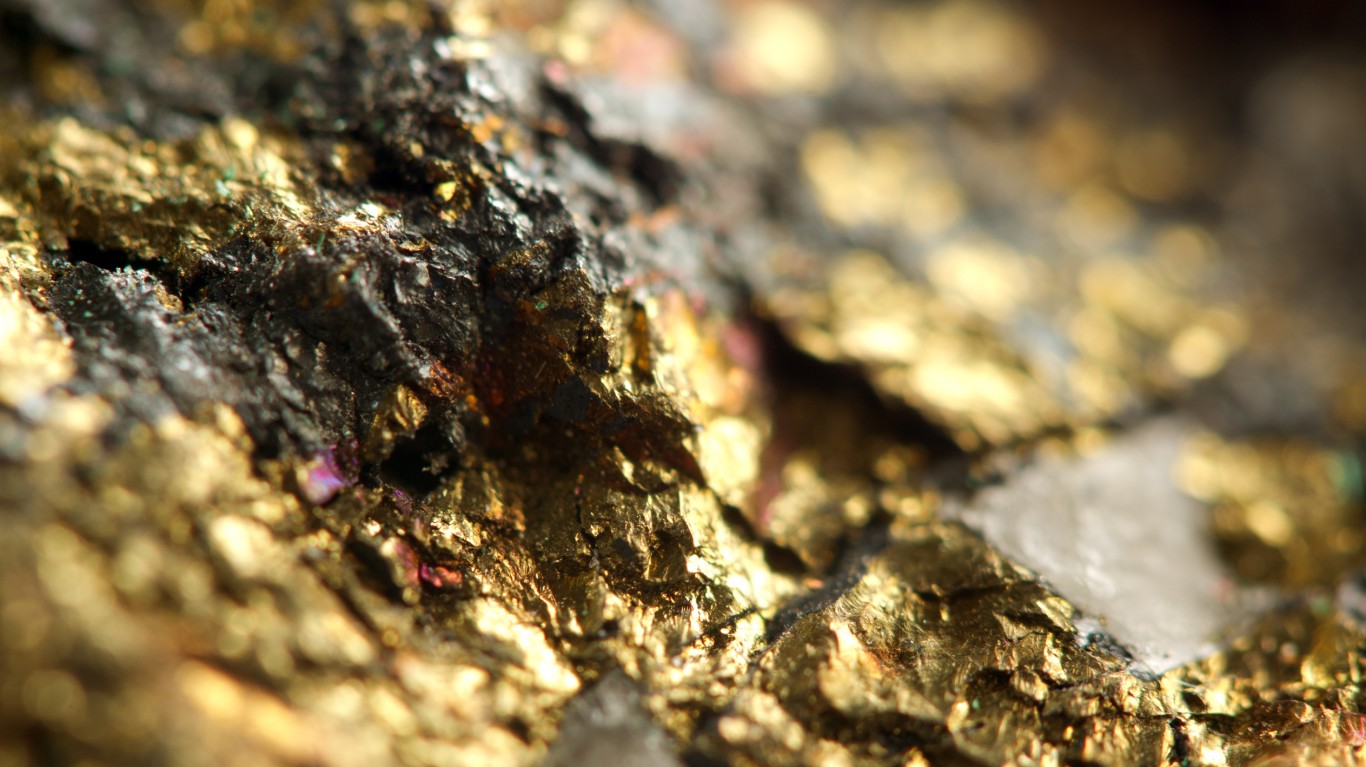

Agnico Eagle Mines

This is one of Wall Street’s most preferred North American gold producers. Agnico Eagle Mines Ltd. (NYSE: AEM) is a senior Canadian gold-mining company that has produced precious metals since 1957. Its eight mines are located in Canada, Finland and Mexico, with exploration and development activities in each of these regions, as well as in the United States and Sweden.

The company and its shareholders have full exposure to gold prices due to its long-standing policy of no forward gold sales. The stock has been crushed as gold has sold off last year’s highs. And with a surge of inflation, you can bet many savvy portfolio managers are ready to add back top companies like this. Agnico Eagle has declared a cash dividend every year since 1983.

Shareholders receive a 3.62% dividend. The BofA Securities price target on Agnico Eagle Mines stock is $60, but the consensus target is higher at $90.21. Shares closed almost 2% higher on Wednesday at $44.74.

Exxon Mobil

The recent back-up in oil pricing has this integrated giant trading at levels printed earlier this year and offers investors an excellent entry point. Exxon Mobil Corp. (NYSE: XOM) is the world’s largest international integrated oil and gas company. It explores for and produces crude oil and natural gas in the United States, Canada, South America, Europe, Africa and elsewhere.

Exxon also manufactures and markets commodity petrochemicals, including olefins, aromatics, polyethylene and polypropylene plastics, and specialty products, and it transports and sells crude oil, natural gas and petroleum products.

Top Wall Street analysts expect Exxon to remain a key beneficiary in this higher oil price environment, and most remain strongly positive about the company’s sharp positive inflection in capital allocation strategy, upstream portfolio, and leverage to a further demand recovery, with Exxon Mobil offering greater downstream/chemicals exposure relative to peers.

Exxon Mobil stock comes with a 4.15% dividend, which will continue to be defended. BofA Securities has a $128 price target. The consensus target is lower at $102.67, and the shares closed on Wednesday at $84.84.

[in-text-ad]

Medical Properties Trust

This stock may offer investors the best value at current price levels. Medical Properties Trust Inc. (NYSE: MPW) acquires, develops and invests in health care facilities and leases health care facilities to health care operating companies and providers. The company also provides mortgage loans to health care operators, as well as working capital and other term loans to its tenants/borrowers.

With a growing portfolio and a versatile business model, the company continues to rank high across Wall Street. The analysts noted that the company’s acute care hospitals rent coverage increased nicely and the company attributed the increase to better cost controls and higher patient admissions.

Shareholders receive a 7.40% distribution. Key Corp’s $18 price target is less than the $21.50 consensus target for Medical Properties Trust stock. The shares closed at $15.68 on Tuesday.

Newmont

This is one of the largest mining companies and a solid buy for investors who are more conservative. Newmont Corp. (NYSE: NEM) is engaged in the production of gold.

Its North America segment consists primarily of Carlin, Phoenix, Twin Creeks and Long Canyon in Nevada and Cripple Creek and Victor in Colorado. The South America segment consists primarily of Yanacocha in Peru and Merian in Suriname. The Australia segment consists primarily of Boddington, Tanami and Kalgoorlie in Australia. The Africa segment consists primarily of Ahafo and Akyem in Ghana.

Newmont stock investors receive a 3.78% dividend. The $85 BofA Securities price objective compares with a $118.55 consensus target and the most recent close at $58.19.

Phillips 66

This extremely diversified energy company has a long and successful operating history, and shares have backed up nicely. Phillips 66 (NYSE: PSX) operates through four segments: Midstream, Chemicals, Refining, and Marketing and Specialties. The company holds many of these assets within its MLP, Phillips 66 Partners.

The company benefits from the tax-advantaged structure while still operating a more diversified operating business that also contains many assets that are not ideal MLP assets, such as its fast-growing chemical manufacturing business and its super-profitable refined products marketing business.

Phillips 66 remains a top refining idea across Wall Street, where many continue to see headroom for incremental capital returns. Most analysts are very constructive on a positive rate of change at Refining in 2022 at the company. In addition, they continue to see attractive non-refining value in the other segments.

Investors receive a 4.87% dividend. Wells Fargo’s $127 price target is greater than the $115.39 consensus target. Phillips 66 stock ended Wednesday’s trading at $79.65.

[in-text-ad]

VICI Properties

This is the top pick across Wall Street in the net lease group, and it is an ideal pick for investors who are more conservative and looking for gaming exposure. VICI Properties Inc. (NYSE: VICI) is a triple net lease real estate investment trust (REIT) that was spun out of Caesars Entertainment post-bankruptcy.

The company has 23 mixed-use gaming, lodging and entertainment properties in its portfolio, and a subsidiary that owns four championship golf courses. VICI also owns roughly 34 acres of undeveloped land in Las Vegas, which it leases to Caesars.

Much of the focus has been on VICI’s recent deal to acquire the real estate of the Venetian Resort in Las Vegas, with Apollo as a new tenant. Looking ahead, many on Wall Street are positive on VICI’s embedded growth pipeline with Caesars Entertainment, including a put/call on the Centaur properties in Indiana (starting in January) and a right of first refusal on a strip asset sale for Caesars, which could occur soon after a full earnings before interest, taxes, depreciation, amortization and restructuring or rent costs recovery.

Investors receive a 4.56% distribution. The VICI Properties price target at Goldman Sachs is $39, while the consensus target is $35.13. Shares closed at $31.60 on Wednesday.

W.P. Carey

This net lease REIT has an incredible distribution for income investors. W.P. Carey Inc. (NYSE: WPC) ranks among the largest net lease REITs, with an enterprise value of approximately $18 billion and a diversified portfolio of operationally critical commercial real estate that includes 1,215 net lease properties covering approximately 142 million square feet, as of September 30, 2020.

For nearly five decades, the company has invested in high-quality single-tenant industrial, warehouse, office and retail properties subject to long-term leases with built-in rent escalators. Its portfolio is located primarily in the United States and northern and western Europe, and it is well diversified by tenant, property type, geographic location and tenant industry.

Investors receive a 5.16% distribution. Raymond James has set a $95 price target. The consensus target is $88.33. W.P. Carey stock closed at $82.17 on Wednesday.

Both oil and gold have sold off significantly this year and are offering outstanding entry points for investors looking to get a degree of inflation protection after the staggering increase in prices paid. It is important to remember that the consumer price index report is a trailing, or backward-looking, data set. The sharp drop in energy pricing likely will not be a factor until the July report comes out in early August. Also remember that the three REITs pay distributions that may contain return of principal.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.