For existing and potential investors, earnings have been one of the most important metrics seen in a company. Investors can be attracted to companies that already declared their quarterly results and outperformed expectations, but investors can stay ahead of the curve by uncovering the stocks that are poised to beat their quarterly earnings expectations. Outperformance acts as a catalyst and helps raise investor confidence in the stock, resulting in increased prices.

About the Tech Market

The Zacks Technology Services industry comprises companies involved in the manufacturing, development and design of a wide range of software, hardware and communication equipment. This includes powertrain technologies, advanced analytics, collaboration software, specialty printers and financial solutions. The industry serves diverse markets and customers, providing products and services to consumers, small business owners, tax professionals, financial advisors and certified public accounting firms. Additionally, some industry participants offer clinical research services, data storage technology and technology-enabled solutions.

Per Statista, revenues from the IT services market are expected to be $1,241 billion in 2023, of which the majority is expected from IT outsourcing (around $460 billion). The IT services market is expected to reach $1,771 billion by 2028, seeing an annual growth rate (CAGR) of 7.37%. The ongoing global digitization trend is creating prospects for the market, including 5G, blockchain and artificial intelligence (AI). The United States, a significant IT market, is poised for growth due to the widespread adoption of smart technologies and increased security investments. Companies are embracing AI, machine learning (ML), blockchain, and data science to gain a competitive edge.

AI and ML have been gaining traction in the technology market. The global AI market, valued at around $142 billion as of 2023, is growing as you read this article and is expected to be $100 billion by 2030, per Statista. ML, a subset of artificial intelligence and the largest part of the AI ecosystem, is expected to grow from $140 billion to $2 trillion in 2030.

Key Factors to Consider for Technology Service Stocks

The industry experienced accelerated growth in the first quarter of 2023, with remote and hybrid work models gaining traction. Enterprises actively pursued a balance between on-premise and cloud infrastructures to offer flexible and adaptable hybrid solutions in the era of digital transformation. The pandemic-induced remote work trend drove the demand for cloud solutions, cost-efficient business support and digital monetization solutions, improving the industry’s prospects.

With industry participants modernizing legacy processes to align with evolving IT services, the digitization wave acted as a tailwind in the first quarter. They aimed to integrate emerging technologies like the cloud, IoT, AI and analytics. Additionally, increasing internet penetration in emerging markets, especially in the Asia-Pacific region, supported industry growth.

Zacks Methodology

However, picking the right stock could be difficult unless one knows the proper method. To make the task simple, we rely on the Zacks methodology, combining a Zacks Rank — Zacks Rank #1 (Strong Buy) or 2 (Buy) or 3 (Hold) — and a positive Earnings ESP.

Our proprietary methodology, Earnings ESP, shows the percentage difference between the Most Accurate Estimate and the Zacks Consensus Estimate. Research shows that for stocks with this combination of rank and ESP, chances of a positive earnings surprise are as high as 70%.

You can uncover the best stocks to buy or sell before they’re reported with our Earnings ESP Filter.

Here are 5 Technology Services stocks that have the right combination of elements to deliver a positive surprise this earnings season:

SPX Technologies SPXC: This is a diversified company specializing in highly engineered products and technologies, with a strong presence in HVAC, detection and measurement markets. SPXC has an Earnings ESP of +1.59% and currently sports Zacks Rank #1. The Zacks Consensus Estimate for the company’s second-quarter 2023 bottom line is pegged at 84 cents, indicating 18.3% growth from the year-ago reported figure. The consensus estimate for revenues is pegged at $390.7 million, suggesting 10.4% growth from the year-ago reported number.

Trane Technologies TT: This is a renowned multinational company focused on climate technology, specializing in delivering HVAC solutions for a diverse range of residential, commercial and industrial needs. The company has an Earnings ESP of +1.20% and a Zacks Rank #2 at present. The Zacks Consensus Estimate for the company’s second-quarter 2023 earnings is pegged at $2.55, indicating 18.1% growth from the year-ago reported figure. The consensus estimate for revenues is pegged at $4.62 billion, implying a 10.3% rise from the year-ago reported figure.

Aptiv APTV: This is a global technology company that specializes in designing and manufacturing advanced electrical systems and solutions for the automotive industry. It currently has an Earnings ESP of +12.88% and Zacks Rank #2. The Zacks Consensus Estimate for the company’s second-quarter 2023 earnings is pegged at $1.01, whereas the estimate for revenues is pegged at $4.7 billion. The consensus estimate for earnings indicates more than 100% growth from the year-ago reported figure, whereas the same for revenues suggests a 15.8% rise.

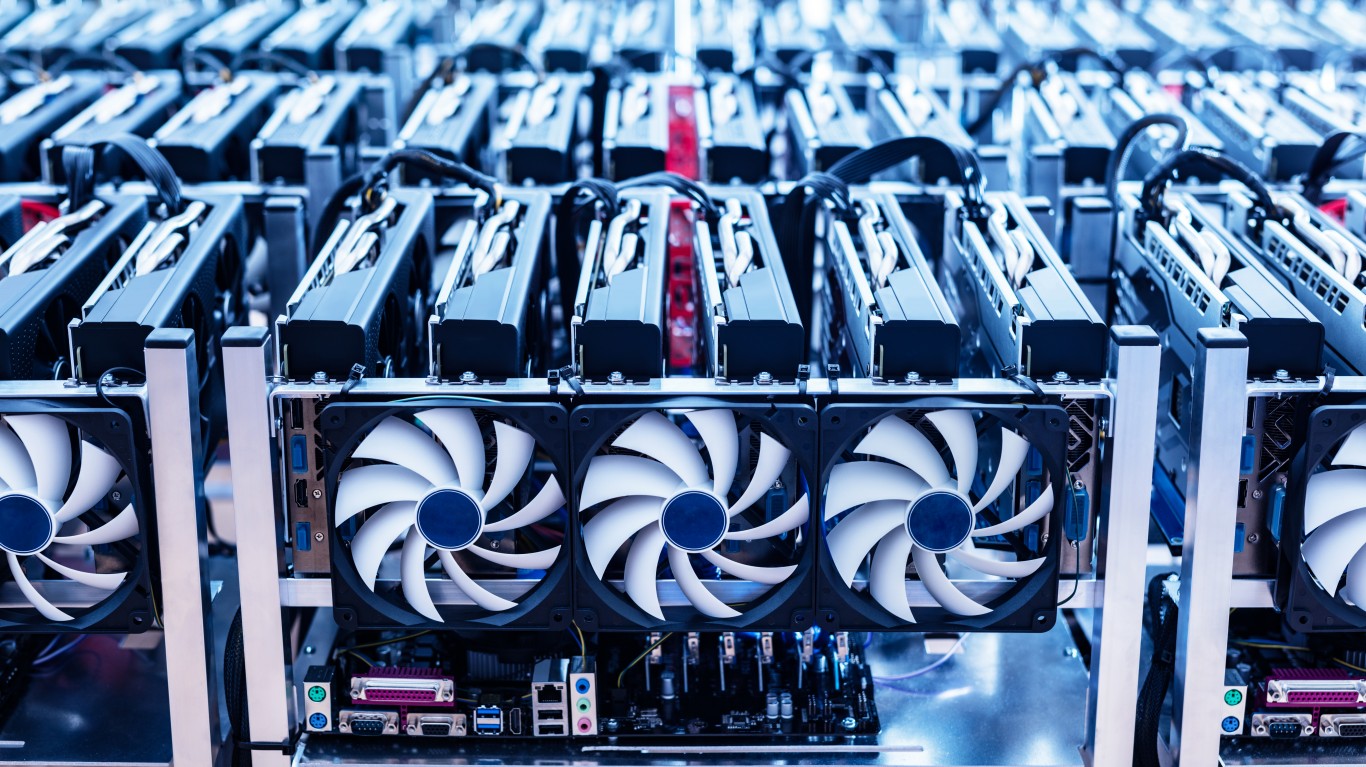

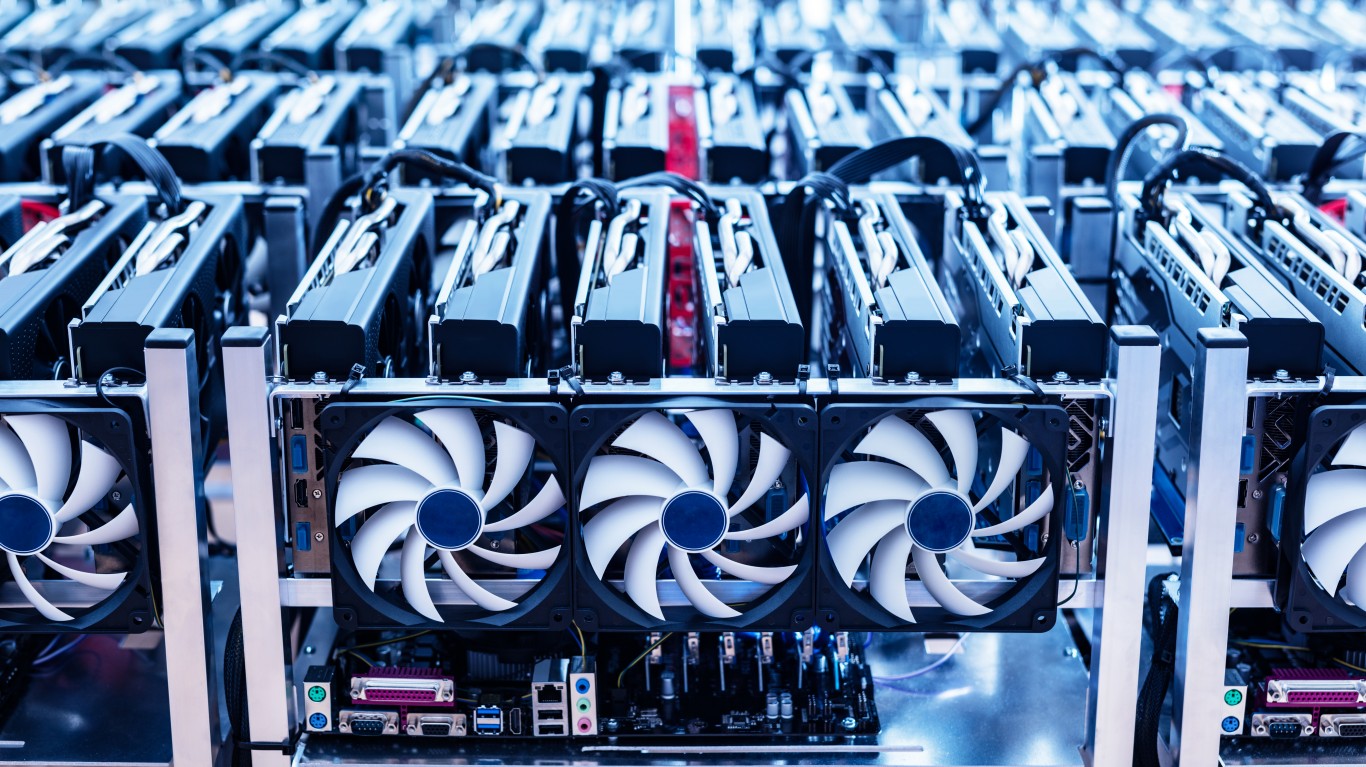

Riot Platforms RIOT: The Castle Rock, CO-based bitcoin mining company, formerly Riot Blockchain, follows a vertically integrated strategy, operating data centers in central Texas. RIOT has an earning ESP of +70.21% and a Zacks Rank #3 at present. The consensus mark for the company’s second-quarter 2023 bottom line is pegged at negative 24 cents, suggesting a 52% improvement from the year-ago reported figure. The revenue estimate is pegged at $83.01 million, indicating a 13.8% increase from the year-ago reported number.

Spotify SPOT: This is a popular digital music streaming platform that allows users to access a vast library of songs, podcasts and other audio content. Spotify currently has an Earnings ESP of +40.26% and a Zacks Rank #3. The Zacks Consensus Estimate for the company’s second-quarter 2023 bottom line is pegged at negative 84 cents, indicating 7.7% growth from the year-ago reported figure. The consensus estimate for revenues is pegged at $3.52 billion, suggesting a 15.3% year-over-year rise.

Trane Technologies plc (TT): Free Stock Analysis Report

SPX Technologies, Inc. (SPXC): Free Stock Analysis Report

Riot Platforms, Inc. (RIOT): Free Stock Analysis Report

Aptiv PLC (APTV): Free Stock Analysis Report

Spotify Technology (SPOT): Free Stock Analysis Report

To read this article on Zacks.com click here.

This article originally appeared on Zacks

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.