Apparently, renowned hedge fund manager Bill Ackman is not through yet building a stake in real estate firm Howard Hughes Holdings. But the biggest insider purchases of the week were in energy giants Exxon Mobile and Energy Transfer. Here is a look at these and more notable insider buying of the past week.

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

Remember that when the earnings-reporting season is in full swing, many insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported recently.

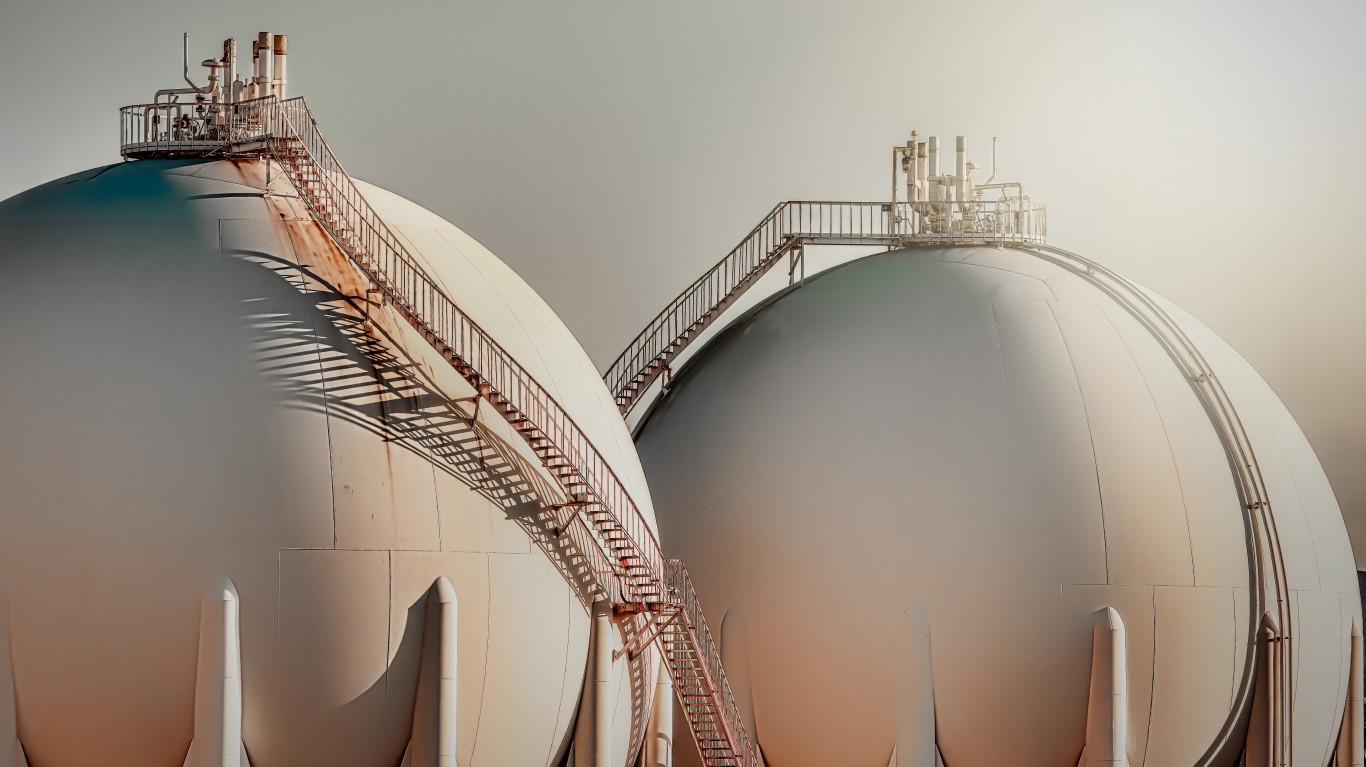

Energy Transfer

The natural gas transportation and storage company posted mixed third-quarter results recently and announced the closure of its acquisition of Crestwood Equity Partners. Energy Transfer stock is down about 3% in the past week and was last seen trading around $13 per share, just below Kelcy’s purchase price. However, that price is up about 11% year to date. The consensus price target is $17.19.

Exxon Mobil

Exxon paid nearly $70 billion to acquire Denbury Resources and Pioneer Natural Resources, as big oil mergers return to the market. Exxon’s stock price has retreated more than 4% in the past week and was last seen trading below the purchase price range indicated above. That is down 6% or so year to date, but the consensus price target of $121.10 suggests more than 17% upside potential.

Howard Hughes

Ackman has served as board chair of Howard Hughes since November 2010. Pershing Square has purchased almost 1.91 million shares of the stock so far this year. The share price is slightly lower than a week ago but down about 16% in the past 90 days. The consensus price target is up at $93.50, and all five analysts covering the stock recommend buying shares. (America’s 50 richest billionaires and when they got that way.)

Sarepta Therapeutics

A third-quarter report with a narrower-than-expected loss and revenue that exceeded expectations was accompanied by news of disappointing Phase 3 results for its Duchenne muscular dystrophy treatment. Despite a rollercoaster ride in the past week, shares were last seen 1% or so higher, still within Ingram’s purchase price range. The stock is down more than 23% in the past 90 days, but up from a recent 52-week low of $55.25.

Remitly Global

The Seattle-based company posted mixed third-quarter results and boosted its guidance. Shares plunged afterward and were last seen trading below $21. That is just above the director’s purchase price. However, the stock is still up almost 81% year to date, and the $31.43 price target suggests there is more upside to come.

Staar Surgical

Staar Surgical recently posted better-than-expected third-quarter earnings, but an activist investor is urging the company to spin off its business in China. Shares dropped more than 16% in recent days to less than $33 apiece. That is below the purchase price range above. The stock is down 50% or so from six months ago. The $53.25 consensus price target suggests analysts think the shares have plenty of room to run.

Keurig Dr Pepper

The chief operating officer, Timothy Cofer, made the 100,000-share buy above, and he is expected to become CEO in 2024. The company recently posted strong third-quarter results, and the stock is up more than 6% since then. It is also up almost 11% from last month’s 52-week low. Shares were last seen trading below Cofer’s purchase price. The consensus price target is $36.00.

And Others

Some insider buying was seen at Blackstone, Enterprise Products Partners, Lumen Technologies, Mastercard, United Airlines and Wells Fargo in the past week as well.Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.