After a year like 2023, investors are probably taking the proverbial victory lap, and with good reason, with the Nasdaq up a stunning 43% and the S&P 500 up 24%. However, the tide could turn this year, and the fact that inflation remains sticky, as evidenced by the December consumer price index report, may be part of the reason.

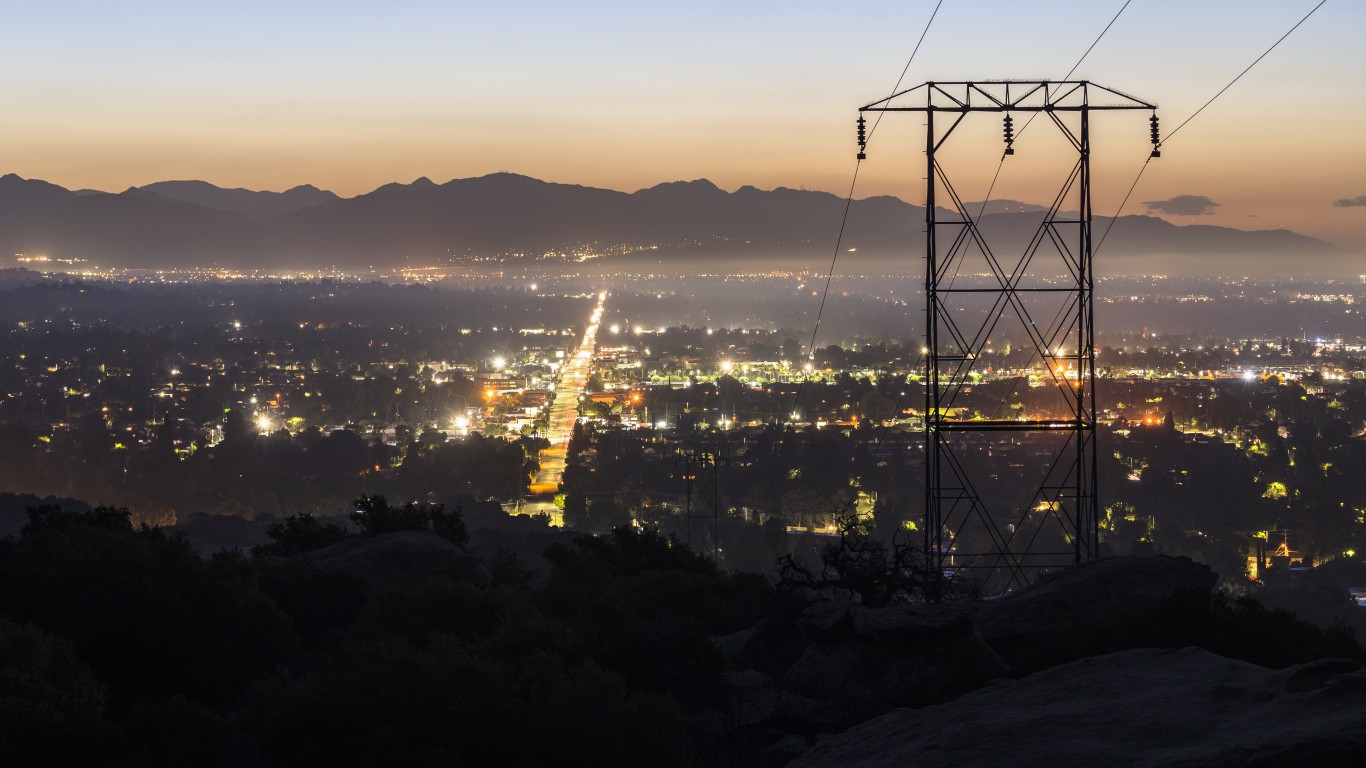

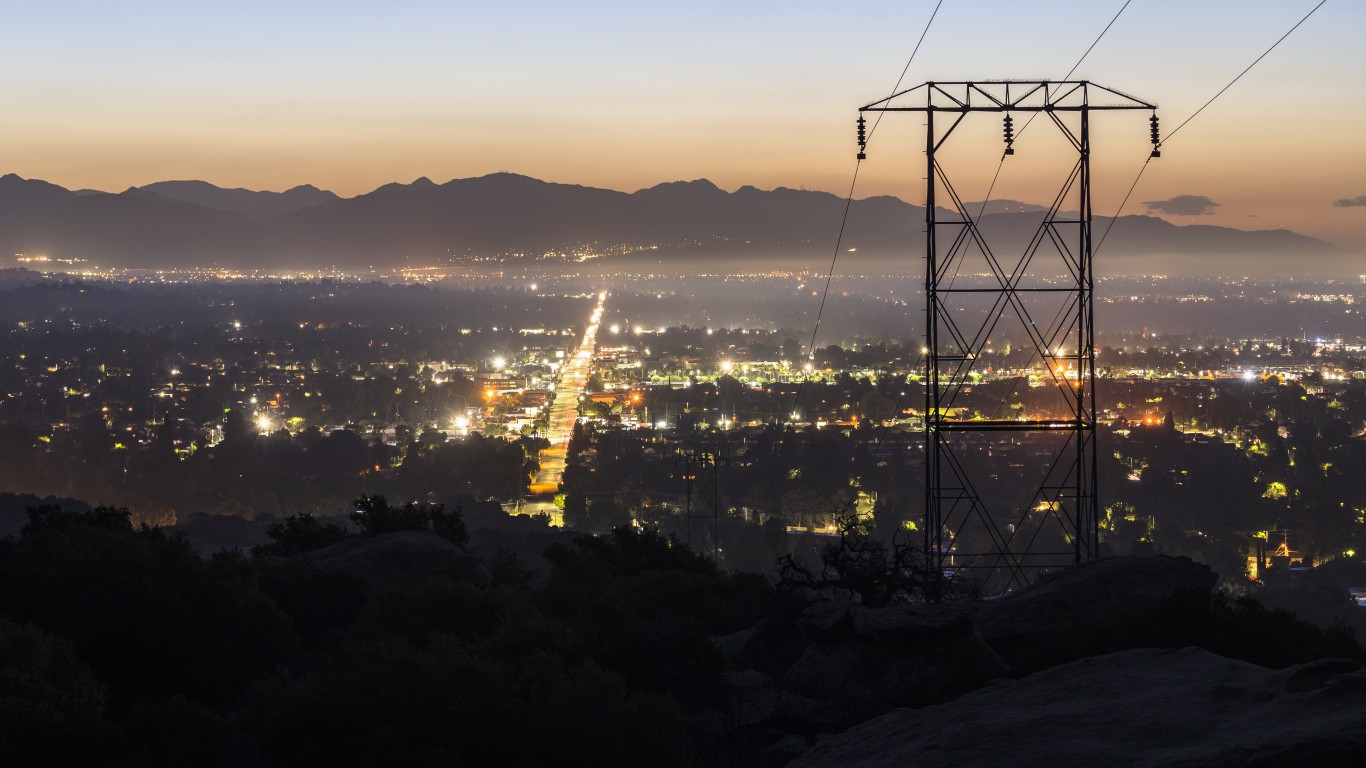

While interest rates probably start to come down by the summer or, at the latest, the fall, one sector that was a victim of rising rates last year may be a benefactor if they decline this year: utility stocks. Everyone needs power, regardless of the economy.

We screened our 24/7 Wall St. utility stock research and found five top companies that are buy-rated on Wall Street and pay significant and dependable dividends to shareholders.

American Electric Power

This industry-leading utility pays investors a hefty 4.38% dividend. American Electric Power Co., Inc. (NYSE: AEP) is an electric public utility holding company that generates, transmits, and distributes electricity for sale to retail and wholesale customers in the United States.

It operates through

- Vertically Integrated Utilities

- Transmission and Distribution Utilities

- AEP Transmission Holdco

- Generation & Marketing segments

The company generates electricity using:

- Coal

- Lignite

- Natural gas

- Renewable energy

- Nuclear energy

- Hydro,

- Solar energy

- Wind and other energy sources

It also supplies and markets electric power wholesale to other electric utility companies, rural electric cooperatives, municipalities, and other market participants.

Consolidated Edison

This old-school utility stock offers income investors the stability and track record many seek now and a solid 3.55% dividend. Consolidated Edison Inc. (NYSE: ED), through its subsidiaries, engages in the regulated electric, gas, and steam delivery businesses in the United States.

It offers electric services to approximately:

- 3.6 million customers in New York City and Westchester County

- Gas to about 1.1 million customers in Manhattan, the Bronx, parts of Queens, and Westchester County

- Steam to approximately 1,530 customers in parts of Manhattan

The company also supplies electricity to approximately 0.3 million customers in southeastern New York and northern New Jersey and gas to about 0.1 million customers in southeastern New York.

In addition, it operates:

- 543 circuit miles of transmission lines

- 15 transmission substations

- 63 distribution substations

- 87,951 in-service line transformers

- 3,869 pole miles of overhead distribution lines

- 2,320 miles of underground distribution lines

- 4,359 miles of mains

- 377,741 service lines for natural gas distribution

Consolidated Edison owns, develops, and operates renewable and energy infrastructure projects, provides energy-related products and services to wholesale and retail customers, and invests in electric and gas transmission projects.

Duke Energy

This is an excellent idea now, located in a growing part of the country and paying a hefty 4.22% dividend. Duke Energy Corporation (NYSE: DUK) and its subsidiaries operate as an energy company in the United States.

It operates through two segments:

- Electric Utilities and Infrastructure (EU&I)

- Gas Utilities and Infrastructure (GU&I).

The EU&I segment generates, transmits, distributes, and sells electricity in the Carolinas, Florida, and the Midwest and

To develop electricity, Duke Energy uses the following:

- Coal

- Hydroelectric

- Natural gas

- Oil

- Solar and wind sources

- Renewables

- Nuclear fuel

This segment also sells electricity to municipalities, electric cooperative utilities, and load-serving entities.

The GU&I segment distributes natural gas to

- Residential

- Commercial

- Industrial

- Power generation natural gas customers

The segment also invests in pipeline transmission projects, renewable natural gas projects, and natural gas storage facilities.

Exelon

This top utility stock makes good sense now for conservative accounts and pays a dependable 3.97% dividend. Exelon Corporation (NYSE: EXC) is a utility services holding company engaged in the energy distribution and transmission businesses in the United States and Canada.

The company purchases and regulates retail sales of electricity and natural gas and the transmission and distribution of electricity and natural gas to retail customers.

It also offers support services, including:

- Legal

- Human resources

- Information technology

- Supply management

- Financial

- Engineering

- Customer operations

- Distribution and transmission planning

- Asset management

- System operations

- Power procurement services

The company serves:

- Distribution utilities

- Municipalities

- Cooperatives

- Financial institutions

- Commercial, industrial, governmental, and residential customers.

Southern Company

This large-cap utility leader pays a solid 3.94% dividend. Southern Company (NYSE: SO), through its subsidiaries, engages in the generation, transmission, and distribution of electricity.

It operates through three segments:

- Gas Distribution Operations

- Gas Pipeline Investment

- Gas Marketing Services

The company also develops, constructs, acquires, owns, and manages power generation assets, including renewable energy projects, and sells electricity in the wholesale market; and distributes natural gas in Illinois, Georgia, Virginia, and Tennessee, as well as provides gas marketing services, gas distribution operations, and gas pipeline investments operations.

Southern Company serves approximately 8.8 million electric and gas utility customers. Further, the company offers digital wireless communications and fiber optics services.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.