Overall, the number of notable insider purchases may have dwindled with the earnings-reporting season in full swing, but there were still some huge, headline-making buys in the past week or so.

Conventional wisdom is that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

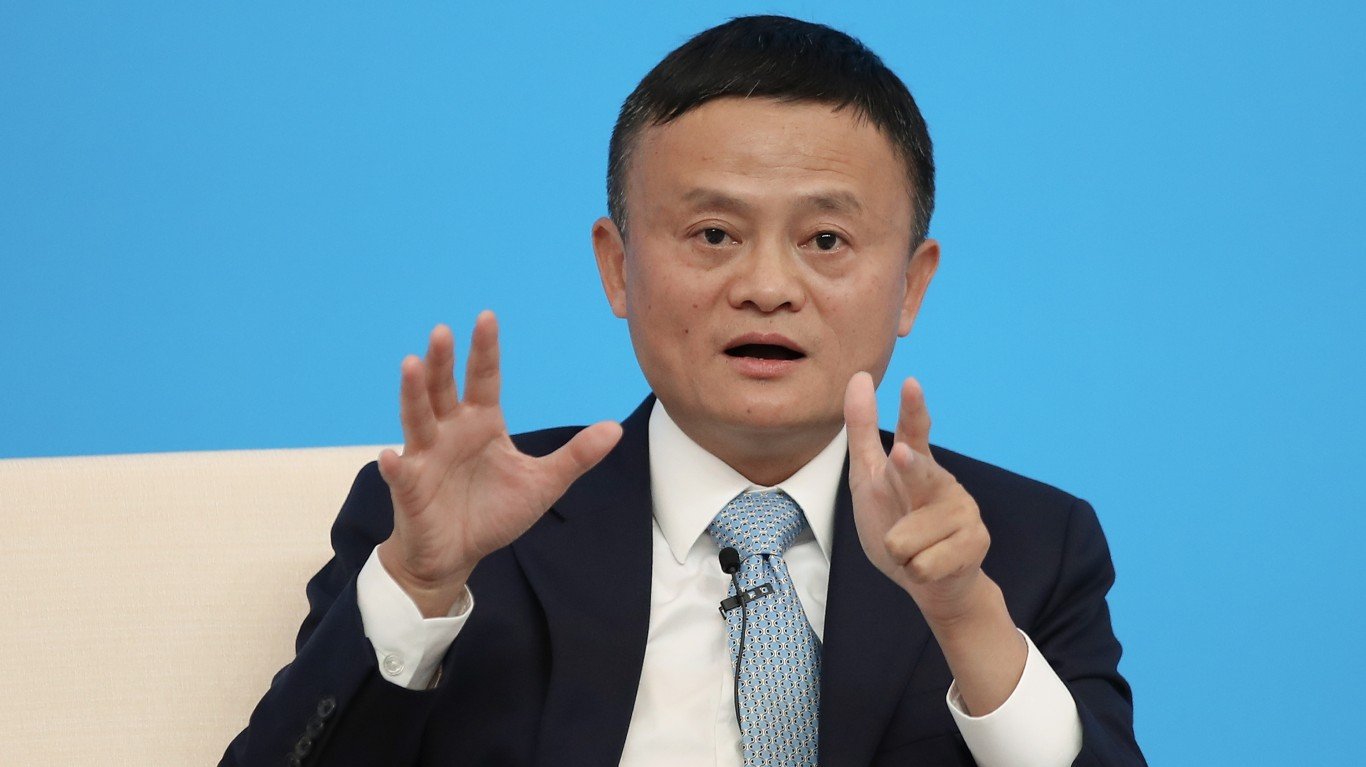

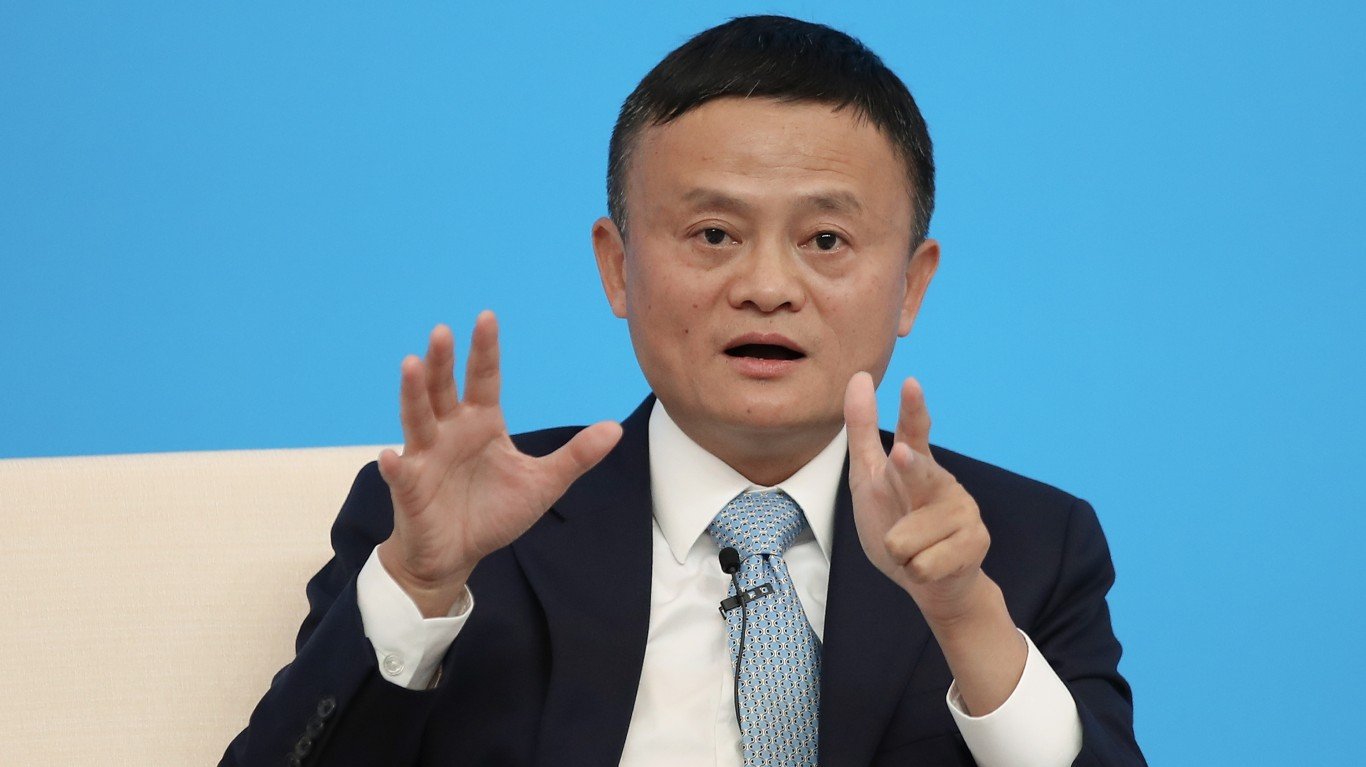

One of the biggest insider buying stories of the week was a report that Alibaba Group Holding Ltd. (NYSE: BABA) founders Jack Ma and Joe Tsai have bought more than $200 million worth of the stock in New York and Hong Kong in the past quarter. They have eclipsed Softbank to become the largest shareholders. This show of confidence as the shares tumbled after a failed spin-off helped boost Alibaba’s value by $13 billion after the news.

Below are some of the other notable insider purchases that were reported in the past week.

Mexican Billionaire’s Huge Energy Buy

- Buyer(s): 10% owner Control Empresarial de Capitales

- Total shares: more than 19.6 million

- Price per share: $11.70

- Total cost: almost $230 million

This Mexico-based investment company is controlled by billionaire entrepreneur Carlos Slim. The purchase more than doubled its stake in Talos Energy Inc. (NYSE: TALO) to almost 34.75 million shares. The company made a public offering of 30 million shares to fund a recent acquisition. The stock is down more than 15% in the past six months but was last seen trading above the buyer’s purchase price at over $13 a share. Note that this buyer recently picked up more than $73 million worth of PBF Energy Inc. (NYSE: PBF) shares as well.

Buffett Scoops Up More Liberty Media Shares

- Buyer(s): 10% owner Berkshire Hathaway

- Total shares: more than 1.0 million

- Price per share: $30.87 to $31.00

- Total cost: over $31.0 million

Berkshire Hathaway has increased its stake in Liberty Media Corp. (NASDAQ: LSXMK) to more than 47.4 million. And shares of this holding company were last seen trading near the top of that purchase price range. However, the stock is still about 23% lower than a year ago. Note that Liberty Media and Sirius XM Holdings Inc. (NASDAQ: SIRI) plan to merge, and Liberty Media recently completed an acquisition of its own.

And Even More Liberty Media Shares

- Buyer(s): 10% owner Berkshire Hathaway

- Total shares: almost 439,000

- Price per share: $30.92 to $31.00

- Total cost: around $13.6 million

Buffett also has increased the stake in Liberty Media Corp. (NASDAQ: LSXMA) to around 22.9 million. Shares of this holding company were last seen trading at the top of the purchase price range. The stock has gained about 27% in the past 90 days. As mentioned above, Liberty Media and Sirius XM are in the process of merging, and Liberty Media completed an acquisition earlier this month. (Warren Buffett can’t get enough of these seven dividend monsters.)

Viridian Therapeutics Public Offering

- Buyer(s): 10% owner Fairmount Funds Management

- Total shares: nearly 476,200

- Price per share: $21.00

- Total cost: shy of $10 million

This owner took advantage of an offering of shares of common stock to boost its stake in Viridian Therapeutics Inc. (NASDAQ: VRDN) to around 1.8 million shares. But the shares of this biopharmaceutical company were last seen trading below the buyer’s purchase price range, after retreating more than 11% in the past month. However, the company appointed a new chief executive last fall, and the stock is more than 53% higher since then. The $39.27 consensus price target of analysts suggests the stock could almost double in the next 12 months.

An Edgewise Therapeutics Secondary Offering

- Buyer(s): a director

- Total shares: more than 454,500

- Price per share: $11

- Total cost: nearly $5.0 million

This Colorado-based biopharmaceutical company also had an offering of common stock. The buyer, who is also a 10% owner of Edgewise Therapeutics Inc. (NASDAQ: EWTX), increased the stake to over 14.4 million shares. The timing of the purchase is fortunate, as the stock popped almost 22% in the past week to about $16 a share. The analysts’ consensus recommendation is to buy shares. Note though that the chief financial officer sold 90,000 shares last week, and other executives parted with shares back in December.

CalciMedica to Double?

- Buyer(s): a director

- Total shares: almost 679,400

- Price per share: $3.702

- Total cost: more than $2.5 million

This is another director who is also a beneficial owner. The CalciMedica Inc. (NASDAQ: CALC) stake has risen to more than 946,700 shares of this California-based biopharmaceutical company, which were last seen trading well above the purchase price range at over $5 apiece. The stock has gained over 83% in the past month, but it is still down somewhat compared to when it resumed trading on the Nasdaq last summer. The consensus price target is up at $10.13 per share.

Hedge Fund Legend Boosts Gold Stake

- Buyer(s): 10% owner Paulson & Co.

- Total shares: over 2.2 million

- Price per share: $0.664

- Total cost: around $1.5 million

Billionaire hedge fund manager John Paulson runs this investment firm. Its International Tower Hill Mines Ltd. (NYSE: THM) stake has increased to almost 64.2 million shares. The stock is up more than 43% since its most recent quarterly report and recently hit a 52-week high of $0.69 per share. Note that Paulson’s holdings also include gold miners Agnico Eagle Mines, AngloGold Ashanti, and NovaGold Resources.

Trading Cash Bonuses for Stock

- Buyer(s): CEO Ronny Yakov and another executive

- Total shares: more than 1.1 million

- Price per share: $0.7651

- Total cost: about $900,000

Note that these shares were acquired in lieu of the cash payment of accrued bonuses. Yakov also purchased over 22,300 shares of New York-based fintech company OLB Group Inc. (NASDAQ: OLB) last summer, and his stake is now up to about 5.4 million shares. That makes him a beneficial owner. The shares were last seen trading at around $0.89 apiece. That is more than 42% higher than 90 days ago, while the Nasdaq is up about 21% in that time.

And Other Insider Buying

In the past week or so, some insider buying was reported at CME, Compass Minerals, FB Financial, Inspire Medical Systems, Mueller Industries, Northwest Bancshares, Texas Capital Bancshares, Tillys, Wolfspeed and York Water as well.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.