Born in 1936 and worth a reported $5.8 billion, Carl Icahn is considered one of the premier investors of our time. The former corporate raider turned activist investor has been a force on Wall Street for decades. He became renowned for taking prominent positions in companies he felt were undervalued and seeing those stocks move higher.

So what is Mr. Icahn’s biggest holding now? While he likely has dozens of stocks in his portfolio, the largest is in his company, Icahn Enterprise L.P. (NYSE: IEP), in which he owns a reported 86% of the shares.

On the company’s web page, Icahn Enterprises L.P. is promoted as a diversified holding company engaged in seven primary business segments:

- Investment

- Energy

- Automotive

- Food Packaging

- Real Estate

- Home Fashion

- Pharma

The company’s energy segment refines and markets transportation fuels and produces and markets nitrogen fertilizers such as urea ammonium nitrate and ammonia.

Its Automotive segment is involved in the retail and wholesale distribution of automotive parts and offers automotive repair and maintenance services.

The company’s Food Packaging segment produces and sells cellulosic, fibrous, and plastic casings for preparing processed meat products.

Its Real Estate segment involves investment properties, construction and sale of single-family homes, and management of a country club.

The company’s Home Fashion segment manufactures, sources, markets, distributes and sells home fashion consumer products.

Its Pharma segment offers pharmaceutical products and services.

The main question for investors is how the limited partnership could pay such a massive dividend. Essentially, Mr. Icahn is paying himself an enormous dividend, as he owns most of the shares, but the reason for the vast dividend is quite another story.

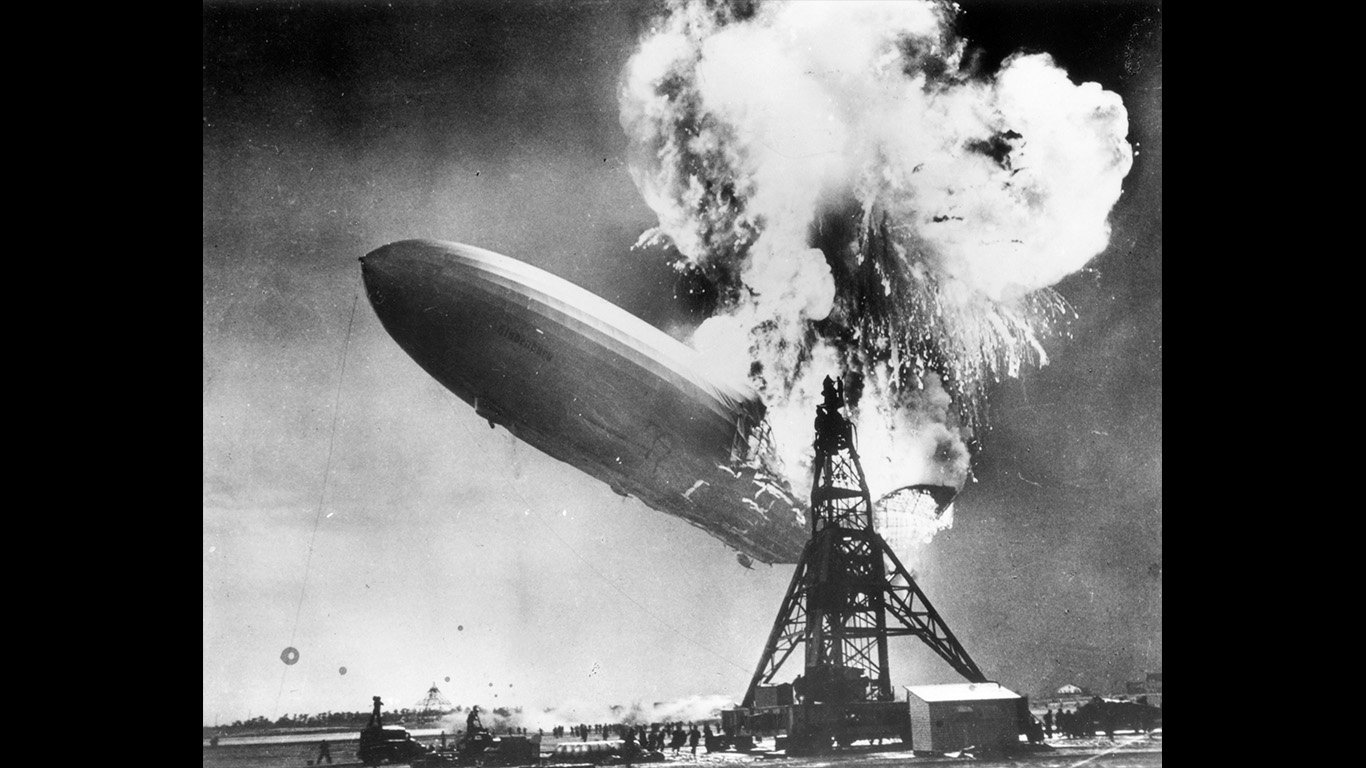

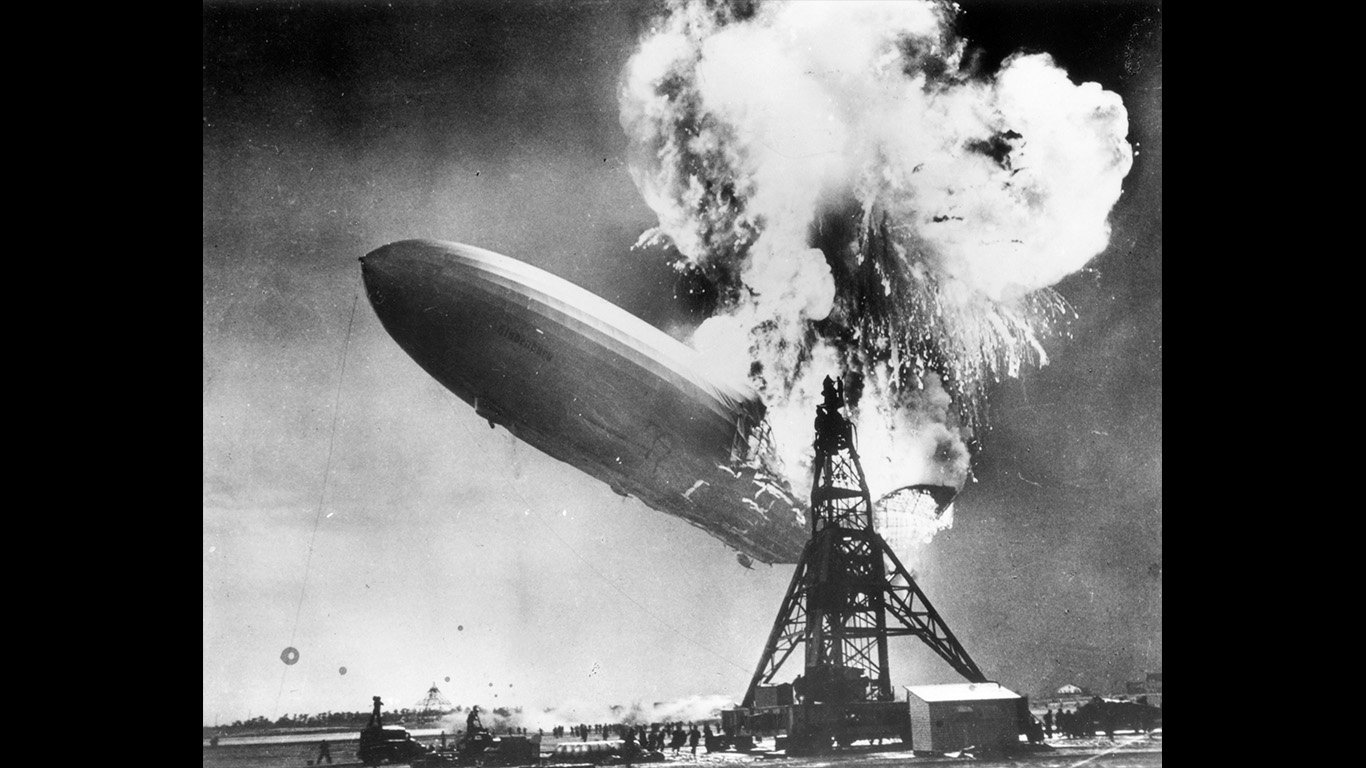

Short Sellers Took Aim

In May of last year, short-seller Hindenburg Research published a critical research report on the fund, causing the shares to plunge in market value by a stunning $6 billion. Accusing the fund of having a “Ponzi-like” structure to pay dividends to investors, the stock fell from $50 to $30 in a matter of days and then down below $20 in a few weeks.

While the shares rallied back to the mid-$30 late last summer, likely on short-covering by companies like Hindenburg, the shares nosedived again in the fall and have traded below the $20 level since October. The Hindenburg report knocked the shares down 35% to the lowest level in over a decade.

According to published reports, Hindenburg has also taken on other big targets in the past, including India’s conglomerate Adani Group and Block, Inc. (NYSE: SQ), led by Twitter co-founder and former CEO Jack Dorsey.

Daring investors may jump in

So, should investors take a chance on the fallen angel, or are other proverbial shoes getting ready to drop? For the bold and brave, the fund has continued to pay its $1 per quarter dividend, which currently gives the LP a remarkable 20% yield. The stock will be ex-divided on March 11th.

According to published data, only one Wall Street firm covers the stock, and that is Jefferies, who kept a Buy rating on the shares while lowering their target price to $27 from $43, which was way back in August of last year.

Aggressive income investors can take a shot at the shares at current trading levels; a rise to the Jefferies target would be a massive 50% gain. Still, suppose there is an interruption in the dividend, any more negative reports on the fund, or should anything happen to Mr. Icahn as he closes in at the age of 90. In that case, you can bet the short sellers could return in a heartbeat, and the shares could head to the single digits.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.