One of the most frustrating things is finding a great deal and feeling like you’re too late to take advantage of it. This is particularly true when it comes to money. We always want to make sure we’re making the most of our money and always getting the best deal.

If you’ve recently discovered Robinhood and wish you could take part in some of the benefits they offer to their new customers, there’s no need to worry, you haven’t missed out. Those who have their assets invested with the similar platform E*Trade can quickly and easily transfer their holdings to Robinhood. We looked into all the steps and will guide you through the process.

Why Move Your Account From E*Trade to Robinhood?

Whether you want to transfer your account from E*Trade to Robinhood depends on the benefits you get with your current account compared to the promised benefits of Robinhood.

Currently, Robinhood offers a 1% match on every IRA contribution (and a 3% match for those with Robinhood Gold). Your uninvested cash will only earn .01% interest at E*Trade while a free account with Robinhood earns 1% and Gold accounts earn 5% (Read more about Robinhood Gold here). E*trade also no longer charges commissions for trades or options.

Additionally, if you don’t already have an account with Robinhood, you can get your first stock for free by simply setting up your account. Finally, until April 30, 2024, Robinhood is offering a 3% match on every 401(k) rollover or IRA transfer (Read about Robinhood’s IRAs here).

E*trade will charge you a fee for transferring your assets away, but Robinhood will reimburse any transfer fee up to $75 per transfer.

If you feel like transferring to Robinhood is the right decision, you will need to initiate an ACATS.

ACATS Overview

ACATS stands for Automated Customer Account Transfer Service. It used to be a complicated and long process for transfering assets between financial institutions, but today it is almost entirely automated and electronic. Any delay is usually the reluctance of your broker to let you leave. An ACATS only requires you to submit an authorized request to your current broker to send your assets to another company.

ACATS transfers are completed by a private holding company called the Depository Trust & Clearing Corporation which is responsible for most of the settlement of securities in the United States.

For Robinhood, you can transfer stocks, ETFs, options contracts that don’t expire within seven days, margin balances, and cash balances to your Robinhood account. Assets that can’t be transferred include fractional shares, crypto, options that expire within seven days, mutual funds, bonds, futures, annuities, and any other asset that isn’t included on the transferable list.

Without further ado, here is how you move your assets from E*Trade to Robinhood.

Step 1: Set Up Your Robinhood Account

You need to initiate your ACATS from within your Robinhood account, so you will need to set one up before you begin.

If you have a smartphone, download the Robinhood app, create an account using your email, verify your identity and your age, and connect your bank account. The Robinhood app is very intuitive and easy to use, and it will guide you through the process and make sure you understand all the features of the app. If this is your first account, you can claim your first stock for free.

Step 2: Verify your E*Trade Account Information

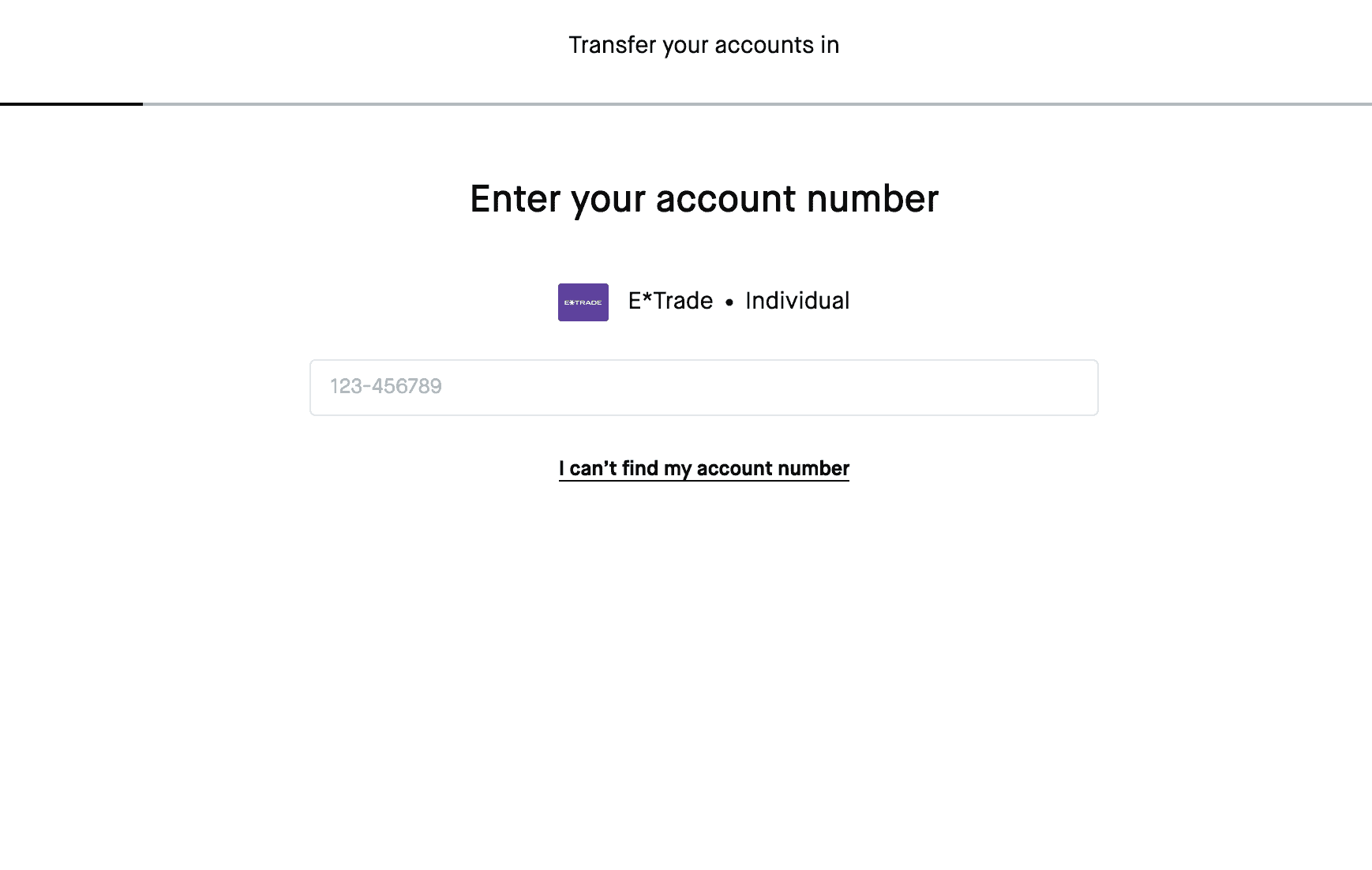

Make sure you have the right E*Trade account number before you initiate the transfer. Robinhood will not let you proceed with the process unless you have the correct account number. The online request on the Robinhood app will help you verify this information.

Additionally, you should check what assets you have with E*Trade, as not all assets are transferable. Only your stocks, ETFs, some options contracts, margin balances, and cash balances will be transferred, everything else will remain with E*Trade.

Robinhood will only accept assets that are being transferred from margin brokerage accounts, traditional and Roth IRAs, and individual cash accounts. If your E*Trade account is a trust account, joint account, business account, or custodial account, your account transfer will be rejected. There is no option to transfer from these accounts until the account type changes.

This is also a good time to review the assets you have with E*trade and confirm which assets you want to transfer, and which ones Robinhood will accept. This will save you time and frustration down the line when you might face a transfer rejection.

Step 3: Initiate an Account Transfer

You can initiate an account transfer from the smartphone app or from the website, as long as you are logged in to your account.

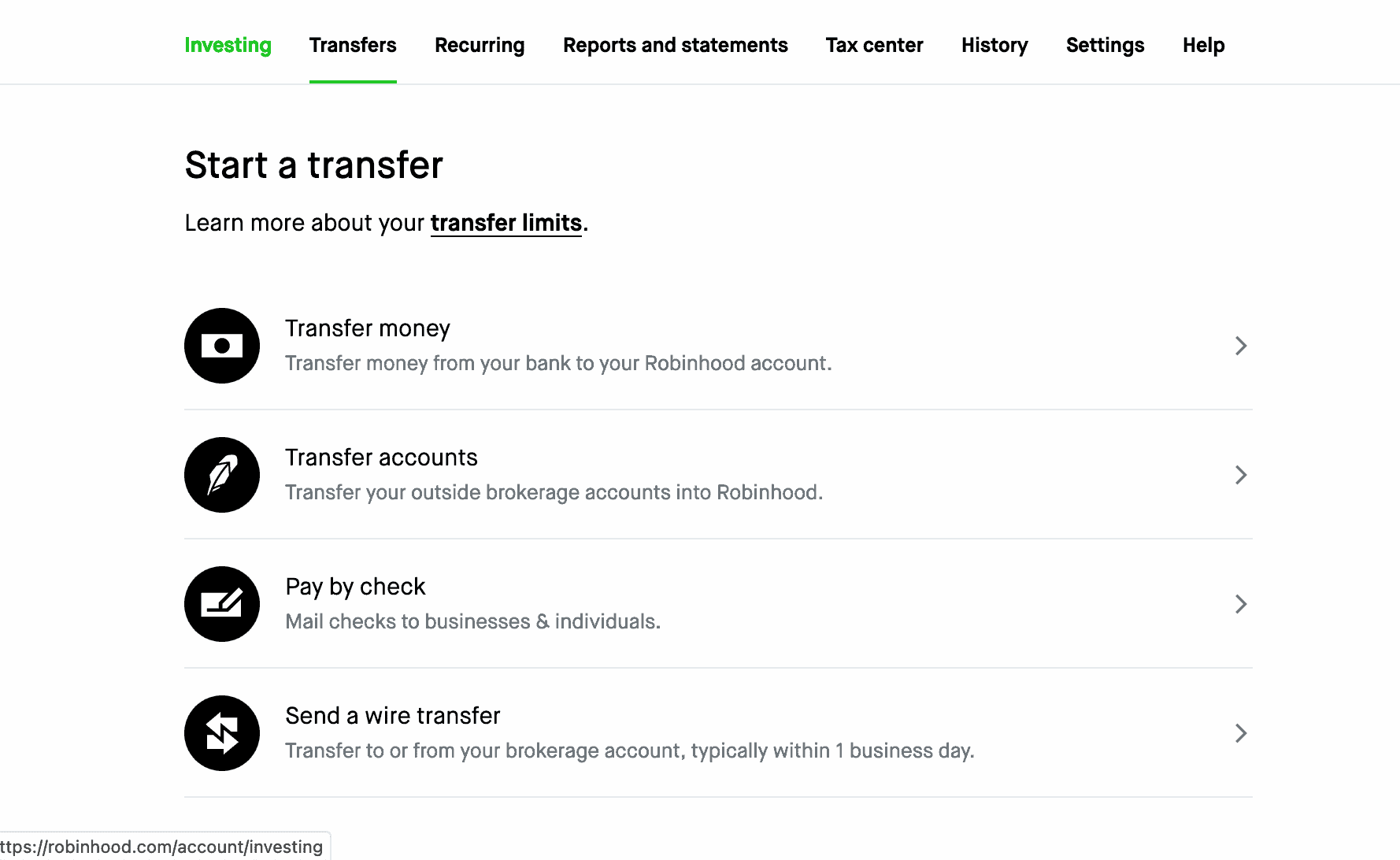

From the app, you will select the profile tab on the bottom right, then select the menu tab on the top left. Under the menu, you will see many options for managing your account and assets. You will want to pick the Transfers option.

Here, you will see four transfer options, you will want to pick the Transfer accounts option. Robinhood will show you a few pages of information about asset transfers including fees, what can be transferred, and more. From here, you will select E*Trade as your brokerage and input your account number. Next, you will need to confirm the name on the account. It is important to note that your name at E*Trade must match the name you use for Robinhood. You will need to pick whether you want to initiate a full account transfer or a partial account transfer. If your E*Trade account has assets that can’t be transferred, pick the partial account transfer option.

Robinhood will verify that you actually want to transfer your account, and then you’re done!

The process is the same on the website, except you will find the transfers option under the Account tab in the top right.

Robinhood supports both full account transfers and partial account transfers.

Step 4: Wait for the Transfer to Complete

Once you submit your ACATS request, Robinhood will send a request for the assets to E*Trade. This might take some time. After E*Trade accepts the request, your funds will become unavailable to use until the process is complete.

The full transfer time can take anywhere between five and seven business days. There is no real reason for this delay other than financial institutions keeping these assets on their books for as long as possible to squeeze just a little more value out of them before letting them go.

During this time, there is nothing you can do but wait. You can cancel a transfer request under the History menu, but depending on how far along the process is, the cancellation might not be successful.

Once the assets arrive in your Robinhood account, they are immediately available to use. You might even continue to receive money from E*Trade for up to six months after the transfer if they receive payments such as dividends that arrived too late to be included with the initial transfer.

Things to Keep in Mind

If your transfer request was rejected, it might be because the account number you entered does not match the name on the account or it might be wrong. If you’re trying to transfer assets that Robinhood doesn’t support, the entire request will be rejected. A good rule to keep in mind is that if a security is available for purchase on Robinhood, then it can be transferred.

Also, you can’t transfer margin balances until Robinhood has approved your margin investing ability and enabled the feature for your account. The same applies to options — if your account hasn’t been approved for options trading, then you can’t transfer options and your transfer request will be rejected.

An account transfer does not automatically close your E*Trade account, especially if you still have assets in your account that could not be transferred. You will need to close your account yourself if you want to complete the process.

If you’re curious about any other part of the Robinhood process, check out this page: a regularly updated list of all our Robinhood guides, news coverage, and lists of benefits.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.