2022 was a dreadful year for investors, with the S&P 500 down almost 20% and the Nasdaq lower by a stunning 33%. What a difference a year can make. In 2023, the S&P 500 was up 24.2 %, with the longest weekly winning streak since 2004. The Nasdaq had an astounding 43.4% move higher, the most significant annual gain since 2020. The venerable Dow Jones Industrials came in up 13%.

However, just ten companies have made up 95% of the gains in the S&P 500, and nine of the ten heaviest-weighted stocks in the Nasdaq 100 have accounted for almost all the profits. What do these stocks have in common? They are nearly all technology stocks, and the technology sector will likely continue to drive some upside in 2024.

With the potential for some big downside after a substantial fourth-quarter rally and interest rates close to the top for this cycle, we decided to look for companies paying solid and dependable dividends that investors can buy now and hold forever.

First, What are Dividends?

In short, a dividend is a monthly to quarterly payout as a reward for holding a company’s stock. By just simply holding onto the stock, the investor will get a check based on the amount of shares they hold. For example, if an investor were to buy $1000 of stock in a dividend-paying company at the market average of 2.2% that would get roughly $22 every month.

7. AT&T

- Ticker Symbol: NYSE: T

- Dividend Yield: 6.62%

- Industry: Telecommunications and Media

Connects The World

The legacy telecommunications company has been going through a lengthy restructuring, lowering the dividend. AT&T, Inc. provides worldwide telecommunications, media, and technology services. Its Communications segment offers wireless voice and data communications services.

AT&T Sells Through Its Company-owned Stores, Agents, and Third-party Retail Stores

- Handsets

- Wireless data cards

- Wireless computing devices

- Carrying cases

- Hands-free devices

AT&T Also Provides

- Data

- Voice

- Security

- Cloud solutions

- Outsourcing

- Managed and professional services

- Customer premises equipment for multinational corporations, small and mid-sized businesses, and governmental and wholesale customers.

In addition, this segment offers broadband fiber and legacy telephony voice communication services to residential customers.

It Markets Its Communications Services And Products Under

- AT&T

- Cricket

- AT&T PREPAID

- AT&T Fiber

The company’s Latin America segment provides wireless services in Mexico and video services in Latin America. This segment markets its services and products under the AT&T and Unefon brands.

6. Bristol-Myers Squibb

- Ticker Symbol: NYSE: BMY

- Dividend Yield: 4.68%

- Industry: Medical

Treating All Kinds Of Illness

This top company remains a solid pharmaceutical stock to own long-term, offering an outstanding entry point. Bristol-Myers Squibb Company discovers, develops, licenses, manufactures, and markets pharmaceutical products worldwide.

The Company’s Products Include

- Revlimid, an oral immunomodulatory drug for the treatment of multiple myeloma

- Opdivo for anti-cancer indications

- Eliquis, an oral inhibitor indicated for the reduction in risk of stroke/systemic embolism in NVAF and for the treatment of DVT/PE

- Orencia for adult patients with active RA and psoriatic arthritis, as well as reducing signs and symptoms in pediatric patients with active polyarticular juvenile idiopathic arthritis

The Company Also Provides

- Sprycel for the treatment of Philadelphia chromosome-positive chronic myeloid leukemia

- Yervoy for the treatment of patients with unresectable or metastatic melanoma

- Abraxane, a protein-bound chemotherapy product

- Implicit for the treatment of multiple myeloma

- Reblozyl for the treatment of anemia in adult patients with beta-thalassemia

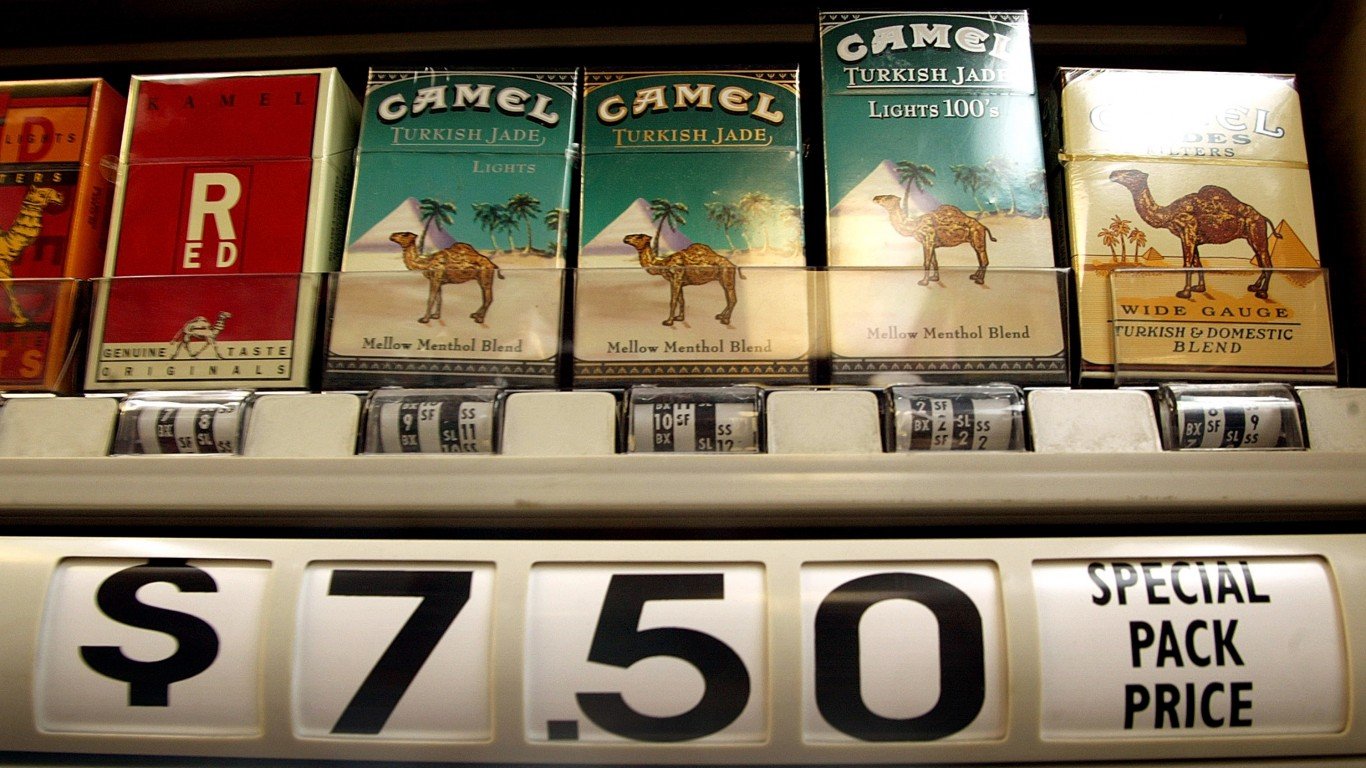

5. British American Tobacco

- Ticker Symbol: NYSE: BTI

- Dividend Yield: 9.57%

- Industry: Tobacco

An Investor’s Personal Money Printing Company

British American Tobacco pays a huge dividend that is worth keeping in your portfolio.

British American Tobacco Plc Offers

- Vapor

- Tobacco heating

- Modern oral nicotine products

- Combustible cigarettes

- Traditional oral products, such as snus and moist snuff

The Company Offers Its Products Under These Brands

- Vuse,

- Glo

- Velo

- Grizzly

- Kodiak

- Dunhill

- Kent

- Lucky Strike

- Pall Mall

- Rothmans

- Camel

- Natural American Spirit

- Newport

- Vogue

- Viceroy

- Kool

- Peter Stuyvesant

- Craven A

- State Express 555

- Shuang Xi brands

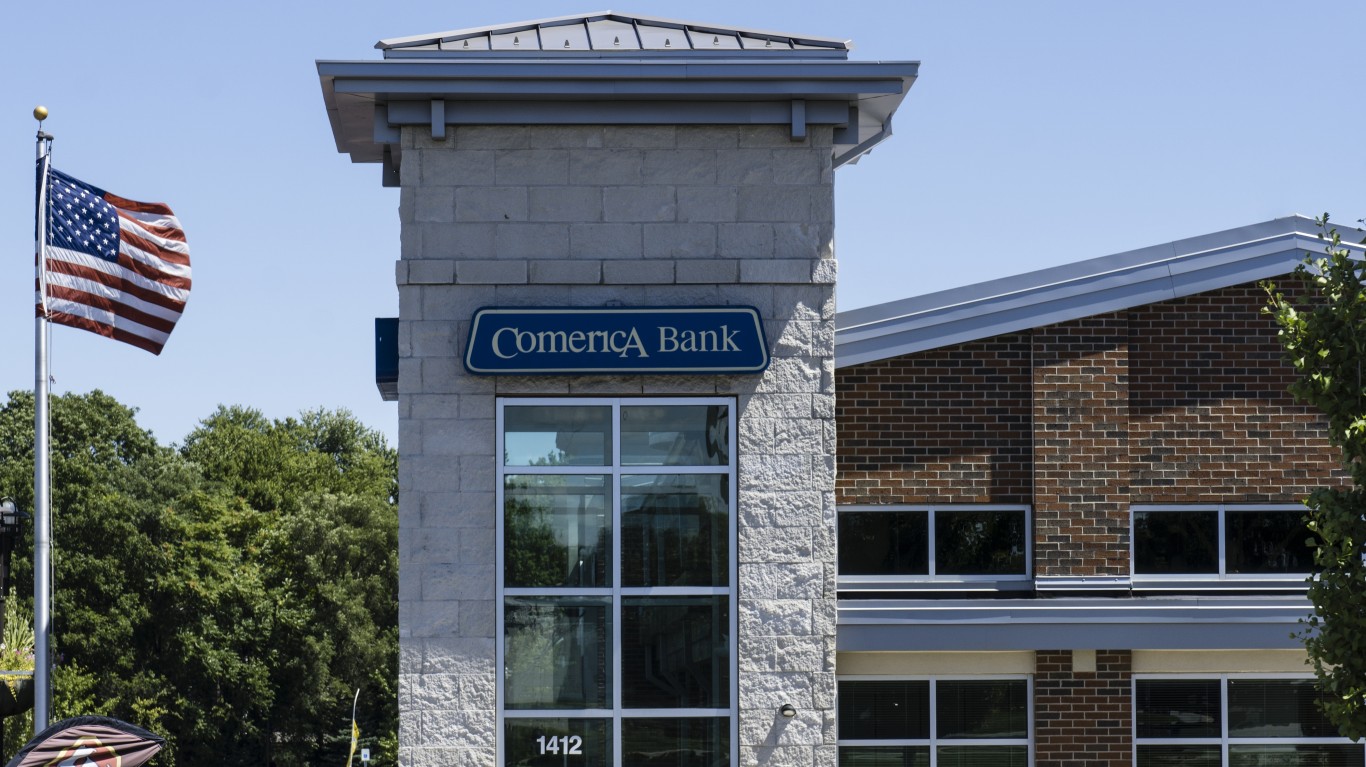

4. Comerica

- Ticker Symbol: NYSE: CMA

- Dividend Yield: 5.09%

- Industry: Banking

Keeps The Money Flowing

Based in Dallas, this fast-growing banking center giant pays a substantial dividend yield. Comerica, Inc. provides various financial products and services.

The Company Operates In

- Commercial banking

- Retail banking

- Wealth management

- Finance segments

The Commercial Bank Segment Offers

- Commercial loans and lines of credit

- Deposits

- Cash management

- Capital market products

- International trade finance

- Letters of credit

- Foreign exchange management services

- Loan syndication services

- Payment and card services for small and middle-market businesses, multinational corporations, and governmental entities

The Retail Bank Segment Provides

- Personal financial services, such as consumer lending

- Consumer deposit gathering

- Mortgage loan origination and various

- Consumer products that include deposit accounts, installment loans, credit cards, student loans, home equity lines of credit

- Residential mortgage loans and commercial products and services to micro-businesses.

The Wealth Management Segment Offers Products And Services Comprising

- Fiduciary

- Private banking

- Retirement

- Investment management and advisory

- Investment banking and brokerage services

- Annuity products and life, disability, and long-term care insurance products

Comerica Operates In

- Texas

- California

- Michigan

- Arizona

- Florida

- Canada

- Mexico.

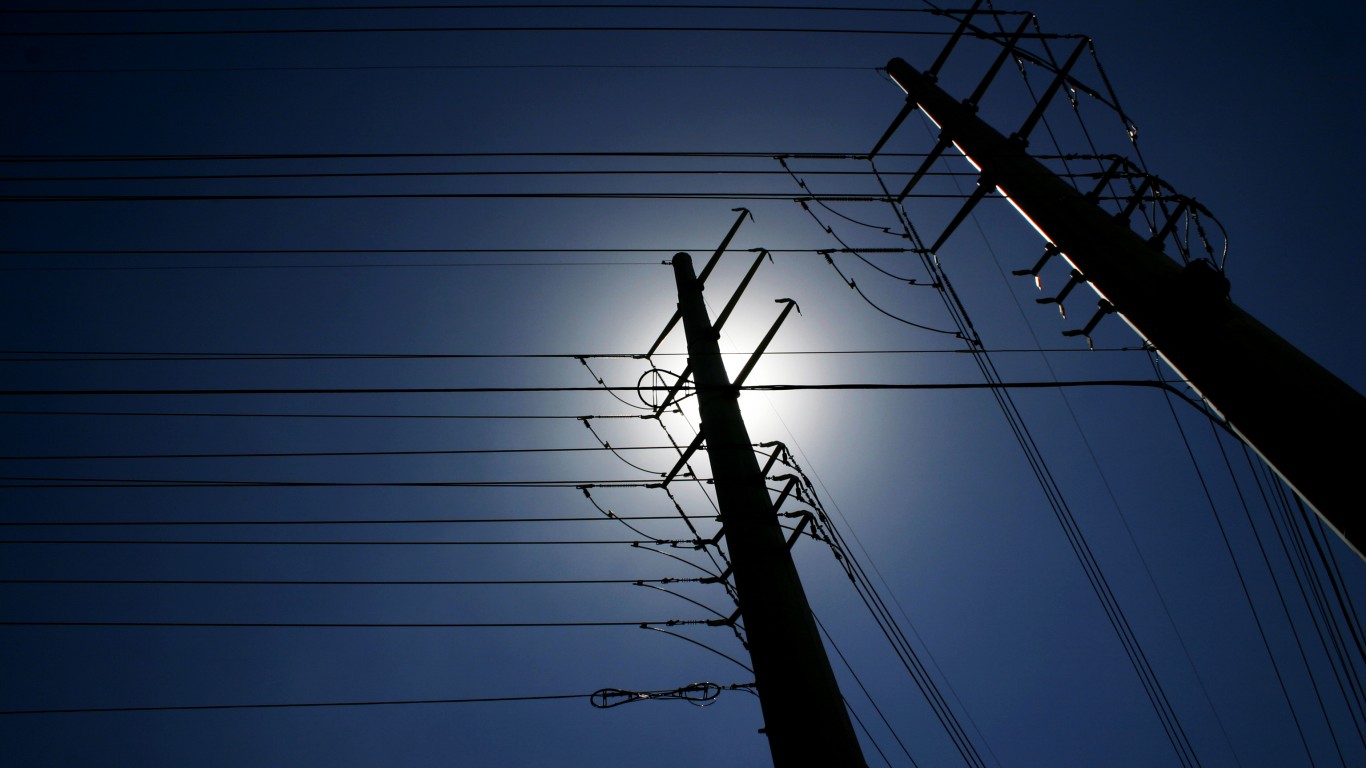

3. Dominion Energy

- Ticker Symbol: NYSE: D

- Dividend Yield: 5.68%

- Industry: Utilities

Keeps The Lights On

Many of the Wall Street firms we cover are still very positive on utilities, and this company pays a strong dividend yield.

Dominion Energy, Inc. Operates Through Four Segments

- Dominion Energy Virginia,

- Gas Distribution,

- Dominion Energy South Carolina, and

- Contracted Assets.

The Dominion Energy Virginia segment generates, transmits, and distributes regulated electricity to residential, commercial, industrial, and governmental customers in Virginia and North Carolina.

The Gas Distribution Segment Engages In

- Regulated natural gas gathering

- Transportation

- Distribution and sales activities

- Distributes nonregulated renewable natural gas

The Dominion Energy South Carolina Segment

- Generates

- Transmits

- Distributes electricity and natural gas to residential, commercial, and industrial customers in South Carolina.

The Company’s Portfolio Of Assets Included Approximately

- 30.2 gigawatts of electric generating capacity

- 10,500 miles of electric transmission lines

- 85,600 miles of electric distribution lines

- 94,200 miles of gas distribution lines

- Dominion serves approximately 7 million customers.

2. Kinder Morgan

- Ticker Symbol: NYSE: KMI

- Dividend Yield: 6.41%

- Industry: Energy

This is one of the top energy stocks and remains a favorite across Wall Street, paying a dependable dividend yield. Kinder Morgan, Inc. is an energy infrastructure company in North America. The company operates through Natural Gas, Products, Terminals, and CO2 segments.

The Natural Gas Pipelines Segment

- Owns and operates the interstate and intrastate natural gas pipeline and underground storage systems

- Natural gas gathering systems and natural gas processing and treating facilities

- Natural gas liquids fractionation facilities and transportation systems

- Liquefied natural gas liquefaction and storage facilities

The Terminals Segment Owns And Operates Liquids and Bulk Terminals

- Gasoline

- Diesel fuel

- Chemicals

- Ethanol

- Metals

- Petroleum coke

- Owns tankers

Lastly, the CO2 segment produces, transports, and markets CO2 to recover and produce crude oil from mature oil fields and owns interests in/or operates oil fields and gasoline processing plants, as well as a natural oil pipeline system in West Texas. It holds and runs approximately 83,000 miles of pipelines and 144 terminals.

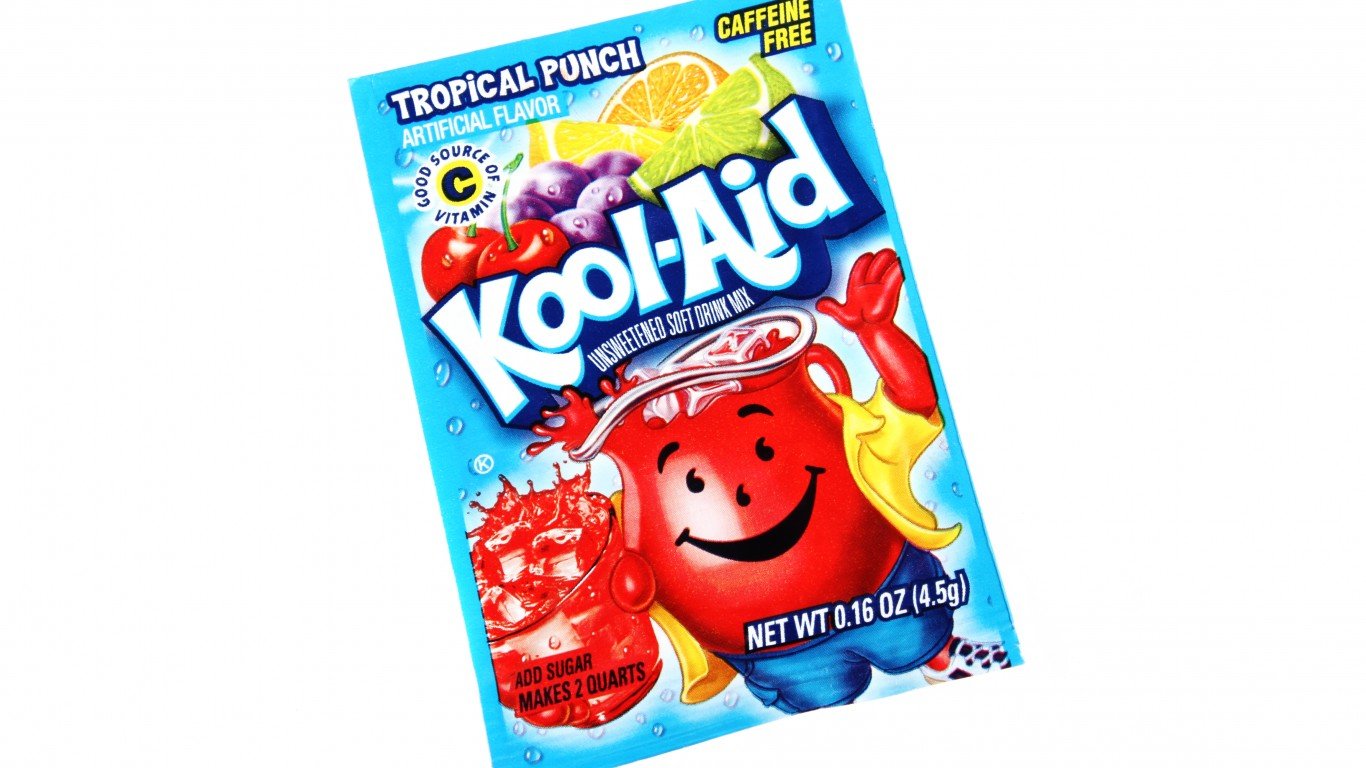

1. Kraft Heinz

- Ticker Symbol: NYSE: KMI

- Dividend Yield: 4.33%

- Industry: Food

Even in bad times, everybody has to eat, and this company always stands to benefit while paying a massive dividend yield. The Kraft Heinz Company was formed almost nine years ago via the merger of H.J. Heinz Company and Kraft Foods Group. Warren Buffett holds a massive position in Berkshire Hathaway of 325 million shares. The company is a leading global food company with $25 billion of estimated annual revenues generated by well-known brands. Kraft Heinz is North America’s third-largest food and beverage manufacturer and derives 76% of revenues from that market. And 24% from International.

The Company’s Additional Brands Include

- ABC

- Capri Sun

- Classico

- Jell-O

- Kool-Aid

- Lunchables

- Ore-Ida

- Oscar Mayer

- Philadelphia

- Planters

- Plasmon

- Quero

- Weight Watchers Smart Ones

- Velveeta

- Kraft,

- Heinz,

- Oscar Meyer

- Maxwell House

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.