Retirement accounts are meant to be set up and forgotten until the day you retire and find out how well it performed over all those years. Investment banks are counting on this. They don’t expect you to check on how your investments are doing, and they definitely don’t want you looking around for better options to manage your money.

Today, however, new options and new technology make taking a closer look at your investments and alternate IRA plans a reasonable option. In order to compete with the larger investment banks, smaller and younger companies have to entice new customers to transfer their existing retirement funds with attractive offers and valuable rewards. This is the case with Robinhood.

If you’ve looked into your IRA options and decided that Robinhood might be the right choice for you, follow our guide to make sure you do it right and end up satisfied with the process. This is how to move your account from Fidelity Investments to Robinhood.

What is Robinhood?

Robinhood is a relatively new player in the stock trade industry, and even newer in the retirement investment business. Robinhood officially launched its mobile app in 2015, offering commission-free stock trades to new and amateur traders. The low barrier to entry and ease-of-use made it a popular choice and the app exploded in value. Subsequently, Robinhood launched its IRA options in 2022. Read more about Robinhood’s IRA options.

Robinhood found significant success with younger generations, particularly millennials who make up a majority of the company’s customer base. They found the clean, straight-forward design and commission-free trading an attractive alternative to the large investment banks that ruined their financial prospects as they were growing up.

Why Transfer your Fidelity Account to Robinhood?

You should have two things in mind when considering where to keep your IRA: the amount of returns you can earn, and the safety of your investments.

Regarding safety, all reputable investment firms are covered by the Securities Investor Protection Corporation (SIPC) which covers your investment (up to $500,000) in the event the company fails. Robinhood has also purchased additional insurance for its customers. If the coverage of the SIPC is not enough to cover your losses, this additional will cover the remainder up to $50 million of securities and $1.9 million for cash.

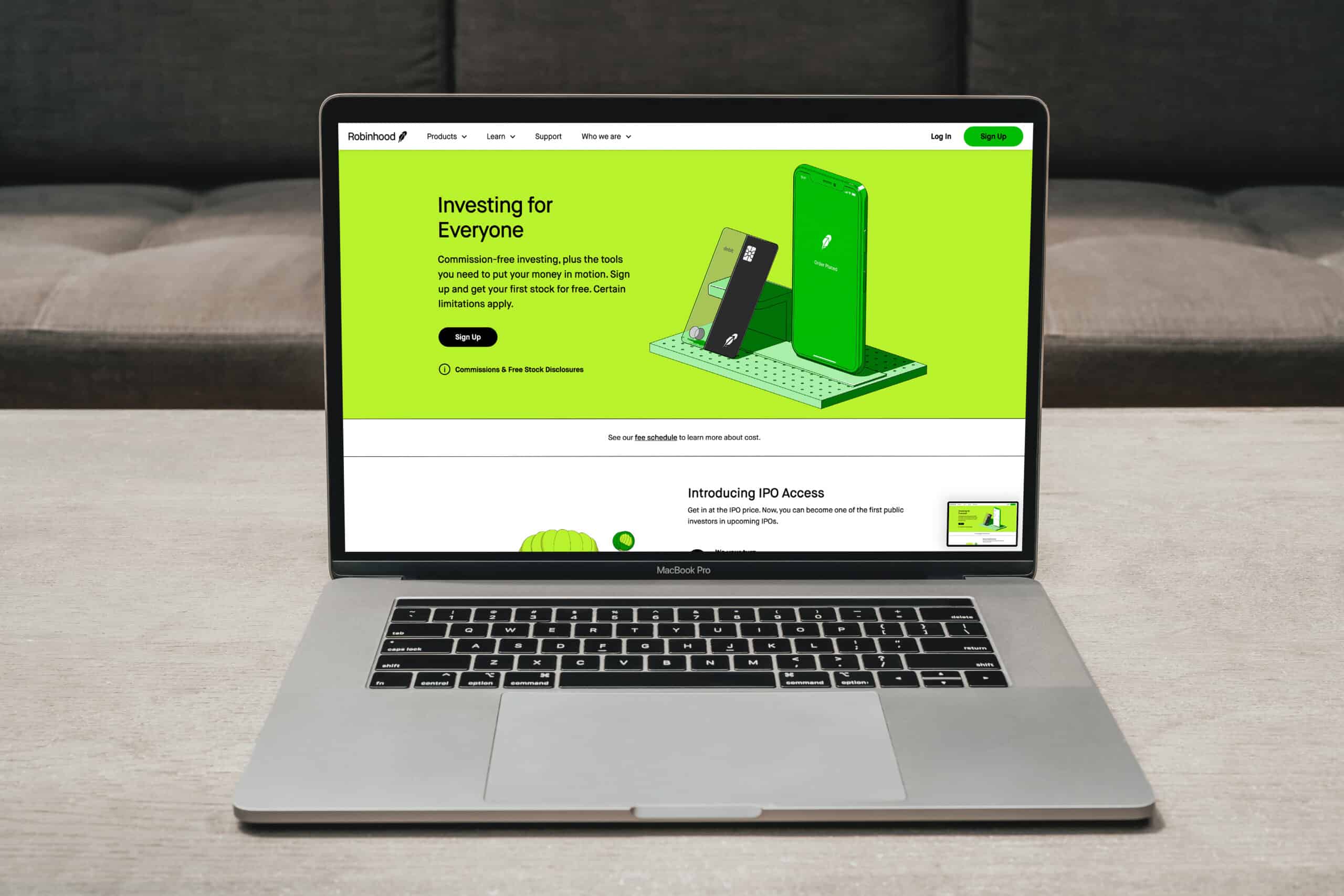

Regarding the amount you can expect to earn over the lifetime of your investment, nobody can tell. The stock market is an unpredictable monster, and investment portfolios will behave relatively the same between companies and across portfolio options. The difference with Robinhood, however, is that it offers a match to every contribution you make to your IRA account.

Every IRA account with Robinhood qualifies for a 1% match to every contribution. Whether you maximize your annual contributions or invest just one dollar a month, Robinhood will match it. If you have a Robinhood Gold account, that match increases to 3%. Robinhood Gold costs $5 every month or $60 per year. So, if you invest just $2,000 into your account every year, your Gold account already begins to pay for itself. Of course, this doesn’t include the other benefits of Robinhood Gold. Read more about if the 3% match is worth it.

At the time of the writing of this article, Robinhood also offers a 3% match for each account transfer and 401(k) rollover. So, if you have an account with Fidelity already, you can earn a 3% bonus just for transferring it to Robinhood (given you have a Gold account, otherwise you will get a 1% match).

Robinhood also allows you to engage in limited margin trading with the funds in your IRA if you want.

If this is enough to convince you to switch from Fidelity to Robinhood, you will want to initiate an ACATS.

What is an ACATS?

You don’t need to know what an ACATS is to make use of it, but it is nice to understand the process.

ACATS stands for automated customer account transfer service, and it is a nearly entirely electronic system by which one investment company can request and receive your IRA from another company. There are no physical forms you need to fill in and mail. In fact, most of the work is done on your behalf by the requesting company (in this case, Robinhood) once they have the account information for the IRA they are looking for.

How to Transfer Your Account to Robinhood

If you don’t already have a Robinhood account, you will have to download the app on your smartphone and create an account using your government ID and connecting your bank account. You will also receive your first stock for free during this time, so that’s nice!

Once your account is set up, decide whether you want to sign up for Robinhood Gold and get the 3% match, or stick with the 1% match for free accounts. If you want a Gold account, click on the menu option within the app or the website and follow the instructions. Read more about Robinhood Gold here.

Then, create your IRA account by clicking on the Retirement menu option. Here you will be prompted to choose the type of account you want (Traditional IRA or Roth IRA). Robinhood will show you a few screens educating you about your IRA account, and give you a few options to customize your account.

Keep in mind that Robinhood accepts transfers of all individual cash, traditional IRAs, Roth IRAs, and margin brokerage accounts. Trust, business, custodial, and joint accounts can’t be transferred. Robinhood supports full and partial account transfer options.

Once you are satisfied with your account, it is time to initiate the ACATS.

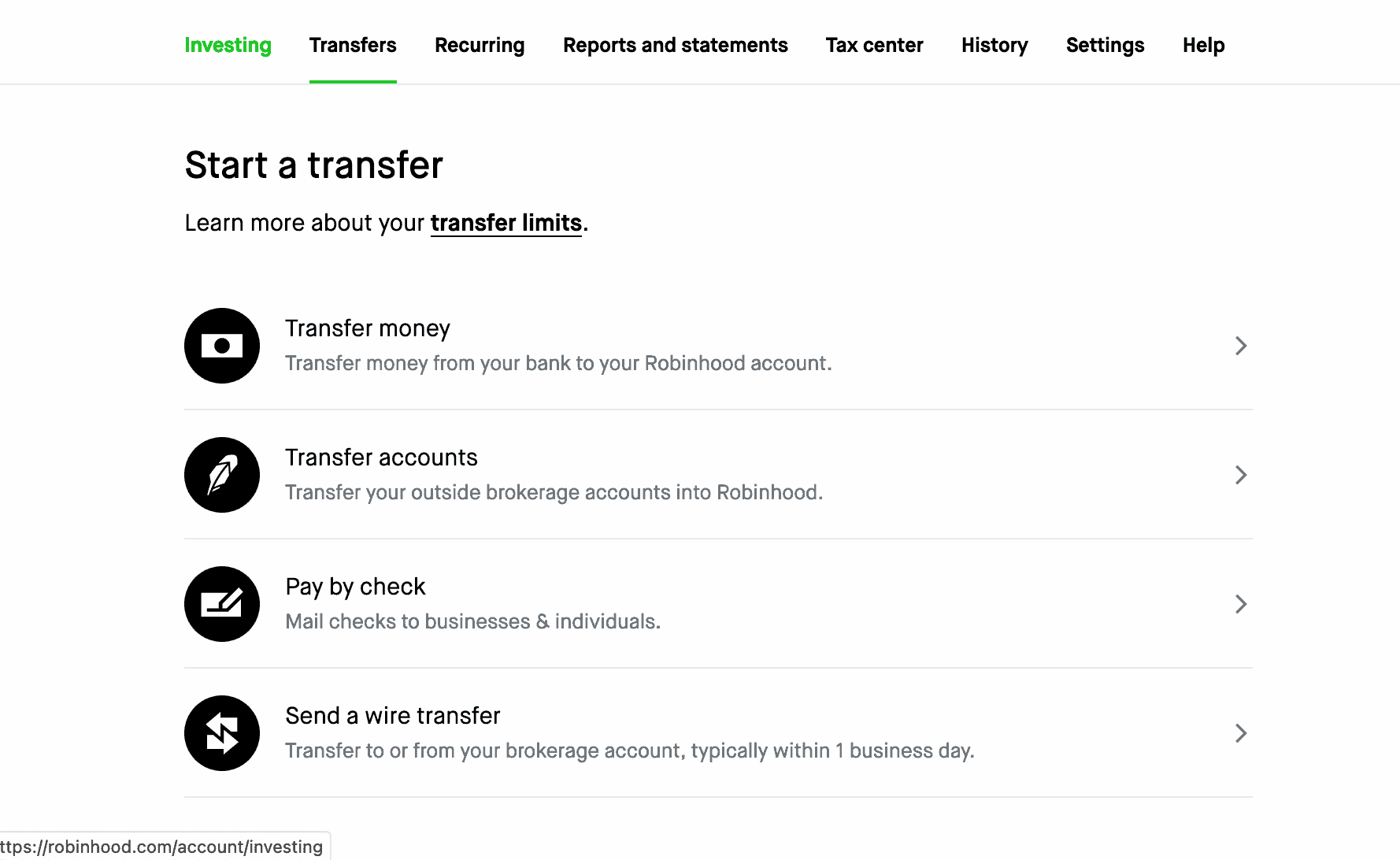

After your IRA account is set up, click on the account menu option (the person icon in the bottom right of the app, or the Account tab on the website) and select Transfers. From here you will select the Transfer account option.

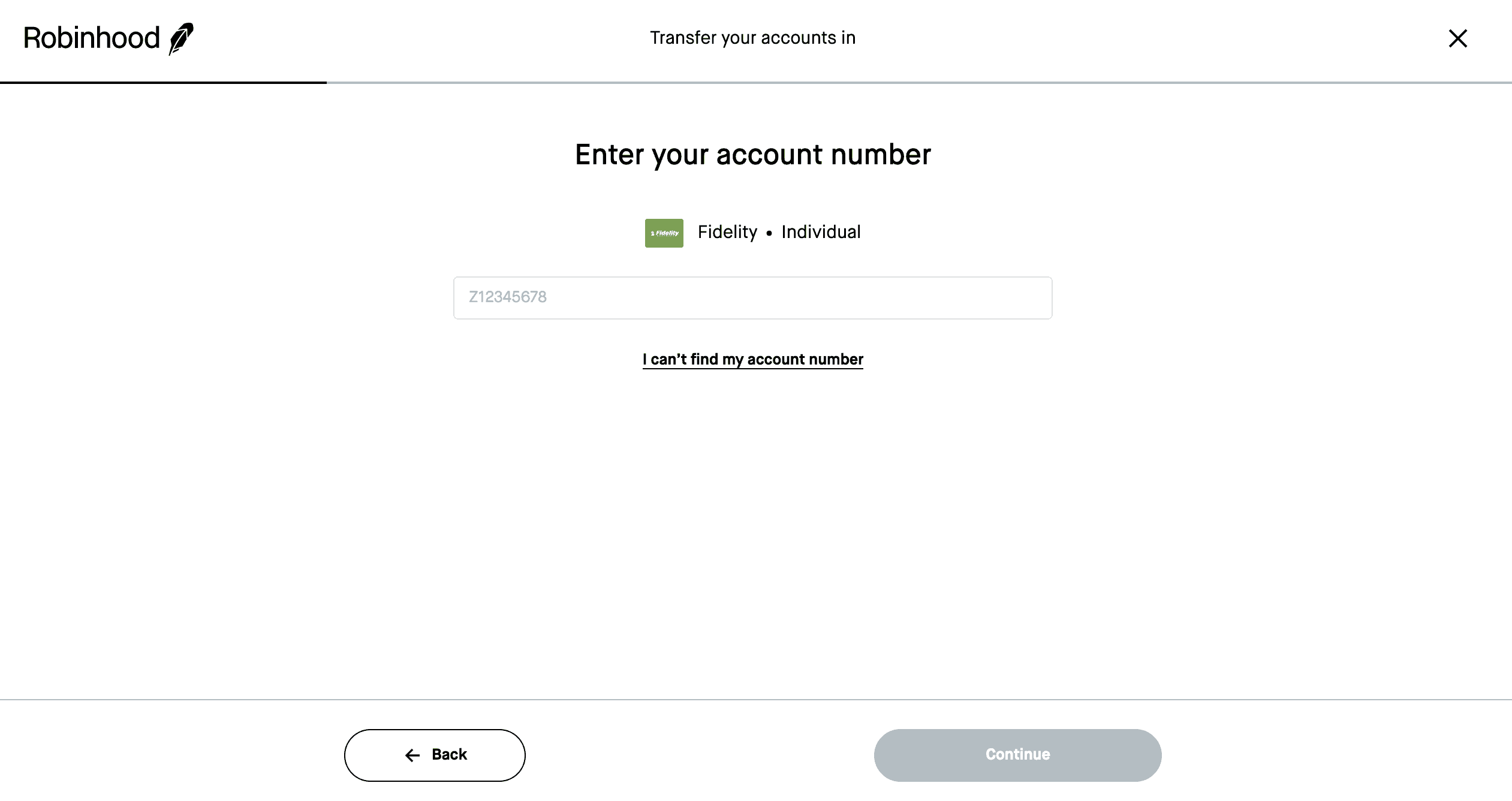

Here you will need to select Fidelity from the list of investment banks and input your account number. Make sure you have the right account number for your IRA at Fidelity. You will then be asked to verify the name associated with the account. Your name must match the name you have on your Robinhood account or the ACAT will be rejected. Double-check that your information is correct, as a rejected ACATS is extremely frustrating and will waste your time.

You will have the option to select whether you want a full account transfer or a partial account transfer. If you want to keep some assets with Fidelity or have some assets that can’t be transferred, then you should select the partial account transfer and pick the assets you want to include in the transfer.

Continue following the prompts until the process is complete.

After the ACATS is submitted, you simply have to wait for Fidelity to accept the ACATS request and process the transfer. This can take anywhere from five to seven business days. There is no real reason for it to take this long other than banks wanting to squeeze every last cent of value from your money, but it will be processed eventually. Once the request is accepted, you won’t be able to access the money in your Fidelity account until the transfer is finished.

Fidelity might charge you a fee for transferring your account to Robinhood, but Robinhood will reimburse you the cost of the fee up to $75 for transfers of $7,500 or more.

If there are any issues with your transfer request, Robinhood will let you know. The usual issues are incorrect names, account numbers, or attempting to transfer assets that Robinhood won’t accept. If the process is successful, make sure to close your Fidelity account yourself, as the ACAT does not automatically close your account once it is empty.

If you’re curious about any other part of the Robinhood process, check out this page: a regularly updated list of all our Robinhood guides, news coverage, and lists of benefits.

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.