A leading offshore driller and a delivery services provider that is turning around saw the most notable insider purchases in the final week of February. And note that several of the transactions featured here were made by returning or regular buyers. A couple of chief executive officers showed love for their companies too.

A well-known adage reminds us that corporate insiders and 10% owners really only buy shares of a company because they believe the stock price will rise and they want to profit from it. Thus, insider buying can be an encouraging signal for potential investors. This is all the more so during times of uncertainty in the markets, and even when markets are near all-time highs.

Remember that with the earnings-reporting season still underway, some insiders are prohibited from buying or selling shares. Below are some of the more notable insider purchases that were reported in the past week.

Transocean

- Buyer(s): a director

- Total shares: 1.0 million

- Price per share: $4.89

- Total cost: nearly $4.9 million

Earlier this month, Switzerland-based contract drilling services provider Transocean Ltd. (NYSE: RIG) reported a narrower loss and a $9 billion backlog in its most recent quarter. Shares are up marginally since then and were last seen trading for about $5 a share, which is above the buyers’ purchase price. Just 13 of 36 analysts who follow the stock recommend buying shares. And yet, their consensus price target of $7.11 would be a gain of over 43% for the stock. Note that shares have traded as high as $8.88 in the past year.

Maplebear

- Buyer(s): a director

- Total shares: almost 137,500

- Price per share: $29.58 to $30.00

- Total cost: over $4.1 million

After buying 2 million shares the previous week, this director returned to the buy window. The recent Maplebear Inc. (NASDAQ: CART) earnings report came with announced layoffs that included the chief operating and technology officers. The stock pulled back more than 7% afterward but has recovered and is now up 44% or so year to date. Shares were last seen trading above the buyer’s latest purchase price range, as well as the price at last year’s initial public offering. The operator of the Instacart delivery service has a cautious Buy recommendation from the consensus of analysts. Their mean price target of $33.95 suggests there is only a little upside potential in the next 12 months. (Maximize convenience with these 12 essential rules for grocery delivery.)

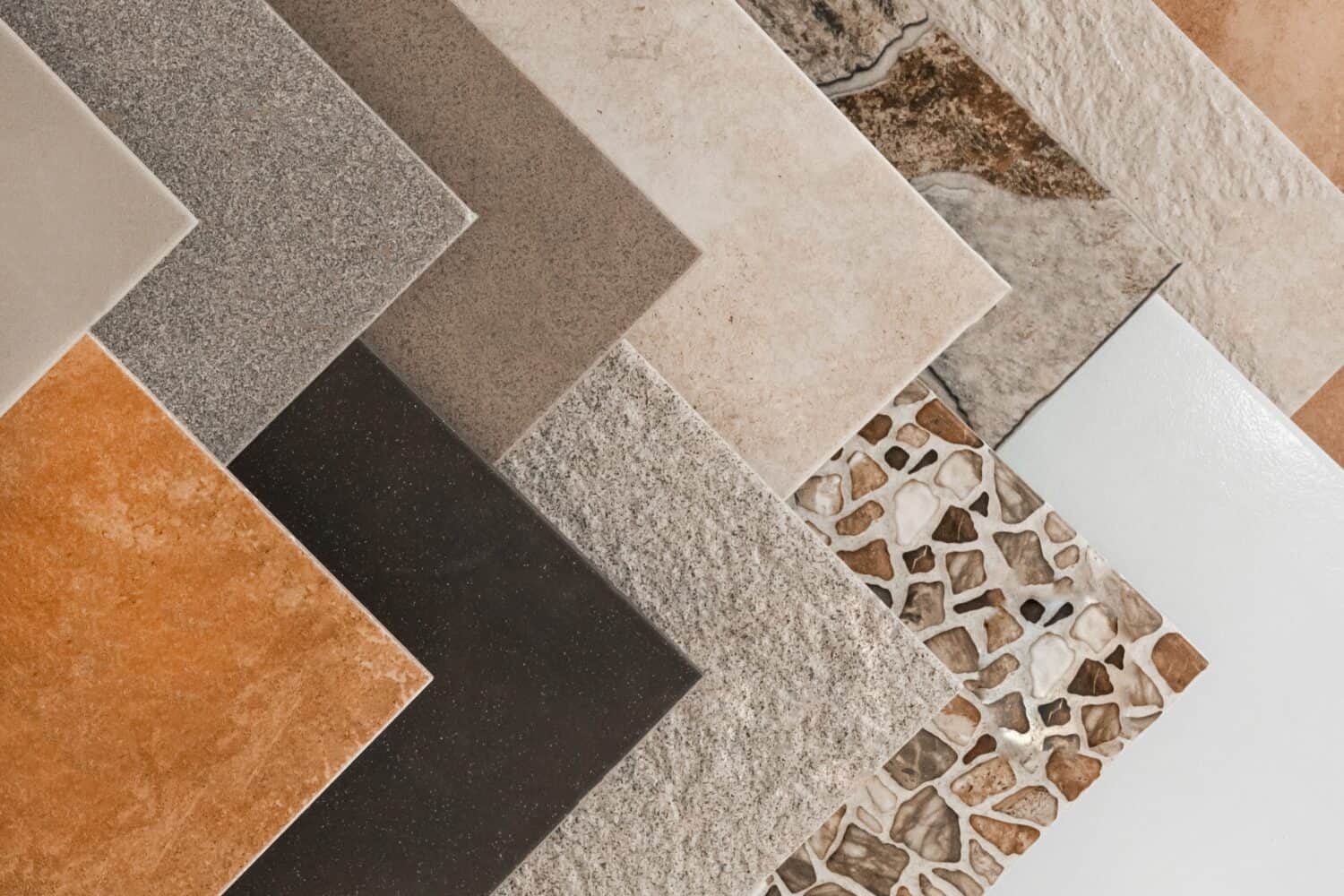

Tile Shop

- Buyer(s): 10% owner Fund 1 Investments

- Total shares: more than 380,600

- Price per share: $6.49 to $6.96

- Total cost: around $2.6 million

This purchase came hot on the heels of a fourth-quarter and full-year report that revealed declining sales. Shares of Minnesota-based retailer Tile Shop Holdings Inc. (NASDAQ: TTSH) have gained more than 6% in the past week and are up almost 28% in the past year, which is about the same as the S&P 500. The consensus recommendation is to buy shares, though that is from just two analysts. They have no mean price target. Note that this buyer has been scooping up batches of shares since the beginning of the year, and the latest purchase was the largest lot yet.

Sphere Entertainment

- Buyer(s): CEO James Dolan

- Total shares: almost 59,400

- Price per share: $40.48 to $41.73

- Total cost: more than $2.4 million

Sphere Entertainment Co. (NYSE: SPHR) recently announced collaborations with the NFL and PepsiCo. The New York City-based company also has named new executives, and revenue was better than expected in the most recent quarterly report. Since the beginning of the year, the stock is up more than 30%, and shares were last seen trading for over $44 apiece. That is over 58% higher than a year ago. Still, analysts are cautious, with a consensus rating of Hold. Their mean price target is less than the current share price. Note that, at about the same time as this purchase, Dolan also sold over $5.5 million worth of Madison Square Garden Sports Corp. (NYSE: MSGS), for which he is CEO as well.

Ondas

- Buyer(s): 10% owner Joseph Popolo

- Total shares: almost 1.8 million

- Price per share: $1.12

- Total cost: $2.0 million

These shares were purchased in a registered direct offering pursuant to a Securities Purchase Agreement, and the transaction more than doubled the buyer’s stake to almost 3.2 million shares. Ondas Holdings Inc. (NASDAQ: ONDS) has not posted its fourth-quarter results yet but did announce preliminary record revenue for last year. In the past year, the share price has ranged from $0.31 to $2.14, and shares were last seen trading near $1.25. Analysts on average recommend buying shares, and their consensus price target is up at $2.50.

Allegion

- Buyer(s): CEO John Stone

- Total shares: 10,000

- Price per share: $131.84 to $132.66

- Total cost: over $1.3 million

Security products maker Allegion PLC (NYSE: ALLE) is headquartered in Dublin, Ireland, and it recently posted strong quarterly results boosted by price hikes. It also hiked its dividend by 7% earlier in the month, which boosted shares. However, they have retreated in the past couple of weeks and were last seen trading near $127, well below Stone’s purchase price range. The consensus price target is less than that purchase price range as well. Analysts on average recommend holding shares.

And Other Insider Buying

In the past week or so, some insider buying was reported at Agree Realty, Apple Hospitality REIT, Caterpillar, Enphase Energy, Goosehead Insurance, Heartland Express, HF Sinclair, J.M. Smucker, National Health Investors, VFC, Warrior Met Coal, Western Midstream Partners, Western Union, and Zions Bancorp as well.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.