For years, 24/7 Wall St. has covered stocks under $10. While not all were home runs, many savvy investors with foresight and patience made millions on stocks that traded in the single digits.

Two companies, which traded under $10 for years, have become the stock market’s darlings and have led the massive rally over the last year, especially since October. For low-price stock skeptics, many of the biggest companies in the world, including Apple Inc. (NASDAQ: AAPL), Amazon.com, Inc. (NASDAQ: AMZN), and Netflix, Inc. (NASDAQ: NFLX), all traded in single digits at one time.

So, we decided to compare two stocks that have been on fire over the last six months. Both have had substantial parabolic moves higher. So, in the Thunderdome, it’s Nvidia Inc. (NASDAQ: NVDA) versus Super Micro Computer, Inc. (NASDAQ: SMCI).

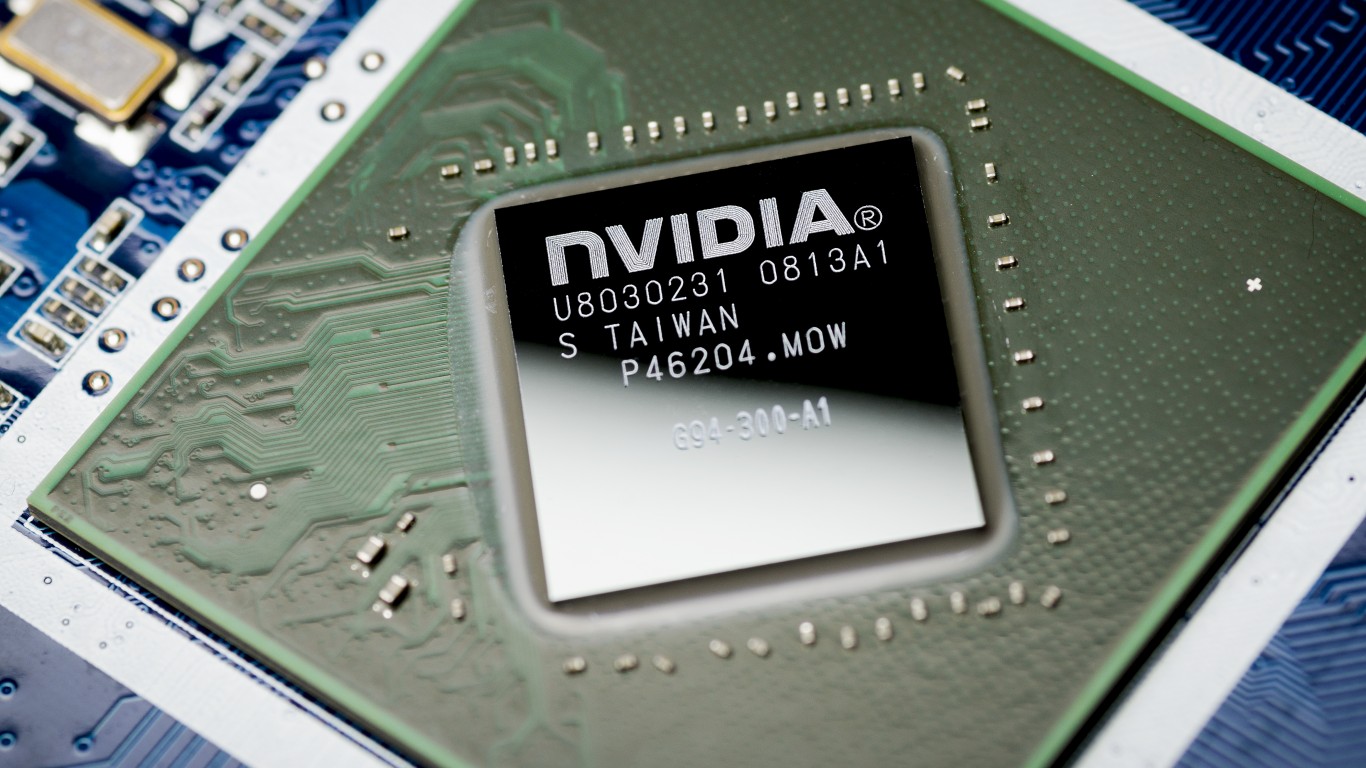

Nvidia emerged as an AI chip giant

The company, which traded under $10 per share from 2000 to 2015, pioneered many technologies on which AI applications depend.

Nvidia graphic cards got the party started

The Nvidia graphics processing units (GPUs) helped the gaming industry explode and were simultaneously the go-to chips for multiple tasks. While Nvidia is still a massive player in the gaming world, the AI explosion changed everything.

Nvidia’s Compute & Networking segment explodes higher

This silo provides:

- Data Center platforms and systems for AI, HPC, and accelerated computing

- Mellanox networking and interconnect solutions; automotive AI Cockpit, autonomous driving development agreements

- Autonomous vehicle solutions

- cryptocurrency mining processors

- Jetson for robotics and other embedded platforms

- NVIDIA AI Enterprise and other software

Nvidia stock moved higher starting in October of 2023

The low close in October of last year was a stunning $407.80, and since then, the stock has skyrocketed an incredible $127%, closing at an all-time high of $926.69 on March 6, 2024.

Don’t forget about a possible stock split

In the summer of 2021, the company conducted a 4-for-one stock split. Many feel that another stock split is right around the corner, as the shares are trading back near the $900 level. The same is true for Super Micro Computer, which has never split it’s U.S. shares.

Wall Street is all in on NVIDIA for now

As is always the case across Wall Street, sell-side analysts are decidedly bullish on a stock when a red-hot stock leads the pack. Of the 37 analysts covering the company, 1 has a Strong Buy rating, 33 have a Buy rating, 2 have a Hold rating, and just 1 has a Sell rating.

The sky is the limit for Nvidia

Nvidia is the clear market leader for chips in AI research and related products. Tech giants such as Alphabet and Meta are well-invested in AI. Meta CEO Mark Zuckerberg stated that his company’s computing infrastructure will include a stunning 350,000 H100 cards by the end of this year.

Super Micro Computer shares were also cheap for years

The stock, which had exploded to over $1200 per share before pulling back recently in a big way, traded below $10 from 2007 to 2010 and then below $20 from 2010 to 2109. It started the massive parabolic move higher in the summer of 2022 and has never looked back.

Super Micro Computer is a giant in China

Semiconductor Manufacturing International Corporation is one of the world’s leading foundries and is the frontrunner in manufacturing capability, manufacturing scale, and comprehensive service in the Chinese Mainland.

China is making advanced chips

While U.S. sanctions have been put into place regarding advanced semiconductors, Super Micro Computer has continued making them. This could turn out to be a big negative in the future.

Just who owns Super Micro Computer?

While many shareholders own the stock China state-owned civilian and military telecommunications equipment provider Datang Telecom Group and the China Integrated Circuit Industry Investment Fund are significant shareholders of the company. Notable customers include Huawei, Qualcomm, Broadcom, and Texas Instruments. Washington, D.C., likely does not view the Chinese owners favorably.

And we have a winner…

Based on the comparison, the race is very close, but Nvidia’s vast product line gives it the edge over Super Micro Computer. While Wall Street favors both stocks and loves their data center exposure, Nvidia is the chosen leader, with far less downside potential. Both have made huge moves higher over the last six months and have retreated significantly over the previous month.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.