Everything about Walmart is gigantic. By revenue, it’s the largest retailer on earth. Bigger than Costco (Nasdaq: COST), Amazon (Nasdaq: AMZN), and Target (NYSE:TGT). The company operates more than 10,000 stores, employs over 2,300,000 people, and over the long run has been one of the greatest investments of all time.

Recently, we looked at how much $1,000 invested in Walmart 30 years ago was worth today. For those lucky investors who purchased three decades ago, they’d have turned $1,000 into nearly $13,000 today.

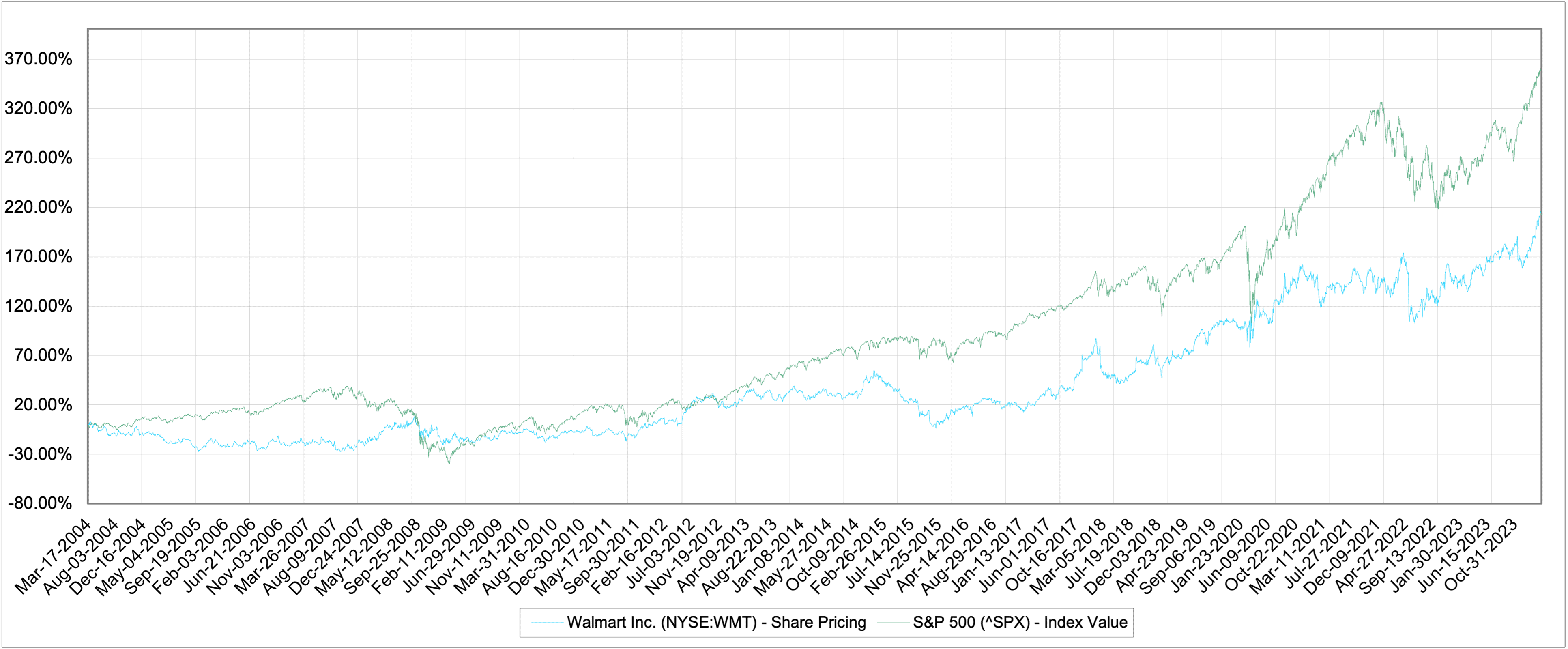

But the path was bumpy, filled with volatility, big gains, losses, and over a decade with 0% returns. With ten fewer years to smooth out the performance, let’s see how investors would have done had they invested $1,000 in Walmart 20 years ago.

$1,000 Invested in Walmart 20 Years ago…

Shockingly, if you’d invested $1,000 in Walmart 20 years ago you’d have $3,112 today. This compares to $4,550 if you’d invested in the S&P 500 instead. The first thing that jumps out is the difference between Walmart’s 20 and 30 year performance. Over two decades the company has lost handily to the S&P 500, but over 30 years it’s crushed it.

While this doesn’t include dividends, or dividend reinvestments for either investment, one thing is clear: a decade can make a huge difference! Let’s take a closer look.

Why Did Walmart Underperform So Badly?

What explains Walmart’s 20 year performance, and why it differs so much from it’s 30 year? A few things jump out.

- Starting 20 years ago, shares in Walmart languished and couldn’t find a consistently positive return until the very end of 2011

- That seven year stretch included the great financial crisis, recession, and a challenging environment for consumers

- The market, due to the volatility above, heavily repriced the multiple it was willing to pay for Walmart

- In 2004 investors were willing to pay paying roughly 18x enterprise value to EBIT, in 2011 that has shrunk to only 9x

This last point is the most important. While Walmart the investment may have been a poor performer for roughly 7 years, Walmart the company was continuing to grow. In 2004 the company’s net income was $9 billion. By the end of 2011 it was $16.4 billion, and yet investors lost money because their appetite for the multiple they were willing to pay for those earnings changed.

Even a fantastic company can underperform if you buy when shares are expensive. Knowing exactly when shares are overpriced is tricky though. Fellow retailer Amazon looked expensive for decades, but the company was able to grow enough to justify the multiple, and investors ended up doing just fine.

What Next?

So what are the lessons for investors today? First, patience. Even an investment that loses to the market for 20 years can end up trouncing it over 30. Whatever your time horizon is on your positions, try and extend it. Second, valuation matters. Be mindful of the multiple you’re willing to pay for shares in a company, even a world class one, because if things don’t go as planned (or better) it can take awhile to catch up. Third, buying an index fund like the S&P 500 can still work out just fine.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.