While much attention has been devoted of late to high flying stocks dealing with hot trends, like Artificial Intelligence, cloud computing, social media, or other areas, technology covers a wide area. In fact, there are conventional tech stocks that might have been analyst darlings in the past that have quietly continued innovating and growing, but with less fanfare.

24/7 Wall St. has tracked a number of stocks over the period of a decade that have made triple and even quadruple digit percentage returns for those investors intuitive enough to have taken the plunge early. One such stock that is well known, since it’s a semiconductor company best known for its PC, video game graphics, and server chips: Advanced Micro Devices (NASDAQ: AMD).

A Half Century Rivalry

Analogous to the rivalry between sneaker companies Adidas (Adolph “Adi” Dessler and brother Rudolph) vs. Puma (spun off by Rudolph Dassler), AMD was started roughly 10 months after Intel (NASDAQ: INTC) by a former Intel employee in the late 1960’s, and for nearly 50 years was perceived as an Intel copycat, especially when it came to CPUs (Central Processing Units).

The perception that AMD was a “second-best compromise” persisted in the computing community for decades. Given that AMD chips were often slower than Intel ones, albeit less expensive, manufacturer like IBM (NYSE: IBM) and Compaq, which is now owned by Hewlett-Packard (NYSE: HPQ) would install them in their student and budget computer desktops and laptops.

The Game Changer

In 2014, Taiwan-born Dr. Lisa Su, a veteran of IBM and Texas Instruments (NASDAQ: TXN), became CEO of AMD. She immediately went to work expanding AMD’s sales in non-PC markets from 10% to over 40%, establishing a niche in the video gaming and embedded devices sectors.

Within three years under her leadership, AMD was able to unveil the Ryzen, which became a game changer.

AMD’s Ryzen CPU, based on a principle of multiple microscopic CPUs working in tandem, outperformed Intel’s CPU’s in speed and efficiency, and most importantly – cost only half as much.

Ryzen added tens of billions to AMD’s revenues, and in 2022, AMD surpassed Intel in market cap.

AMD’s Achilles’ Heel

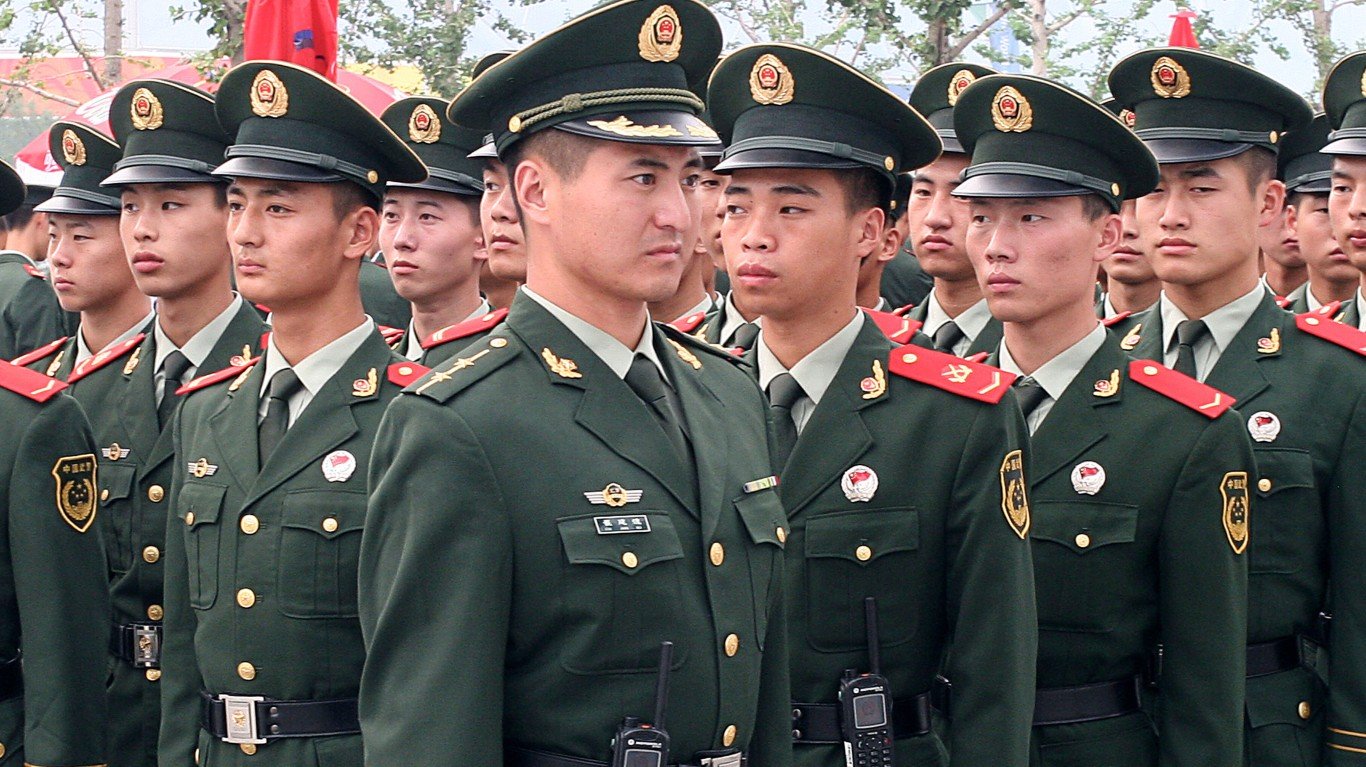

Unlike Intel, AMD does not have major manufacturing facilities in the US. Dr. Su’s reputation and ties to Taiwan have created a strong relationship with manufacturing plants owned by Taiwan Semiconductor Manufacturing Co, (NYSE: TSMC). While the relationship between AMD and TSMC remains strong, geopolitical tensions between Taiwan and China, whose CCP leadership continues to advocate for “reunification” with Taiwan, even if by military invasion, continues to be a risk factor.

Not a One-Trick Pony

In addition to Ryzen, AMD has also built a formidable reputation for itself with its graphic processors for video gaming and other applications.

AMD’s MI300 GPU (Graphics Processing Units) and similar products are addressing AI workloads for cloud computing, which is stirring up interest. Microsoft (NASDAQ: MSFT) and Oracle (NASDAQ: ORCL) are already using the MI300. As a result, AMD is now on the radar alongside other AI related stocks, such as Nvidia (NASDAQ: NVDA), and will likely trade in tandem with the AI sector going forward.

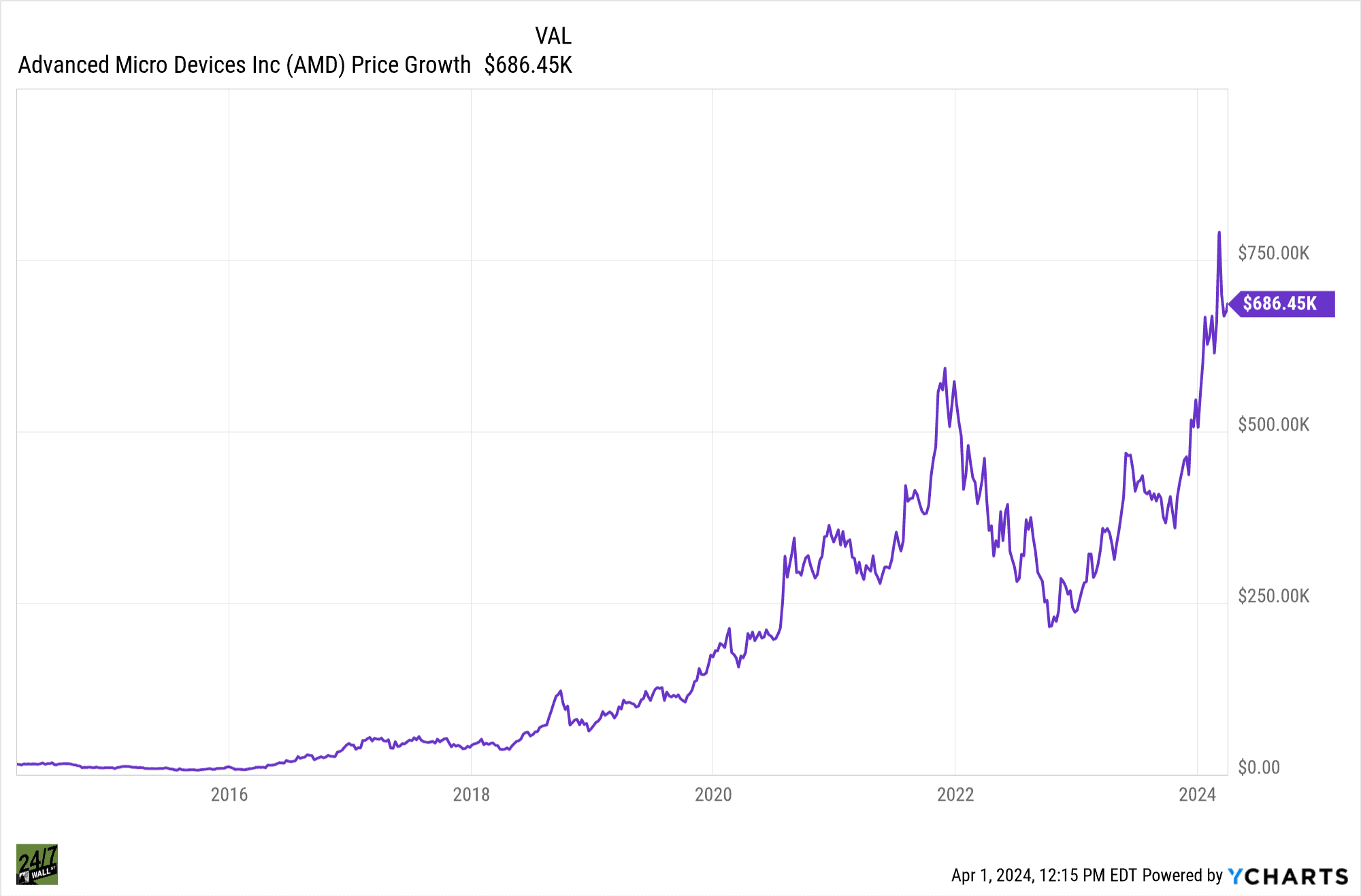

Looking Back at What a $15,000 Investment in Advanced Micro Devices Would Look Like Now

So just how much money would you have today if you invested $15,000 in AMD stock 10 years ago? At the beginning of Q2 2014, AMD stock was trading at roughly $4 per share. A $15,000 investment would have purchased 3,750 shares. At the time of this writing, AMD stock closed at $183. That equals $686,450,000 or a 44.7X ROI.

ALERT: Take This Retirement Quiz Now (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.