Herman Minsky was an American economist and a professor of economics at Washington University and Bard College. He was one of the first economists to successfully explain the gross inflation “malaise” of the Jimmy Carter era during the 1970s, and his theories also anticipated the 2008 subprime-fueled banking meltdown.

Essentially, Minsky’s theories hold that if broad financial prosperity leads to profligate spending by the government, speculative euphoria can cause debt to outpace revenues, leading to inflation, and subsequently trigger a severe banking and economic contraction. Although he was a Socialist from the Keynesian school of economics, Minsky nevertheless saw the forest for the trees, and his theories have been cited respectfully by economists from the more conservative Milton Friedman and Friedrick Hayek pro-capitalist free market schools of economics. Minsky’s theories have especially been referenced regarding the current inflation-driven economic tightrope, where the US has become one of the top debtor nations within a scant 3 years, and the US Federal debt stands at $34 trillion.

We are already seeing this scenario play out again with the latest multi-trillion dollar budget passed by Congress and the drunken sailor-like spending from the government that is now adding $1 trillion in owed interest every month. The excess money printing is devaluing the dollar even further, shrinking the buying power of American households across the nation.

We screened our 24/7 Wall St. dividend equity research database, looking for stocks that pay massive dividends, and we found a collection of companies that, combined, can generate over $27,000 a year in passive annual income if you invest just $50,000 in each stock at the time of this writing.

KKR Income Opportunities Fund

- Stock #1 : KKR Income Opportunities Fund (NYSE: KIO)

- Yield: 12.96%

- Shares for $50,000: 3,692

- Annual Passive Income: ~$6,480

Kohlberg, Kravis, Roberts & Co. LP, better known as KKR, has a long history of high profile leveraged buyouts and other types of acquisitions, immortalized in the book, Barbarians at the Gate, which detailed the RJR Nabisco Deal, and which starred James Garner and Jonathan Pryce in the 1993 film adaptation.

Of course, with $553 billion AUM, KKR has a lot of different divisions for investment and generating profits. The San Francisco-based KKR Income Opportunities Fund is KKR’s listed, closed-end, high-yield fund. Investing primarily in high-yield “junk” bonds, secured and unsecured loans, but also deploys risk-adjusted strategies for hedging and mitigation of sudden downside trends.

First Trust High Income Long/Short Fund

- Stock #2 : First Trust High Income Long/Short Fund (NYSE: FSD)

- Yield: 12.26%

- Shares for $50,000: 4,191

- Annual Passive Income: ~$6,130

The First Trust High Income Long/Short Fund is a closed-end fund that focuses on high-yielding corporate “junk” bonds, notes, commercial paper and debentures. What is somewhat different from many of its peers is that it also utilizes a long/short strategy to maximize returns.

As of the end of February, First Trust High Income Long/Short Fund was shorting US Treasury Bonds, which, given the state of the Federal Reserve and the ascending inflation rate, will likely go down in price as the Fed issues more T-bonds and notes, further depressing the price, and earning money for the short position.

As for long positions, 14.29% of the portfolio was invested in the Energy sector, with Services next at 9.51%, Capital Goods at 9.33%, Basic Industry at 8.25%, and Media at 7.45%. First Trust High Income Long/Short Fund’s offices are in Wheaton, IL.

Neuberger Berman Next Generation Connectivity Fund

- Stock #3: Neuberger Berman Next Generation Connectivity Fund (NYSE: NBXG)

- Yield: 12.01%

- Shares for $50,000: 4,255

- Annual Passive Income: ~$6,005

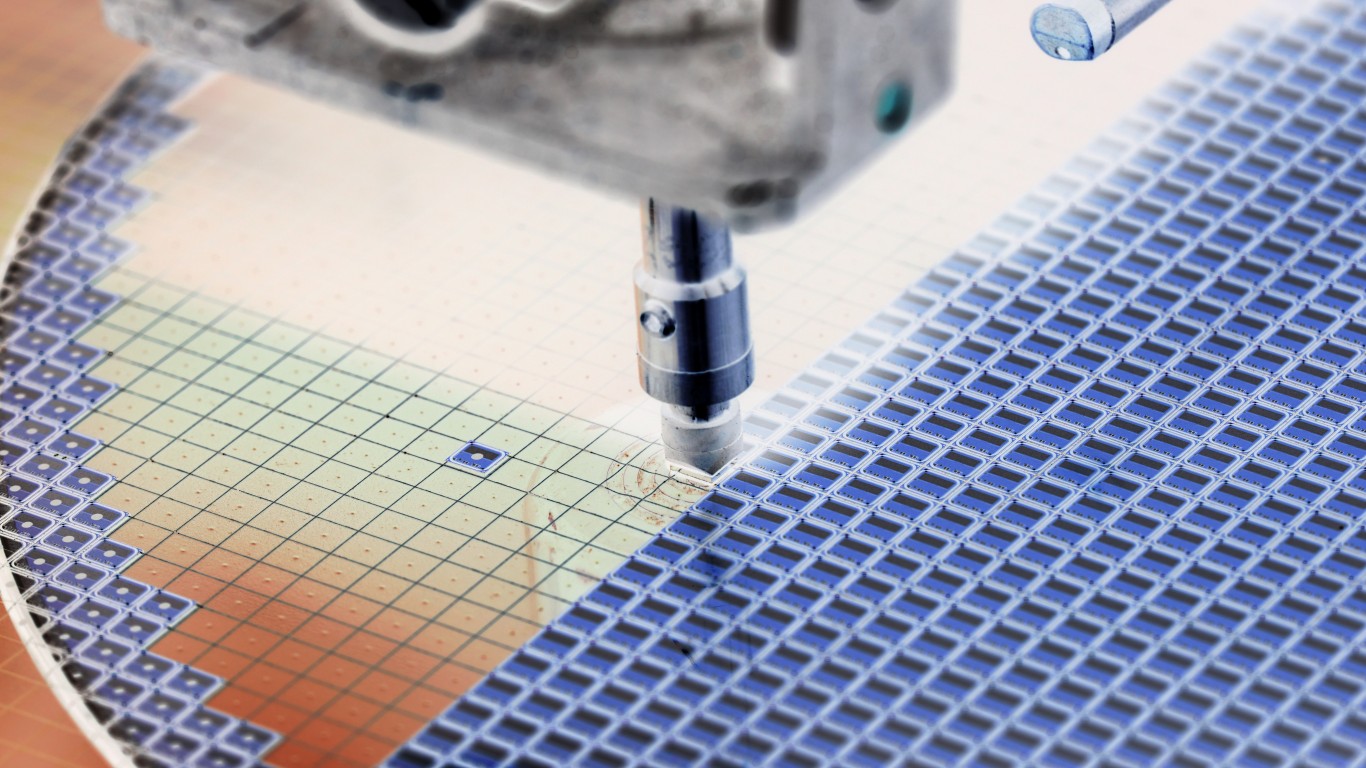

Best known for its mutual funds, Neuberger Berman Next Generation Connectivity Fund is a closed-end “specialty” fund, which, in this case, refers to technology. With 86% of its $1.1 billion portfolio assets invested in global technology stocks, its returns are all based on capital gains and dividends. The stock selections deal with all aspects of technology, including social media, cloud computing, semiconductor manufacturing, AI, and so forth. Apart from some cash and a small amount of unclassified assets, everything else is devoted to tech stocks – no fixed income at all.

An example of the top positions held by the Neuberger Berman Next Generation Connectivity Fund as of the end of February, 2024 are: Taiwan Semiconductor Manufacturing Co. Ltd. ADR (NYSE: TSM): 3.46%, Applied Materials, Inc. (NASDAQ: AMAT): 2.82%, Monolithic Power Systems, Inc. (NASDAQ: MPWR): 2.79%, Nvidia Corp. (NASDAQ: NVDA): 2.66%, and Advanced Micro Devices, Inc. (NASDAQ: AMD): 2.65%.

Atlantica Sustainable Infrastructure plc

- Stock #4: Atlantica Sustainable Infrastructure plc (NASDAQ: AY)

- Yield: 9.79%

- Shares for $50,000: 2,705

- Annual Passive Income: ~$4,895

Headquartered in Brentford, United Kingdom, Atlantica Sustainable Infrastructure Plc is engaged in green energy production, along with operation of electric transmission lines and water desalination. The green energy platforms include: 1) Renewable Energy via solar and wind power, and 2) Natural gas originated electricity and steam power.

In addition to the UK, Atlantica Sustainable Infrastructure plc also does business in the Americas, Europe, Africa, and the Middle East.

While ESG initiatives and green energy companies have been the target of negative US press of late for their lack of economic viability compared with conventional energy companies, it’s helpful to remember that Atlantica is based in the UK and does much of its business in nations where there are hefty government subsidies for green energy. The Climate Council published a list of 11 countries leading the way in green energy, and the UK was listed as number 3, with European nations taking 1, 4, 5 and 11, South and Central American countries at 2 and 6, African at 7 and 9. The other two were China and New Zealand.

Tortoise Energy Infrastructure Corporation

- Stock #5 : Tortoise Energy Infrastructure Corporation (NYSE: TYG)

- Yield: 9.37%

- Shares for $50,000: 1,617

- Annual Passive Income: ~$4,685

By only buying and selling predominantly public shares of midstream oil companies, and those that engage in storage and transport of natural gas and coal, Overland Park, KS headquartered Tortoise Energy Infrastructure Corporation is basically a fuel and commodity services company.

Tortoise Energy’s portfolio holds mostly stocks, with 77% allocation, and then Master Limited Partnerships (midstream stocks) at 19%. Its top five holdings, percentagewise, as of 2/29/2024 are:

1) Williams Companies, Inc. (NYSE: WMB): 9.7%

2) Targa Resources, Corp. (NYSE: TRGP): 8.3%

3) Sempra Energy (NYSE: SRE): 7.4%

4) MPLX LP (NYSE: MPLX): 7.3%

5) Hess Midstream LP (NYSE: HESM): 6.7%

As with all stock purchases, proper due diligence and research should be exercised before purchasing to ensure that the securities in question meet investment targets and risk tolerance profiles. Also, the portfolio itself should be monitored regularly to check for any news or market conditions that could affect the stock price or dividend amounts.

| Name: | Yield: | Annual Dividend Income: | |

| KKR Income Opportunities Fund (NYSE: KIO) | 12.96% | $6,480 | |

| First Trust High Income Long/Short Fund (NYSE: FSD) | 12.26% | $6,130 | |

| Neuberger Berman Next Generation Connectivity Fund (NYSE: NBXG) | 12.01% | $6,005 | |

| Atlantica Sustainable Infrastructure plc (NASDAQ: AY) | 9.79% | $4,895 | |

| Tortoise Energy Infrastructure Corporation (NYSE: TYG) | 9.37% | $4,685 | |

| Total: | $28,195 |

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.