Charles Schwab offers an expert-tailored list of exchange-traded funds (ETFs) known for diversification and competitive fees.

What are ETFs?

An ETF is a diversified and professionally managed portfolio containing a mix of stocks, bonds and other securities. Their design offers instant diversification. This means investing in an ETF can save you the time and effort of researching and picking your own stocks to build a portfolio.

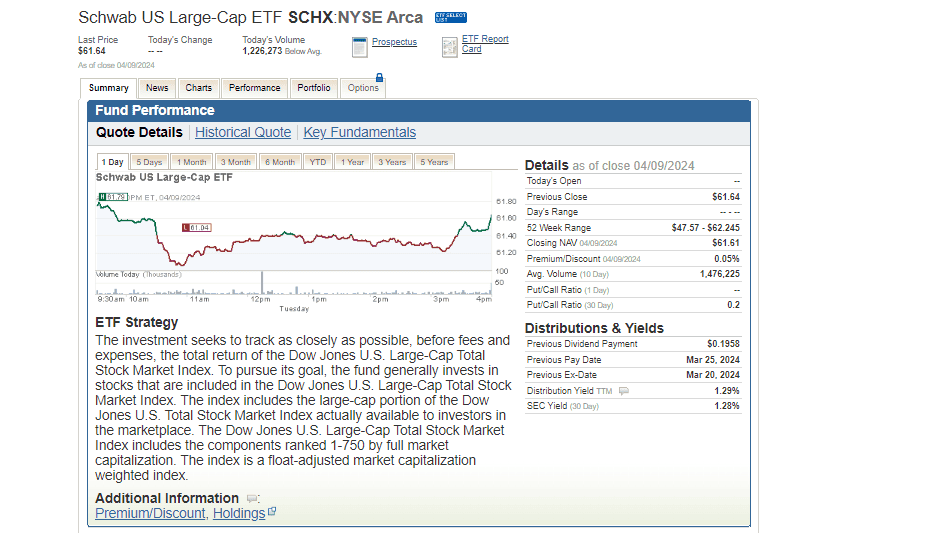

You can buy and sell ETF shares on a stock exchange via your brokerage account – in a similar manner as trading stocks. Like stocks, ETF share prices fluctuate throughout the trading day. Mutual fund shares, on the other hand, trade once a day at the same price.

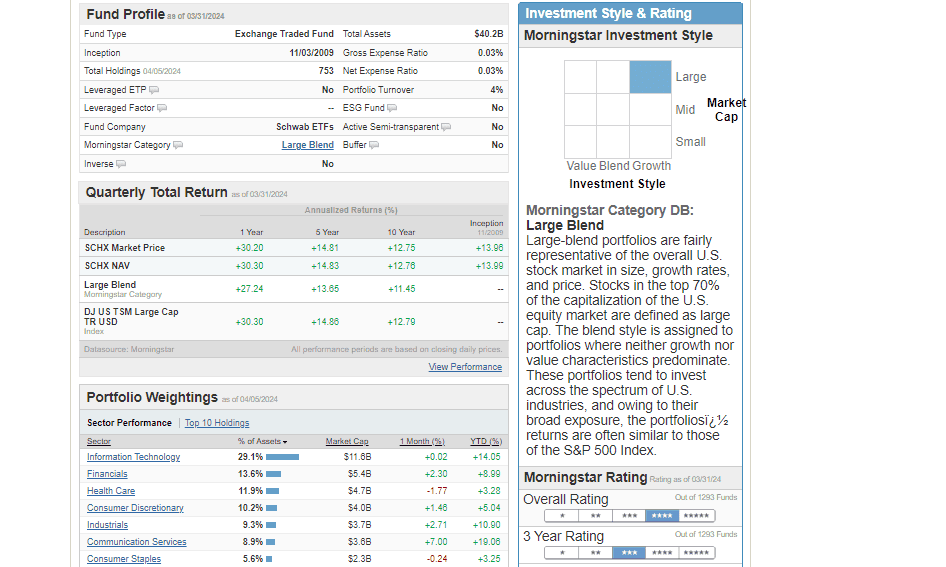

Generally speaking, ETFs are known for lower operating costs than actively-managed mutual funds. Many ETFs are passively managed and invest in stocks within a major market index. This may translate to lower fees on the investor’s end.

By opening a brokerage account with Schwab, you can trade commission-free ETFs. Its advanced research tools also let you look up and explore thousands of ETFs.

But the Schwab ETF Select List narrows down ETFs to those hand picked by experts at The Schwab Center for Financial Research.

What are ETF fees?

Common ETF fees include expense ratios. These are ongoing operating costs charged by the fund managers on an annual basis. These are expressed as a percentage of assets under management.

So a $10,000 investment in an ETF with a 0.20% expense ratio would mean a $20 annual fee.

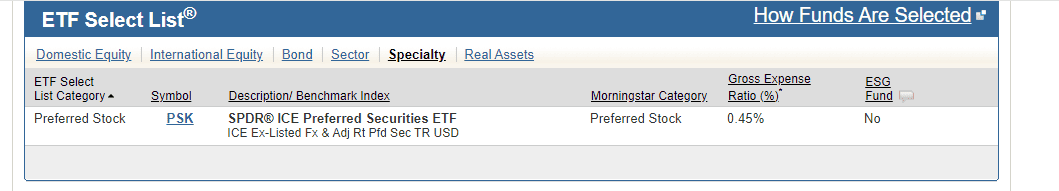

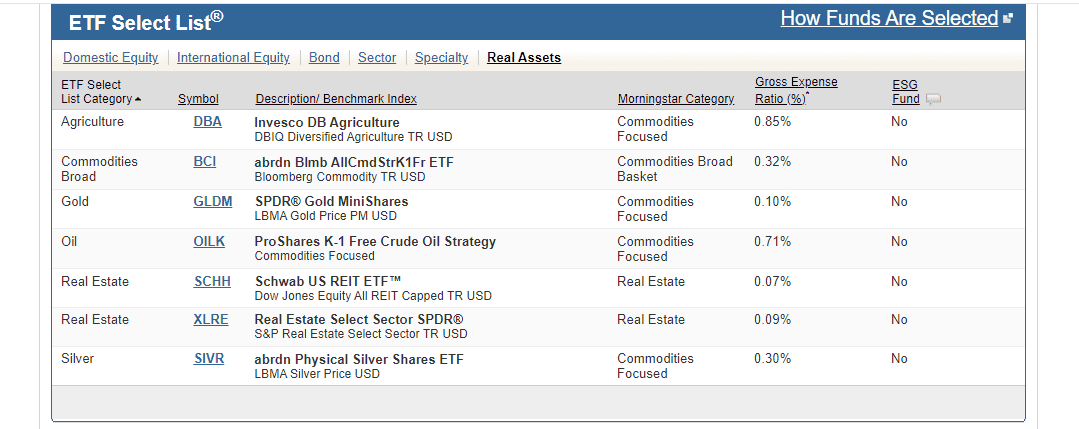

On average, the passively-managed ETF expense ratio across the industry is about 0.19%. The average expense ratio on Schwab ETFs is 0.05%. But expense ratios across funds can vary widely. Expense ratios for funds on the Schwab ETF Select List range from 0.03% to 0.85%.

So it’s important to compare expense ratios, especially if you’re considering ETFs that track the same market index. You can find expense ratios and other information by visiting the Schwab ETF Select List home page.

How does the Schwab ETF Select List work?

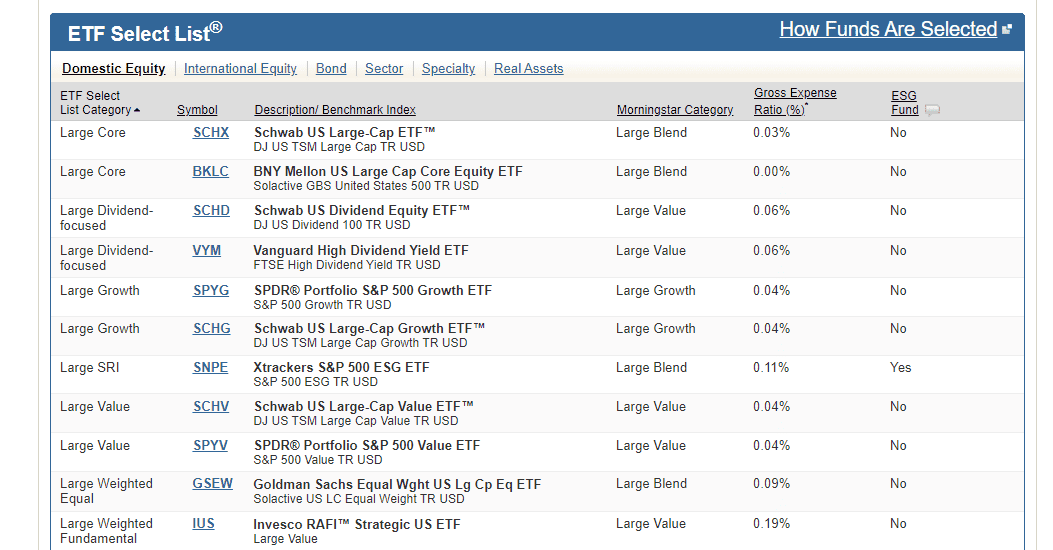

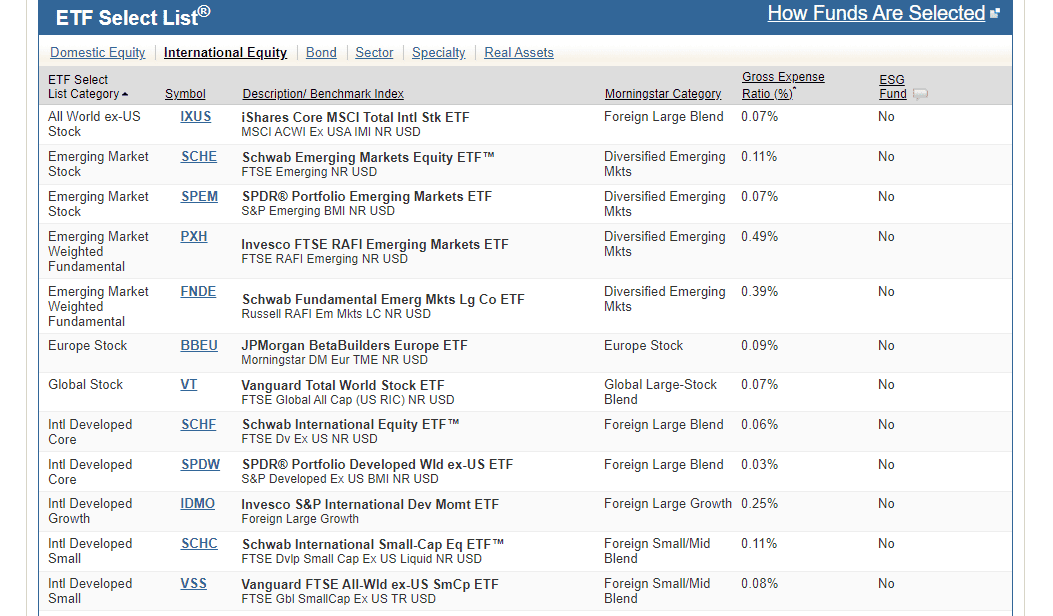

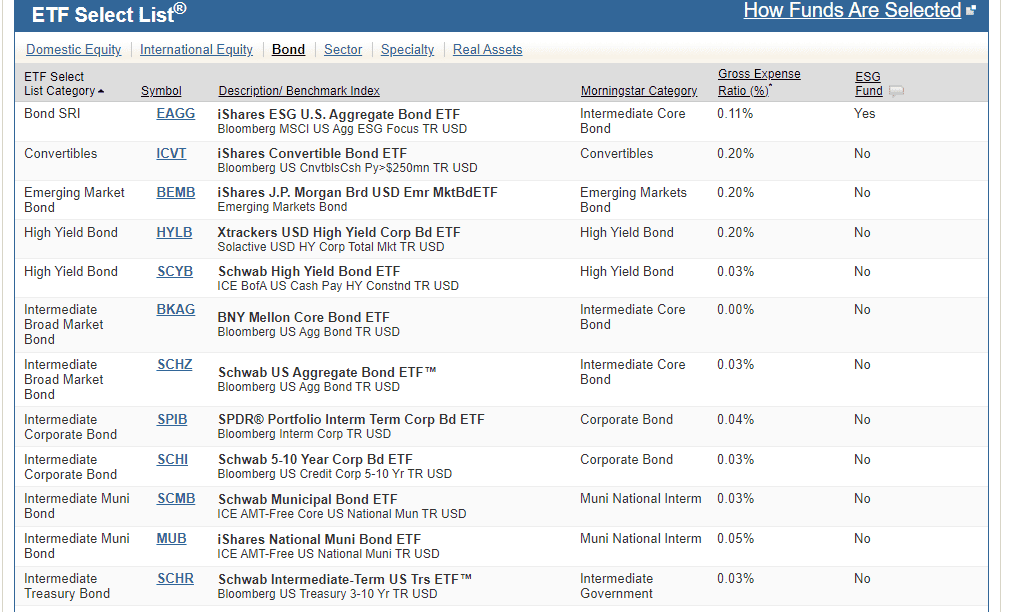

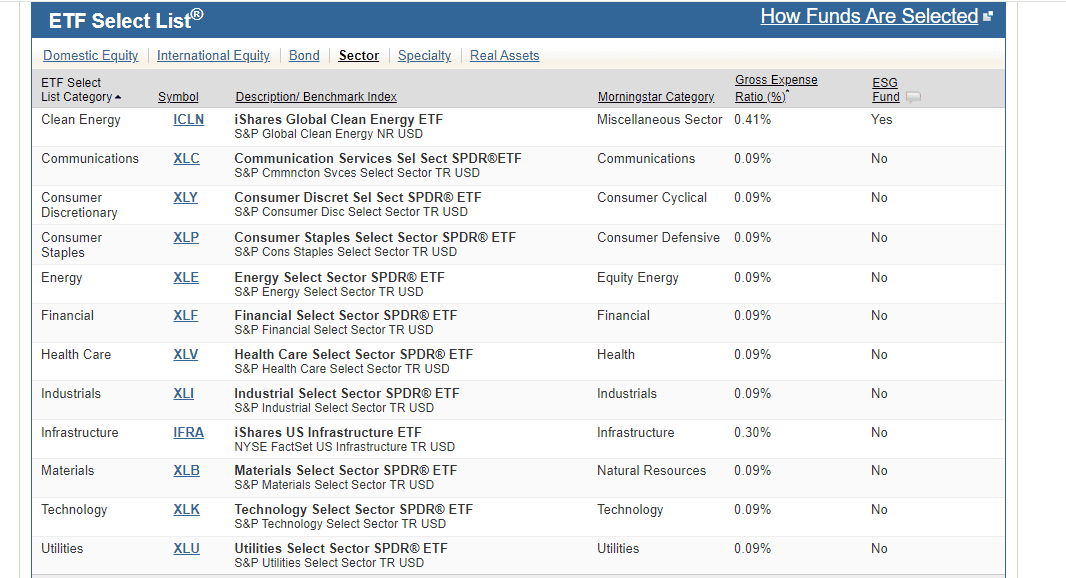

By visiting the Schwab ETF Select list on its official website, you can look up ETFs based on the following criteria.

- Domestic Equity

- International Equity

- Bond

- Sector

- Specialty

- Real Assets

And by clicking on an ETF’s ticker symbol, you can look up real-time data such as quotes, performance history, fund objectives, fees, blend style, portfolio weightings and more.

Getting started with investing in ETFs

You can start investing in ETFs commission-free by opening a brokerage account with Schwab. You can choose from taxable accounts, traditional individual retirement accounts (IRAs) and Roth IRAs.

Additionally, Schwab offers the following products

- Automated investing account or robo-advisor service

- Custodial account for the benefit of a minor

- 529 college savings plans

- Health Savings Accounts (HSA)

- Credit cards with rewards offers

If you want to learn more about Schwab, check out our regularly-updated list of Charles Schwab guides, news and coverage.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.