Advanced Micro Devices (Nasdaq: AMD) is one of those stocks that’s always in the right place at the right time for chip demand, whether it’s gaming, blockchain or artificial intelligence (AI). These days, AI stocks are all the rage. So why is Advanced Micro Devices (Nasdaq: AMD), an exciting chip company, flashing red today? And perhaps more importantly, is the writing on the wall for an upcoming reversal?

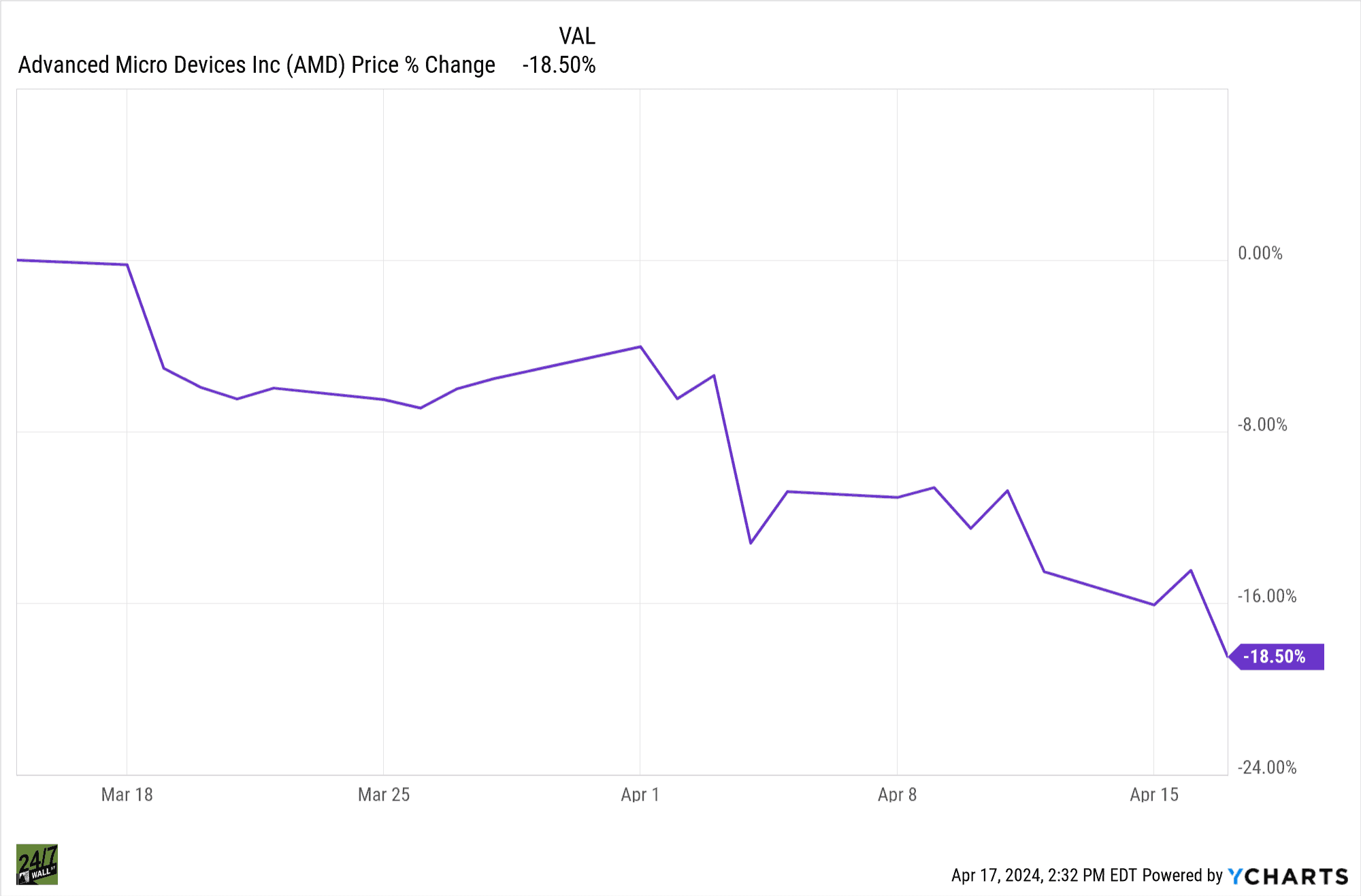

At market closing, the stock had tumbled by over 5.78% to below $154.02 per share and is down nearly 20% in the past 30 days alone, lagging the iShares Semiconductor ETF in the period. Growth investors are accustomed to wild fluctuations in valuations, and they are getting what they signed up for in AMD.

Tech Profit Taking

AMD is taking the brunt of a broader sell-off in tech stocks, pressuring the Nasdaq lower by approximately 1% today. The sharp declines could be chalked up to some profit taking after the Nasdaq reached its sixth all-time high of the year, the most recent record of which came earlier this month. AMD could also be down in sympathy as shares of rival chipmaker Nvidia (Nasdaq: NVDA) also fell.

After Fed Chairman Jerome Powell dampened interest rate cut hopes this week, investors may just be throwing out the baby with the bath water, so to speak. Meanwhile, according to social media scuttlebutt, investors have been buying up calls on AMD, expecting to profit from an upcoming reversal in the stock price. Whether or not they are right remains to be seen.

AI Competitive Landscape

In recent days, AMD launched the Ryzen PRO 8040 Series, a set of semiconductor chips for AI-powered business laptops and desktops as it seeks to grow its share of the market pie. While AMD boasts a market cap of over $250 billion, it’s also up against stiff competition from the likes of industry stalwart Intel (Nasdaq: INTC) and AI-phenomenon Nvidia, the latter of which is known for its graphic processing units (GPUs). While PC demand might not be at its peak, the industry could be on the verge of an upgrade cycle from which AMD stands to benefit.

Is AMD Stock a Sell in 2024?

While today’s sell-off in AMD stock might be surprising, especially considering shares were higher in the pre-market, it doesn’t mean that the stock should be placed on the sell list for 2024. Consider what Wall Street analysts are saying, including HSBC, which upgraded AMD stock to a buy this week.

The analyst firm believes investors should overlook AMD as an AI play at their own risk, owing to a couple of catalysts. First, it is readying the highly anticipated launch of its AI accelerator chip, M1300, and secondly it is taking on Nvidia on the latter company’s turf – GPUs. HSBC sees 40% upside in AMD stock on expectations it will exceed Wall Street’s revenue guidance.

AMD is expected to report first quarter earnings on April 30.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.