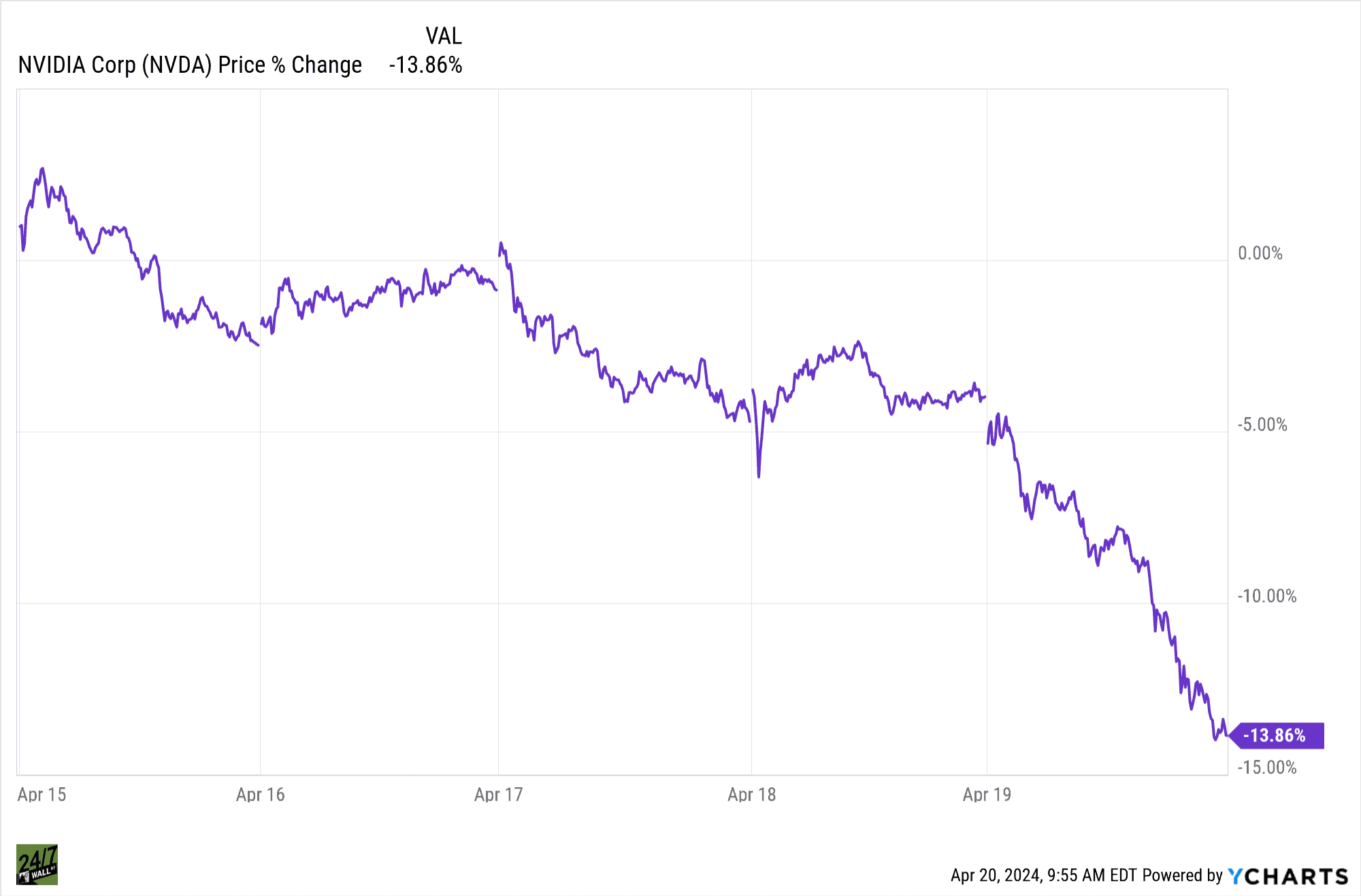

AI phenomenon Nvidia (Nasdaq: NVDA) got the wind taken out of its sails this week. After tumbling 10% from fresh all-time highs of almost $1,000 seen in March, Nvidia stock found itself slipping below the psychologically sensitive $800 level.

Given its roughly 5% weighting in the S&P 500, Nvidia’s performance also weighed on the broader markets, dampening the mood and reminding investors of just how influential big tech stocks can be, in good times and bad.

Contagion Fears

As the face of AI in tech circles, Nvidia’s woes didn’t appear to be company-specific. Chip stock weakness spread throughout, dragging the PHLX Semiconductor index, in which Nvidia is also a member, 6.2% lower in sympathy and sending the sector spiraling into technical correction territory.

Investors were taking a breather from the group as fears of an AI bubble placed a spotlight on lofty valuations. Those concerns were seemingly realized when chip-equipment maker ASML (Nasdaq: ASML) revealed it suffered an orders shortfall last quarter. That was enough to unleash the bears, who have yet to relax their grip on chip stocks.

Fed Chairman Jerome Powell didn’t help market sentiment when he weighed in on inflation running hotter than he’d expected. The Fed chief is in no hurry to cut interest rates this year, causing investors and traders alike to adjust their expectations.

‘AI Fatigue?’

Nvidia remains far ahead of the AI pack with its cutting-edge chip sets. Just last week, Nvidia CEO Jensen Huang, a billionaire, revealed the start of the “super chip” era, an announcement that coincided with the company’s unveiling of the next generation of AI chips, the B200 set. The company also introduced its GPU-focused AI chatbot, dubbed RTX, to compete with ChatGPT.

It’s quite possible, as The Wall Street Journal suggested, that investors are merely experiencing “AI fatigue,” needing some space from the craze until some of the latest market headwinds dissipate. With a $2 trillion market cap, Nvidia is more than able to drive the markets in either direction, as this past week has reminded investors.

Is Nvidia a Sell in 2024?

Despite the tech downturn, Wall Street remains bullish on Nvidia stock. Inside Edge Capital’s Todd Gordon has attached an $1,150 price target on Nvidia shares along with a “strong buy” rating.

Not to be outdone, Evercore recently initiated coverage on Nvidia, setting an $1,160 price target and “outperform” rating on the stock. According to Evercore, Nvidia transcends the chip space and instead reflects the “AI ecosystem.” The analyst firm further explained “computing eras last 15-20 years and are typically dominated by a single vertically integrated ecosystem company, whose returns are measured in 100-to-1000 bagger range.”

Smart Investors Are Quietly Loading Up on These “Dividend Legends” (Sponsored)

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.