Special Report

Potential Marijuana Tax Revenue in Every State

Published:

Last Updated:

While the legal structure supporting marijuana sales would be quite different in each U.S. region, other states can begin to better understand the financial impact legalization would have on their states. The Tax Foundation used sales per capita in these two states and the assumption of a 25% effective tax rate to determine the potential tax revenue from marijuana sales in each state.

While tax revenue from marijuana sales exceeded expectations in both Colorado and Washington, the revenue increase remains small relative to the overall state tax revenue. This could support arguments of both those who claim the financial incentives are enough to push for legalization, and those who claim they are not worth the potential risks.

Click here to see the potential tax revenue from recreational marijuana in each state.

Click here to see the 14 next states to legalize pot.

Click here to see the 11 states least likely to legalize marijuana.

For example, based on a 25% tax rate — the lowest among the four states that legalized marijuana — potential annual revenues for states legalizing marijuana would likely range from $16 million in less populated states such as Wyoming to $1.1 billion in California. When compared to all tax revenue statewide, the percentage increase of this potential revenue ranges from only a 0.3% increase in state tax revenue in North Dakota to a 1.6% increase in New Hampshire.

Increasing tax revenues is not the only financial benefit of legalization. States also save from spending less on enforcing marijuana laws. However, this saved money is at least partially repurposed to regulating the new market.

Marijuana legalization is still hotly debated nationwide, with many states likely to legalize soon while others are doubtful. Based on two previous analyses, 24/7 Wall St. identified the next 14 states to legalize marijuana and the 11 states least likely to legalize marijuana. If all of the 14 states legalize, the combined annual additional revenue is expected to be $3.1 billion. The 11 states least likely to legalize would miss out on an estimated $1.2 billion annually.

To identify the potential tax revenue from the sale of marijuana in every state, 24/7 Wall St. used estimates based on sales per capita in Colorado and Washington from The Tax Foundation. All potential revenues are based on a 25% tax rate. Total state tax revenues are from the U.S. Census Bureau. Marijuana usage figures are from the Substance Abuse and Mental Health Services Administration. The likelihood of legalization is based on two previous analyses from 24/7 Wall St.

This is the potential tax revenue from marijuana sales in every state.

1. Alabama

> Potential pot tax revenue: $134 million

> Total state tax revenue: $9.29 billion (24th lowest)

> Marijuana use rate: 5.6% of adults (5th lowest)

> Likelihood of legalizing: Low

2. Alaska

> Potential pot tax revenue: $20 million

> Total state tax revenue: $3.39 billion (8th lowest)

> Marijuana use rate: 12.2% of adults (7th highest)

> Likelihood of legalizing: N/A

3. Arizona

> Potential pot tax revenue: $188 million

> Total state tax revenue: $13.08 billion (20th highest)

> Marijuana use rate: 8.9% of adults (14th highest)

> Likelihood of legalizing: High

4. Arkansas

> Potential pot tax revenue: $82 million

> Total state tax revenue: $8.94 billion (22nd lowest)

> Marijuana use rate: 6.8% of adults (20th lowest)

> Likelihood of legalizing: Low

5. California

> Potential pot tax revenue: $1.08 billion

> Total state tax revenue: $138.07 billion (the highest)

> Marijuana use rate: 9.3% of adults (13th highest)

> Likelihood of legalizing: High

6. Colorado

> Potential pot tax revenue: $150 million

> Total state tax revenue: $11.76 billion (22nd highest)

> Marijuana use rate: 15.2% of adults (the highest)

> Likelihood of legalizing: N/A

7. Connecticut

> Potential pot tax revenue: $99 million

> Total state tax revenue: $15.94 billion (19th highest)

> Marijuana use rate: 8.6% of adults (17th highest)

> Likelihood of legalizing: High

8. Delaware

> Potential pot tax revenue: $26 million

> Total state tax revenue: $3.18 billion (7th lowest)

> Marijuana use rate: 8.2% of adults (18th highest)

> Likelihood of legalizing: High

9. Florida

> Potential pot tax revenue: $557 million

> Total state tax revenue: $35.38 billion (5th highest)

> Marijuana use rate: 7.6% of adults (25th highest)

> Likelihood of legalizing: Medium

10. Georgia

> Potential pot tax revenue: $281 million

> Total state tax revenue: $18.63 billion (16th highest)

> Marijuana use rate: 8.0% of adults (20th highest)

> Likelihood of legalizing: Low

11. Hawaii

> Potential pot tax revenue: $39 million

> Total state tax revenue: $6.03 billion (14th lowest)

> Marijuana use rate: 7.9% of adults (21st highest)

> Likelihood of legalizing: Medium

12. Idaho

> Potential pot tax revenue: $46 million

> Total state tax revenue: $3.67 billion (9th lowest)

> Marijuana use rate: 6.3% of adults (14th lowest)

> Likelihood of legalizing: Low

13. Illinois

> Potential pot tax revenue: $354 million

> Total state tax revenue: $39.18 billion (4th highest)

> Marijuana use rate: 7.7% of adults (23rd highest)

> Likelihood of legalizing: High

14. Indiana

> Potential pot tax revenue: $182 million

> Total state tax revenue: $16.85 billion (17th highest)

> Marijuana use rate: 7.6% of adults (24th highest)

> Likelihood of legalizing: Low

15. Iowa

> Potential pot tax revenue: $86 million

> Total state tax revenue: $8.27 billion (20th lowest)

> Marijuana use rate: 5.0% of adults (2nd lowest)

> Likelihood of legalizing: Medium

16. Kansas

> Potential pot tax revenue: $80 million

> Total state tax revenue: $7.33 billion (18th lowest)

> Marijuana use rate: 6.4% of adults (17th lowest)

> Likelihood of legalizing: Low

17. Kentucky

> Potential pot tax revenue: $122 million

> Total state tax revenue: $11.10 billion (24th highest)

> Marijuana use rate: 6.9% of adults (21st lowest)

> Likelihood of legalizing: Medium

18. Louisiana

> Potential pot tax revenue: $128 million

> Total state tax revenue: $9.70 billion (25th highest)

> Marijuana use rate: 6.2% of adults (10th lowest)

> Likelihood of legalizing: Medium

19. Maine

> Potential pot tax revenue: $37 million

> Total state tax revenue: $3.85 billion (10th lowest)

> Marijuana use rate: 12.9% of adults (5th highest)

> Likelihood of legalizing: High

20. Maryland

> Potential pot tax revenue: $165 million

> Total state tax revenue: $18.93 billion (15th highest)

> Marijuana use rate: 8.6% of adults (15th highest)

> Likelihood of legalizing: High

21. Massachusetts

> Potential pot tax revenue: $187 million

> Total state tax revenue: $25.24 billion (9th highest)

> Marijuana use rate: 12.0% of adults (8th highest)

> Likelihood of legalizing: High

22. Michigan

> Potential pot tax revenue: $273 million

> Total state tax revenue: $24.80 billion (10th highest)

> Marijuana use rate: 10.4% of adults (10th highest)

> Likelihood of legalizing: High

23. Minnesota

> Potential pot tax revenue: $151 million

> Total state tax revenue: $23.13 billion (12th highest)

> Marijuana use rate: 7.3% of adults (25th lowest)

> Likelihood of legalizing: Medium

24. Mississippi

> Potential pot tax revenue: $82 million

> Total state tax revenue: $7.57 billion (19th lowest)

> Marijuana use rate: 5.9% of adults (8th lowest)

> Likelihood of legalizing: Medium

25. Missouri

> Potential pot tax revenue: $167 million

> Total state tax revenue: $11.24 billion (23rd highest)

> Marijuana use rate: 8.1% of adults (19th highest)

> Likelihood of legalizing: Medium

26. Montana

> Potential pot tax revenue: $28 million

> Total state tax revenue: $2.66 billion (4th lowest)

> Marijuana use rate: 10.2% of adults (11th highest)

> Likelihood of legalizing: High

27. Nebraska

> Potential pot tax revenue: $52 million

> Total state tax revenue: $4.88 billion (11th lowest)

> Marijuana use rate: 5.8% of adults (7th lowest)

> Likelihood of legalizing: Medium

28. Nevada

> Potential pot tax revenue: $79 million

> Total state tax revenue: $7.14 billion (17th lowest)

> Marijuana use rate: 7.7% of adults (22nd highest)

> Likelihood of legalizing: High

29. New Hampshire

> Potential pot tax revenue: $37 million

> Total state tax revenue: $2.28 billion (3rd lowest)

> Marijuana use rate: 11.7% of adults (9th highest)

> Likelihood of legalizing: Medium

30. New Jersey

> Potential pot tax revenue: $246 million

> Total state tax revenue: $29.68 billion (7th highest)

> Marijuana use rate: 6.3% of adults (11th lowest)

> Likelihood of legalizing: Medium

31. New Mexico

> Potential pot tax revenue: $57 million

> Total state tax revenue: $5.76 billion (13th lowest)

> Marijuana use rate: 9.7% of adults (12th highest)

> Likelihood of legalizing: Medium

32. New York

> Potential pot tax revenue: $544 million

> Total state tax revenue: $76.98 billion (2nd highest)

> Marijuana use rate: 8.6% of adults (16th highest)

> Likelihood of legalizing: High

33. North Carolina

> Potential pot tax revenue: $276 million

> Total state tax revenue: $23.40 billion (11th highest)

> Marijuana use rate: 6.7% of adults (19th lowest)

> Likelihood of legalizing: Medium

34. North Dakota

> Potential pot tax revenue: $21 million

> Total state tax revenue: $6.12 billion (15th lowest)

> Marijuana use rate: 5.8% of adults (6th lowest)

> Likelihood of legalizing: Medium

35. Ohio

> Potential pot tax revenue: $319 million

> Total state tax revenue: $27.02 billion (8th highest)

> Marijuana use rate: 7.0% of adults (23rd lowest)

> Likelihood of legalizing: Medium

36. Oklahoma

> Potential pot tax revenue: $108 million

> Total state tax revenue: $9.10 billion (23rd lowest)

> Marijuana use rate: 6.3% of adults (12th lowest)

> Likelihood of legalizing: Low

37. Oregon

> Potential pot tax revenue: $111 million

> Total state tax revenue: $9.68 billion (25th lowest)

> Marijuana use rate: 12.6% of adults (6th highest)

> Likelihood of legalizing: N/A

38. Pennsylvania

> Potential pot tax revenue: $352 million

> Total state tax revenue: $34.19 billion (6th highest)

> Marijuana use rate: 7.3% of adults (24th lowest)

> Likelihood of legalizing: Medium

39. Rhode Island

> Potential pot tax revenue: $29 million

> Total state tax revenue: $2.97 billion (6th lowest)

> Marijuana use rate: 12.9% of adults (4th highest)

> Likelihood of legalizing: High

40. South Carolina

> Potential pot tax revenue: $135 million

> Total state tax revenue: $8.93 billion (21st lowest)

> Marijuana use rate: 6.6% of adults (18th lowest)

> Likelihood of legalizing: Medium

41. South Dakota

> Potential pot tax revenue: $24 million

> Total state tax revenue: $1.61 billion (the lowest)

> Marijuana use rate: 4.8% of adults (the lowest)

> Likelihood of legalizing: Low

42. Tennessee

> Potential pot tax revenue: $182 million

> Total state tax revenue: $11.81 billion (21st highest)

> Marijuana use rate: 5.5% of adults (3rd lowest)

> Likelihood of legalizing: Low

43. Texas

> Potential pot tax revenue: $755 million

> Total state tax revenue: $55.26 billion (3rd highest)

> Marijuana use rate: 5.9% of adults (9th lowest)

> Likelihood of legalizing: Medium

44. Utah

> Potential pot tax revenue: $82 million

> Total state tax revenue: $6.31 billion (16th lowest)

> Marijuana use rate: 5.6% of adults (4th lowest)

> Likelihood of legalizing: Low

45. Vermont

> Potential pot tax revenue: $17 million

> Total state tax revenue: $2.96 billion (5th lowest)

> Marijuana use rate: 13.4% of adults (2nd highest)

> Likelihood of legalizing: High

46. Virginia

> Potential pot tax revenue: $231 million

> Total state tax revenue: $18.95 billion (14th highest)

> Marijuana use rate: 7.0% of adults (22nd lowest)

> Likelihood of legalizing: Medium

47. Washington

> Potential pot tax revenue: $197 million

> Total state tax revenue: $19.45 billion (13th highest)

> Marijuana use rate: 13.1% of adults (3rd highest)

> Likelihood of legalizing: N/A

48. West Virginia

> Potential pot tax revenue: $51 million

> Total state tax revenue: $5.38 billion (12th lowest)

> Marijuana use rate: 6.4% of adults (15th lowest)

> Likelihood of legalizing: Medium

49. Wisconsin

> Potential pot tax revenue: $159 million

> Total state tax revenue: $16.41 billion (18th highest)

> Marijuana use rate: 6.4% of adults (17th lowest)

> Likelihood of legalizing: Medium

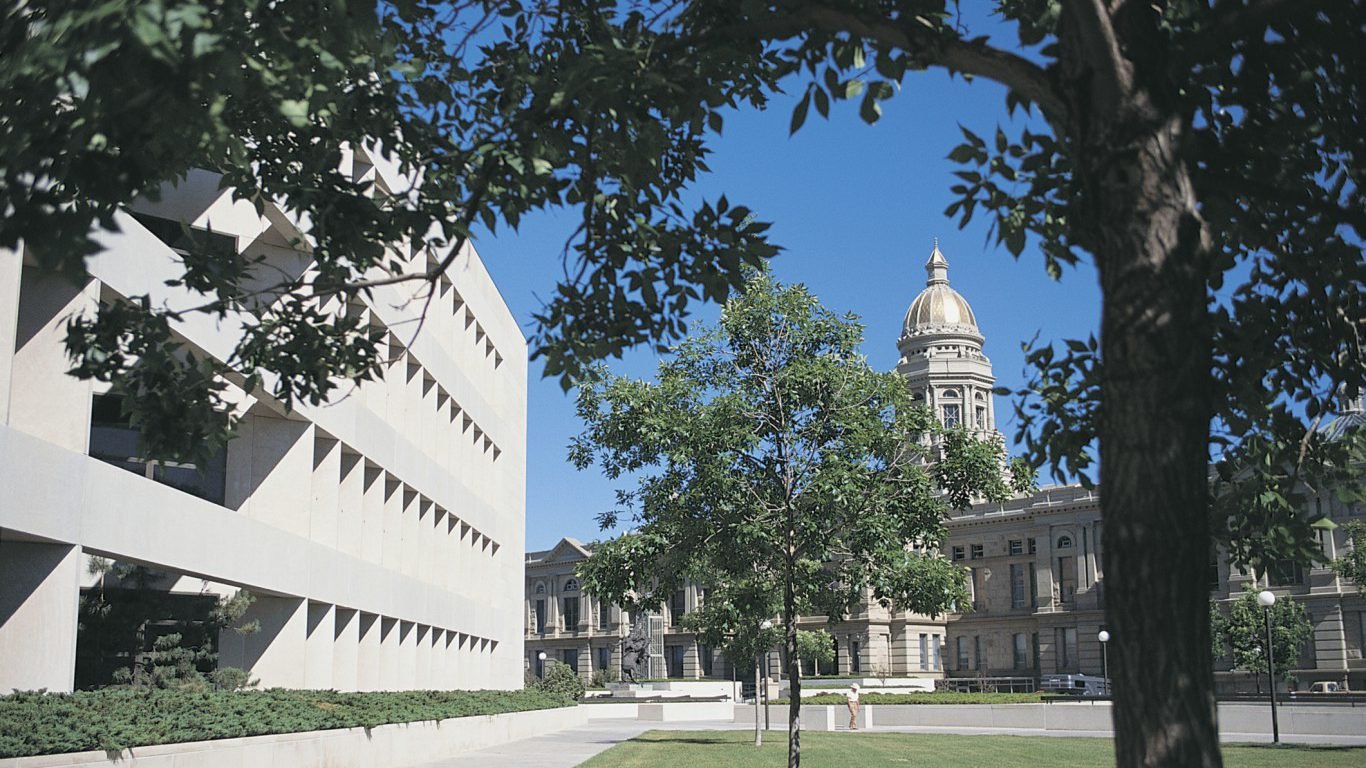

50. Wyoming

> Potential pot tax revenue: $16 million

> Total state tax revenue: $2.26 billion (2nd lowest)

> Marijuana use rate: 6.3% of adults (13th lowest)

> Likelihood of legalizing: Low

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.