Special Report

Most (and Least) Tax-Friendly States for Business

Published:

Last Updated:

States compete to attract new businesses, which can generate jobs and contribute to economic growth. While every state levies some form of taxes on businesses, some states are more tax-friendly than others. In addition to other factors, such as the strength of the labor force, a state’s tax code is an important consideration for businesses choosing where to operate.

Tax codes are complex, and the tax-friendliness of a state is determined by far more than just the corporate income tax rate. Each year, the Tax Foundation, a think tank advocating for a simpler tax code, measures over 100 variables within each state’s tax system to determine how tax-friendly each state is for business.

According to the report, Wyoming is the most tax-friendly state for business in the country, while New Jersey is the least. To highlight how tax climates vary between states, 24/7 Wall St. listed all 50 states based on the Tax Foundation’s 2017 ranking.

Click here to see the most and least tax-friendly states for business.

While states with the most business-friendly climates generally have lower tax rates, the Tax Foundation’s ranking also rewards simpler tax codes. States that do not levy one major form of taxation frequently rank among the most tax-friendly. For example, New Hampshire, Montana, and Oregon levy no sales tax, while Wyoming, Nevada, and South Dakota levy no corporate or individual income tax. All of these states rank within the 10 most tax-friendly states for business.

In contrast, states that are the least tax-friendly for business have high tax rates and complex structures. States levying a flat individual or corporate income tax, for example, are rated more favorably than states with complex, multi-tier systems. New Jersey, which has the worst-ranked tax environment for business of any state, has the highest property tax collections per capita and is one of only two states with both an inheritance tax and estate tax. The state also has complex individual and corporate income tax systems, and both are, according to the Tax Foundation, among the worst in the country.

Based on The Tax Foundation’s 2017 State Business Tax Climate Index, 24/7 Wall St. reviewed the states with the best and worst business tax environments. Property tax collections per capita are from this report and are as of July 2016. The highest tier in each state’s individual and corporate income tax structures as well as state sales tax rates were obtained from The Tax Foundation’s 2017 Facts and Figures report and are as of January 2017. Seasonally adjusted unemployment rates for February 2017 are from the Bureau of Labor Statistics.

These are the most and least tax-friendly states for business.

50. New Jersey

> State sales tax rate: 6.9% (tied-6th highest)

> Property taxes collections per capita: $2,989 (the highest)

> Unemployment rate: 4.4% (tied-23rd lowest)

> Top individual income tax rate: 9.0% (6th highest)

> Top corporate income tax rate: 9.0% (tied-5th highest)

[in-text-ad]

49. New York

> State sales tax rate: 4.0% (tied-7th lowest)

> Property taxes collections per capita: $2,494 (4th highest)

> Unemployment rate: 4.4% (tied-23rd lowest)

> Top individual income tax rate: 8.8% (8th highest)

> Top corporate income tax rate: 6.5% (tied-23rd highest)

48. California

> State sales tax rate: 7.3% (the highest)

> Property taxes collections per capita: $1,365 (22nd highest)

> Unemployment rate: 5.0% (tied-14th highest)

> Top individual income tax rate: 13.3% (the highest)

> Top corporate income tax rate: 8.8% (8th highest)

47. Vermont

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $2,331 (5th highest)

> Unemployment rate: 3.0% (6th lowest)

> Top individual income tax rate: 9.0% (7th highest)

> Top corporate income tax rate: 8.5% (10th highest)

[in-text-ad-2]

46. Minnesota

> State sales tax rate: 6.9% (tied-6th highest)

> Property taxes collections per capita: $1,547 (15th highest)

> Unemployment rate: 4.0% (tied-17th lowest)

> Top individual income tax rate: 9.9% (4th highest)

> Top corporate income tax rate: 9.8% (3rd highest)

45. Ohio

> State sales tax rate: 5.8% (24th lowest)

> Property taxes collections per capita: $1,215 (22nd lowest)

> Unemployment rate: 5.1% (tied-11th highest)

> Top individual income tax rate: 5.0% (17th lowest)

> Top corporate income tax rate: 0.0% (tied-the lowest)

[in-text-ad]

44. Rhode Island

> State sales tax rate: 7.0% (tied-2nd highest)

> Property taxes collections per capita: $2,282 (6th highest)

> Unemployment rate: 4.5% (tied-24th highest)

> Top individual income tax rate: 6.0% (23rd highest)

> Top corporate income tax rate: 7.0% (tied-20th highest)

43. Connecticut

> State sales tax rate: 6.4% (12th highest)

> Property taxes collections per capita: $2,726 (2nd highest)

> Unemployment rate: 4.7% (tied-21st highest)

> Top individual income tax rate: 7.0% (13th highest)

> Top corporate income tax rate: 9.0% (tied-5th highest)

42. Maryland

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $1,504 (17th highest)

> Unemployment rate: 4.2% (22nd lowest)

> Top individual income tax rate: 5.8% (tied-24th highest)

> Top corporate income tax rate: 8.3% (11th highest)

[in-text-ad-2]

41. Louisiana

> State sales tax rate: 5.0% (tied-16th lowest)

> Property taxes collections per capita: $849 (9th lowest)

> Unemployment rate: 5.8% (4th highest)

> Top individual income tax rate: 6.0% (tied-19th highest)

> Top corporate income tax rate: 8.0% (tied-13th highest)

40. Iowa

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $1,515 (16th highest)

> Unemployment rate: 3.2% (tied-8th lowest)

> Top individual income tax rate: 9.0% (5th highest)

> Top corporate income tax rate: 12.0% (the highest)

[in-text-ad]

39. Wisconsin

> State sales tax rate: 5.0% (tied-16th lowest)

> Property taxes collections per capita: $1,843 (12th highest)

> Unemployment rate: 3.7% (tied-13th lowest)

> Top individual income tax rate: 7.7% (10th highest)

> Top corporate income tax rate: 7.9% (15th highest)

38. Arkansas

> State sales tax rate: 6.5% (tied-9th highest)

> Property taxes collections per capita: $659 (3rd lowest)

> Unemployment rate: 3.7% (tied-13th lowest)

> Top individual income tax rate: 6.9% (tied-14th highest)

> Top corporate income tax rate: 6.5% (tied-23rd highest)

37. South Carolina

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $1,077 (20th lowest)

> Unemployment rate: 4.4% (tied-23rd lowest)

> Top individual income tax rate: 7.0% (12th highest)

> Top corporate income tax rate: 5.0% (tied-11th lowest)

[in-text-ad-2]

36. Georgia

> State sales tax rate: 4.0% (tied-7th lowest)

> Property taxes collections per capita: $1,011 (19th lowest)

> Unemployment rate: 5.3% (tied-6th highest)

> Top individual income tax rate: 6.0% (tied-19th highest)

> Top corporate income tax rate: 6.0% (tied-15th lowest)

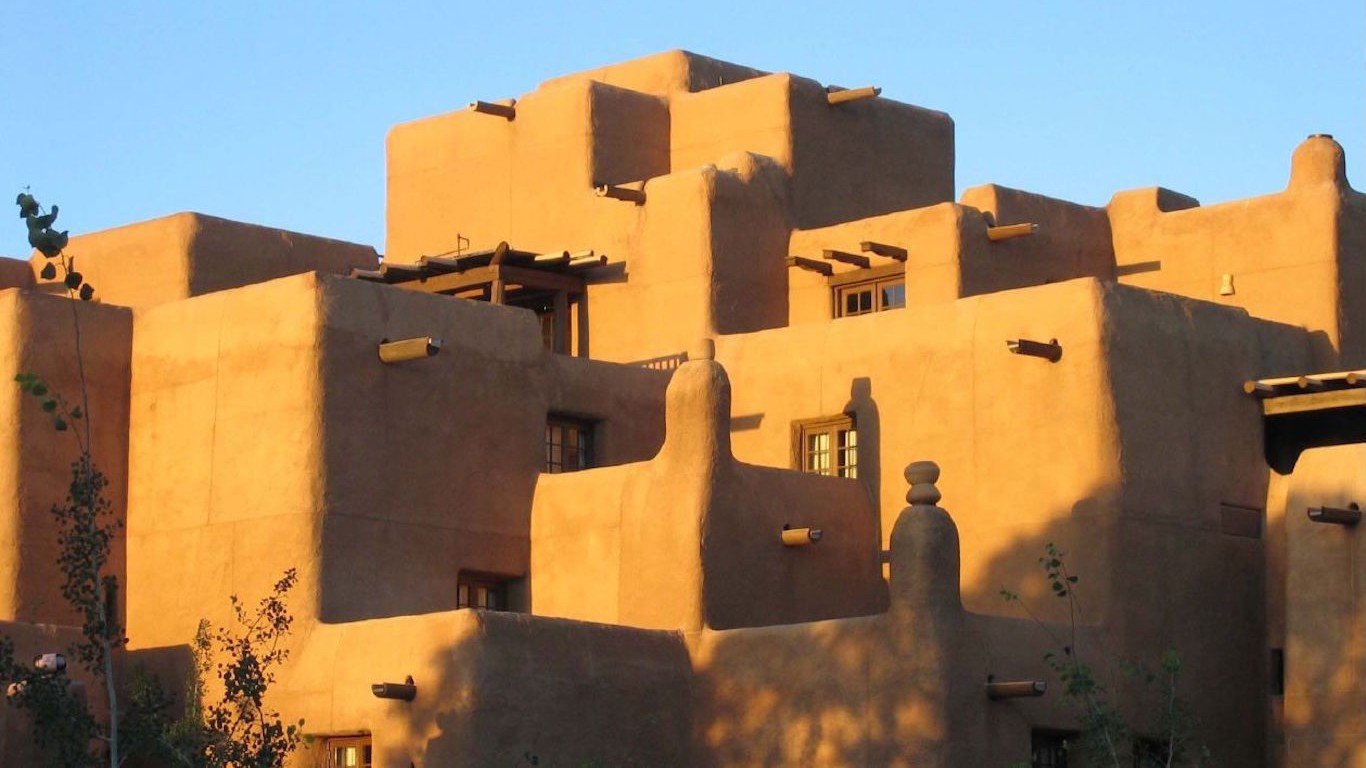

35. New Mexico

> State sales tax rate: 5.1% (19th lowest)

> Property taxes collections per capita: $685 (4th lowest)

> Unemployment rate: 6.8% (the highest)

> Top individual income tax rate: 4.9% (16th lowest)

> Top corporate income tax rate: 6.2% (tied-20th lowest)

[in-text-ad]

34. Kentucky

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $732 (5th lowest)

> Unemployment rate: 4.9% (tied-17th highest)

> Top individual income tax rate: 6.0% (tied-19th highest)

> Top corporate income tax rate: 6.0% (tied-15th lowest)

33. Virginia

> State sales tax rate: 5.3% (20th lowest)

> Property taxes collections per capita: $1,430 (18th highest)

> Unemployment rate: 3.9% (16th lowest)

> Top individual income tax rate: 5.8% (tied-24th highest)

> Top corporate income tax rate: 6.0% (tied-15th lowest)

32. Alabama

> State sales tax rate: 4.0% (tied-7th lowest)

> Property taxes collections per capita: $548 (the lowest)

> Unemployment rate: 6.2% (3rd highest)

> Top individual income tax rate: 5.0% (tied-18th lowest)

> Top corporate income tax rate: 6.5% (tied-23rd highest)

[in-text-ad-2]

31. Oklahoma

> State sales tax rate: 4.5% (tied-13th lowest)

> Property taxes collections per capita: $595 (2nd lowest)

> Unemployment rate: 4.6% (23rd highest)

> Top individual income tax rate: 5.0% (tied-18th lowest)

> Top corporate income tax rate: 6.0% (tied-15th lowest)

30. Maine

> State sales tax rate: 5.5% (tied-21st lowest)

> Property taxes collections per capita: $1,907 (11th highest)

> Unemployment rate: 3.2% (tied-8th lowest)

> Top individual income tax rate: 10.2% (2nd highest)

> Top corporate income tax rate: 8.9% (7th highest)

[in-text-ad]

29. North Dakota

> State sales tax rate: 5.0% (tied-16th lowest)

> Property taxes collections per capita: $1,140 (21st lowest)

> Unemployment rate: 2.9% (tied-4th lowest)

> Top individual income tax rate: 2.9% (8th lowest)

> Top corporate income tax rate: 4.3% (tied-8th lowest)

28. Mississippi

> State sales tax rate: 7.0% (tied-2nd highest)

> Property taxes collections per capita: $899 (11th lowest)

> Unemployment rate: 5.2% (tied-9th highest)

> Top individual income tax rate: 5.0% (tied-18th lowest)

> Top corporate income tax rate: 5.0% (tied-11th lowest)

27. Massachusetts

> State sales tax rate: 6.3% (tied-13th highest)

> Property taxes collections per capita: $2,069 (8th highest)

> Unemployment rate: 3.4% (11th lowest)

> Top individual income tax rate: 5.1% (24th lowest)

> Top corporate income tax rate: 8.0% (tied-13th highest)

[in-text-ad-2]

26. Hawaii

> State sales tax rate: 4.0% (tied-7th lowest)

> Property taxes collections per capita: $943 (13th lowest)

> Unemployment rate: 2.8% (tied-2nd lowest)

> Top individual income tax rate: 8.3% (9th highest)

> Top corporate income tax rate: 6.4% (tied-23rd lowest)

25. Nebraska

> State sales tax rate: 5.5% (tied-21st lowest)

> Property taxes collections per capita: $1,649 (13th highest)

> Unemployment rate: 3.2% (tied-8th lowest)

> Top individual income tax rate: 6.8% (16th highest)

> Top corporate income tax rate: 7.8% (16th highest)

[in-text-ad]

24. Pennsylvania

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $1,376 (21st highest)

> Unemployment rate: 5.0% (tied-14th highest)

> Top individual income tax rate: 3.1% (9th lowest)

> Top corporate income tax rate: 10.0% (2nd highest)

23. Illinois

> State sales tax rate: 6.3% (tied-13th highest)

> Property taxes collections per capita: $1,982 (9th highest)

> Unemployment rate: 5.4% (5th highest)

> Top individual income tax rate: 3.8% (11th lowest)

> Top corporate income tax rate: 7.8% (17th highest)

22. Kansas

> State sales tax rate: 6.5% (tied-9th highest)

> Property taxes collections per capita: $1,425 (19th highest)

> Unemployment rate: 4.0% (tied-17th lowest)

> Top individual income tax rate: 4.6% (14th lowest)

> Top corporate income tax rate: 7.0% (tied-20th highest)

[in-text-ad-2]

21. Arizona

> State sales tax rate: 5.6% (23rd lowest)

> Property taxes collections per capita: $1,009 (18th lowest)

> Unemployment rate: 5.1% (tied-11th highest)

> Top individual income tax rate: 4.5% (13th lowest)

> Top corporate income tax rate: 4.9% (tied-10th lowest)

20. Idaho

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $888 (10th lowest)

> Unemployment rate: 3.6% (12th lowest)

> Top individual income tax rate: 7.4% (11th highest)

> Top corporate income tax rate: 7.4% (19th highest)

[in-text-ad]

19. Delaware

> State sales tax rate: 0.0% (tied-the lowest)

> Property taxes collections per capita: $825 (7th lowest)

> Unemployment rate: 4.5% (tied-24th highest)

> Top individual income tax rate: 6.6% (17th highest)

> Top corporate income tax rate: 8.7% (9th highest)

18. West Virginia

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $798 (6th lowest)

> Unemployment rate: 5.2% (tied-9th highest)

> Top individual income tax rate: 6.5% (18th highest)

> Top corporate income tax rate: 6.5% (tied-23rd highest)

17. Washington

> State sales tax rate: 6.5% (tied-9th highest)

> Property taxes collections per capita: $1,350 (23rd highest)

> Unemployment rate: 4.9% (tied-17th highest)

> Top individual income tax rate: 0.0% (tied-the lowest)

> Top corporate income tax rate: 0.0% (tied-the lowest)

[in-text-ad-2]

16. Colorado

> State sales tax rate: 2.9% (tied-6th lowest)

> Property taxes collections per capita: $1,333 (24th highest)

> Unemployment rate: 2.9% (tied-4th lowest)

> Top individual income tax rate: 4.6% (15th lowest)

> Top corporate income tax rate: 4.6% (tied-9th lowest)

15. Missouri

> State sales tax rate: 4.2% (tied-12th lowest)

> Property taxes collections per capita: $977 (17th lowest)

> Unemployment rate: 4.1% (tied-20th lowest)

> Top individual income tax rate: 6.0% (tied-19th highest)

> Top corporate income tax rate: 6.3% (tied-21st lowest)

[in-text-ad]

14. Texas

> State sales tax rate: 6.3% (tied-13th highest)

> Property taxes collections per capita: $1,560 (14th highest)

> Unemployment rate: 4.9% (tied-17th highest)

> Top individual income tax rate: 0.0% (tied-the lowest)

> Top corporate income tax rate: 0.0% (tied-the lowest)

13. Tennessee

> State sales tax rate: 7.0% (tied-2nd highest)

> Property taxes collections per capita: $838 (8th lowest)

> Unemployment rate: 5.3% (tied-6th highest)

> Top individual income tax rate: 5.0% (tied-18th lowest)

> Top corporate income tax rate: 6.5% (tied-23rd highest)

12. Michigan

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $1,320 (25th highest)

> Unemployment rate: 5.3% (tied-6th highest)

> Top individual income tax rate: 4.3% (12th lowest)

> Top corporate income tax rate: 6.0% (tied-15th lowest)

[in-text-ad-2]

11. North Carolina

> State sales tax rate: 4.8% (15th lowest)

> Property taxes collections per capita: $903 (12th lowest)

> Unemployment rate: 5.1% (tied-11th highest)

> Top individual income tax rate: 5.5% (25th lowest)

> Top corporate income tax rate: 3.0% (tied-7th lowest)

10. Oregon

> State sales tax rate: 0.0% (tied-the lowest)

> Property taxes collections per capita: $1,285 (25th lowest)

> Unemployment rate: 4.0% (tied-17th lowest)

> Top individual income tax rate: 9.9% (3rd highest)

> Top corporate income tax rate: 7.6% (18th highest)

[in-text-ad]

9. Utah

> State sales tax rate: 6.0% (25th lowest)

> Property taxes collections per capita: $952 (14th lowest)

> Unemployment rate: 3.1% (7th lowest)

> Top individual income tax rate: 5.0% (tied-18th lowest)

> Top corporate income tax rate: 5.0% (tied-11th lowest)

8. Indiana

> State sales tax rate: 7.0% (tied-2nd highest)

> Property taxes collections per capita: $968 (15th lowest)

> Unemployment rate: 4.1% (tied-20th lowest)

> Top individual income tax rate: 3.2% (10th lowest)

> Top corporate income tax rate: 6.3% (tied-21st lowest)

7. New Hampshire

> State sales tax rate: 0.0% (tied-the lowest)

> Property taxes collections per capita: $2,690 (3rd highest)

> Unemployment rate: 2.7% (the lowest)

> Top individual income tax rate: 5.0% (tied-18th lowest)

> Top corporate income tax rate: 8.2% (12th highest)

[in-text-ad-2]

6. Montana

> State sales tax rate: 0.0% (tied-the lowest)

> Property taxes collections per capita: $1,407 (20th highest)

> Unemployment rate: 3.8% (15th lowest)

> Top individual income tax rate: 6.9% (tied-14th highest)

> Top corporate income tax rate: 6.8% (22nd highest)

5. Nevada

> State sales tax rate: 6.9% (8th highest)

> Property taxes collections per capita: $972 (16th lowest)

> Unemployment rate: 4.9% (tied-17th highest)

> Top individual income tax rate: 0.0% (tied-the lowest)

> Top corporate income tax rate: 0.0% (tied-the lowest)

[in-text-ad]

4. Florida

> State sales tax rate: 6.0% (tied-16th highest)

> Property taxes collections per capita: $1,216 (23rd lowest)

> Unemployment rate: 5.0% (tied-14th highest)

> Top individual income tax rate: 0.0% (tied-the lowest)

> Top corporate income tax rate: 5.5% (14th lowest)

3. Alaska

> State sales tax rate: 0.0% (tied-the lowest)

> Property taxes collections per capita: $1,913 (10th highest)

> Unemployment rate: 6.4% (2nd highest)

> Top individual income tax rate: 0.0% (tied-the lowest)

> Top corporate income tax rate: 9.4% (4th highest)

2. South Dakota

> State sales tax rate: 4.5% (tied-13th lowest)

> Property taxes collections per capita: $1,231 (24th lowest)

> Unemployment rate: 2.8% (tied-2nd lowest)

> Top individual income tax rate: 0.0% (tied-the lowest)

> Top corporate income tax rate: 0.0% (tied-the lowest)

[in-text-ad-2]

1. Wyoming

> State sales tax rate: 4.0% (tied-7th lowest)

> Property taxes collections per capita: $2,173 (7th highest)

> Unemployment rate: 4.7% (tied-21st highest)

> Top individual income tax rate: 0.0% (tied-the lowest)

> Top corporate income tax rate: 0.0% (tied-the lowest)

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.