Big or small, some financial habits can zap a solid financial plan and leave smart savers with empty wallets. To avoid buyer’s remorse and similar guilt about neglecting your finances, you need to know what habits might be costing you extra.

GoBankingRates is a 24/7 Wall St. content partner offering articles that help readers learn about money and better manage their finances. Its content is produced independently of 24/7 Wall St.

Click here to see 40 money habits that can leave you broke.

1. Your App Addiction

In the list of things to waste money on, smartphone apps are a big one. Those $1.99 purchases seem inexpensive enough, but they can snowball — especially if you have kids who are adding to the overall purchase price or frequency.

Consider free app downloads exclusively or cap yourself and your family with a monthly app budget.

[in-text-ad]

2. Paying Bank Fees

Many banking fees can be avoided, so there’s no reason to pay these if you don’t have to. Instead, find a financial institution that will allow you to avoid certain fees.

With the right checking account, you can avoid the monthly fee with a monthly direct deposit or minimum daily balance of $500 or more. When it’s that easy to avoid a fee, you should always take advantage so you can keep more of your money in your account.

ALSO READ: Budgeting 101: How To Create a Budget You Can Live With

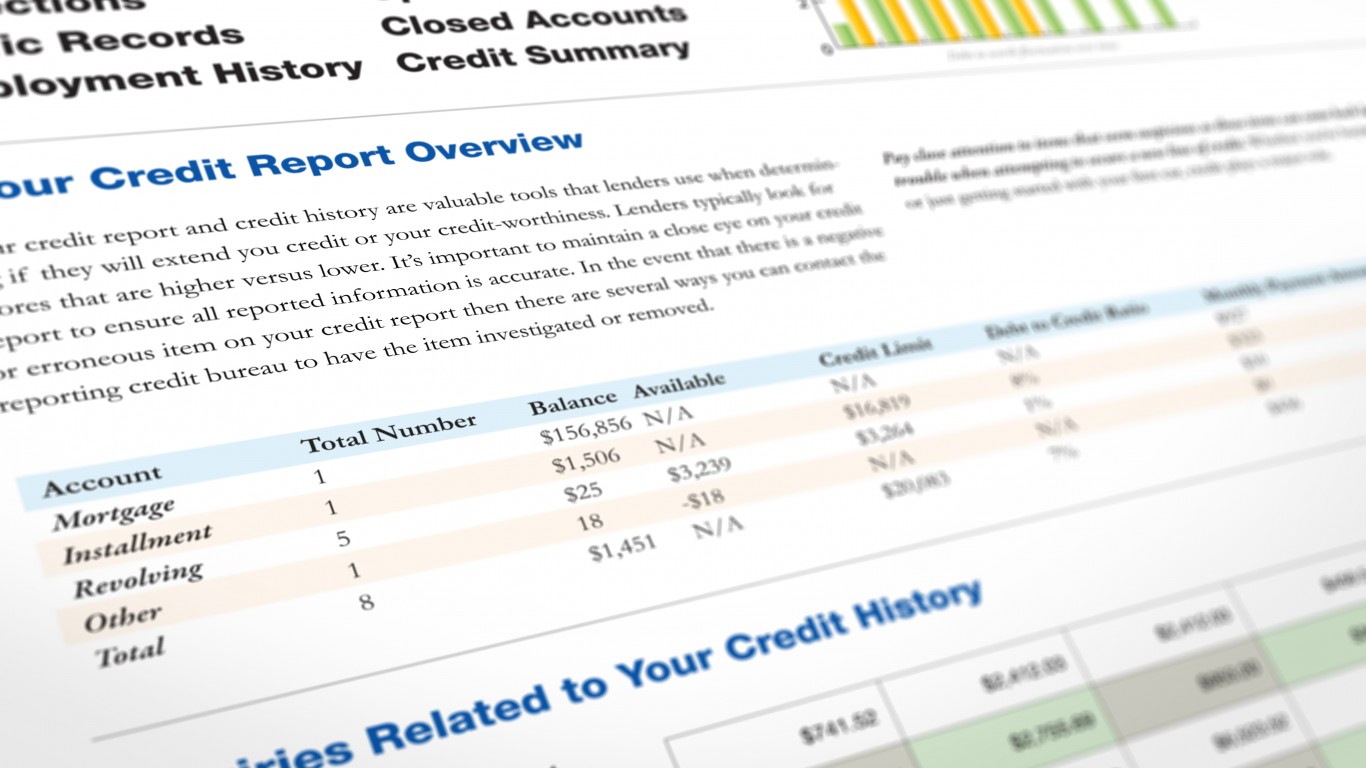

3. Not Checking Your Credit Report

People with top-tier credit ratings qualify for the lowest finance rates when car or home shopping. Over a 30-year term, a quarter of a percentage point can add up to thousands of dollars.

Check your credit history regularly and clean up any problems as soon as they arise.

4. Having Wine With Dinner

Buying wine with dinner is a pricey proposition. Restaurateurs routinely mark up bottles by about three times the wholesale price — sometimes more. Consider a BYOB-friendly restaurant instead or, if you can bear it, skip the wine altogether when dining out.

[in-text-ad-2]

5. Leasing Your Car

A 2019 cost-comparison report by car cost site Edmunds found that the overall cost of leasing a compact SUV can be over $5,000 more than the cost of buying a similar car used, and it is about $7,000 more than buying the same car new when you take equity into consideration.

Drop the lease and invest the difference, and you can boost your overall financial scenario.

6. Ignoring a 401(k) Match

One in four employees doesn’t save enough to receive the full 401(k) match provided by his employer, according to a report by investment advisory firm Financial Engines. That means the average employee leaves $1,336 in his employer’s coffers each year. That’s like telling your boss you didn’t want a pay raise this year.

It’s recommended to max out your 401(k) contributions, but at the very least you should contribute enough to get your employer’s match.

[in-text-ad]

7. Going Out for Lunch

A survey by Visa found that the average American spends about $20 per week on eating out for lunch. Over a year, that adds up to a staggering $1,043. No need to waste money on lunches out when a brown bag lunch is cheaper and, if packed correctly, can be more nutritious.

ALSO READ: Why You Should Start Budgeting Now for 2022

8. Using Store Credit Cards

Retail stores are notorious for offering a discount on an initial purchase if you sign up for the store card. Although that 10 or 20% discount might sound sweet when you’re standing at the checkout line, signing up is far from a good idea.

The store isn’t offering the discount with sign-up just to be nice, said Daniel Zajac, certified financial planner with Simone Zajac Wealth Management Group in Exton, Pennsylvania. “They know that most of their customers will not pay off the card and they will make up the discount and more in interest payments,” he said. Instead, Zajak suggests shoppers bypass the discount and start to track expenses and debt.

9. Overdrawing Your Account

Are you wasting money on overdraft fees? America’s largest banks raked in more than $11.68 billion in overdraft fees alone in 2019, The New York Times reported.

Stop lining the pockets of bank presidents and set up overdraft protection. Or, monitor your accounts to make sure funds for any outstanding checks are covered.

[in-text-ad-2]

10. Keeping Your Gym Membership

Your unused gym membership — even one you managed to save on — is not a good deal if you’re not actually using it. Attracting members who won’t actually come work out is a strategic move by many gym owners, according to NPR’s Planet Money.

Most Planet Fitness gyms, for example, can hold about 300 people, but the average location has 6,000 members, the show reported. The reason this business model works is because only a small fraction of members use the facilities on more than a semi-regular basis.

The secret is to know yourself. If you’re not going to work out, don’t sign up to make gym payments.

11. Accepting Bad Checks

One fee levied by banks is a bounced-check fee applied to the person who tries to cash or deposit the check. That’s right — some banks assess a fee against recipients of checks from people whose accounts have insufficient funds.

The solution? Make sure anyone writing you a check has sufficient funds in the account it’s coming from — if you can.

[in-text-ad]

12. Not Having Health Insurance

“Young people, especially men, often think that they’re invincible and don’t need health insurance,” said Steven Fox, a San Diego-based financial planner with Next Gen Financial Planning. “However, unexpected tragedies like a car accident or bad sports injury could result in significant financial setbacks on top of the other problems.”

College-age students can remain on their parents’ health insurance plans until age 26, sign up for their school’s health program or buy low-cost catastrophic coverage from commercial carriers, he added.

Regardless of age, not having health insurance can be costly; you will have to pay out of pocket if you do need medical attention.

ALSO READ: 30 Weird Ways People Go Broke

13. Ditching Your Change

For people who still use cash when out and about, the amount of change received on a daily basis can add up. Don’t just disregard your coins. Instead, save them in a jar and periodically bring them to your bank for sorting and deposit. You’ll be surprised at how much you save over time. And you can grow those savings even more by putting them in the right savings account.

14. Not Checking In With Your Partner

Couples who don’t make a plan to check in with each other about spending choices run the risk of ruining a financial plan. Elle Martinez, founder of Couple Money, suggests a check-in for purchases over a certain dollar amount (she likes $100).

“Double-dipping into the joint account can quickly drain things, so keeping one another in the loop is essential,” she said.

[in-text-ad-2]

15. Smoking Cigarettes

As many as 34.2 million Americans still smoke cigarettes, according to the Centers for Disease Control and Prevention. A pack of smokes costs between $5 and $13, depending on where you live. At half a pack a day, that’s anywhere between $200,000 and $600,000 over the course of 40 years, assuming you’d invested that money at an 8% return instead.

Give up this habit and save your money — and your health.

16. Signing Up For a Premium Auto Loan

“Being approved for a $20,000 auto loan doesn’t mean that your budget for a car is $20,000,” said Fox. That money needs to be repaid, he added, and young people pay a very high cost to borrow at an early stage in life. “Spending should be determined by a well-thought-out budget, not by the size of a line of credit,” he said.

[in-text-ad]

17. Falling For a Bait-and-Switch

Ever bring a sale item to the cash register only to find it’s not actually on sale? Ever take a cab and get hit with a fare that’s higher than expected? Avoid the bait-and-switch by saying “no” to items that don’t turn out to be on sale and by asking cab drivers for a fare estimate upfront.

ALSO READ: 12 Essential Money Tips for Every Phase of Your Financial Life

18. Making Impulse Purchases

Adding a pack of gum to your shopping cart at the grocery store checkout might not seem like a big deal, but habitual impulse shopping is. Online retailers, for example, have added new tricks to entice you to return to your abandoned digital shopping cart — such as by emailing you reminders and promotional offers — and making it easier than ever to make purchases, like offering in-store pickup. Those unplanned expenses can easily ruin a well-planned budget if not kept in check.

19. Carrying Credit Card Debt

Double-digit credit card interest rates are the norm, which means that people who carry a balance are taking a serious hit to their wealth.

“By making the minimum suggested payments, you’ll continue to pay that high interest rate for many years,” said Zajak. “I encourage clients to get their debt paid off as quickly as possible. Once that is complete, direct that money into another savings or investment vehicle and start amassing real wealth.”

[in-text-ad-2]

20. Paying Yourself Last

“I’ve been guilty of this, which is why I preach about it all the time,” said Amanda Abella, business coach for millennials and author of Amazon best-seller “Make Money Your Honey.” “If I don’t give myself money first (for savings, personal bills or investing), then I notice I tend to spend more on business expenses within the month because I feel like I have the money to do so.”

21. Drinking Fancy Coffee

David Bach’s famous “Latte Factor” concept made Americans aware of what their coffee habits are doing to their bottom lines. A $4 cup of joe per day comes out to almost $240,000 when compounded at 6% for 40 years. Check out your own personal latte factor using Bach’s online Latte Factor calculator.

[in-text-ad]

22. Not Keeping an Emergency Fund

Without an emergency safety net in place, it’s easy to break out the credit cards and ruin a well-thought-out budget if the car breaks down or the roof leaks. Having an emergency cushion of three to six months’ worth of expenses can keep your plan in place when unexpected events occur.

ALSO READ: Budgeting 101: How To Create a Budget You Can Live With

23. Buying Groceries Without a List

People who shop without a list can easily fall prey to grocery shopping “creep,” the phenomenon that happens when you add “just one more thing” to your cart several times per trip. You probably don’t need chocolate-covered pretzels or frozen waffles. Having a list keeps you from running afoul of your spending plan and spending more than anticipated.

24. Not Tracking ‘Invisible’ Expenses

“It’s easy to scrutinize your tangible expenses, like groceries and gas,” said Paula Pant, founder of the Afford Anything blog. “But many people let money leak from their ‘invisible’ bills, like insurance premiums and mortgage interest.”

Pant suggested consumers take one day per year to shop for competing insurance plans and mortgage rates. “These expenses can move the needle far more than shaving 10 cents at the pump ever could,” she said.

[in-text-ad-2]

25. Letting FOMO Get the Better of You

Fear of missing out — aka FOMO — can cause you to spend money unnecessarily. “You need to turn off social media sometimes so that you don’t always cave to FOMO,” said Martin Dasko, author of “Next Round’s On Me: How to Achieve Financial Freedom in Your 20s” and the Studenomics blog.

“This dangerous habit convinces you that you’re always missing out and that you need to participate in everything,” Dasko said. “It’s OK to stay in. It’s OK to do your own thing. You’re not always going to miss out.”

26. Paying For Monthly Subscription Services

If you don’t take the time to monitor your monthly fees, online streaming services can easily add up. Cancel your Netflix, Hulu and Spotify accounts — and any other services — if you find that you aren’t using them.

[in-text-ad]

27. Splitting Lunch With a Friend

“It might be a bit easier, simpler and faster to divide the bill evenly — but doing so has cost me more,” said Jason Vitug, founder of Phroogal. “There was a time I was in a very tight budget but still wanted to eat with friends,” he said, adding that his bill would have totaled $10 with tip and tax. When he was asked to split the bill and pay $25 — which would have covered the meals and drinks of his friends — he objected. “The jokes followed, but I managed to break the social dining habit and help my finances,” he said.

ALSO READ: Why You Should Start Budgeting Now for 2022

28. Not Automating Your Payments

One of the cornerstones to savvy money management is in savings and payment automation.

“I automate retirement, savings, credit card payments and more,” said Abella. “If someone isn’t automating, then they are just more likely to miss financial goals or miss payments.”

29. Keeping Up With the Joneses

Trying to keep up with appearances and match the financial spending patterns of people around you is a recipe for disaster.

“People generally think they spend less than they actually do,” said Chad Smith, CFP and partner at Financial Symmetry in Raleigh, North Carolina. “Buying bigger houses, cars and other toys can easily blow past spending targets originally assumed in financial plans.”

[in-text-ad-2]

30. Increasing Your Standard of Living

“Too often, once people learn they are getting a raise, mental planning begins of how they can finally buy the next thing they’ve been waiting [for],” said Smith. If they saved most or all of the raise instead of buying a new iPhone, he suggested, many people could reach financial independence much sooner than expected.

31. Window Shopping

There is some real wisdom to the line of thought that if you don’t see it, you won’t want it.

“Avoid window-shopping and you’ll spend less,” said Roger Whitney, CPF with Agile Retirement Management in Fort Worth, Texas. “It’s amazing how ‘need to have’ pops into my head when I’m shopping.”

If you simply remove or avoid temptation, you’re much more likely to spend less.

[in-text-ad]

32. Assuming Life Will Always Be Like It Is Today

Not planning for future downfalls is one of the worst habits that can sabotage a financial plan, said debt expert Jackie Beck. It’s easy to assume life will always be as rosy as it is today but, for some people, that won’t be the case. If you don’t plan for life’s downside, “you don’t leave room for error, unexpected events or emergencies — and that can wreak havoc on your budget,” she said.

ALSO READ: 30 Weird Ways People Go Broke

33. Not Keeping Track of Your Cash Flow

“Not everyone is into budgeting, but at the very least you need to understand where you’re spending your money,” Martinez said. “Free services like Mint and Personal Capital make it simple to set things up so you get updates on your balances and spending.”

34. Not Asking For a Raise

“If you are being underpaid or are underemployed, your focus should be on getting a raise, finding a side hustle or looking for a new job,” said Kelly Whalen, founder of The Centsible Life. “You should always be looking for ways to earn more to help you increase your savings and reach your financial goals,” she said.

[in-text-ad-2]

35. Your Brand Loyalty

Brand-loyal customers often get the first crack at coupons and special deals, but they’re also more likely to spend on things they don’t truly need. People who shop exclusively for a particular brand are at risk of sabotaging a financial plan, said Tai McNeely, co-founder and financial educator at His and Her Money.

“I know someone that loves Apple products so much that every time a new product comes out, he has to get it,” she said. Buying an expensive product you don’t need just because it’s newly available is a surefire way to overspend.

36. Going To Happy Hour

It’s easy to get in the habit of relying on food and drink to decompress after a long day at work.

“I’d grab a drink with friends more often than I realized,” said Jim Wang, founder of Wallet Hacks. “Spending $20 for a bunch of cocktails with friends isn’t a big deal until you do it half a dozen times in a month and you wonder where that money disappeared to.”

[in-text-ad]

37. Using an Out-of-Network ATM

ATMs can charge up to several dollars per withdrawal, and those fees can sneak up on you. Even if the ATM is in a highly convenient location, consider that $3 per week can add up to $156 for the year, the cost of a fancy dinner out with a loved one or an extra deposit into an individual retirement account.

If your current bank or credit union doesn’t have many fee-free ATMs, consider switching.

ALSO READ: Cutting Out These 25 Expenses Will Save You $16,142.08 a Year

38. Not Planning Ahead for Expected Needs

“A lot of spending is due to last-minute decisions,” said Carey Ransom, president at OC4 Venture Studio. He offered these examples: “You’re going somewhere, and you forget to bring water or a snack. You forget your umbrella and get stuck in the rain. You are late getting somewhere and have to park in a premium spot.”

Add those kinds of unexpected purchases up, and you might just blow your budget, he added.

39. Neglecting Maintenance

Any solid spending plan should budget for home and auto maintenance costs. Worn weather stripping, a poorly maintained HVAC unit or a clogged fan belt can create a bigger financial burden later on than the immediate cost of routine maintenance.

[in-text-ad-2]

40. Not Allowing Yourself Some Wiggle Room

“If you try too hard to stick to a budget or plan, it can backfire,” said Valerie Rind, author of “Gold Diggers and Deadbeat Dads.” Instead, know that your plan is a roadmap. If you veer off track, accept it and keep moving forward. If you don’t beat yourself up, you’re more likely to get back on track right away.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.