The COVID-19 pandemic has ushered in an unprecedented surge in demand for homes in the United States. Inventory is at a record low, as is the average time homes are on the market. Meanwhile, both home prices and the share of homes selling above asking price have reached record highs.

Of course, in some parts of the country, exorbitant home prices are nothing new. Even before the pandemic, there were metro areas across the country where the median home value was over $100,000 higher than the national median of $217,500.

Using data on median home value from the U.S. Census Bureau, 24/7 Wall St. identified the most expensive metro areas to buy a home in the United States. Most of the metropolitan areas on this list are in the Western United States, including 17 in California alone.

Home values in a given area are often a reflection of what residents can afford. And not surprisingly, with only a handful of exceptions, the local median household income exceeds the $65,712 national median in nearly every metro area on this list. Here is a look at the cities where home values are rising fastest.

Still, despite the higher incomes, home values in the metro areas on this list are high enough that buyers are more likely than average to have to rely on a mortgage. In most counties on this list, the share of homeowners who are financing with a mortgage is above the 61.7% share of homeowners with a mortgage nationwide. High home prices also appear to make homeownership prohibitively expensive for many living in these places, as most metro areas on this list have a lower homeownership rate than the 64.1% rate nationwide. Here is a look at the cities where the middle class can no longer afford housing.

Click here to see the most expensive metros to buy a home in the nation.

Click here to see our detailed methodology.

50. Charlottesville, VA

> Median home value: $317,700

> Median monthly housing costs with a mortgage: $1,670 — 77th highest of 384 metros

> Share of housing units with a mortgage: 62.5% — 153rd highest of 380 metros (tied)

> Homeownership rate: 65.0% — 148th lowest of 384 metros (tied)

> Median household income: $75,907 — 46th highest of 384 metros

[in-text-ad]

49. Flagstaff, AZ

> Median home value: $317,700

> Median monthly housing costs with a mortgage: $1,765 — 56th highest of 384 metros

> Share of housing units with a mortgage: 49.4% — 31st lowest of 380 metros (tied)

> Homeownership rate: 61.5% — 82nd lowest of 384 metros (tied)

> Median household income: $58,085 — 176th lowest of 384 metros

48. Austin-Round Rock-Georgetown, TX

> Median home value: $318,400

> Median monthly housing costs with a mortgage: $1,992 — 26th highest of 384 metros

> Share of housing units with a mortgage: 67.7% — 53rd highest of 380 metros

> Homeownership rate: 57.6% — 35th lowest of 384 metros

> Median household income: $80,954 — 24th highest of 384 metros

47. Medford, OR

> Median home value: $318,900

> Median monthly housing costs with a mortgage: $1,549 — 107th highest of 384 metros

> Share of housing units with a mortgage: 57.3% — 120th lowest of 380 metros (tied)

> Homeownership rate: 63.0% — 109th lowest of 384 metros (tied)

> Median household income: $56,450 — 146th lowest of 384 metros

[in-text-ad-2]

46. California-Lexington Park, MD

> Median home value: $320,700

> Median monthly housing costs with a mortgage: $1,961 — 32nd highest of 384 metros (tied)

> Share of housing units with a mortgage: Not available

> Homeownership rate: 72.3% — 55th highest of 384 metros (tied)

> Median household income: $87,947 — 11th highest of 384 metros

45. Ocean City, NJ

> Median home value: $320,900

> Median monthly housing costs with a mortgage: $1,895 — 40th highest of 384 metros

> Share of housing units with a mortgage: 56.9% — 115th lowest of 380 metros (tied)

> Homeownership rate: 74.6% — 25th highest of 384 metros

> Median household income: $69,980 — 75th highest of 384 metros

[in-text-ad]

44. St. George, UT

> Median home value: $323,800

> Median monthly housing costs with a mortgage: $1,560 — 103rd highest of 384 metros

> Share of housing units with a mortgage: 60.9% — 186th highest of 380 metros (tied)

> Homeownership rate: 72.1% — 61st highest of 384 metros (tied)

> Median household income: $63,595 — 121st highest of 384 metros

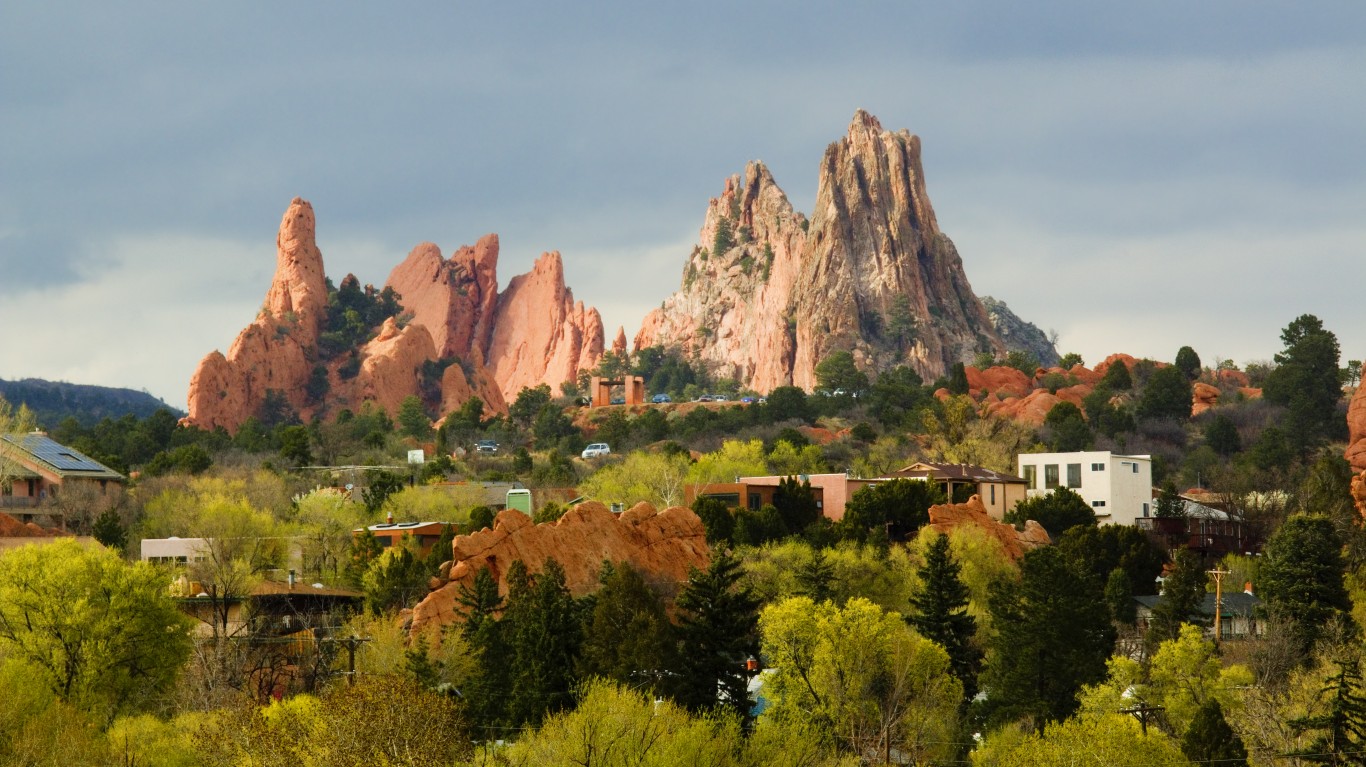

43. Colorado Springs, CO

> Median home value: $324,100

> Median monthly housing costs with a mortgage: $1,699 — 65th highest of 384 metros

> Share of housing units with a mortgage: 74.3% — 4th highest of 380 metros

> Homeownership rate: 64.9% — 145th lowest of 384 metros (tied)

> Median household income: $72,633 — 55th highest of 384 metros

42. Carson City, NV

> Median home value: $325,200

> Median monthly housing costs with a mortgage: $1,502 — 124th highest of 384 metros (tied)

> Share of housing units with a mortgage: Not available

> Homeownership rate: 58.9% — 46th lowest of 384 metros (tied)

> Median household income: $57,270 — 157th lowest of 384 metros

[in-text-ad-2]

41. Wenatchee, WA

> Median home value: $327,500

> Median monthly housing costs with a mortgage: $1,571 — 98th highest of 384 metros

> Share of housing units with a mortgage: 59.0% — 155th lowest of 380 metros (tied)

> Homeownership rate: 64.9% — 145th lowest of 384 metros (tied)

> Median household income: $60,532 — 176th highest of 384 metros

40. Olympia-Lacey-Tumwater, WA

> Median home value: $333,100

> Median monthly housing costs with a mortgage: $1,773 — 55th highest of 384 metros

> Share of housing units with a mortgage: 69.9% — 27th highest of 380 metros (tied)

> Homeownership rate: 68.7% — 126th highest of 384 metros (tied)

> Median household income: $78,512 — 34th highest of 384 metros

[in-text-ad]

39. Modesto, CA

> Median home value: $335,400

> Median monthly housing costs with a mortgage: $1,762 — 57th highest of 384 metros

> Share of housing units with a mortgage: 68.8% — 40th highest of 380 metros

> Homeownership rate: 57.4% — 33rd lowest of 384 metros (tied)

> Median household income: $63,037 — 128th highest of 384 metros

38. Chico, CA

> Median home value: $336,600

> Median monthly housing costs with a mortgage: $1,688 — 68th highest of 384 metros

> Share of housing units with a mortgage: 60.2% — 180th lowest of 380 metros

> Homeownership rate: 59.1% — 49th lowest of 384 metros (tied)

> Median household income: $62,563 — 135th highest of 384 metros

37. Mount Vernon-Anacortes, WA

> Median home value: $353,300

> Median monthly housing costs with a mortgage: $1,687 — 69th highest of 384 metros

> Share of housing units with a mortgage: 64.5% — 114th highest of 380 metros (tied)

> Homeownership rate: 69.9% — 98th highest of 384 metros (tied)

> Median household income: $67,175 — 94th highest of 384 metros

[in-text-ad-2]

36. Salt Lake City, UT

> Median home value: $356,400

> Median monthly housing costs with a mortgage: $1,690 — 66th highest of 384 metros

> Share of housing units with a mortgage: 72.5% — 9th highest of 380 metros

> Homeownership rate: 68.2% — 136th highest of 384 metros (tied)

> Median household income: $80,196 — 27th highest of 384 metros

35. Provo-Orem, UT

> Median home value: $360,600

> Median monthly housing costs with a mortgage: $1,689 — 67th highest of 384 metros

> Share of housing units with a mortgage: 72.9% — 7th highest of 380 metros

> Homeownership rate: 67.9% — 145th highest of 384 metros (tied)

> Median household income: $79,152 — 32nd highest of 384 metros

[in-text-ad]

34. Greeley, CO

> Median home value: $366,800

> Median monthly housing costs with a mortgage: $1,810 — 53rd highest of 384 metros

> Share of housing units with a mortgage: 73.1% — 6th highest of 380 metros

> Homeownership rate: 73.6% — 36th highest of 384 metros (tied)

> Median household income: $78,615 — 33rd highest of 384 metros

33. Naples-Marco Island, FL

> Median home value: $370,800

> Median monthly housing costs with a mortgage: $1,949 — 34th highest of 384 metros

> Share of housing units with a mortgage: 45.3% — 9th lowest of 380 metros

> Homeownership rate: 74.2% — 29th highest of 384 metros (tied)

> Median household income: $76,025 — 44th highest of 384 metros

32. Riverside-San Bernardino-Ontario, CA

> Median home value: $378,500

> Median monthly housing costs with a mortgage: $1,969 — 30th highest of 384 metros

> Share of housing units with a mortgage: 70.9% — 17th highest of 380 metros (tied)

> Homeownership rate: 63.9% — 124th lowest of 384 metros (tied)

> Median household income: $70,954 — 67th highest of 384 metros

[in-text-ad-2]

31. Bremerton-Silverdale-Port Orchard, WA

> Median home value: $378,800

> Median monthly housing costs with a mortgage: $1,845 — 49th highest of 384 metros

> Share of housing units with a mortgage: 72.0% — 10th highest of 380 metros

> Homeownership rate: 69.9% — 98th highest of 384 metros (tied)

> Median household income: $79,624 — 29th highest of 384 metros

30. Reno, NV

> Median home value: $383,000

> Median monthly housing costs with a mortgage: $1,732 — 62nd highest of 384 metros

> Share of housing units with a mortgage: 66.5% — 74th highest of 380 metros (tied)

> Homeownership rate: 58.5% — 41st lowest of 384 metros (tied)

> Median household income: $72,132 — 58th highest of 384 metros

[in-text-ad]

29. Stockton, CA

> Median home value: $385,600

> Median monthly housing costs with a mortgage: $1,946 — 35th highest of 384 metros

> Share of housing units with a mortgage: 70.9% — 17th highest of 380 metros (tied)

> Homeownership rate: 58.4% — 39th lowest of 384 metros (tied)

> Median household income: $68,997 — 82nd highest of 384 metros

28. Corvallis, OR

> Median home value: $389,000

> Median monthly housing costs with a mortgage: $1,982 — 27th highest of 384 metros

> Share of housing units with a mortgage: 60.7% — 189th highest of 380 metros (tied)

> Homeownership rate: 57.3% — 32nd lowest of 384 metros

> Median household income: $70,835 — 68th highest of 384 metros

27. Bellingham, WA

> Median home value: $398,300

> Median monthly housing costs with a mortgage: $1,727 — 63rd highest of 384 metros

> Share of housing units with a mortgage: 64.9% — 101st highest of 380 metros (tied)

> Homeownership rate: 64.4% — 135th lowest of 384 metros (tied)

> Median household income: $69,372 — 78th highest of 384 metros

[in-text-ad-2]

26. Portland-Vancouver-Hillsboro, OR-WA

> Median home value: $408,600

> Median monthly housing costs with a mortgage: $1,975 — 28th highest of 384 metros

> Share of housing units with a mortgage: 70.8% — 20th highest of 380 metros (tied)

> Homeownership rate: 61.8% — 89th lowest of 384 metros (tied)

> Median household income: $78,439 — 35th highest of 384 metros

25. Barnstable Town, MA

> Median home value: $409,700

> Median monthly housing costs with a mortgage: $1,964 — 31st highest of 384 metros

> Share of housing units with a mortgage: 62.3% — 159th highest of 380 metros (tied)

> Homeownership rate: 80.0% — 5th highest of 384 metros (tied)

> Median household income: $85,042 — 17th highest of 384 metros

[in-text-ad]

24. Bend, OR

> Median home value: $413,500

> Median monthly housing costs with a mortgage: $1,745 — 61st highest of 384 metros

> Share of housing units with a mortgage: 66.1% — 80th highest of 380 metros

> Homeownership rate: 70.7% — 83rd highest of 384 metros (tied)

> Median household income: $71,643 — 62nd highest of 384 metros

23. Fort Collins, CO

> Median home value: $420,100

> Median monthly housing costs with a mortgage: $1,844 — 50th highest of 384 metros

> Share of housing units with a mortgage: 69.2% — 35th highest of 380 metros (tied)

> Homeownership rate: 65.7% — 167th lowest of 384 metros (tied)

> Median household income: $75,186 — 51st highest of 384 metros

22. Sacramento-Roseville-Folsom, CA

> Median home value: $434,400

> Median monthly housing costs with a mortgage: $2,143 — 23rd highest of 384 metros

> Share of housing units with a mortgage: 69.9% — 27th highest of 380 metros (tied)

> Homeownership rate: 60.4% — 61st lowest of 384 metros

> Median household income: $76,706 — 40th highest of 384 metros

[in-text-ad-2]

21. Denver-Aurora-Lakewood, CO

> Median home value: $437,800

> Median monthly housing costs with a mortgage: $2,009 — 25th highest of 384 metros

> Share of housing units with a mortgage: 74.7% — 3rd highest of 380 metros

> Homeownership rate: 64.3% — 133rd lowest of 384 metros (tied)

> Median household income: $85,641 — 15th highest of 384 metros

20. Bridgeport-Stamford-Norwalk, CT

> Median home value: $444,500

> Median monthly housing costs with a mortgage: $2,852 — 4th highest of 384 metros

> Share of housing units with a mortgage: 67.5% — 55th highest of 380 metros

> Homeownership rate: 66.1% — 179th lowest of 384 metros (tied)

> Median household income: $97,053 — 4th highest of 384 metros

[in-text-ad]

19. Washington-Arlington-Alexandria, DC-VA-MD-WV

> Median home value: $446,300

> Median monthly housing costs with a mortgage: $2,417 — 16th highest of 384 metros

> Share of housing units with a mortgage: 76.5% — 1st highest of 380 metros

> Homeownership rate: 63.5% — 120th lowest of 384 metros

> Median household income: $105,659 — 3rd highest of 384 metros

18. Vallejo, CA

> Median home value: $460,500

> Median monthly housing costs with a mortgage: $2,305 — 19th highest of 384 metros

> Share of housing units with a mortgage: 71.1% — 15th highest of 380 metros

> Homeownership rate: 62.2% — 95th lowest of 384 metros (tied)

> Median household income: $86,652 — 14th highest of 384 metros

17. Boston-Cambridge-Newton, MA-NH

> Median home value: $482,700

> Median monthly housing costs with a mortgage: $2,482 — 12th highest of 384 metros

> Share of housing units with a mortgage: 69.9% — 27th highest of 380 metros (tied)

> Homeownership rate: 61.5% — 82nd lowest of 384 metros (tied)

> Median household income: $94,430 — 5th highest of 384 metros

[in-text-ad-2]

16. New York-Newark-Jersey City, NY-NJ-PA

> Median home value: $482,900

> Median monthly housing costs with a mortgage: $2,807 — 5th highest of 384 metros

> Share of housing units with a mortgage: 62.8% — 145th highest of 380 metros (tied)

> Homeownership rate: 50.8% — 6th lowest of 384 metros

> Median household income: $83,160 — 21st highest of 384 metros (tied)

15. Seattle-Tacoma-Bellevue, WA

> Median home value: $503,000

> Median monthly housing costs with a mortgage: $2,359 — 18th highest of 384 metros

> Share of housing units with a mortgage: 71.7% — 11th highest of 380 metros

> Homeownership rate: 59.7% — 55th lowest of 384 metros

> Median household income: $94,027 — 6th highest of 384 metros

[in-text-ad]

14. Boulder, CO

> Median home value: $592,000

> Median monthly housing costs with a mortgage: $2,193 — 21st highest of 384 metros

> Share of housing units with a mortgage: 66.7% — 64th highest of 380 metros (tied)

> Homeownership rate: 61.6% — 84th lowest of 384 metros (tied)

> Median household income: $88,535 — 10th highest of 384 metros

13. Santa Maria-Santa Barbara, CA

> Median home value: $593,800

> Median monthly housing costs with a mortgage: $2,410 — 17th highest of 384 metros

> Share of housing units with a mortgage: 63.0% — 142nd highest of 380 metros

> Homeownership rate: 52.2% — 9th lowest of 384 metros (tied)

> Median household income: $75,653 — 47th highest of 384 metros

12. Salinas, CA

> Median home value: $602,900

> Median monthly housing costs with a mortgage: $2,459 — 13th highest of 384 metros

> Share of housing units with a mortgage: 66.4% — 77th highest of 380 metros (tied)

> Homeownership rate: 52.8% — 12th lowest of 384 metros

> Median household income: $77,514 — 37th highest of 384 metros

[in-text-ad-2]

11. San Diego-Chula Vista-Carlsbad, CA

> Median home value: $619,300

> Median monthly housing costs with a mortgage: $2,698 — 7th highest of 384 metros

> Share of housing units with a mortgage: 70.1% — 26th highest of 380 metros

> Homeownership rate: 53.8% — 17th lowest of 384 metros

> Median household income: $83,985 — 18th highest of 384 metros

10. Oxnard-Thousand Oaks-Ventura, CA

> Median home value: $629,600

> Median monthly housing costs with a mortgage: $2,639 — 10th highest of 384 metros (tied)

> Share of housing units with a mortgage: 71.3% — 13th highest of 380 metros (tied)

> Homeownership rate: 62.8% — 106th lowest of 384 metros (tied)

> Median household income: $92,236 — 8th highest of 384 metros

[in-text-ad]

9. San Luis Obispo-Paso Robles, CA

> Median home value: $637,000

> Median monthly housing costs with a mortgage: $2,427 — 15th highest of 384 metros

> Share of housing units with a mortgage: 60.5% — 186th lowest of 380 metros

> Homeownership rate: 62.4% — 100th lowest of 384 metros

> Median household income: $77,265 — 38th highest of 384 metros

8. Santa Rosa-Petaluma, CA

> Median home value: $664,600

> Median monthly housing costs with a mortgage: $2,639 — 10th highest of 384 metros (tied)

> Share of housing units with a mortgage: 67.2% — 58th highest of 380 metros (tied)

> Homeownership rate: 62.2% — 95th lowest of 384 metros (tied)

> Median household income: $87,828 — 12th highest of 384 metros

7. Los Angeles-Long Beach-Anaheim, CA

> Median home value: $666,900

> Median monthly housing costs with a mortgage: $2,659 — 9th highest of 384 metros

> Share of housing units with a mortgage: 69.8% — 30th highest of 380 metros

> Homeownership rate: 48.2% — 1st lowest of 384 metros

> Median household income: $77,774 — 36th highest of 384 metros

[in-text-ad-2]

6. Napa, CA

> Median home value: $670,000

> Median monthly housing costs with a mortgage: $2,728 — 6th highest of 384 metros

> Share of housing units with a mortgage: 62.3% — 159th highest of 380 metros (tied)

> Homeownership rate: 66.1% — 179th lowest of 384 metros (tied)

> Median household income: $92,769 — 7th highest of 384 metros

5. Kahului-Wailuku-Lahaina, HI

> Median home value: $697,900

> Median monthly housing costs with a mortgage: $2,432 — 14th highest of 384 metros

> Share of housing units with a mortgage: 65.9% — 84th highest of 380 metros (tied)

> Homeownership rate: 60.8% — 68th lowest of 384 metros (tied)

> Median household income: $80,754 — 25th highest of 384 metros

[in-text-ad]

4. Urban Honolulu, HI

> Median home value: $739,700

> Median monthly housing costs with a mortgage: $2,670 — 8th highest of 384 metros

> Share of housing units with a mortgage: 66.0% — 81st highest of 380 metros (tied)

> Homeownership rate: 57.4% — 33rd lowest of 384 metros (tied)

> Median household income: $87,470 — 13th highest of 384 metros

3. Santa Cruz-Watsonville, CA

> Median home value: $839,500

> Median monthly housing costs with a mortgage: $2,948 — 3rd highest of 384 metros

> Share of housing units with a mortgage: 64.8% — 104th highest of 380 metros (tied)

> Homeownership rate: 59.9% — 56th lowest of 384 metros (tied)

> Median household income: $89,269 — 9th highest of 384 metros

2. San Francisco-Oakland-Berkeley, CA

> Median home value: $940,900

> Median monthly housing costs with a mortgage: $3,237 — 2nd highest of 384 metros

> Share of housing units with a mortgage: 69.7% — 31st highest of 380 metros

> Homeownership rate: 54.0% — 18th lowest of 384 metros

> Median household income: $114,696 — 2nd highest of 384 metros

[in-text-ad-2]

1. San Jose-Sunnyvale-Santa Clara, CA

> Median home value: $1,116,400

> Median monthly housing costs with a mortgage: $3,533 — 1st highest of 384 metros

> Share of housing units with a mortgage: 67.9% — 51st highest of 380 metros (tied)

> Homeownership rate: 55.2% — 22nd lowest of 384 metros (tied)

> Median household income: $130,865 — 1st highest of 384 metros

Methodology

To determine the most expensive metros to buy a home in the nation, 24/7 Wall St. reviewed one-year estimates of median owner-occupied home values from the U.S. Census Bureau’s 2019 American Community Survey.

We used the 384 metropolitan statistical areas as delineated by the United States Office of Management and Budget and used by the Census Bureau as our definition of metros.

Metropolitan areas were ranked based on their owner-occupied median home values. To break ties, we used median monthly housing costs with a mortgage.

Additional information on median monthly housing costs with a mortgage, the share of owner-occupied housing units that have a mortgage, rates of homeownership, and median household income are also one-year estimates from the 2019 ACS.

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St. 24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.