The United States views China as one of its main competitors in the struggle for power over global resources and markets. With the rapid build-up of U.S. military equipment in Australia over recent months — reaching a scale not seen since World War II — some might wonder if a conflict is imminent, whether the U.S. takes an offensive operation in Asia or defends its allies and interests from a Chinese offensive. (These are 26 times the U.S. sent armed forces to China.)

Looming military engagements are not the only site of conflict between the world’s two largest economies. The massive trade flows as well as competition over rights to technological developments between the two nations mean trade regulations and world trade agreements have major consequences. China supplies $536.3 billion in goods to the U.S., or 16.5% of U.S. imports annually, the most of any nation.

According to a factsheet released by the U.S. department of the treasury on Aug. 9, 2023, President Joe Biden has issued an executive order that will restrict U.S. investments in Chinese technology. The order includes investments in semiconductor, quantum information, and artificial intelligence technology. The “Countries of Concern” include China and the administrative regions Hong Kong and Macao.

China denounced the executive order, with a Chinese Foreign Ministry spokesperson stating that “China strongly deplores and firmly opposes the US’s single-minded rollout of restrictions on investments in China.” The spokesperson also said that the move is “politicizing business engagement” and that it is “blatant economic coercion and tech bullying,” which “violates the principles of market economy and fair competition,” and “destabilizes global industrial and supply chains and hurts the interests of both China and the US and the global business community.”

Most notably under former President Donald Trump but continued under Biden, the U.S. ramped up its application of Section 232 — the section of the 1962 Trade Expansion Act — that allows the president to impose trade restrictions. From 2017 to 2022, the number of investigations launched under the Act represent nearly a quarter of all Section 232 investigations initiated by the U.S. in the past 60 years. (Also see, comparing America’s 20 richest cities to China’s.)

24/7 Wall St. reviewed nine investigations conducted since 2017 by the U.S. or U.S.-based entities from the August report, “2023 Report on WTO Compliance of the United States” (table Section 232 Investigations Launched in Recent 5 Years).

Click here to see US-China trade wars: how do these 9 imports threaten US National Security?

Steel

> Year initiated: 2017

The U.S. Department of Commerce launched an investigation into China’s steel production practices in 2017. The probe concluded that China’s high-volume, low-cost steel exports were a threat to national security and potentially detrimental to America’s industrial vitality. Consequently, then President Trump imposed 25% tariffs on imported steel products from all countries, excluding Canada and Mexico.

From China’s perspective, the tariffs were seen as a protectionist policy, undermining the principles of free trade. The World Trade Organization also questioned the use of national security as justification for the tariffs given that most steel imports in the U.S were used for civilian purposes, not military. China cited Canada and Mexico as exemptions from the tariffs on steel under the condition of finalizing the United States-Mexico-Canada-Agreement. This investigation and its outcomes intensified trade tensions between the U.S. and China.

[in-text-ad]

Aluminum

> Year initiated: 2017

The Department of Commerce initiated an investigation into China’s aluminum production practices in 2017. The probe concluded that the import of aluminum products from China was a potential threat to U.S. national security, which led to the imposition of a 10% tariff on imported aluminum products from all nations except neighbors, Canada and Mexico.

The decision was met with criticism from both the WTO and China. The WTO raised questions about the fairness and legitimacy of the investigation. From China’s perspective, the investigation was seen as prejudiced and detrimental to the principles of free trade. China added Canada and Mexico as examples of exemptions from the tariffs on aluminum.

Automotive parts

> Year initiated: 2018

In 2018, the Department of Commerce initiated an investigation into China’s automotive parts production, prompting international scrutiny. This was viewed by some, including the WTO and Chinese reports, as a potential threat to economic globalization because of possible disruptions in the global supply chain. These entities expressed concerns about the investigation’s implications for international trade norms and the potential for escalating trade conflicts. At the time of the imposition of tariffs, the U.S. imported $143 billion in automotive parts.

Uranium ore and products

> Year initiated: 2018

Uranium ore and its products, primarily used as fuel in nuclear power plants, are of strategic and economic importance. In 2018, North American uranium producers Ur-Energy Inc. and Energy Fuels Inc. requested an investigation into China’s production of these materials. They alleged that China was flooding the market with cheap uranium, undermining their business.

President Trump did not concur and did not limit imports of uranium. The U.S. formed the U.S. Nuclear Fuel Working Group to seek recommendations on growing domestic nuclear-fuel production. Beijing has expressed concerns that the probe could lead to protectionist measures, hampering free trade. Similarly, WTO warned that such investigations could trigger a tit-for-tat trade war, posing a threat to the global economic order.

[in-text-ad-2]

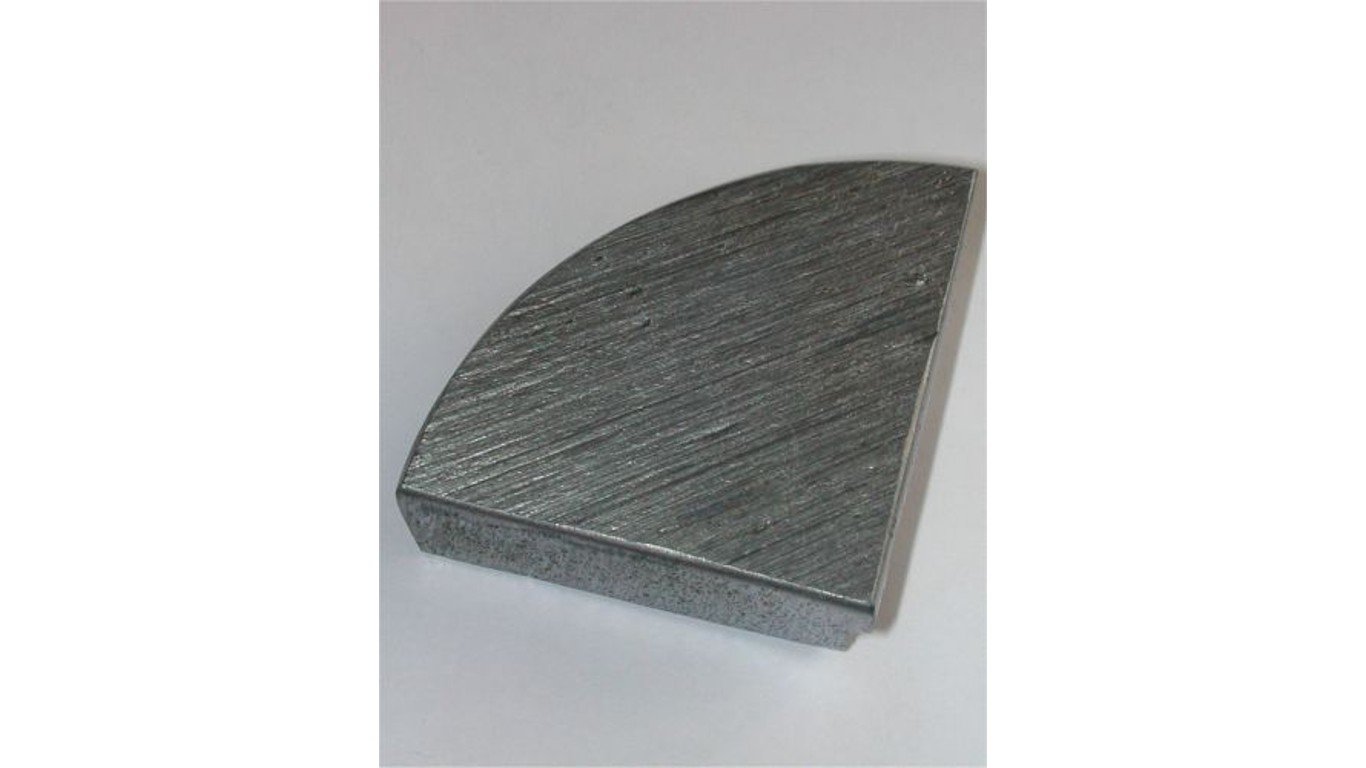

Titanium sponge

> Year initiated: 2019

In an investigation initiated by Titanium Metals Corp., China’s titanium sponge production was scrutinized over concerns it could impair U.S. national security. Titanium sponge is used as the basis for titanium parts in U.S. fighter aircraft and engines, satellite parts, Navy ships, submarines, and military vehicles. The Department of Commerce concurred with the concerns as did President Trump, though he chose not to restrict titanium sponge imports. At the time of the investigation, the U.S. imported less than 1% of titanium sponge from China.

From the perspective of China and the WTO, this investigation could be perceived as unjust. According to WTO and Chinese reports, the investigation lacked transparency and seemed to violate the principles of non-discrimination and predictability.

Transformers, transformer cores, transformer regulators, and other pts. & accs.

> Year initiated: 2020

The Department of Commerce investigation into China’s production of these components in 2020 raised eyebrows on the global stage. China, a major global supplier of these products, came under scrutiny for alleged unfair trade practices. According to the World Trade Organization, such investigations can disrupt the global supply chain and are seen as a threat to economic globalization. This is because protective measures, such as tariffs or import restrictions, can lead to trade wars and economic instability.

China’s view, as reported, was that these investigations undermine the multilateral trading system and impede global economic recovery, particularly in the precarious context of the pandemic.

[in-text-ad]

Portable cranes

> Year initiated: 2020

Manitowoc Company, Inc., a major American crane manufacturer, conducted an investigation into China’s portable crane production in 2020, citing potential threats to national security. The company’s concerns were rooted in the belief that China’s rapidly growing manufacturing capabilities in this sector could undercut American industry and compromise U.S. infrastructure projects.

From the perspective of the WTO and China, these claims were viewed as protectionist and in violation of free trade agreements. They argued that competition from China would encourage innovation and efficiency, and should not be seen as a national security threat. The investigation led to no specific presidential action. The government said Manitowoc withdrew its request in 2020, “citing a changing economic environment due to the effects of the COVID-19 pandemic.”

Vanadium

> Year initiated: 2020

AMG Vanadium LLC and U.S. Vanadium LLC conducted an investigation in 2020 into China’s vanadium production, alleging it threatened to impair U.S. national security. The probe was predicated on the belief that China’s control over the majority of vanadium resources and its ability to dictate global pricing and supply posed significant risks to the U.S. energy sector, which heavily relies on vanadium (a rare element) for energy storage applications.

China and many WTO reports have contended that such measures could be viewed as biased. China claimed that these duties were only applied to its products. They argue that the investigation disregards China’s efforts to comply with international trade regulations and fails to acknowledge the global nature of commodity markets. These sources also suggested that the investigation might be an attempt to impose protectionist measures under the guise of national security concerns. The results of the investigation did not lead to any specific presidential action. However, the matter remains a significant point of contention in U.S.-China trade relations.

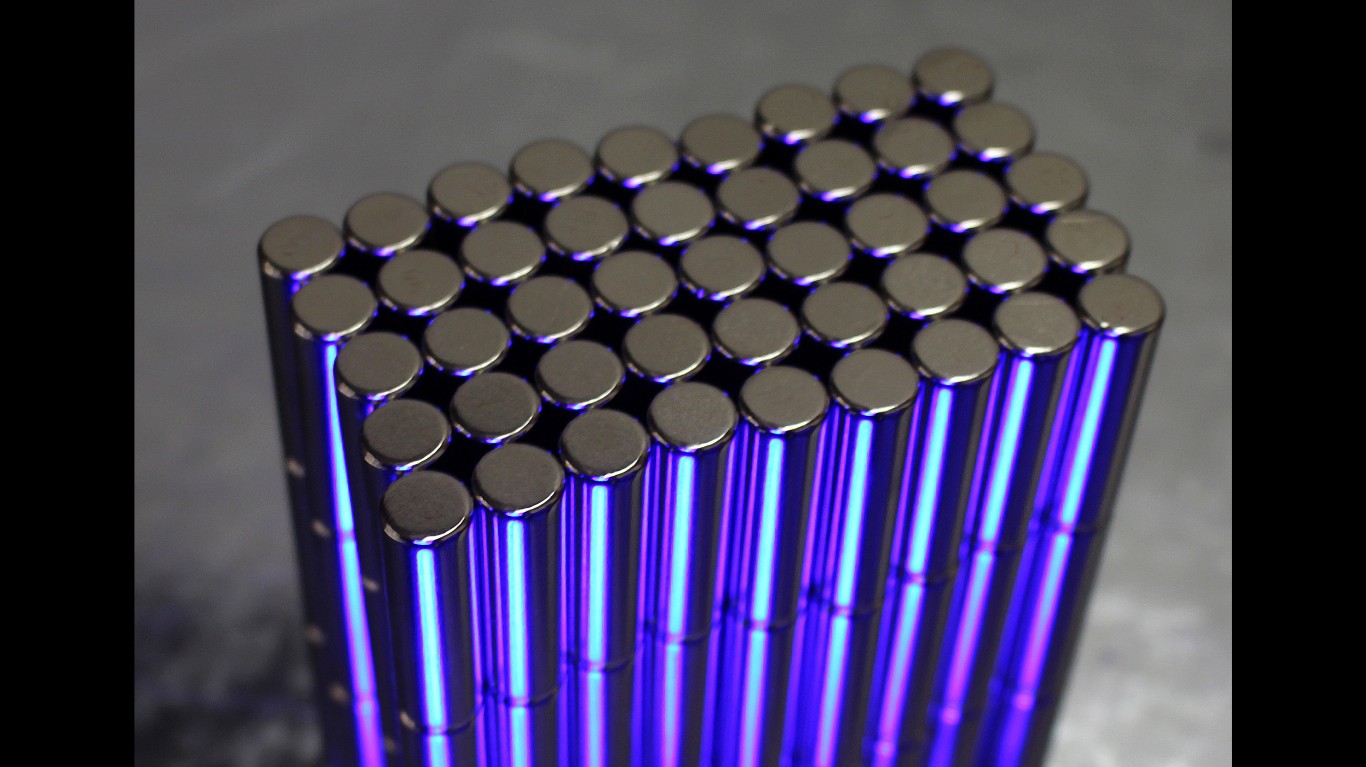

NdFeB permanent magnets

> Year initiated: 2021

NdFeB permanent magnets, composed of Neodymium, Iron, and Boron, are powerful, rare-earth magnets that play a crucial role in electric vehicles, wind turbines, and consumer electronics. The Department of Commerce investigation into China’s NdFeB permanent magnet production raised significant attention globally in 2021. In September 2022, President Biden decided against limiting imports of neodymium magnets.

While the DOC aimed to protect American industries from unfair competition, the move was seen by some as a threat to economic globalization. The World Trade Organization reports have generally emphasized the importance of open trade, and China has historically championed globalization, viewing the investigation as potentially detrimental to these principles.

Essential Tips for Investing: Sponsored

A financial advisor can help you understand the advantages and disadvantages of investment properties. Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to three financial advisors who serve your area, and you can interview your advisor matches at no cost to decide which one is right for you. If you’re ready to find an advisor who can help you achieve your financial goals, get started now.

Investing in real estate can diversify your portfolio. But expanding your horizons may add additional costs. If you’re an investor looking to minimize expenses, consider checking out online brokerages. They often offer low investment fees, helping you maximize your profit.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.

24/7 Wall St.