2018 was one of the last full years we would feel normal as a world for a long time. We had no idea what was hurling around the corner. That year, Drake led the charts with “God’s Plan” and Cardi-B was just starting to make a name for herself in music. The Golden State Warriors had just come off their second NBA championship in a row, and third in four years. From a Wall Street perspective, it was a bad year.

The S&P 500 fell 6.2%. The S&P 500 is an index tool to use to follow stocks because it takes the largest 500 stocks on the markets and follows them. They overall fell, which is rare to happen in one year. The Dow also dropped 5.6%. The Dow is another index tool used to follow market trends, but it only uses 30 companies to track. The decline in the value of stocks this year was the worst since 2008, which is when the housing market crashed. The reason the market started to slow can be attributed to the trade war with China that year, the concern over interest rates rising too quickly, and the slowdown over the world’s economic growth, among other things.

However, the market flow didn’t stop companies from going public. Smaller companies especially like going public because it can be a much easier way to raise funds to continue expanding compared to getting loans. It’s also slightly more risky because you don’t want to fail on Wall Street. Some companies did well this year, while others might be second-guessing themselves.

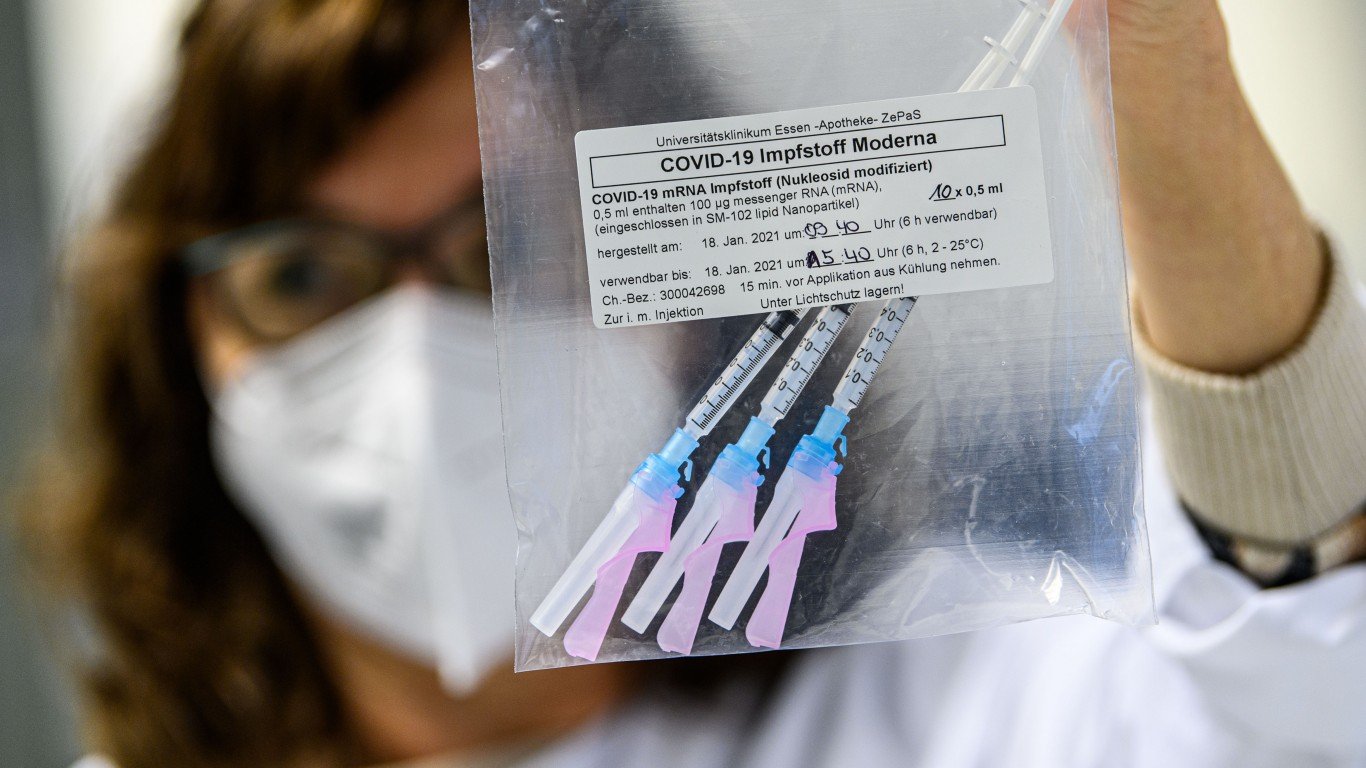

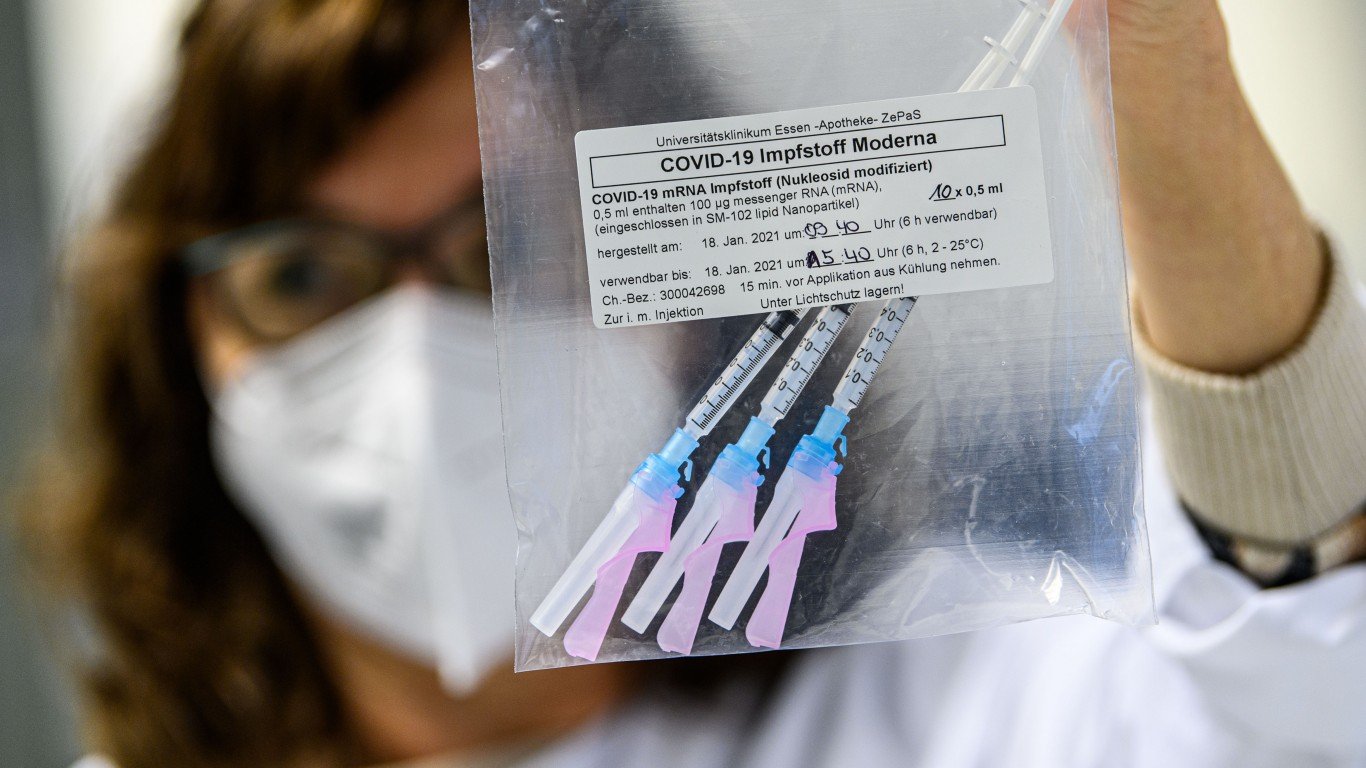

Moderna

- IPO Date: December 17, 2018

- Opening Price: $18.60

There was a right time and place to get in on the Moderna (NASDAQ: MRNA) stock. That time and place was the second they went public. Nobody could have predicted what was to come for Moderna and how big of a role they’d play in our lives. However, a health company starting at $18.60 per share in 2018 should be on your radar. Health companies, especially ones that have government contracts, will always be around and consistently rising. They were a consistent riser, getting to $28 by March 2020. After they became one of the faces of a COVID-19 vaccine, their value shot up in a meteoric way. By September 2021, the stock was worth $449. The stock has fallen ever since that point, but they are still proudly boasting a value of $74.10.

ADT Inc.

- IPO Date: January 19, 2018

- Opening Price: $12.39

If you’re looking for a way to keep your home safe and protected, ADT (NYSE: ADT) has been the way to go. There have even been studies done that show ADT is so successful that just having their sign in your front yard is enough to keep burglars away from your home. They also provide services that include fire protection, meaning they’ll alert authorities if something were to happen to your home. We don’t think about these things happening to us until they do.

ADT decided 2018 was the right time to go public with their stock. They opened at $12.39, hoping they would rise quickly in the ranks of best stocks to own. Unfortunately, that didn’t quite happen. Instead, they only went up to $12.64, their all-time highest. The stock is only worth $6.14 today, thanks to the many different options people have for home security.

Avast PLC

- IPO Date: May 1, 2018

- Opening Price: $243

Protecting yourself on the internet has become more important than protecting your physical self. The internet is where all of our data is. If that gets into the wrong hands, who knows what might happen? Avast is a cyber security company from the Czech who has become one of the leaders in cybersecurity. Having a strong force behind you in the cyber world is important. Avast first saw the importance of protecting technology back in 1988.

A floppy disk found by someone at a convention led the founders to start this company. When they first launched in 2018, the company stock was going for $243. Today, you’ll have to shell out $495 to get one share of Avast. Because they’re a European company, you’ll have to go to the European markets to purchase Avast if you wish to add them to your portfolio. With how dangerous the internet is becoming, it might be smart to do so.

Unity Biotechnology

- IPO Date: May 4, 2018

- Opening Price: $165

When we think of a biotechnology company, we think of success and stock prices that are through the roof. That was the idea Unity Biotechnology (NASDAQ: UBX) had when they launched their company as a public one. There was a lot of hope, as Unity was looking like they were going to have huge breakthroughs, especially in the osteoarthritis area of medicine. However, this was never formulated, and the company is struggling to stay working as of today. When they first went public, one share of Unity was going for $165. The prices quickly would rise to $220 per share, but that would be the highest they’d get. The company has had a nasty fall, and now its stock price is $1.72 per share.

Codemasters

- IPO Date: June 1, 2018

- Opening Price: $249

Video games will be part of life forever now. Codemasters was one of the first to produce video games, and they have been quite successful at it. The first game they came out with was “Super Robin Hood” in 1986. This game was reviewed well and sold like hotcakes off the shelves. Codemasters rode this wave and continued to pump out great video game after game. Today, they’re known for games like the “F1” racing series and “Grid Legends.” Because of their great history with revenue, the company stock opened up for $249 in 2018. There’s been no stopping this stock in its rise to $602. Like Avast, Codemasters is a European-based company, so you’ll have to find a market that trades with them.

Mesa Air Group

- IPO Date: August 10, 2018

- Opening Price: $11.75

Everyone was held in their homes during quarantine and is now itching to travel and explore the world. We didn’t realize what we had until it was taken away from us. One of the ways we get to new places is by flying. The Mesa Air Group (NASDAQ: MESA) is a group that operates with Mesa Airlines, the parent company to United Express and American Eagle until 2023. These two airline companies are the smaller aircraft carriers for United and American.

Local travel in these smaller airplanes was thought to be one of the ways of the future. It looks like that might not be the case if the company’s stock price has anything to say about that. When Mesa Air Group first went public in 2018, their shares were going for $11.75. There were two times the stock rose to $15, but other than that it’s been nothing to ride home about. Today, the stock is going for $0.57. That’s right. 57 cents.

Yeti Holdings

- IPO Date: October 26, 2018

- Opening Price: $16.45

Something that’s taken the United States by storm is hiking and spending time outdoors. One of the most important things to have is a solid water bottle and cooler for drinks to stay hydrated. This is where Yeti (NYSE: YETI) comes into play. The outdoors company has become almost aligned with the outdoors. It’s normal to hear someone ask if you have your Yeti instead of a water bottle these days before a hike. It turns out people do enjoy having a quality water bottle for their hikes, as is reflected in how their stock has done. When the company first went public in 2018, Yeti was going for $16.45. Today, you can purchase one share of the stock for $43.52. Make sure you keep an eye on this stock, as they want to explore and spend as much time in nature continue to grow.

Arlo Technologies

- IPO Date: August 3, 2018

- Opening Price: $22.10

Getting into the technology space is a great way to make a killing, most of the time. This isn’t the case for all technology companies. Sadly, Arlo Technologies (NYSE: ARLO) falls into the category of what could have been. They had the right idea of getting into the game, but they didn’t quite make the mark they were thinking they would. This company first went public in 2018 and came out of the gate with a great price of $22.10. As of that exact moment, the stock has only seen a number close to that one time. Today, you can purchase a share of Arlo Technologies for $8.77. The jump for some companies on Wall Street works out and works out wonderfully. For others, it doesn’t go the way they think it should go.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the

advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.