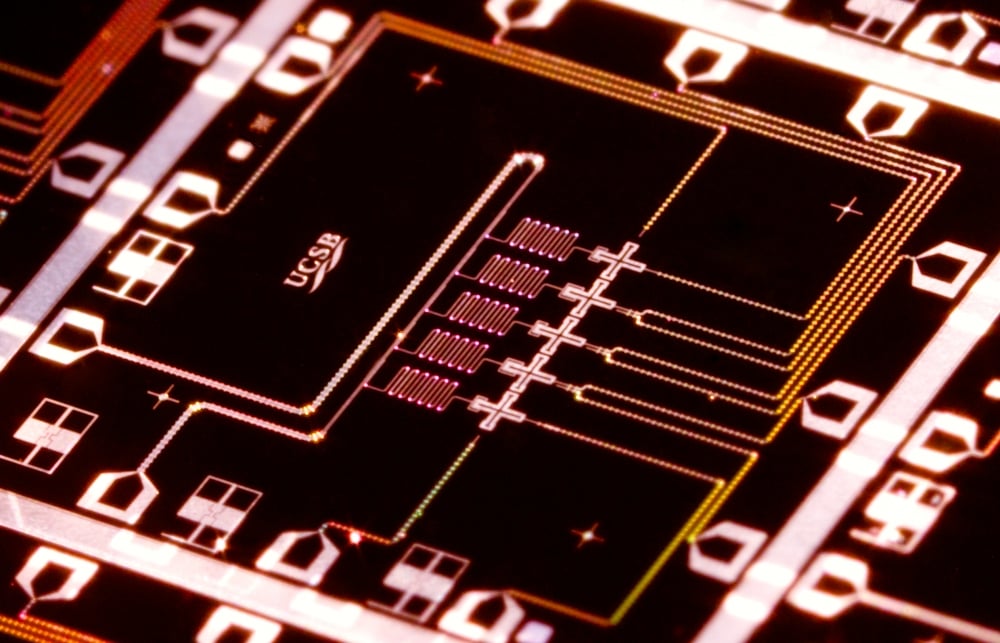

As we make our way through corporate earnings season, overall it is not looking as bad as previously thought. This is leaving at least somewhat of an optimistic tone. As a result, this earnings season is likely to be all about guidance, as far as most companies are concerned. Source: University of California - Santa Barbara

Source: University of California - Santa Barbara

24/7 Wall St. has put together a preview of some of the larger tech companies that are reporting their quarterly results in the middle of May. We have reviewed the consensus earnings estimates from Thomson Reuters, the stock price and trading history, as well as added some additional color on each. Be advised that the earnings and revenue estimates may change ahead of the formal reports, and some companies may change earnings dates as well.

Mobileye N.V. (NYSE: MBLY) is scheduled to report its first-quarter earnings on Monday. The consensus estimates call for earnings per share (EPS) of $0.07 and $44.23 million in revenue. Back in March, Mobileye completed a secondary offering consisting of 14.5 million shares. This came on the heels of an upgrade from one of the offering’s underwriters, Goldman Sachs. At that time Goldman Sachs raised Mobileye to a Buy rating from Neutral and raised its price target to $50 from $40.40. Mobileye shares closed at $45.81 on Friday. The consensus price target is $55.78. The 52-week trading range is $31.11 to $60.28.

ALSO READ: Merrill Lynch’s 10 Reasons Everything in the World Is About to Change

Rackspace Hosting Inc. (NYSE: RAX) is set to post its first-quarter results Monday, and the consensus estimates call for EPS of $0.20 and $481.71 million in revenue. Last fall the company announced it was updating and modernizing its relationship with Microsoft and now offers support for Microsoft’s private cloud offering, along with added support for Google Apps. The company also got Wall Street’s attention this time last year when it said it was looking at strategic alternatives. With no firm suitors lining up, the company has continued to increase the focus on product development. Rackspace shares were trading at $54.00 as the week came to a close, in a 52-week trading range of $26.18 to $56.20. The stock has a consensus analyst price target of $54.84.

GoDaddy Inc. (NYSE: GDDY) is about to have its first earnings report as a public company. Currently the company is still in its quiet period and analysts have yet to make any calls on it. GoDaddy will report its earnings Tuesday. Its shares ended the week at $24.88. The stock has a post-IPO trading range of $20.00 to $27.27.

Cisco Systems Inc. (NASDAQ: CSCO) is set to report on Wednesday, which will be the last formal earnings report with John Chambers as CEO. Cisco has consensus estimates of EPS at $0.53 on $11.54 billion in revenue. Shares are trading at a low 13.3 estimated 2015 earnings, and it boasts an outstanding 7.44 free cash flow yield. The networking giant’s numerous headwinds include up and down demand from telecom carriers, weakness in emerging markets and threats to its very lucrative switching business. Yet, analysts feel all these headwinds are going away. The company also stands to benefit from a better corporate spending environment in Europe, as well as continued growth here at home. Shares were trading at $29.23 at the end of Friday’s session. The consensus price target is $30.09, and the stock has a 52-week trading range of $22.49 to $30.31.

ALSO READ: 5 Jefferies Franchise Pick Tech Stocks to Buy With Huge Upside

Applied Materials Inc. (NASDAQ: AMAT) will post its quarterly results on Thursday. Consensus estimates call for EPS of $0.28 and revenue of $2.40 billion. The company has long been a powerhouse in chip capital equipment, and it is a top franchise pick for 2015 at Jefferies. It is the global leader in precision materials engineering solutions for the semiconductor, flat panel display and solar photovoltaic industries. Analysts were disappointed when its merger with Tokyo Electron was called off recently. Shares ended the week at 19.69, in a 52-week trading range of $18.48 to $25.71. The consensus price target is only $24.55.

Symantec Corp. (NASDAQ: SYMC) is set to report its fiscal fourth-quarter results on Thursday. The consensus estimates call for $0.44 in EPS and $1.56 billion in revenue. Symantec is looking to unlock more value in its plans to spin off its Veritas data-storage and recovery business, according to recent reports. The question remains how this will affect the company. Credit Suisse thinks it might have the answer with its Outperform rating and a price target of $30, which is tied for the highest price target on Wall Street. Symantec shares closed trading at $25.53 on Friday. The consensus price target is $25.23, and the stock has a 52-week trading range of $20.58 to $27.32.

Sponsored: Attention Savvy Investors: Speak to 3 Financial Experts – FREE

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.