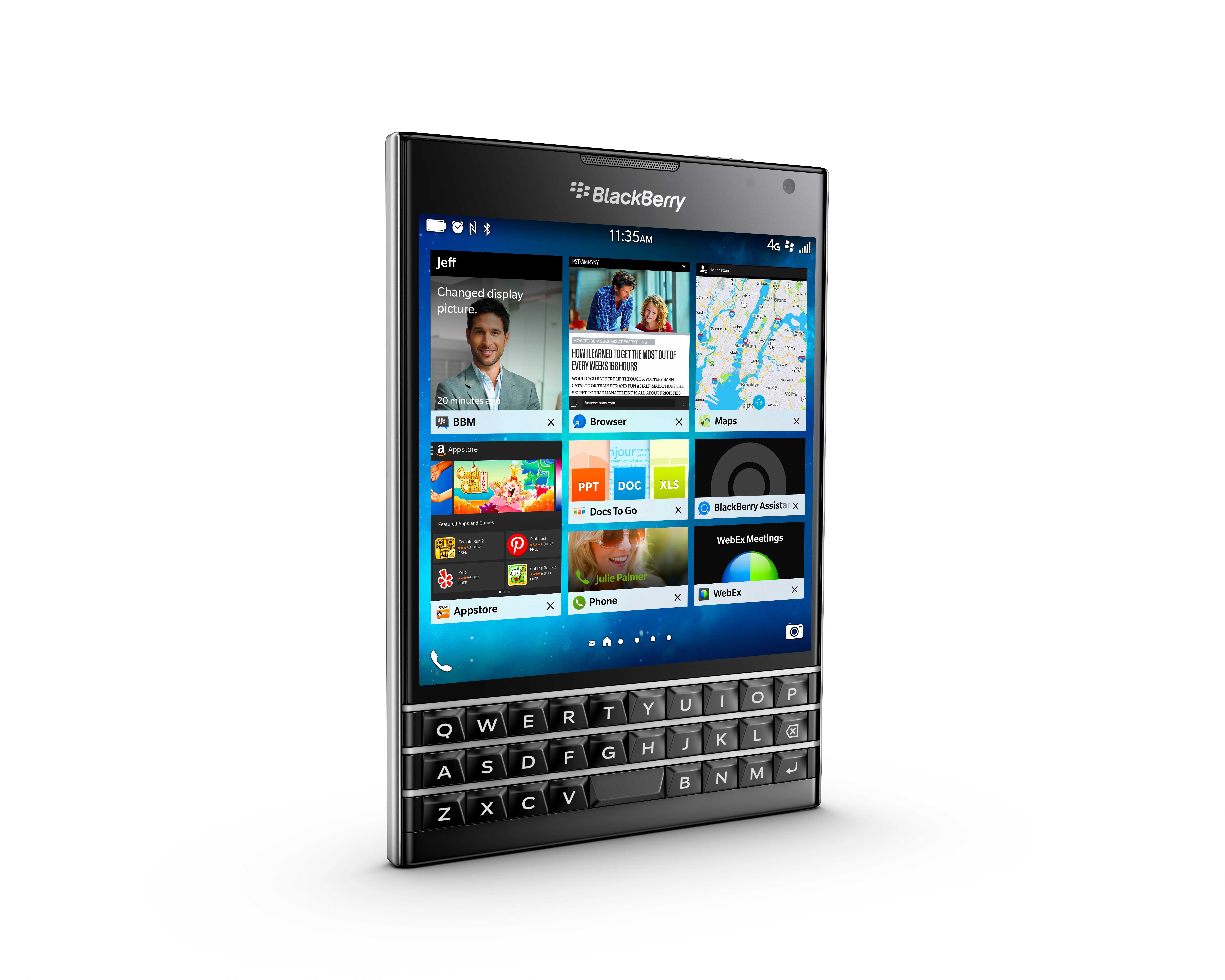

BlackBerry Ltd. (NASDAQ: BBRY) reported its fiscal second-quarter financial results before the markets opened Friday. The company had a net loss of $0.13 per share on $491 million in revenue. That compared to Thomson Reuters consensus estimates of a net loss of $0.09 per share on revenue of $610.99 million. In the same period of the previous year, the company posted a net loss of $0.02 per share and $916 million in revenue. Source: courtesy of BlackBerry Ltd.

Source: courtesy of BlackBerry Ltd.

In terms of its outlook, the company anticipates modest sequential growth in total revenue in each of the remaining quarters of fiscal 2016, as well as positive free cash flow. Also BlackBerry targets sustainable non-GAAP profitability in the fiscal 2016 fourth quarter.

Along with releasing this earnings report, the company also confirmed plans to launch a flagship handheld device that will run on the Android operating system with BlackBerry security.

Executive Chairman and CEO John Chen of BlackBerry commented on earnings:

We are focused on making faster progress to achieve profitability in our handset business. Today, I am confirming our plans to launch Priv, an Android device named after BlackBerry’s heritage and core mission of protecting our customers’ privacy. Priv combines the best of BlackBerry security and productivity with the expansive mobile application ecosystem available on the Android platform.

On the books, the company had $100 million in positive free cash flow, as well as cash and investments totaling $3.35 billion.

Chen added:

I am confident in our strategy and continued progress, highlighted by our fourth consecutive quarter of year-over-year double digit growth in software licensing revenue and sixth consecutive quarter of positive free cash flow. In order to expand our leadership in cross-platform software and services, we are investing strategically — organically through new products and services based on the BES platform, and through acquisitions like AtHoc and Good.

Shares of BlackBerry were down 5.4% at $6.65 midday Friday. The stock has a consensus analyst price target of $8.74 and a 52-week trading range of $6.41 to $12.63.

ALSO READ: 9 Well-Known Stocks With Solid Dividend Yields Above 5%

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.