Technology

4 Stocks Will Benefit From Huge Data Center Spending and Metro Optical Build

Published:

Last Updated:

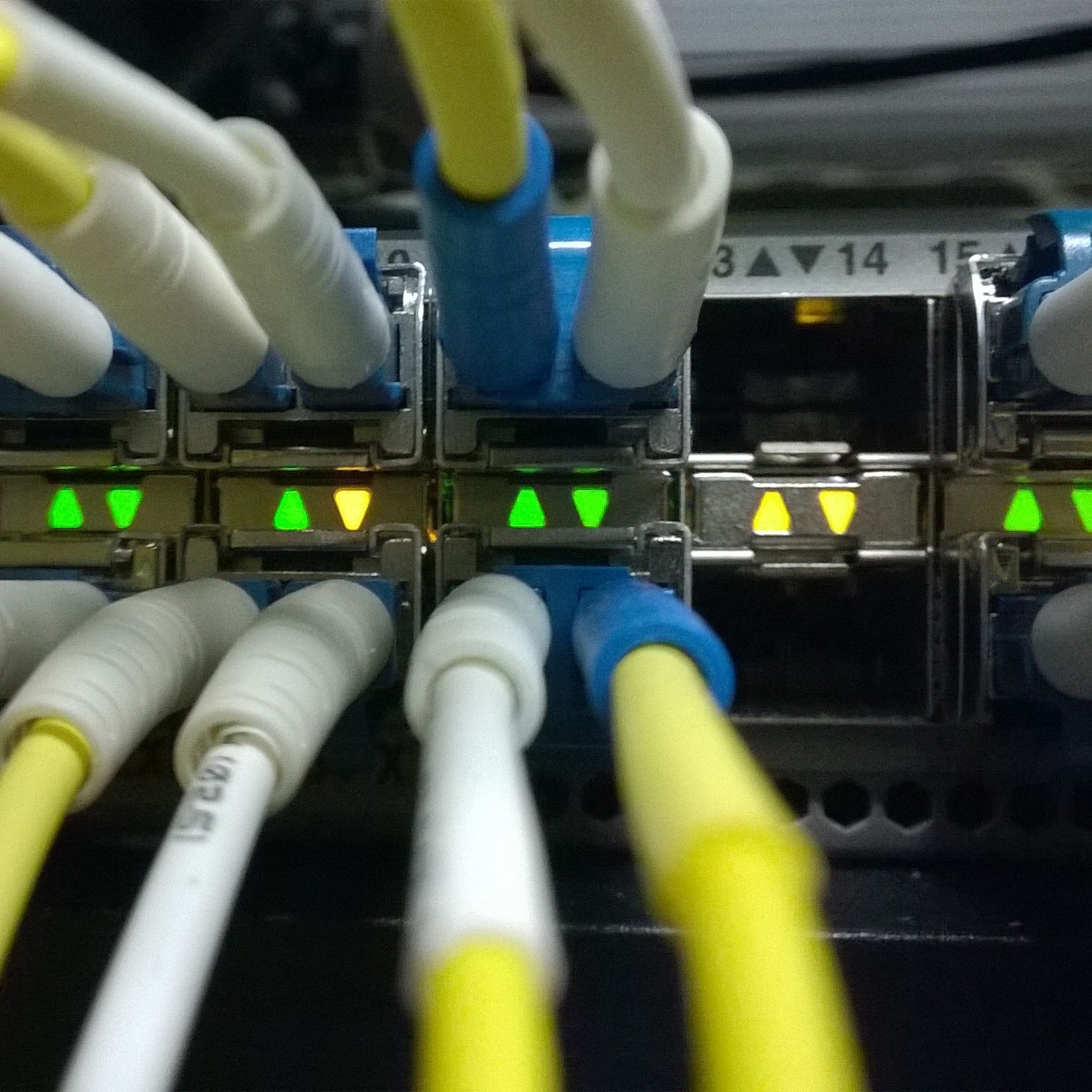

The huge growth in networking and data centers should come as little surprise to investors that follow technology. The incredible and sustained growth in capital expenditures in the sector is expected to be as high as a whopping $15 billion per year. A new research report from Deutsche Bank features four outstanding stock ideas to play this gigantic growth. Source: Thinkstock

Source: Thinkstock

While the Deutsche Bank team doesn’t take any huge chances with their stock picks, it does seem that they have narrowed the candidates to those most likely to benefit from capital expenditures for data center optical and for metro roll-outs. With huge cloud computing, video and audio streaming, and storage demands incrementally increasing, the demand isn’t going away anytime soon. All four of the stocks are rated Buy at Deutsche Bank.

Cisco

This is one of the top mega-cap technology stock picks on Wall Street and perhaps a surprising defensive pick for volatile markets like we have witnessed. Cisco Systems Inc. (NASDAQ: CSCO) posted outstanding earnings in August, and many on Wall Street have raised price targets for the networking giant significantly higher. Cisco is also one of the 24/7 Wall St. top 10 stocks to own for the next decade.

Earlier this year, Cisco won an important contract for the Verizon build-out of its next-generation 100G metro network. While Cisco’s optical business is small as a part of total revenue, this win is seen by Wall Street as a significant endorsement of the investments Cisco has made into its optics business. The Deutsche Bank research suggests that Cisco is likely to introduce 100G+ data center optical platforms sometime next year, and it targets the Web 2.0 and cloud customer base, in addition to sales opportunities in carrier-neutral data centers.

Analysts across Wall Street point to an estimated double-digit bookings momentum for Cisco’s Meraki Cloud Services. Many think that Meraki is likely to be a $1 billion plus run-rate business this year, with an incredible 50% to 70% compounded annual growth rate. A jump from 40 GE to 100 GE data center switching and next generation security are also adding to the total sales profile and product mix.

Cisco investors are paid a very solid 2.88% dividend. The Deutsche Bank price target for the stock is $35, and the Thomson/First Call consensus target is $31.14. The shares closed most recently at $29.

ALSO READ: Jefferies Has 4 Fallen Angels Stocks to Buy With Big Potential Upside

Corning

This was a huge player in the fiber build-outs in the 1990s and may be ready to ramp back up for new deployments. Corning Inc. (NYSE: GLW) is one of the world’s leading innovators in materials science. For more than 160 years, Corning has applied its unparalleled expertise in specialty glass, ceramics and optical physics.

Its products enable diverse industries such as consumer electronics, telecommunications, transportation and life sciences. They include damage-resistant cover glass for smartphones and tablets; precision glass for advanced displays; optical fiber, wireless technologies and connectivity solutions for high-speed communications networks; trusted products that accelerate drug discovery and manufacturing; and emissions-control products for cars, trucks and off-road vehicles.

Deutsche Bank sees the company being highly leveraged to large spending growth that they expect to see in data center optical connectivity.

Corning investors receive a 2.74% dividend. The Deutsche Bank price target is $21, and the consensus target is $20.84. Shares closed Thursday at $17.60.

CommScope

This is another top play for investors that may be somewhat more under the radar. CommScope Holding Co. Inc. (NASDAQ: COMM) provides connectivity and infrastructure solutions for wireless, business enterprise and residential broadband networks in the North America, Europe and elsewhere. Its network infrastructure solutions help customers increase bandwidth, maximize existing capacity, improve network performance and availability, increase energy efficiency and simplify technology migration.

ALSO READ: 4 Top Merrill Lynch Dividend-Paying Pharmaceutical Stocks to Buy Now

CommScope was granted early termination of the waiting period in connection with the previously announced agreement to acquire TE Connectivity’s telecom, enterprise and wireless businesses ,and the deal finally closed in August. This is an acquisition that Deutsche Bank was positive about. The analyst also feels that the company will benefit from the low-teens percentage spending growth in data center optical connectivity.

The Deutsche Bank price target is $37. The consensus target is $34.92. The stock closed on Thursday at $31.70.

Infinera

This is another solid play for investors in data networking. Infinera Corp. (NASDAQ: INFN) provides Intelligent Transport Networks for network operators, enabling reliable, easy to operate, high-capacity optical networks. Infinera leverages its unique large-scale photonic integrated circuits to deliver innovative optical networking solutions for the most demanding network environments. Intelligent Transport Networks enable carriers, cloud network operators, governments and enterprises to automate, converge and scale their data center, metro, long-haul and subsea optical networks.

Infinera also blew away earnings recently, and Deutsche Bank continues to recommended buying shares as Infinera is the firm’s top small cap pick. Revenues came in ahead of Wall Street expectations, and the company also provided forward guidance that was very strong. Deutsche Bank points to the fact the company is leveraged to data center interconnect market, making it another benefactor.

While the Deutsche Bank price target is $28, the consensus target is $26.09. Shares closed Wednesday at $18.63.

ALSO READ: Merrill Lynch Adds High-Yielding Energy Stock to US1 Best Ideas List

This huge spending growth could continue for years to come as demand across the entire sector grows. These top stocks to buy are more suitable for aggressive growth accounts that can tolerate a degree of volatility.

Ever wanted an extra set of eyes on an investment you’re considering? Now you can speak with up to 3 financial experts in your area for FREE. By simply

clicking here you can begin to match with financial professionals who can help guide you through the financial decisions you’re making. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.