During the most recent bull market, the technology sector was perhaps the biggest winner. Tech stocks like Apple and Facebook saw massive gains and were more-or-less the tip of the spear for the markets shooting higher.

With the advent of this bear market, we’ve seen incredible losses across the board. Considering tech companies had some of the highest multiples and valuations going into this COVID-19 crisis, they were some of the first to give it back.

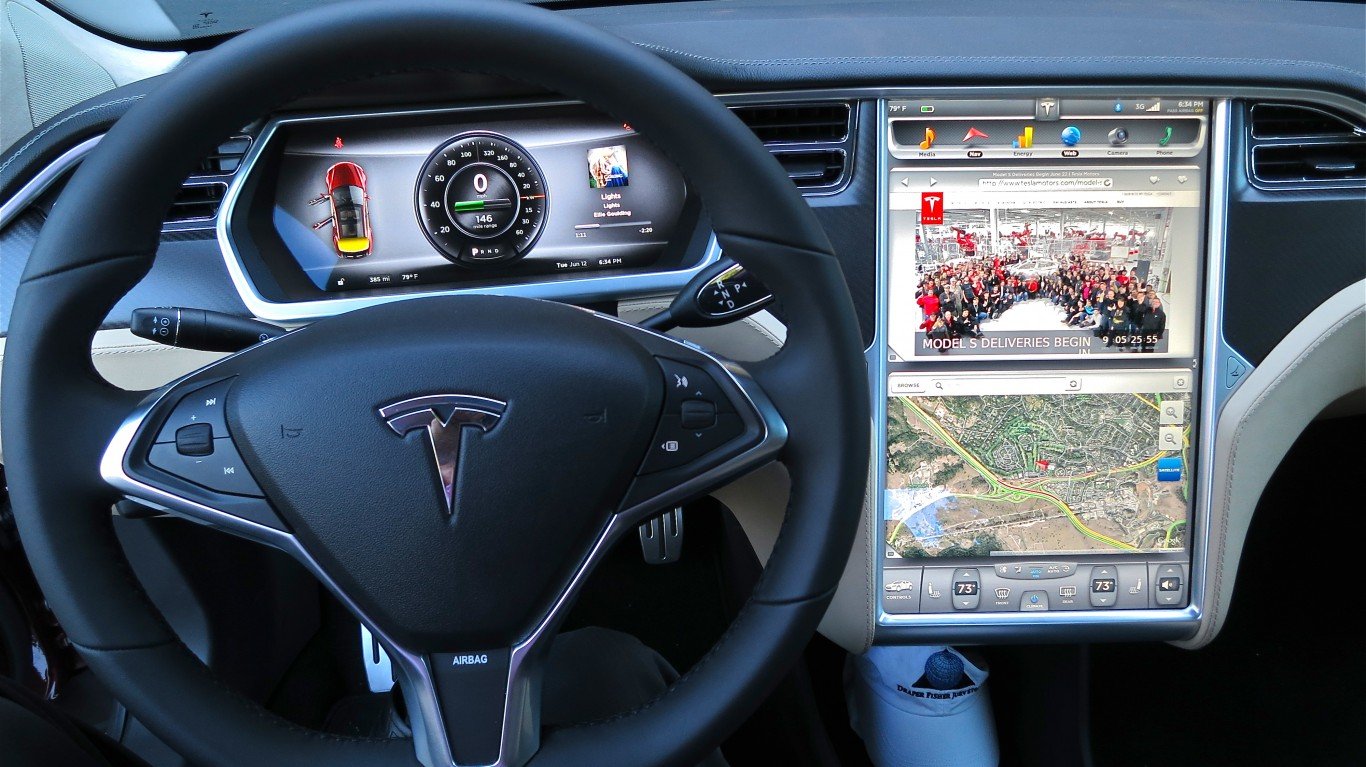

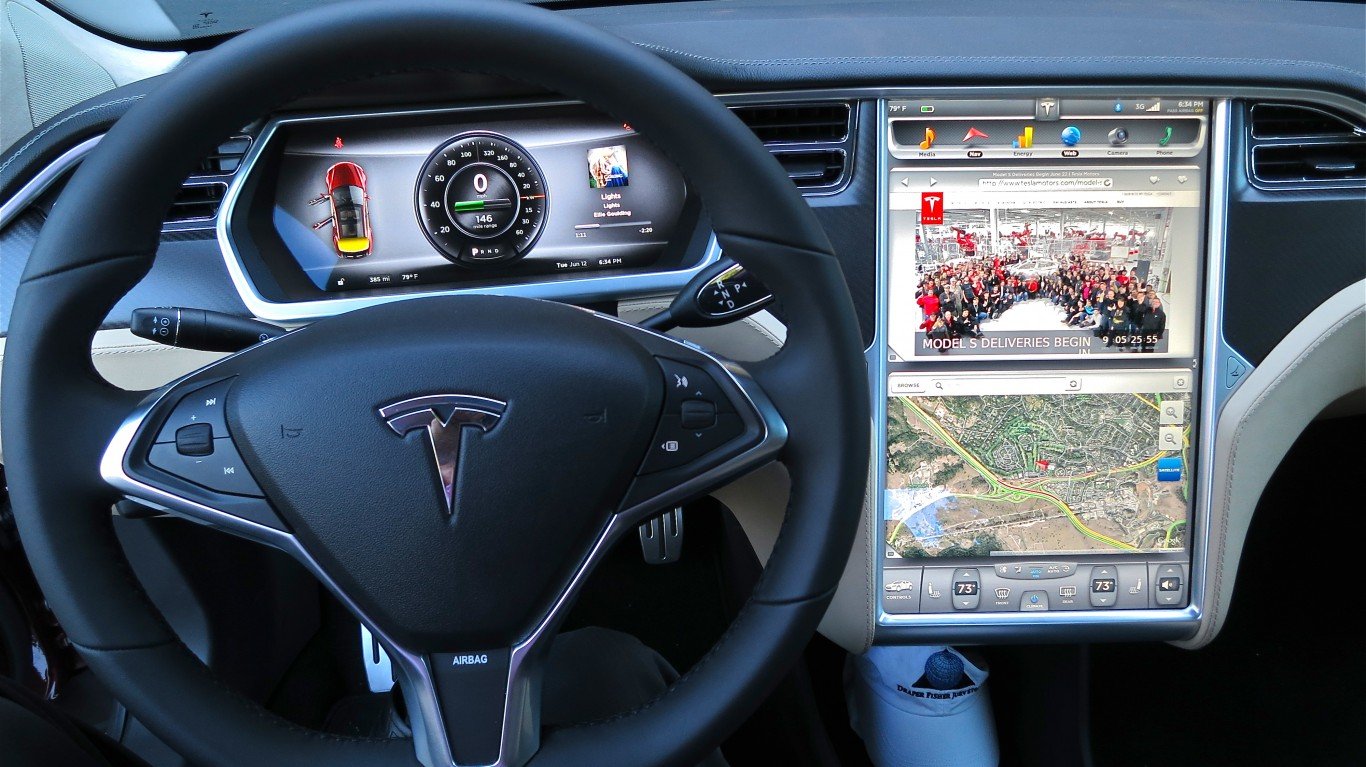

Going into February, Tesla Inc. (NASDAQ: TSLA) was an absolute market darling. The stock had more than doubled in the span of less than six months. The stock has been halved since February 19, when markets peaked.

24/7 Wall St. has taken a look at some of the biggest winners of the bull market to see what their stocks have done today and since the markets peaked on February 19. We have included a recent trading history and what the current consensus analyst target is.

Apple Inc. (NASDAQ: AAPL) shares have pulled back about 21% from the market high on February 19, and the stock is down 5% year to date. Apple stock traded down over 8% at $254.28 on Monday, in a 52-week range of $170.27 to $327.85. The consensus price target is $330.41.

Facebook Inc. (NASDAQ: FB) shares are down over 30% from the peak, and down 17% year to date. Facebook stock was last seen down about 11% at $151.07, in a 52-week range of $146.57 to $224.20. The consensus price target is $245.13.

Shares of Microsoft Corp. (NASDAQ: MSFT) were down 23.5% from mid-February, but actually up less than 1% year to date (excluding Monday’s move). Microsoft stock was down about 10% at $143.19. The 52-week range is $115.52 to $190.70, and the consensus price target is $193.58.

Alphabet Inc. (NASDAQ: GOOGL) is down 27.4% from the peak, and 9% lower since the beginning of 2020. Alphabet stock traded down about 9% at $1,106.06, in a 52-week range of $1,027.03 to $1,530.74. The consensus analyst target is $1,612.87.

Netflix Inc. (NASDAQ: NFLX) was down 20% from February 19 but up about 4% year to date. Netflix stock retreated 7% to $311.64, in a 52-week range of $252.28 to $393.52. The consensus price target is $365.03.

Amazon.com Inc. (NASDAQ: AMZN) was down 23% from the peak. The share price also is 3% lower year to date. Amazon stock traded 6% down to $1,677.00 on Monday, in a 52-week range of $1,626.03 to $2,185.95. The consensus price target is $2,400.96.

Tesla stock is down 53% from its all-time high in early February, and it is still up about 31% year to date, excluding Monday’s move. Shares of Tesla were down 17% at $453.20, within a 52-week range of $442.18 to $968.99. The consensus price target is $503.67.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Or are you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.