NVIDIA (Nasdaq: NVDA) has become the story stock of the past 18 months. Like Cisco during the Dot-Com Boom or Apple during the emergence of smartphones, it’s the single company most investors think of with AI.

Of course today we know that the birth of the Internet spawned other companies like Google while booming smartphones made winners of everything from apps to smartphone processors.

Likewise, the emergence of generative AI will likely lead to many winners beyond just NVIDIA. Let’s look at three companies you might be overlooking that could become huge winners from the trend.

1.Taiwan Semiconductor

Taiwan Semiconductor (NYSE: TSM) is the largest manufacturer of semiconductors in the world. Despite its dominant position, you might be surprised to learn that it’s trailed the recent performance of many of its suppliers.

In the past 5 years, Taiwan Semiconductor is up a very impressive 235%. Yet, Lam Research (NASDAQ: LCRX), which sells much of the equipment that Taiwan Semiconductor uses is up 456% while Cadence Design Systems (NASDAQ: CDNS) which sells software used to design semiconductors is up 415%.

If you’re building a portfolio of semiconductor stocks then Lam Research, Cadence, and Taiwan Semiconductor are all fantastic companies with essential places in the industry. However, Lam Research trades for 37X earnings, Cadence trades for 81X, and Taiwan Semiconductor trades for about 24X.

A key reason Taiwan Semiconductor has always traded at a discount is geopolitical fears. Simply put, if China ever invaded Taiwan they would likely nationalize the company. However, in recent weeks its shares have been running and closing the valuation gap with peers like Lam and Cadence as it becomes clear just how much coming demand there is for Taiwan Semiconductor’s leading-edge chips.

Those leading-edge chips (used in applications like artificial intelligence) are a small amount of Taiwan Semiconductor’s total production but deliver outsized revenue. Since December 2020, the revenue Taiwan Semiconductor receives per Foundry Wafer has jumped from about $4,000 to nearly $7,000 today.

That’s some impressive pricing power Taiwan Semiconductor is flexing as we’re only at the beginning of an AI boom that could last throughout the next decade.

2. ASML

When you think of the most impressive technologies on Earth, ASML‘s (NASDAQ: ASML) EUV Lithography systems should be at the top of the list. New machines cost about $380 million each, and ASML is the only company on Earth that produces this essential technology.

It does seem almost crazy an industry as essential to the world economy is so dependent on one company, that that is the case with ASML. EUV was a massive undertaking that then-chief rivals Nikon and Canon dropped out of. Today, every leading-edge chip relies on ASML for its creation.

That likely won’t change anytime, either. China has been blocked from importing ASML’s most advanced machines, and will surely pour massive resources into creating a competitor. Through significant innovation, some of their chip companies have pushed the boundaries of what older ASML machines are capable of. Yet, ASML doesn’t produce just incredibly complex and precise machines, it also has significant investment into software that’s also hard to catch up with.

So, what’s the downside of ASML? Right now, valuation is a major issue. The company trades for 46X earnings and faces near-term headwinds where China stocking up on older machines (for fear of further import bans) could create some tough comps in the years ahead.

Yet, over the long run, I truly believe ASML is a “no-brainer” stock. Every company faces risks, but ASML faces less risk of being disrupted than any company I know of. It’s the perfect stock to stay at the forefront of a mega-trend like AI, and you can buy some today and then add more on dips. My strong guess is that if you buy ASML today and add on any drops, you’re going to be very happy with the performance a decade from now.

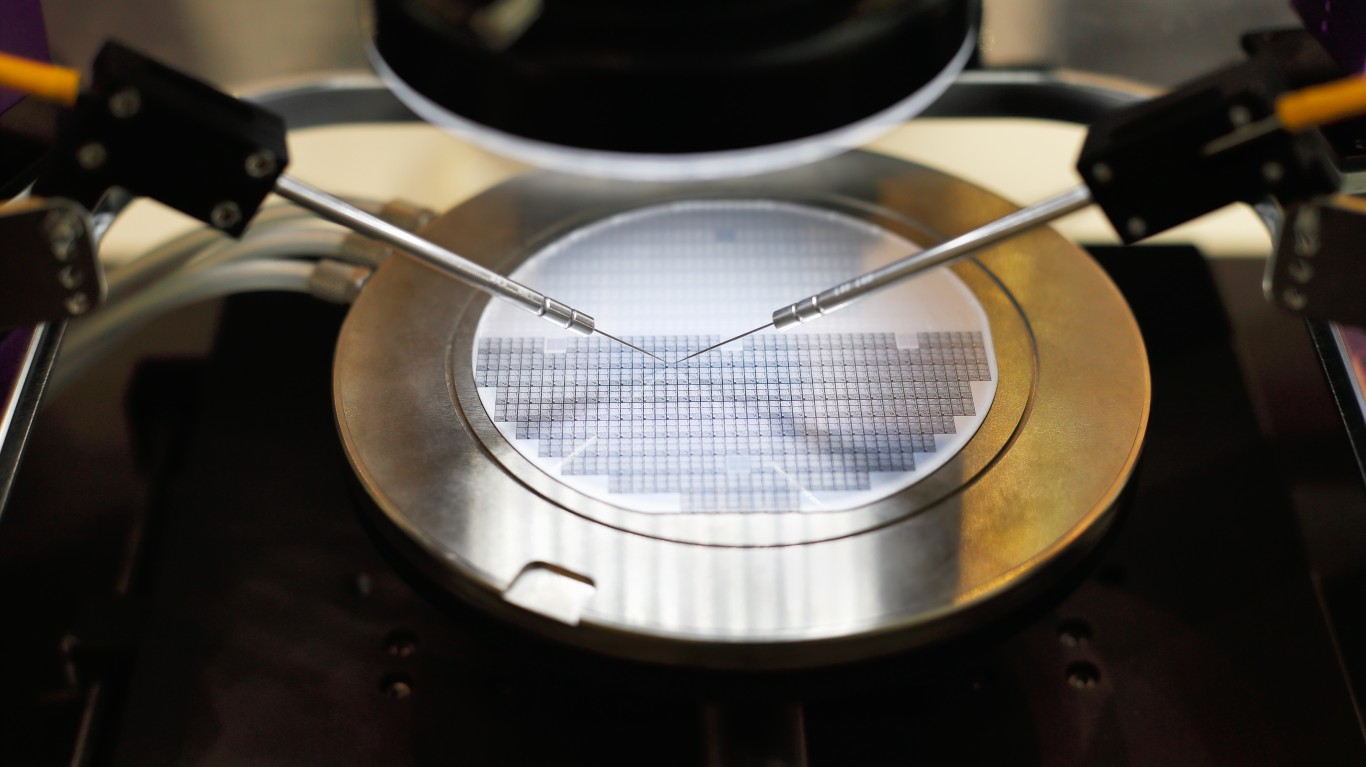

3. Siltronic AG

If you were yawning through Taiwan Semiconductor and ASML as they’re both big names you’ve read before, I wanted to add a third company that’s probably a bit more unknown.

One question I get a lot is “how can I invest in the actual sand or wafers?” That is, investors want to get as close to the beginning of the semiconductor value chain as possible.

Historically, the entire semiconductor industry has been home to brutal cycles of contraction after booms. This has crushed undifferentiated companies (like what you’d find with wafer suppliers) the most. Yet, as semiconductors continue to push the limits of what’s physically possible in chip production, some suppliers become more attractive.

One of those may be Siltronic AG. The company produces the silicon wafers that semiconductors are made of but lacks the dominant market share of either ASML or Taiwan Semiconductor. The industry is fragmented, but the end product is becoming surprisingly advanced. Companies in this industry burned by prior cycles have been loathe to increase capacity, which has led to new orders being booked out for years and favorable pricing dynamics.

Siltronic trades for just 9.6X earnings, which is a fraction of most other semiconductor plays that could benefit from the same tailwinds of massive AI demand. So while the company doesn’t provide the upside of other AI stocks, it starts at a significantly cheaper price. It’s a very cheap way to get exposure.

Siltronic AG is a German company so you’ll likely need a brokerage that can buy foreign securities. If you’re interested in the opportunity, you may want to read this very thorough analysis on the company.

Sponsored: Want to Retire Early? Here’s a Great First Step

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.