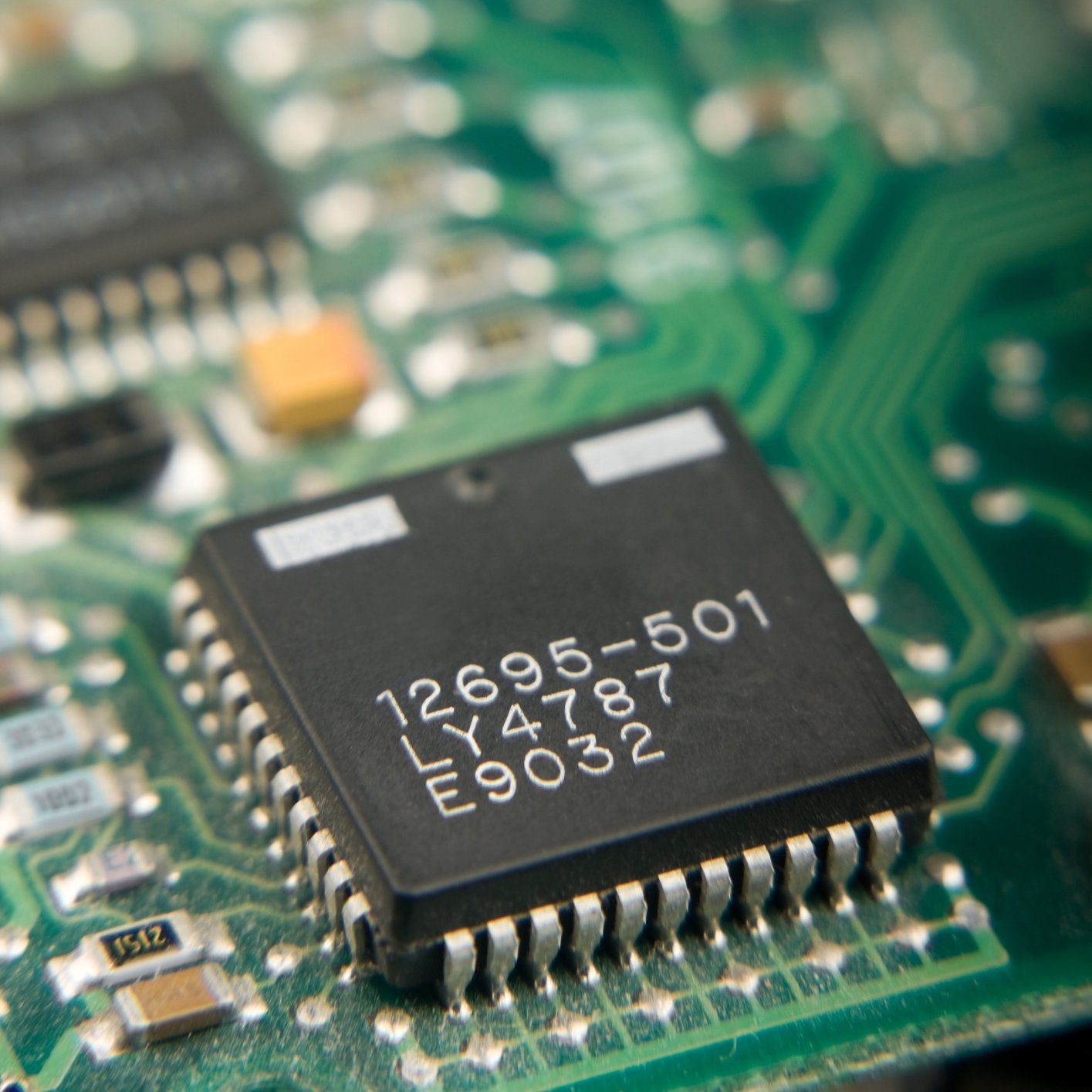

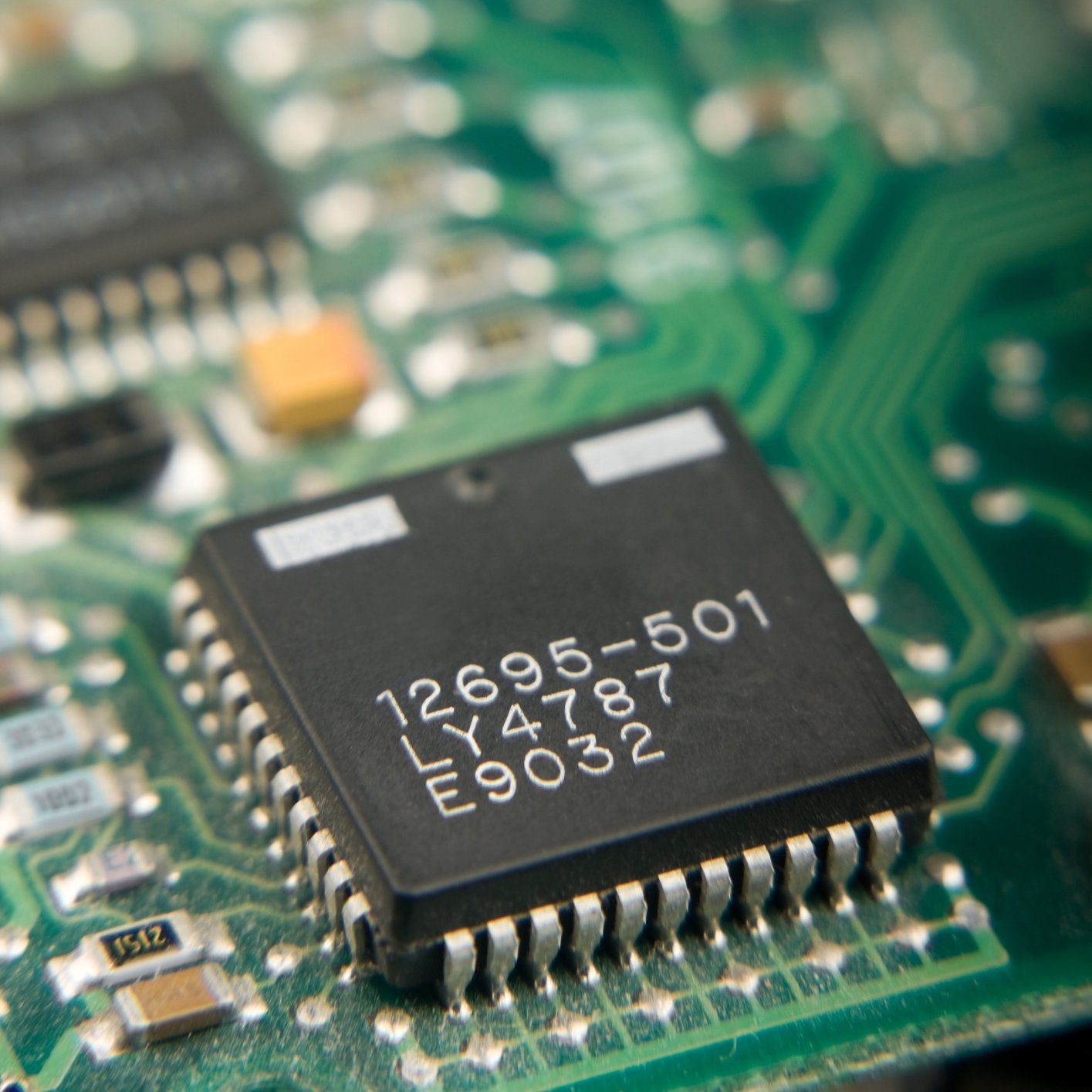

Technology

Analysts Pile Into Qualcomm After Stellar Earnings

Published:

Last Updated:

Qualcomm Inc. (NASDAQ: QCOM) reported a strong fiscal third quarter after the markets closed on Wednesday. The overall reaction from investors was very positive, and this was reflected in the following analyst calls as well.

24/7 Wall St. included highlights from both earnings reports, as well as what analysts were saying about each stock after the fact.

The chipmaker posted adjusted diluted earnings per share (EPS) of $1.16 and revenues of $6 billion. In the second quarter of 2015, Qualcomm reported EPS of $0.99 on revenues of $5.8 billion. Thomson Reuters had estimates for EPS of $0.97 and $5.58 billion in revenue.

In its outlook for its fiscal fourth quarter, Qualcomm guided revenues in a range of $5.4 billion to $6.2 billion, compared with the $5.5 billion reported in the fourth quarter a year ago. Adjusted EPS is forecast in a range of $1.05 to $1.15, compared with an actual total of $0.91 last year. Analysts were expecting fourth-quarter EPS of $1.08 on revenues of $5.73 billion.

During the quarter the company returned $781 million to shareholders in the form of dividends and $100 million in share repurchases. The quarterly dividend is $0.53 per share.

Several analysts weighed in on Qualcomm after earnings were reported:

Shares of Qualcomm closed most recently at $61.15, with a consensus analyst price target of $61.14 and a 52-week trading range of $42.24 to $64.95.

If you want your portfolio to pay you cash like clockwork, it’s time to stop blindly following conventional wisdom like relying on Dividend Aristocrats. There’s a better option, and we want to show you. We’re offering a brand-new report on 2 stocks we believe offer the rare combination of a high dividend yield and significant stock appreciation upside. If you’re tired of feeling one step behind in this market, this free report is a must-read for you.

Click here to download your FREE copy of “2 Dividend Legends to Hold Forever” and start improving your portfolio today.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.