Banking, finance, and taxes

Why This Firm Sees Massive Upside in Fannie Mae and Freddie Mac

Published:

Last Updated:

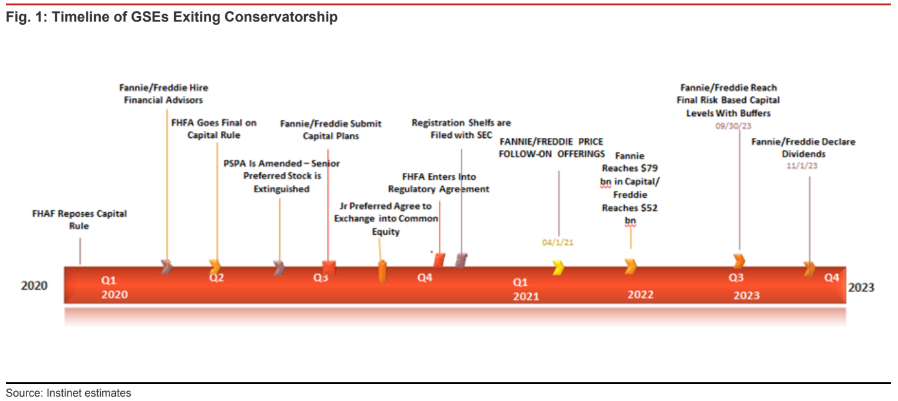

The government-sponsored entities (GSEs) are expected to see some major changes ahead. With the government set to remove Fannie Mae and Freddie Mac from conservatorship, Nomura/Instinet is expecting follow-on capital raises in April of 2021. While most analyst calls expect close to 8% upside in Dow Jones industrial and S&P stocks with Buy ratings at this stage of bull market, Instinet’s Matthew Howlett sees much greater upside potential as the GSEs are on a road to a strong and stable housing recovery as they exit the government’s control. The report predicates that there has simply been no viable solution to pry Fannie Mae and Freddie Mac out of the U.S. mortgage system and that these two GSEs remain as vital as ever concerning the health of the U.S. housing market and broader economy.

Fannie Mae (FNMA) and Freddie Mac (FMCC) were initiated with Buy ratings at Instinet ahead of what is expected to be a recapitalization and release of the companies over the next 12 to 18 months. Fannie Mae comes with a $5.00 target price, almost 50% higher than the current price. The $4.50 target price for Freddie Mac offers an implied upside of just over 40%.

Howlett’s aggressive target prices were based on expected capital raises in April 2021 as the ongoing process is still in massive negotiations. He also outlined an expected framework of a balance sheet restructuring and the expected capital raise that should satisfy all parties involved with reasonable values for the existing securities.

Instinet’s forecast capital framework is expected to be from a combination of retained earnings at the current GSEs as well as a $60 billion capital raise. When that is made, it is currently expected to be an offering of new common shares, a convertible preferred offerin, and also a perpetual preferred stock issuance. The report said:

Prior to this projected capital raise, we expect the Treasury’s senior preferred stock to be canceled and the junior preferred to be exchanged into common stock at the offering price. Pro forma for the exercise of the government warrants into common stock, the U.S. Treasury will own of 33% of Fannie and 29% of Freddie post raise. We expect the Treasury to sell down its stake over a five-year period and to realize $54 billion or more of value.

It is important to consider that the earnings targets that have been created are shown to be fully diluted and after the capital raise. For Fannie Mae, it sees core earnings estimates of $0.78 per share in 2022, followed by $0.82 in 2023 and $0.86 in 2024. Those estimates for Freddie Mac are $0.77 in 2022, $0.80 in 2023 and $0.84 in 2024.

Instinet’s view is that Fannie Mae and Freddie Mac will operate as near monoline guarantors of mortgages with insurance-like features that mainly stand in second or remote loss positions behind risk-sharing arrangements. The firm also expects that the firms will transition toward dividend-paying public utility models with roughly 4.5% earnings growth on a blended basis and with a low operating and credit expense structure.

There is a serious caveat here. The Treasury’s Senior Preferred Stock Purchase Agreement remains a major elephant in the room. For GSE reform to be successful, the firm noted that the Treasury’s stake must be eliminated. That was $191.4 billion at the end of the third quarter in 2019 and is expected to rise to $238 billion after the most recent amendment.

Unfortunately for income investors, Instinet’s report warns that it expects Fannie and Freddie to agree to a moratorium lasting two-and-a-half years on paying any dividends on its common stock so that they can build additional risk buffers to capital. That said, the report projects that the two will pay out approximately 65% of earnings as dividends by the end of 2023. Howlett further outlined how the dividends ultimately will trade at close to 7% dividend yields with an expected growth of about 4% to 5% on the annual payouts based on an expected 13% return on equity and 35% retention rate.

Both of the GSE shares were actively trading higher in Tuesday’s market session. Fannie Mae was last seen trading up over 5% at $3.45 and has a 52-week range of $1.45 to $4.23. Freddie Mac traded at $3.20, and its 52-week range is $1.34 to $4.04.

A visual outline of the expected steps that was created by Instinet for its report is shown below. Remember, any breakdown or extension in negotiations would create delays or other negative expectations to many of the expectations within this report.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.