As governments wrestle with the implications of climate change, the United States has set a goal for 50% of cars manufactured in the U.S. to be electrical vehicles (EVs) rather than internal combustion engine (ICE) vehicles by 2030. Automakers are scrambling to achieve these goals and avoid potential fines from the EPA for exceeding tailpipe emissions standards. General Motors’ (NYSE: GM) plan involves creating a self-sustaining EV manufacturing system. Things have to go right for GM to meet such a bold challenge. Unfortunately, a lot has gone wrong. Below, in no particular order, are seven reasons GM’s EV program could flop. (Check out GM’s EV Dreams Take a Hit).

1. The New UAW Contract

The United Auto Workers union (UAW) began a strike in September 2023. The strike was over pay increases, a four-hour work week, pension and retirement funds, overtime, and protection against plant closures related to increased EV production. GM and the UAW reached an agreement on October 30, 2023, which union members ratified in late November. Management predicts that the contract with the labor union will increase prices across all automobile models. With EVs already costing more than ICE vehicles while operating at a loss, this increased cost could further dampen EV sales.

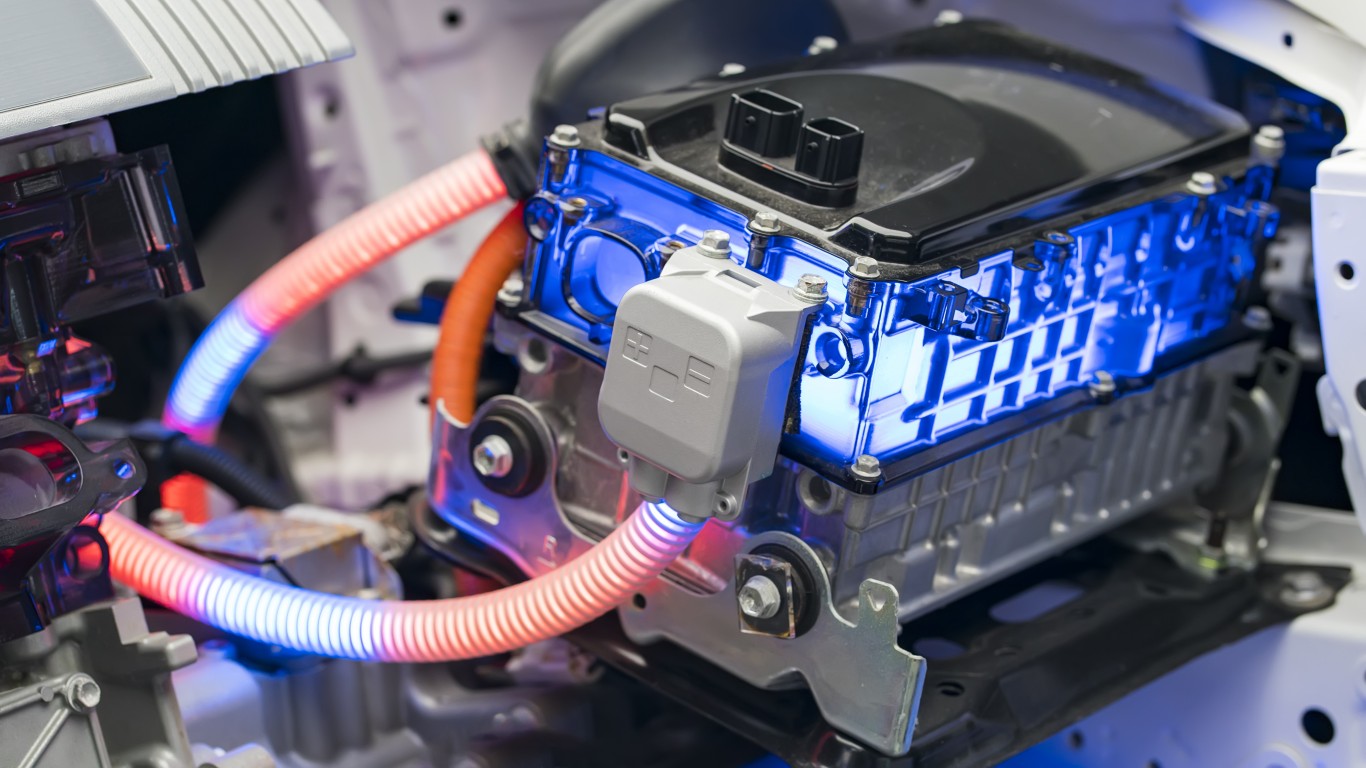

2. Battery Assembly Bottleneck

Unlike other EV manufacturers, GM has obtained battery cells for its EVs. However, the plants GM has established to assemble these cells into its Ultium batteries have been behind schedule, creating a battery bottleneck for the vehicles. In 2023, they needed to provide additional oversight and open more assembly plants to start meeting battery demands. These batteries are intended for use in Chevy Blazers, Cadillac Lyriqs, and GMC Hummer EVs, among others.

3. Software Challenges

Software issues are a common challenge among EV manufacturers, and GM is no exception. GM vehicles have experienced several software problems, both with the infotainment and charging systems. There have been reports of error messages and flickering screens, and the software has also caused issues with vehicle charging. In December, GM placed a stop-sale order for dealers for the new Chevy Blazer EV. The corporation hopes that a newly created quality control team can control the software issues and allow production to move forward.

4. Moving Away From Apple CarPlay and Android Auto

Consumers are also uncomfortable with GM’s decision to abandon Apple CarPlay and Android Auto for its infotainment infrastructure. These are two of the most popular methods for connecting users’ devices to the car’s infotainment systems, but GM decided to create a custom system with Google’s (NASDAQ: GOOGL) assistance. This is not a dealbreaker for all customers, as Tesla (NASDAQ: TSLA) also does not support CarPlay or Auto.

5. The High Cost of Materials

One thing that makes EVs more expensive than internal combustion vehicles is the cost of new materials. This typically concerns the battery supply chain and the rare materials that go into the batteries. GM has tried to address the supply chain issue by contracting with a company to manufacture the cells while GM provides the battery assembly. The bottleneck mentioned above may be short-lived, but nickel, cobalt, and lithium prices may still be an issue as the battery market becomes more competitive.

6. Inadequate Infrastructure

The biggest issue for the EV industry is the nation’s charging infrastructure. The ubiquitous availability of fueling stations for ICE vehicles is a challenging standard for the new EV systems to meet. This affects public perception of EVs as consumers know whether charging stations are widely available in their area. Consumers also consider the concept of range for EVs on a single charge important because of this infrastructure issue. Not only are there a limited number of stations, but the quality of those stations varies widely, too. There needs to be an extensive network of fast-charging stations for the public to change their perceptions of EVs.

7. Decreased Demand for EVs

The issues above, especially the global issues related to infrastructure and cost, lead to a drop in consumer demand. That is a big issue when selling current inventory, even with stop-sale orders and recalls impacting vehicle availability. Consumers have begun to move back from an unpredictable EV supply, calling for an increase in transitional vehicles, such as hybrids. These challenges, among others, are the ones that GM needs to overcome if it wants a stake in the EV market moving forward.

Take This Retirement Quiz To Get Matched With An Advisor Now (Sponsored)

Are you ready for retirement? Planning for retirement can be overwhelming, that’s why it could be a good idea to speak to a fiduciary financial advisor about your goals today.

Start by taking this retirement quiz right here from SmartAsset that will match you with up to 3 financial advisors that serve your area and beyond in 5 minutes. Smart Asset is now matching over 50,000 people a month.

Click here now to get started.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.