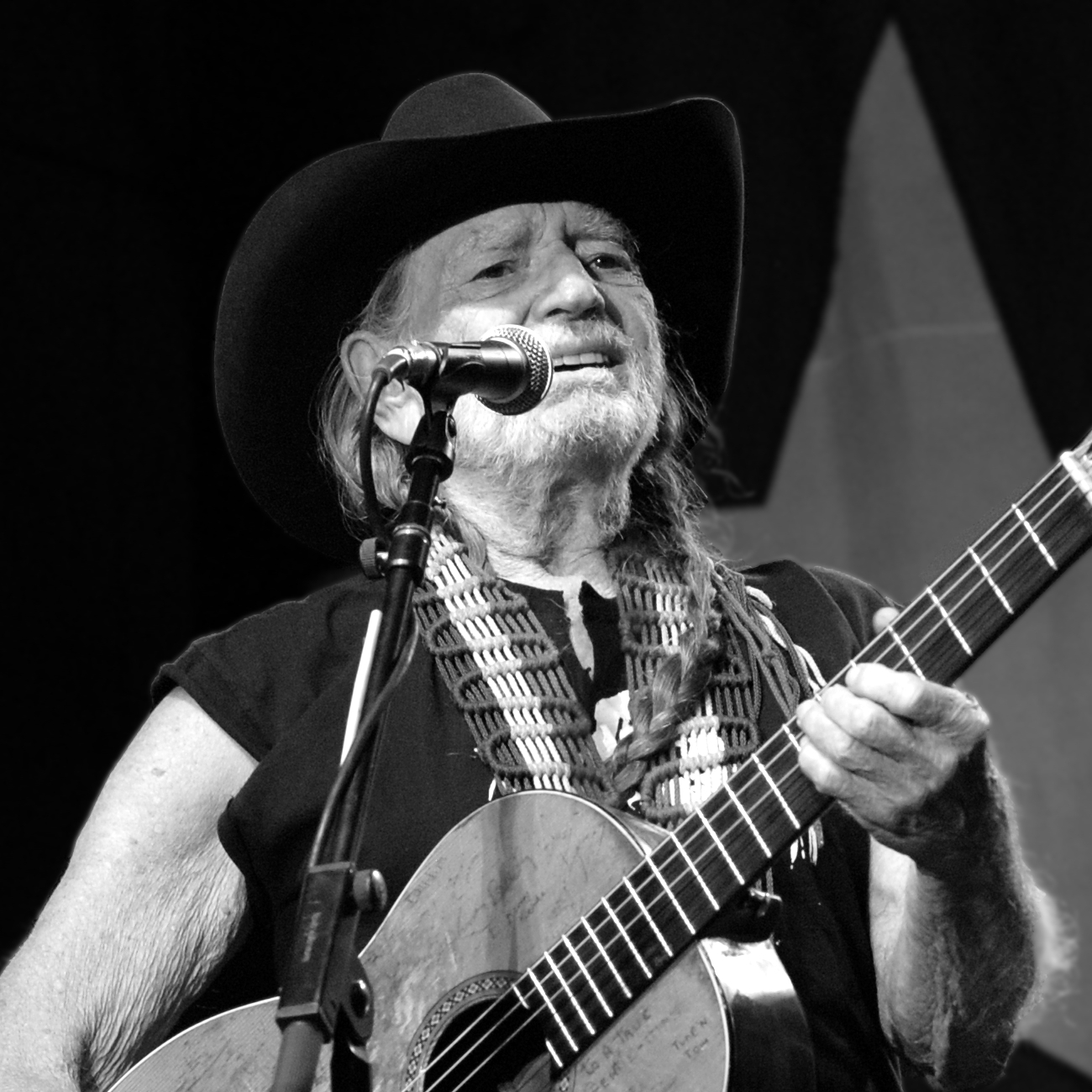

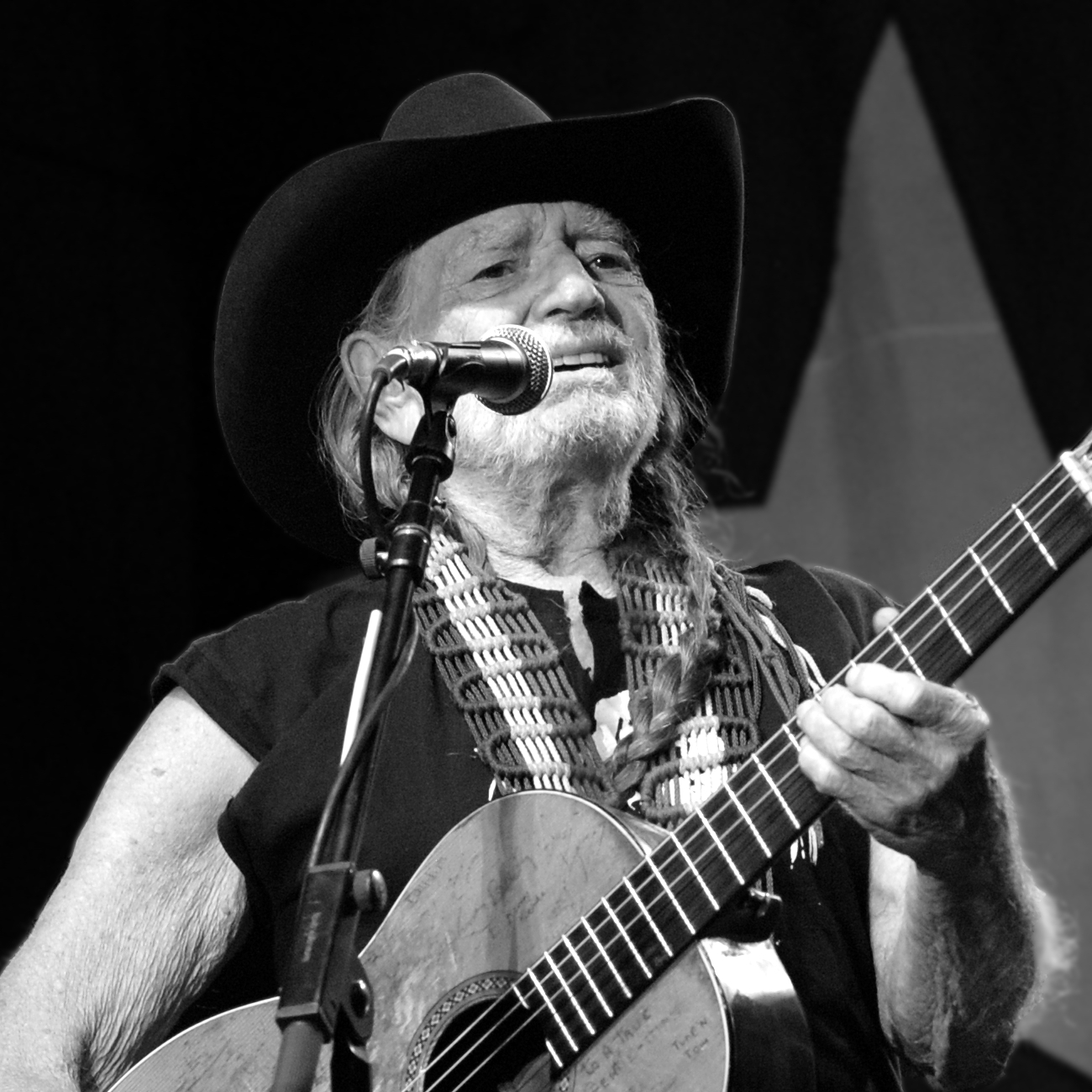

Last September, singer Willie Nelson’s cannabis company, named Willie’s Reserve, scored an investment from a private equity firm to launch its own brand of marijuana for sale in shops located in Colorado and Washington, where sales pot for recreational use are legal. Earlier this week, Willie’s Reserve posted job listings for five positions in the company’s Colorado business.

Willie’s Reserve is seeking a compliance officer, a bookkeeper/office administrator, a production manager, a sales director and an extractor. According to the Fort Worth Star-Telegram, job requirements vary by position and salaries could be as much as $65,000 annually for people with a chemistry degree and two years experience in the cannabis industry.

The company plans to grow, distribute and sell Willie’s Reserve-branded pot. Nelson himself told The Guardian when the investment was announced last year, “I’ve bought a lot of pot over the years, and now I’m going to sell some back.”

Nelson is neither the only nor the first celebrity to try to take advantage of legal pot sales. A Bob Marley-brand was launched last year named after the late Jamaican reggae star. Snoop Dogg and Melissa Etheridge are also in the business, along with weed icon Tommy Chong. Earlier this year actor Woody Harrelson submitted an application for one of the eight dispensary licenses available in Hawaii, but he didn’t make the cut.

Although initial plans for Willie’s Reserve included the company’s own retail stores, but it is not yet clear whether those plans are still in play.

The investment firm that backed Willie’s Reserve is Tuatara Capital, which focuses exclusively on the legal cannabis industry. The private equity firm was started last year by veterans of well-known investment firms like Highbridge and Guggenheim Partners.

Take This Retirement Quiz To Get Matched With A Financial Advisor (Sponsored)

Take the quiz below to get matched with a financial advisor today.

Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests.

Here’s how it works:

1. Answer SmartAsset advisor match quiz

2. Review your pre-screened matches at your leisure. Check out the advisors’ profiles.

3. Speak with advisors at no cost to you. Have an introductory call on the phone or introduction in person and choose whom to work with in the future

Take the retirement quiz right here.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.