Few words in the financial world carry more weight than “management has concluded that there is substantial doubt about the Company’s ability to continue as a going concern.” Chesapeake Energy Corp. (NYSE: CHK) put those words into its first-quarter 10-Q report filed with the U.S. Securities and Exchange Commission (SEC) on May 11. Shares of Chesapeake then plunged more than 12% to close below $13 a share. The stock has lost about half its value in less than two weeks.

In mid-April, Chesapeake completed a 1-for-200 reverse stock split as it tries to maintain its listing on the New York Stock Exchange. Shares of Chesapeake Energy traded at a pre-split price of around $0.13 and a post-split price near $26. The stock closed at $26.85 on the day the reverse split was announced.

It’s not like this is the first time that the oil and gas company has teetered on the edge of extinction, but it may well be the final time.

Chesapeake’s Salad Days

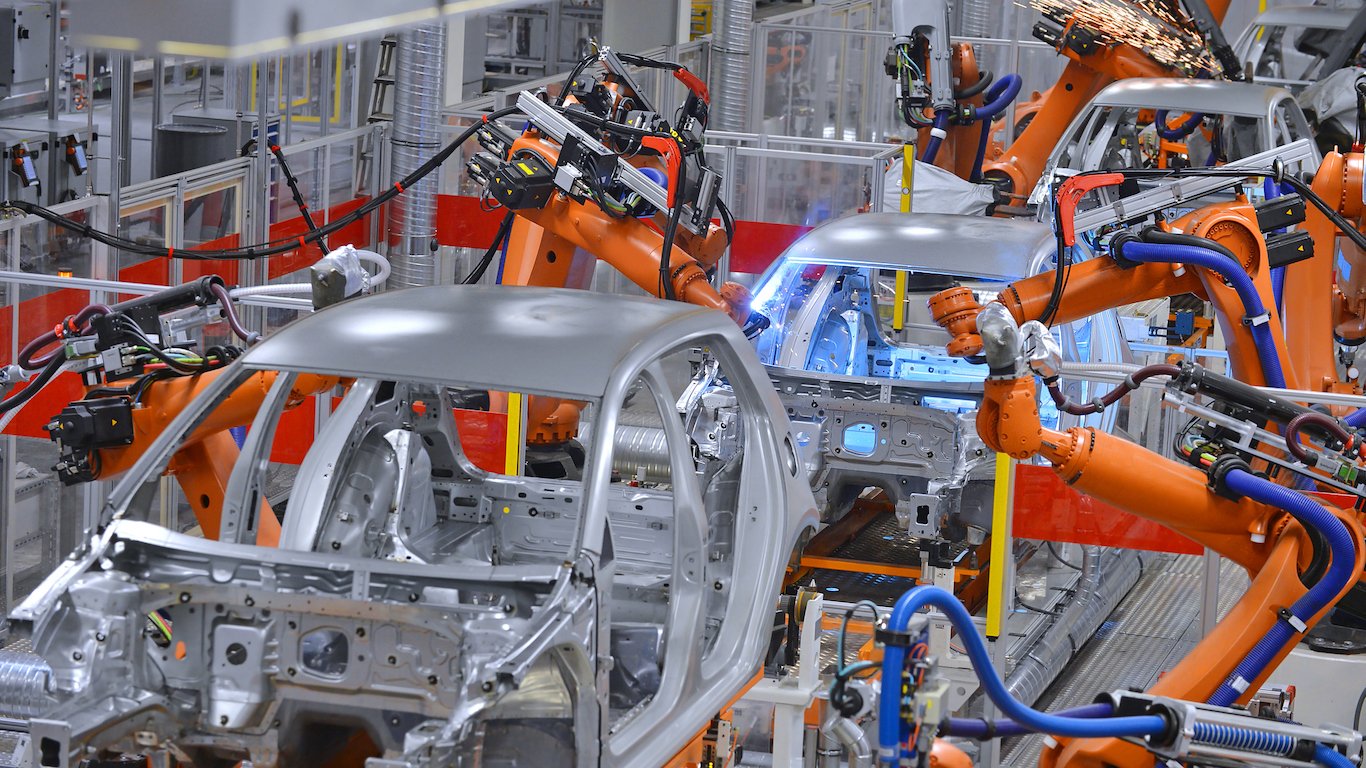

Based in Oklahoma City, Chesapeake was founded in 1989 by Aubrey McClendon and Tom Ward, and it really hit its stride with the horizontal drilling and hydraulic fracturing boom of the mid-2000s. Ward left the company in 2006 and, under McClendon, Chesapeake aggressively leased acreage in many shale gas plays then proved the presence of the energy resource and, finally, flipped the property for a profit.

Chesapeake’s business model was to beat its competitors to new discoveries, to lock up as many acres in a new field as it could, to produce enough gas to demonstrate that the new field was as good as the company claimed, and then to sell the assets to raise more cash and start the process over again.

This may be a fine strategy for a real estate investment trust (REIT) or a private equity firm, and it was a lucrative strategy for Chesapeake when natural gas prices were high. However, natural gas prices tumbled following a mid-decade surge above $12 per million BTUs, and Chesapeake’s long-term debt of around $14 billion (in 2008) became an albatross. The company tried shifting to a higher proportion of oil and natural gas liquids production, but then commodities prices dropped.

Chesapeake sold some $10 billion in assets in 2010, but most of the proceeds went to buy more leases and fund capital spending. Only about a third of it went to pay down debt. As of the end of the first quarter of this year, 10 years later, Chesapeake’s long-term debt totaled around $9.6 billion.

The McClendon Legacy

Founder and longtime CEO McClendon was among the most colorful of the energy industry’s executives. One of McClendon’s perks was a well participation program that allowed him to invest up to 2.5% in new Chesapeake wells. McClendon allegedly used this right as collateral for loans to pay for his share of drilling the wells and borrowed $1.1 billion to fund his portion of the work.

Later in 2012, the SEC opened an investigation into a bid-rigging allegation related to leases in Michigan’s Collingwood shale play. McClendon was forced out as CEO in 2013, and on March 1, 2016, the U.S. Department of Justice indicted him on the bid-rigging charge. He was killed in an automobile crash the next day.

Successor Doug Lawler has faced both low oil and gas pricing and huge debt headwinds. The reverse stock split was a last-ditch attempt to avoid bankruptcy.

What’s Next for Chesapeake?

While the stock market is voting on the future of Chesapeake, the bond market already may have sealed the company’s fate. A 5.375% coupon senior unsecured note due next year was selling on Monday for $0.036 on the dollar. That’s preposterously low.

The reverse stock split, the collapsing bond prices and the never-ending weight of debt have combined to threaten Chesapeake’s ability to remain a “going concern.”

Sponsored: Find a Qualified Financial Advisor

Finding a qualified financial advisor doesn’t have to be hard. SmartAsset’s free tool matches you with up to 3 fiduciary financial advisors in your area in 5 minutes. Each advisor has been vetted by SmartAsset and is held to a fiduciary standard to act in your best interests. If you’re ready to be matched with local advisors that can help you achieve your financial goals, get started now.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.

24/7 Wall St.

24/7 Wall St.