Oil supermajor Royal Dutch Shell PLC (NYSE: RDS-A) announced Friday morning that it had made a sixth oil discovery in its Norphlet play in the Gulf of Mexico. The Dover well is 100% owned by Shell and is located about 170 miles southeast of New Orleans.

Last month the company launched its multibillion Appomattox platform into the Gulf, and the newly discovered well is about 13 miles south of the platform’s location. That’s good luck for the company because it foreshadows a tieback connection from Dover to Appomattox, saving the billions in costs for building another platform. Appomattox is partially owned (21%) by Nexen, the North American subsidiary of China National Offshore Oil Co. Ltd. (NYSE: CEO) or Cnooc, and is expected to be producing oil by the end of next year.

Shell said the well was drilled in 7,500 feet of water to a depth of 29,000 feet below the seafloor. The net pay area of the well is 800 vertical feet, and the company gave no estimate of the number of barrels in the discovery. The Dover well is expected to begin production before the end of next year.

Andy Brown, Shell’s upstream director, said:

Dover showcases our expertise in discovering new, commercial resources in a heartland helping deliver our deep water growth priority. By focusing on near-field exploration opportunities in the Norphlet, we are adding to our resource base in a prolific basin that will be anchored by the Appomattox development.

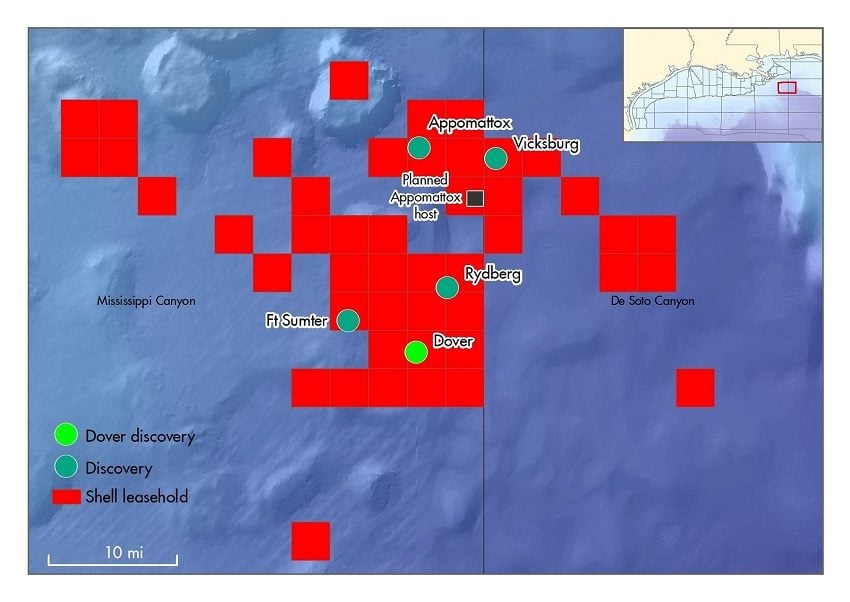

Shell provided the following map of its leases and wells in the Norphlet. The inset shows the location of the play relative to the Gulf Coast.

The Appomattox project was authorized by Shell in 2015 and was the first major deepwater project announced after the 2014 crash in oil prices. West Texas Intermediate (WTI) crude oil prices above $70 a barrel are expected to encourage more of these super-expensive deepwater projects in the Gulf of Mexico and elsewhere.

WTI crude for July delivery has dropped more than 4% by the noon hour Friday to $67.70, after closing last night at $70.71. That’s more than $5 a barrel off the highest price in nearly four years set earlier this week. Brent crude for August delivery has dropped about 2.6% to trade at $76.16.

Sponsored: Want to Retire Early? Start Here

Want retirement to come a few years earlier than you’d planned? Orare you ready to retire now, but want an extra set of eyes on your finances?

Now you can speak with up to 3 financial experts in your area for FREE. By simply clicking here you can begin to match with financial professionals who can help you build your plan to retire early. And the best part? The first conversation with them is free.

Click here to match with up to 3 financial pros who would be excited to help you make financial decisions.

Thank you for reading! Have some feedback for us?

Contact the 24/7 Wall St. editorial team.